Main Street Capital Stock: Still Plenty Of Reasons To Own This BDC (NYSE:MAIN)

da-kuk

This year in April, I issued a relatively bullish article on Main Street Capital (NYSE:MAIN) – Main Street Capital: One Of The Best Ways To Play Defense In BDC Space. As the title implies, the justification behind my optimistic stance on MAIN was its defensive characteristics that makes the dividend stable and predictable.

While more details are embedded in my previous article, these were the key fundamental characteristics that, in my opinion, render the investment case very safe:

- Senior leverage of 2.6x EBITDA through MAIN’s debt position – one of the lowest leverage levels at the portfolio level in the BDC space.

- Debt to equity of 0.79x – significant below the BDC sector average external leverage of 1.15x.

- Consistently increasing NAV base due to a conservative adjusted NII payout, which also introduces an additional layer of safety for MAIN’s dividends (distributions).

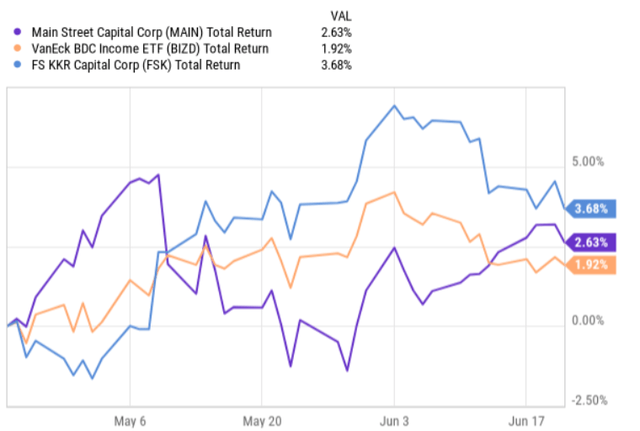

Since the moment when I issued the bull thesis, MAIN has slightly outperformed the market, which is a surprise to me.

In the chart above, I have also added FS KKR Capital (NYSE:FSK) for comparison, which is currently my highest conviction BDC play out there (see more details on why here). Opposite to MAIN’s case, the fact that FSK has managed to deliver alpha over the BDC benchmark is not that surprising to me.

The reason for this is that recently the overall BDC market has been on a strong upward move creating systematic tailwinds for almost all BDCs. Namely, the strengthening of a higher for longer scenario in combination with improving M&A and capital markets environment has pushed BDC total return levels higher. Whenever there is a systematic push, the high beta instruments (in this case BDCs) tend to outperform the more conservative names. Given that MAIN is arguably one of the most defensive BDC out there, my expectation was that we would experience negative alpha during times like these, but then once the market takes the opposite direction, we would enjoy alpha by holding MAIN.

Yet, during this time MAIN has also circulated its Q1, 2024 earnings deck, which reveals several interesting dynamics that are worth contextualizing against the current bull case of MAIN.

Thesis review

All in all, after assessing the Q1, 2024 data points, I think it will quickly become clear for us why the market has sent MAIN’s stock price higher.

In a nutshell, the underlying performance was strong showing a continued positive momentum across the board. For example, after registering Q1, 2024 results, the annualized return on equity reached all time highs, landing at 17.2% level. Also, during the quarter MAIN achieved a new record for NAV per share and NII per share metrics, showing no signs of a reversal in this momentum.

The total investment income for Q1, 2024, increased by 9.4% and 1.8% over the Q1, 2023 and Q4, 2023 periods, respectively. Here we have to appreciate the fact that MAIN managed to deliver stronger returns compared to the previous quarter, which is certainly not the case for many BDCs out there that have been experiencing negative consequences from the system-wide spread compression and reduced investment flows.

As a result of the stronger cash generation and conservative distribution levels, MAIN continued to record increasing NAV results. During the quarter, MAIN recorded a net fair value appreciation of $28.3 million, which translated to a NAV increase of $0.34 per share relative to the fourth quarter in 2023. Plus, this NAV growth has also helped MAIN further strengthen its balance sheet by bringing the regulatory debt to equity leverage down to 0.7x, which again continues to be one of the lowest levels in the BDC sector.

Here it is also worth underscoring that the NAV ticked higher despite MAIN increasing the total dividends paid in the Q1 by 20% as compared to the same period of last year.

Getting back to the investment activity, this quarter ended once again positively for MAIN. During the quarter, the total investment activity in the lower middle market was $92 million, which translated to a net increase of $67 million after adjusting for the repayments. As a result of this, MAIN’s total investment portfolio grew by ~ 6%, which is a significant move.

In this context, Dwayne Hyzak – Chief Executive Officer – sent rather encouraging signals during the recent earnings call that the investment pipeline for 2024 remains strong:

Now, turning to our current investment pipeline. As of today, I would characterize our lower middle market investment pipeline as above average. Consistent with our experience in prior periods of broad economic uncertainty, we believe that the unique and flexible financing solutions that we provide to our lower middle market companies and their owners and management teams, and our differentiated long-term to permanent holding periods represent an even more attractive solution in the current environment and we are confident in our expectations for strong lower middle market investment activity over the remainder of 2024.

Again, this is not that common for other BDCs to record positive net investment flows and be so optimistic about the investment portfolio growth going forward.

Finally, one of the key elements that renders MAIN so defensive is its focus on external asset management, which introduces an additional layer of income predictably and protection from the changes in the interest rate environment.

Here, MAIN’s external investment management contributed circa $8.6 million to the net investment income result, which is an increase of $0.6 million from the prior quarter. Plus, MAIN generated $3.9 million in incentive fees during the quarter leading to a quarterly growth of ~18%.

In the earnings call, Dwayne Hyzak also highlighted how MAIN remains focused on expanding the business in this particular segment, which will allow to de-risk MAIN’s profile even further:

We remain excited about our plans for the external funds that we manage as we execute our investment strategies and other strategic initiatives and we are optimistic about the future performance of the funds and the attractive returns we are providing to the investors of each fund. We remain optimistic about our strategy for growing our asset management business within our internally managed structure and are actively working to increase the contributions from this unique benefit to our Main Street stakeholders.

The bottom line

After assessing the Q1, 2024 data points, it is clear why the market has treated MAIN so nicely. The key metrics that characterize BDC’s performance came in strong with the income and ROE levels reaching all-time highs, NAV continuing to tick higher and the external debt profile improving further from already very conservative level.

Furthermore, the commentary by the Management provided additional positive signs about the forthcoming performance, where the net investment flows are expected to expand the underlying portfolio and the defensive cash flows from the external investment management segment are projected to steadily grow.

As a result of this, I remain bullish on Main Street Capital.