Summit Therapeutics: World Lung Data Not Enough For Ivonescimab To Unseat Keytruda (Yet)

Michal Krakowiak/E+ via Getty Images

Topline Summary and Update

When I last wrote about Summit Therapeutics (NASDAQ:SMMT) back around the time of ASCO 2024, I was excited about the prospects of their heir apparent bispecific approach to combination targeted and immunotherapy. Now, one of the biggest trial readouts in the company’s history has been given at the 2024 IASLC World Lung Conference, showing a definitive PFS improvement in patients with non-small cell lung cancer (NSCLC) compared with pembrolizumab, marketed as Keytruda and sold by Merck to the tune of $7 billion per quarter. And commenters and articles are tolling the death knell of pembrolizumab in NSCLC, and that a new king has emerged to take its place.

But not so fast. There are some significant caveats that are worth going into. Is SMMT worth north of $12 per share (over $8.5 billion in market cap) heading into late 2024 with no approved drugs? Let’s unpack this news and explore the investment thesis again.

Pipeline Updates

This article is going to focus entirely on unpacking the results of a Chinese clinical trial conducted by SMMT’s partner Akeso. This phase 3 study, HARMONi-2, randomly assigned patients with PD-L1-positive advanced NSCLC (with a PD-L1 cutoff of 1% defining “positive”) to receive either pembrolizumab alone or ivonescimab, a bispecific antibody simultaneously binding PD-1 and VEGF, in theory serving to at least combine the effects of both pembrolizumab and an anti-angiogenic agent like bevacizumab (branded Avastin). The primary endpoint was progression-free survival (PFS) as determined by blinded, independent radiological review.

The study arms were generally well balanced, with some slight increase in the proportion of older patients (51% vs 57.5% aged 65 or older in the ivonescimab and pembrolizumab groups, respectively) and patients with brain metastases (16.7% vs 19.5%, respectively), though nothing totally egregious.

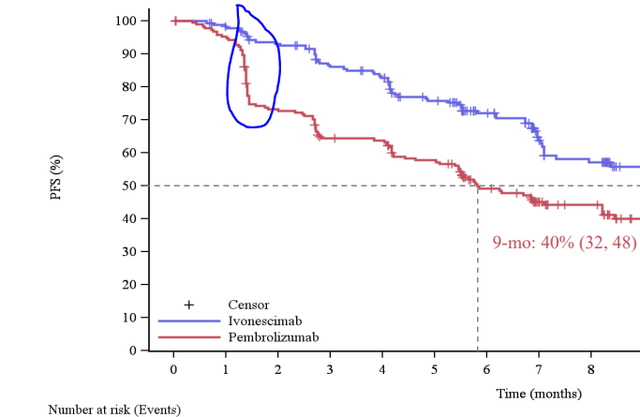

And HARMONi-2 demonstrated a decisive PFS benefit for ivonescimab compared with pembrolizumab, yielding a median of 11.14 months vs 5.82 with pembro. The hazard ratio was 0.51, representing a 49% decrease in the relative risk of progression or death over the course of the study. And a lot of this benefit was observed early on, as there was a large drop-off of patients in the pembro arm early on:

PFS findings from HARMONi-2 (Summit Therapeutics Website)

Source: HARMONi-2 presentation slides from SMMT’s website

This early progression is part and parcel with pembrolizumab’s past clinical experience in this setting, including in KEYNOTE-024, which led to its initial approval as a monotherapy for PD-L1 positive patients.

What’s more, all patient subgroups appeared to have a PFS benefit with ivonescimab. Regardless of age, sex, smoking status, and metastatic disease status, ivonescimab pretty clearly won out. The only outlier here was the small population of patients with stage IIIB/C (i.e., not metastatic but probably not able to be operated on), where there was no apparent difference. We’re talking about 31 patients out of 398, though, so there is little knowledge to be gained from that part of the subgroup analysis.

The response rate was also higher with ivonescimab treatment (50.0% vs 38.5%).

Ivonescimab treatment was associated with an increase in toxicity relative to pembrolizumab, with a near doubling of the risk of grade 3 or higher adverse events (29.4% vs 15.6%). These rarely led to treatment discontinuation, however. Immune-related adverse events occurred in similar rates for both arms, meaning that the added toxicity from ivonescimab appeared to be due to the anti-angiogenic component, which makes sense. These include adverse events like proteinuria, hypertension, and bleeding risk.

As of now, the overall survival data are immature, and those will be read out at a later time. As of now, this is the first drug to beat pembrolizumab in a head-to-head comparison for any cancer, and ivonescimab is poised to make inroads in the management of NSCLC.

The Contrarian Take – Not the Best Comparator

Single-agent pembrolizumab is far from the only use of the anti-PD1 behemoth in NSCLC. While it’s approved for any patient with PD-L1-positive (especially 50% or higher) disease, a lot of the benefit is associated with very, very high levels of PD-L1, to the tune of 90% or more being where you start to reliably see single-agent pembrolizumab strongly outperforming first-line chemotherapy in NSCLC.

Long story short, ivonescimab was pitted against a control arm that is not the standard of care, not even for PD-L1-positive NSCLC. That would actually be one of the several chemotherapy plus checkpoint blocker combinations that are available, including the noteworthy KEYNOTE-189 regimen of platinum, pemetrexed, and pembrolizumab (for patients with non-squamous histology).

Consider for a moment a summary table of PFS values from HARMONi-2 and the 2 KEYNOTE studies that support use of pembrolizumab. Please keep in mind that there’s nothing we can say about comparing these trials to each other, given the wide variations in patient population between the 3 studies.

| Ivonescimab (n = 198) | Pembrolizumab (HARMONi-2) (n = 200) | Pembrolizumab (KEYNOTE-024) (n = 154) | Pembro + chemo (KEYNOTE-189) (n = 410) | |

| Median PFS | 11.14 | 5.82 | 10.3 | 8.8 |

Now, there’s a very good reason why cross-trial comparisons should be avoided, but you can see that pembrolizumab has historically given better median PFS than what was seen in HARMONi-2. Part of this may be due to the fact that HARMONi-2 had a lot more patients with squamous cell histology, which has historically been tougher to treat and is, in fact, not amenable to the KEYNOTE-189 regimen due to the use of pemetrexed chemotherapy.

You can start to see where the story gets pretty muddy. The thing about pembrolizumab is that single-agent anti-PD1 antibodies have had a history of giving underwhelming PFS results, only to come through with an improvement in overall survival relative to historical standards of care, as was seen in the KEYNOTE-042 study (in patients with PD-L1 below 50%).

Setting all of that aside, the long and short of this story is that, in the US, at least, for the majority of patients who can handle the chemotherapy, the KEYNOTE-189 regimen is the standard of care. And HARMONi-2 does not convincingly tell us that this should no longer be the case.

To gain approval based on HARMONi-2, SMMT needs to overcome regulatory hurdles related to using China-only clinical trials to inform treatment of American patients. This is not a trivial matter because the demographic risk factors can differ by a lot between our populations. And the FDA has historically been very hostile to approving drugs based on trials conducted outside of the United States alone. There are a scant few examples that come to mind (toripalimab for nasopharyngeal cancer being one), but it is doubtful that HARMONi-2 will be sufficient to justify approval.

SMMT themselves are not currently conducting a clinical trial similar to HARMONi-2. Their 2 phase 3 trials are focused on ivonescimab plus chemo for squamous cell NSCLC only, as well as in patients with EGFR-mutated NSCLC after progression on an EGFR inhibitor. This places a near-term approval for ivonescimab alone further in doubt. In their latest quarterly guidance and earnings call, a path to regulatory approval in the US was not discussed. I expect this will be a subject of practically every Q&A the company conducts moving forward, though.

Financial Overview

As of their latest quarterly filing, SMMT held $28.4 million in cash and equivalents, as well as $297 million in short-term investments. Their operating expenses for the quarter reached $59.8 million, and after a few smaller items, the net loss for the quarter was $60.3 million.

These holdings do take into account the proceeds from an unsolicited offer to purchase stock from an institutional investor, which grossed $200 million. Given their cash burn, the implied cash runway for SMMT is between 5 and 6 quarters, consistent with corporate guidance that funding should last deep into 2025.

Strengths and Risks

Strength – HARMONi-2 is a win for the ivonescimab story long term

Unequivocally, HARMONi-2 is a positive trial, and it deserves all the lauding it’s getting, despite some of the reticence I’ve communicated in this article. This will almost certainly change practice in China, and it may even lead to something in the United States, for all anyone can know. SMMT has not communicated intentions as such, but stranger things have certainly happened.

Risk – It’s just unclear that it means the end of pembrolizumab’s hegemony in NSCLC

The biggest problem is that HARMONi-2, even if it leads to ivonescimab approval in the US, does not tell us when to use chemo-pembro and when to use ivonescimab. Given uncertainty, a lot of oncologists are going to continue with the game plan we’ve had since 2018, which is to give pembro-chemo as often as possible. There’s just not that much in HARMONi-2 that says pembrolizumab should be retired in the way that some commenters are purporting.

Moreover, what happens if HARMONi-2 does NOT show an overall survival benefit? In that case, there wouldn’t really be any reason to change from where we are today, saving antiangiogenic agents for part of later-line therapy after progression on pembrolizumab-based treatment.

Risk – While more stable, the cash runway is still too short to shepherd ivonescimab to the finish line

SMMT holds a lot of short-term assets that can be used to fund operations, at the expense of dilution from the cash raise. Unfortunately, this was not a definitive solution to cover their expenses, since even getting into Q4 2025 is not going to the projected study completion for their phase 3 trials. It’s going to be tight as HARMONi is expected to be fully enrolled in the second half of 2024, with no clear guidance on when data will come out of that study.

If it’s positive, you can expect a momentum-tripping equity raise almost at the same time. If HARMONi happens to be negative, then SMMT will find itself in serious trouble from a funding perspective, since they won’t have a clear position of strength to build from.

Bottom-Line Summary

At the end of the day, SMMT needs to justify its massive market capitalization. They obviously cannot do that with their sales growth trajectory, since they don’t yet have a product. And the results that we’ve seen from World Lung, despite the wins in terms of surrogate endpoints (i.e., PFS and response rate) do not (yet) signify that we should be changing practice.

What this means for the person who is getting excited about “ivonescimab > pembro, therefore ivonescimab will sell $7 billion per quarter” and goes all in on SMMT stock is that there is still a long wait before ivonescimab will really show its colors.

In the meantime, through many contributing factors, this lofty valuation for a pre-commercial company is unlikely to be sustained for the near term. There are many signs that the longer-term story for SMMT has a lot of promise, but they are still a good ways off from realizing that. In the meantime, there’s too much opportunity for degradation of an investment made today to warrant a strong look at SMMT, not at these levels.

For me, save the $8+ billion market cap for when ivonescimab is on the market and actually shows that pembrolizumab is truly obsolete. That day may come, but HARMONi-2 isn’t going to be how we get there. I say wait and watch for this one, at best, and take profits if you have them. This valuation is too lofty for me at this time.