Ingersoll Rand: Organic Growth And Continued M&A Momentum Should Drive Stock Higher (IR)

monsitj

Investment Thesis

Ingersoll Rand Inc.’s (NYSE:IR) organic revenue growth should recover in the coming quarters. The company saw a sequential acceleration in organic orders and Marketing Qualified Leads (MQL) in the last quarter, which indicates good demand momentum and bodes well for revenue growth in the coming quarters. Further, megatrends like reshoring and sustainability should drive demand for the company’s products, boosting revenue growth. In the medium to long term, the company’s focus on digital initiatives and increasing recurring revenues should help it post strong revenue growth. Besides organic growth, the company has a healthy balance sheet which provides it ample financial flexibility to pursue bolt-on M&A.

On the margin front, the company should benefit from operating leverage, price increases, and moderating inflationary pressures. Further, the recently closed acquisition of ILC Dover is margin accretive and should contribute to margin growth in the coming quarters. In the medium to long term, the margins should benefit from an increased high-margin aftermarket mix. The company has already surpassed its inorganic growth targets for this year and, as organic growth recovers in the coming quarters, I see a good potential for an upward revision in consensus estimates, which can act as a catalyst for the stock. Hence, I maintain my buy rating on IR stock.

Revenue Analysis and Outlook

I last covered Ingersoll Rand in November 2023, discussing the company’s good growth prospects driven by solid backlog and order bookings, good execution, healthy end-market demand, and accretive M&A. Since then, the stock has increased by over 36%, validating my thesis. However, the company’s growth has slowed somewhat in the last quarter.

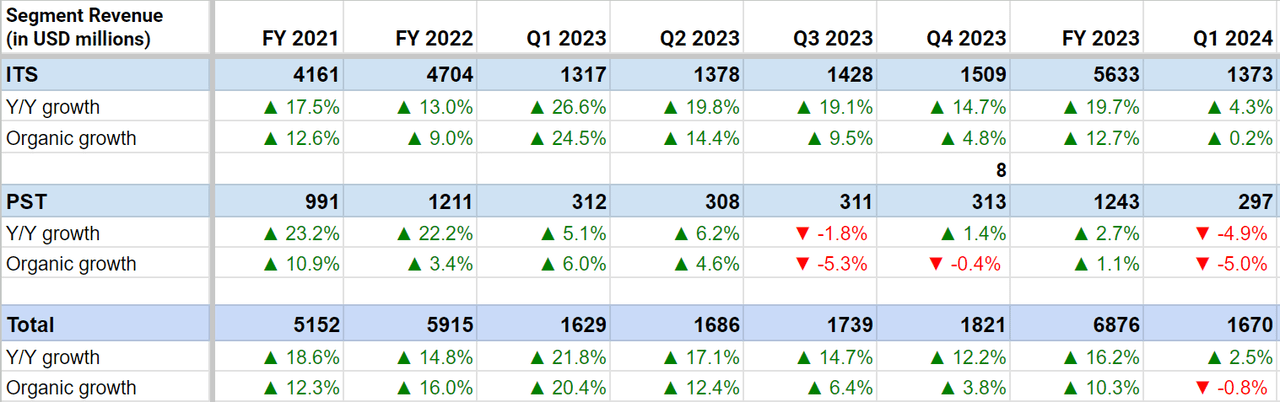

In the first quarter of 2024, the company’s revenue increased by 2.5% Y/Y to $1.67 billion. Excluding a 3.4% contribution from acquisitions and a 0.1% unfavorable impact of FX, organic revenues declined by 0.8% Y/Y.

Segment-wise, the Industrial Technologies & Services (ITS) segment’s revenue increased by 4.3% Y/Y driven by the benefit from acquisitions of 4.2% and organic growth of 0.2%. The organic growth was attributed to higher pricing of 3%, partially offset by a decline in organic volumes of 2.8%.

ITS’ orders were down 3.6% Y/Y on a reported basis and 7.2% Y/Y organically with a book-to-bill of 1.02x. The orders for compressors decreased by high single digits Y/Y primarily due to large and long-cycle project order timing (mainly in the renewable natural gas projects in the U.S. and EV battery and solar projects in China). Excluding these items, organic orders in compressors were flat Y/Y. The orders for industrial blower & vacuum were up high single digits Y/Y in the quarter.

In the Precision & Science Technologies (PST) segment, the revenue declined by 4.9% Y/Y and 5% Y/Y organically. The organic decline was due to lower organic volumes of 7.9% which more than offset higher pricing of 2.9%.

Orders in the PST segment were down 5.4% Y/Y on both reported and organic basis with a book-to-bill of 1.04x. This was mainly due to weakness in the life sciences business and softness in the China wastewater end markets. However, the segment’s short cycle orders remained strong with book and ship orders up high single digits sequentially.

IR’s Historical Revenue Growth (Company Data, GS Analytics Research)

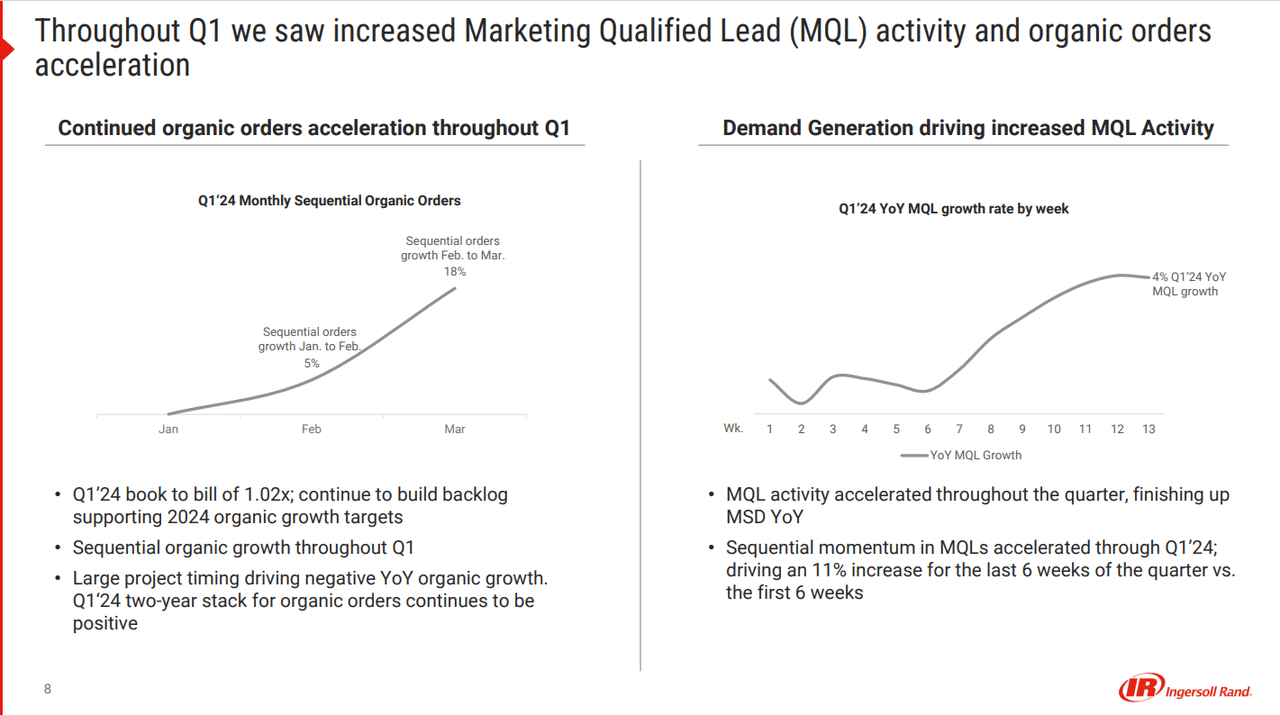

Looking forward, I am optimistic about the company’s revenue growth prospects. While the company’s orders and organic revenues declined last quarter, its book-to-bill was greater than one (1.02x) and backlog kept increasing. This bodes well for future revenue growth. What is more interesting is that the company’s organic orders and Marketing Qualified Leads (MQL) accelerated throughout the quarter.

IR’s Continued organic orders and MQL acceleration throughout Q1 (Company’s Q1 2024 Earnings Presentation)

This sequential acceleration indicates the company entered Q2 with good demand momentum and it bodes well for Q2 orders and revenues.

The company is seeing a strong demand momentum with the reshoring trend driving a good demand for the company’s products in the U.S. The company’s focus on launching new energy-efficient products also is helping it play on the sustainability megatrend. In addition to the U.S., the company is also investing in increasing its production capacity in some of the underpenetrated markets like Latin America, India, Middle East, and Southeast Asia and these geographies could be a good driver for the company’s long-term growth.

The company’s growth should also benefit from digital initiatives and the focus on increasing recurring revenues. The shift towards IoT and connected assets is going to be a big driver for it. A connected asset allows the company to monitor that asset and identify when it needs service, parts, lubricant, etc. The company has also launched the CARE program, which involves a 5-to-10-year agreement in which the company assures responsibility for the performance and maintenance of the compressor. This program is gaining good traction as it delivers predictable operating expenses and reduced downtime, and removes internal requirements for expertise at the customer’s end. During its investor day last year, the company shared its plans to grow its recurring revenue from ~$200mn in 2023 to ~$1bn by 2027. So, I expect the company’s initiatives to increase aftermarket revenues to be a big driver for the company’s revenues in the medium to long term.

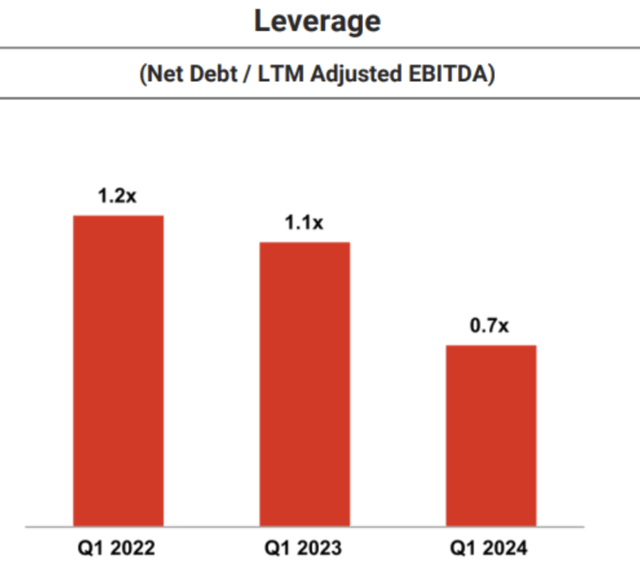

Further, the company’s healthy balance sheet and focus on deploying capital for bolt-on acquisition should continue to complement strong organic growth. The company ended last quarter with a net leverage of ~0.7x giving it ample capacity to pursue bolt-on acquisitions.

IR’s Net Leverage as of Q1 2024 end (Company Presentation)

The company’s long-term target is to have a 400 to 500 bps contribution from inorganic growth. For the current year, the company is already tracking above this target if we look at acquisitions already announced year-to-date. On its last earnings call, management also noted that they have nine transactions at the LoI stage and I am expecting M&A to continue contributing to the company’s organic growth moving forward as well.

Margin Analysis and Outlook

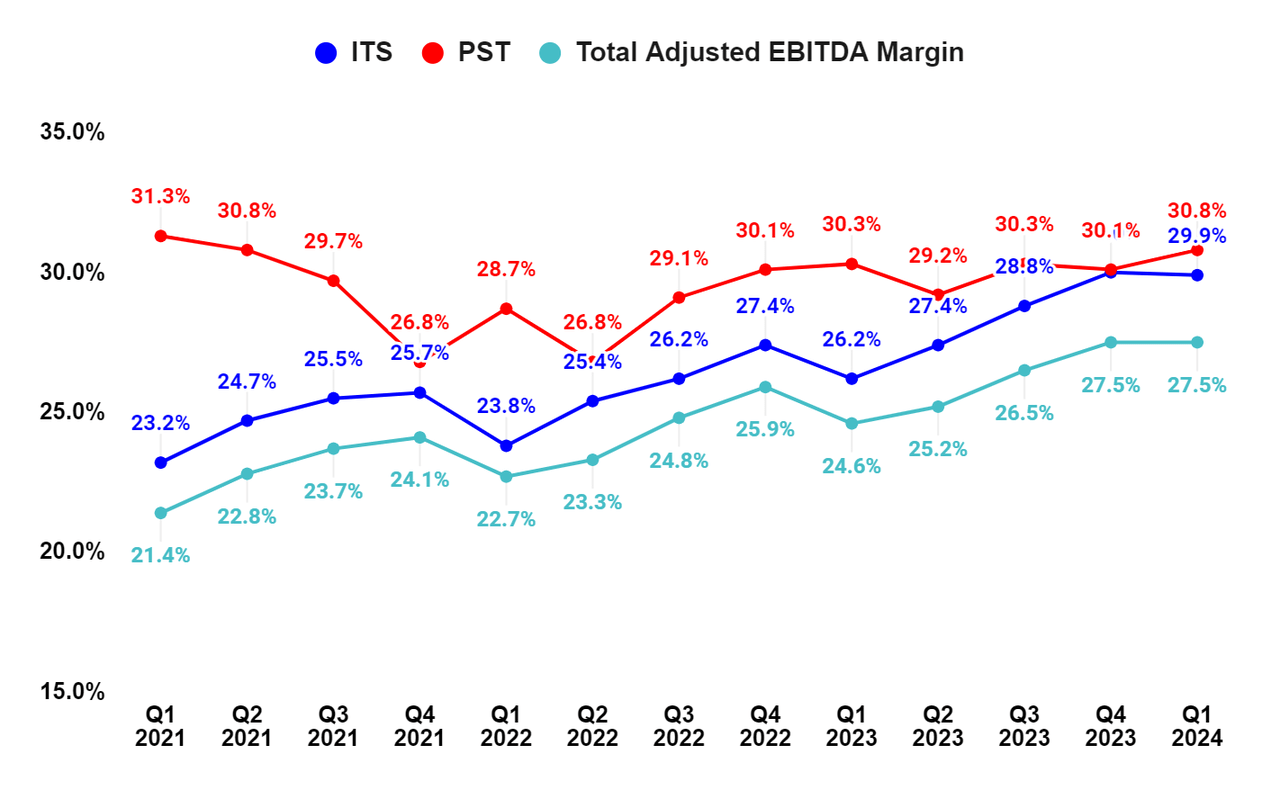

In Q1 2024, the company’s margins benefitted from pricing increases and favorable cost productivity and product mix driven by continued execution of Innovate to Value (i2V) initiatives. This more than offset high SG&A costs due to investments in commercial footprint and R&D initiatives. As a result, the company’s adjusted EBITDA margin expanded by 290 bps Y/Y to 27.5%.

On a segment basis, ITS and PST segments grew adjusted EBITDA margin by 370 bps Y/Y and 50 bps Y/Y, respectively.

IR’s Segment Wise Adjusted EBITDA margin (Company Data, GS Analytics Research)

Looking forward, the company’s margin should benefit from operating leverage given good organic sales growth prospects. Further, continued price increases in a strong demand environment along with moderating inflationary cost pressures should also help margins. The recently closed acquisition of ILC Dover with 30% plus adjusted EBITDA margins is also expected to be accretive to the company’s margins in the coming quarters.

In the medium to long run, the focus on increasing aftermarket business should also positively shift the margin mix as aftermarket revenues usually have higher associated margins. Overall, I remain optimistic about the company’s margin growth prospects.

Valuation

Ingersoll Rand is trading at 28.38x FY24 consensus EPS estimate of $3.28 and 25.97x FY25 EPS estimate of $3.59. In March last year, I presented a bullish case for Ingersoll Rand as an emerging compounding story. The stock was trading at a forward P/E in the low 20s then. I argued that its P/E multiple can narrow its gap with high-quality industrial compounders like Danaher Corporation (DHR) that have similar bolt-on M&A and margin improvement stories and are trading in the mid to high 20s P/E range. The company’s P/E has seen a significant re-rating since then. I believe the company’s P/E multiple is at reasonable levels now.

However, one area where I continue to see further upside is the sell-side growth estimate. Management is targeting 400 to 500 bps annual contribution from M&A and mid-single-digit organic growth which should result in high single-digit revenue growth.

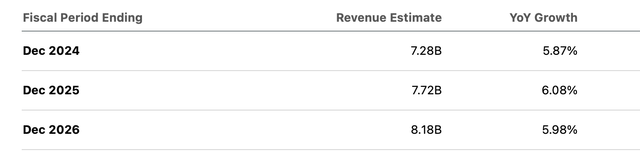

IR Consensus Revenue Estimates (Seeking Alpha)

If we look at consensus revenue estimates, they are close to mid-single digit revenue growth for the next couple of years. The company is already tracking ahead of its inorganic growth targets this year and with a potential recovery in organic growth in the coming quarters (indicated by sequential improvement in orders and MQL activity last quarter), there is a good potential for upward revision in revenue growth estimates. As revenue growth estimates get revised higher, the consensus EPS estimates should also move up. The current consensus EPS estimates are building in high single-digit/low double-digit EPS growth for the next few years but this number can get revised to low teens CAGR as revenue growth estimates increase.

I believe the stock can also deliver a mid-teen CAGR based on solid earnings growth, assuming the P/E multiple remains at the current level. So, I continue to maintain a buy rating on the stock.

Risks

- Inorganic growth is a major component of the company’s growth strategy. However, inorganic growth is relatively riskier compared to organic growth, and there are always risks related to integration missteps, overpaying for an acquisition, and the leverage a company takes to make an acquisition. In case any future acquisition goes wrong, it may negatively impact the stock price.

- The company has a meaningful international presence which exposes the company to risks related to foreign currency fluctuations, geopolitical tension, etc.

Takeaway

The company has good growth potential over the coming years. Revenue growth should benefit from a healthy backlog and book-to-bill, sequential acceleration in orders and MQL, strong demand momentum supported by megatrends like reshoring and sustainability, increasing recurring revenues, and inorganic growth opportunities from M&A. The margin outlook is also favorable, with benefits from operating leverage, pricing increases, margin accretive M&A, and an increased high-margin aftermarket mix. With the company tracking above its inorganic growth targets and the potential for organic growth recovery in the coming quarters, there is a potential for an upward revision in consensus estimates, which can drive the stock higher. So, I continue to have a buy rating on Ingersoll Rand stock.