Twilio: Pessimism Won’t Last Forever (NYSE:TWLO)

hapabapa

Twilio Accelerates Its GAAP Profitability Push

Twilio Inc. (NYSE:TWLO) stock has continued to hover above its $55 consolidation zone since February 2024. However, investors seem to lack sufficient buying conviction to take it higher. In my previous bullish TWLO article in late February, I upgraded TWLO after my December 2023 cautious rating on TWLO panned out. I argued in February that Twilio’s solid growth profile and relatively attractive valuation are critical considerations in my upgraded outlook. While TWLO has underperformed the market over the past three months, the selling intensity has also slowed tremendously.

Despite its relatively attractive valuation, Twilio’s Q1 earnings release in early May 2024 hasn’t provided enough confidence for growth investors to return more aggressively. Twilio has been mired in a growth normalization phase since it decided to focus more on profitable growth. Based on Twilio’s guidance, the company “accelerated its target for GAAP operating profitability” from FY2027 to Q4FY2025. In addition, Twilio has also committed to achieving “breakeven” for its Segment business by Q2FY2025. In addition, Twilio has “made good progress” on its upgraded $3B stock repurchase program, buying back more than $720M of Twilio shares in Q1. Furthermore, Twilio expects to consummate the remaining $1.5B of repurchases by the end of this year. As a result, I believe Twilio has demonstrated its robust free cash flow capabilities and net cash balance sheet, allowing it to buy back its shares aggressively when assessed to be undervalued.

Notwithstanding Twilio’s optimism, and seemingly solid profitable growth commitments, the market remains unconvinced with its recovery. The CPaaS leader maintained its FY2024 organic revenue growth guidance of between 5% and 10%. However, Twilio’s Q2 guidance miss has increased Twilio’s execution risks for FY2024, necessitating a more robust performance in the second half.

Twilio Must Navigate Churn Headwinds Better

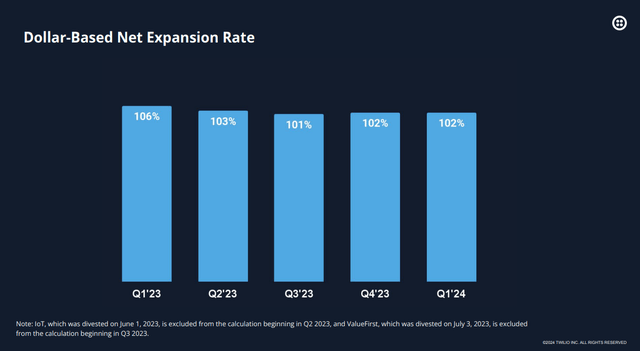

Twilio dollar-based net expansion rates % (Twilio filings)

I assess that the market’s concerns about Twilio’s execution are justified. Twilio’s net expansion rates are low at just 102%. Although it offers a slight improvement from Q3FY2023, the slight improvement has likely failed to convince investors about a robust revenue growth inflection.

Twilio has raised its AI growth possibilities by embedding generative AI across its platform. It has also integrated Segment with other third-party data platforms to enhance Twilio’s CDP capabilities and improve its interoperability with the data platforms.

Despite that, there are concerns about whether the continued churn experienced in its Segment business could affect Twilio’s growth inflection. Salesforce’s (CRM) recent earnings release also lowered the market’s confidence about Salesforce’s near-term AI monetization prospects. As a result, concerns about whether Twilio might face higher execution risks in the second half are justified, as management maintained its full-year outlook.

TWLO Stock Is Valued Very Attractively

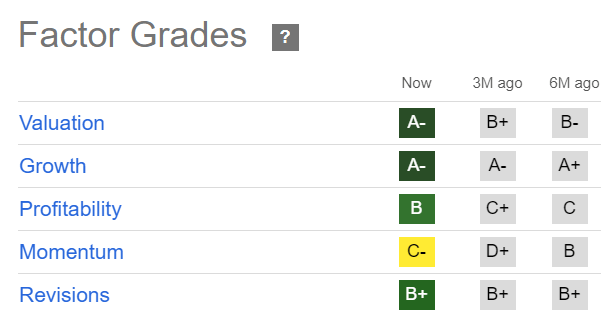

TWLO Quant Grades (Seeking Alpha)

However, the market isn’t dumb. TWLO’s valuation is still highly attractive (“A-” valuation grade), an improvement over the past three to six months. Furthermore, Twilio’s focus on profitable growth should keep GARP investors onside, justifying Twilio’s CPaaS leadership and validating its business model. Moreover, TWLO’s “C-” momentum grade has improved over the past three months, suggesting selling intensity has lowered markedly.

I gleaned that the market seems too pessimistic about Twilio’s growth prospects. Accordingly, TWLO’s forward adjusted PEG ratio is just 0.6. Therefore, it implies a nearly 70% discount relative to TWLO’s sector median, highlighting TWLO’s valuation bifurcation. Furthermore, Wall Street upgraded Twilio’s earnings estimates, corroborating the market’s confidence in Twilio’s ability to maintain its profitability trajectory.

Therefore, I assess that TWLO offers long-term investors an attractive risk/reward profile at the current levels despite its near-term underperformance.

Is TWLO Stock A Buy, Sell, Or Hold?

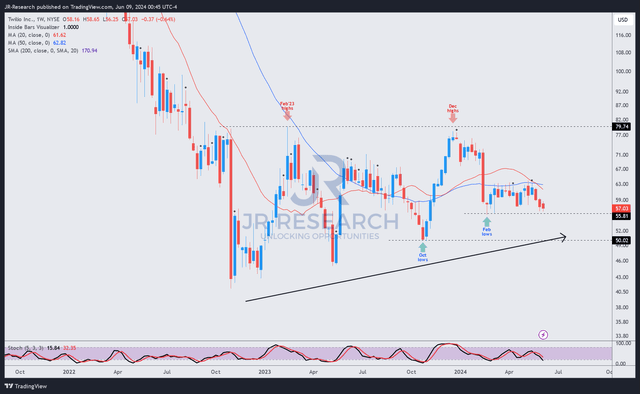

TWLO price chart (weekly, medium-term) (TradingView)

TWLO’s price action shows that the selling digestion from its February 2024 highs remains well-supported above TWLO’s $55 over the past three months. It’s a critical observation because it indicates that dip-buyers are likely accumulating. Therefore, it justifies my observation about TWLO’s relatively attractive risk/reward potential, as discussed earlier.

TWLO has also continued to form higher-lows and higher-highs since its October 2022 bottom, crucial to validating a subsequent uptrend continuation thesis.

Notwithstanding my optimism, given its relatively weak outlook, the market’s de-rating of TWLO’s growth thesis is justified. Coupled with the near-term bearish sentiments over Twilio’s ability to monetize AI more robustly, buying sentiments are anticipated to remain tepid.

Despite that, I assess TWLO’s consolidation (price action moving sideways) as constructive. Therefore, it should provide more confidence for high-conviction TWLO investors to capitalize on the market’s near-term pessimism to buy more shares.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!