SilverBow Resources Acquired By Crescent Energy, Unlocking Value (NYSE:SBOW)

bjdlzx

SilverBow Resources, Inc. (NYSE:SBOW) announced that the company has agreed to be acquired by Crescent Energy Company (CRGY). SilverBow has long struggled with a post-bankruptcy discount that is really not uncommon for companies that have exited bankruptcy. The acquisition from Chesapeake was at a fantastically good price. But the company ended up with too much debt, which gave the market another reason to keep the stock price low.

Nothing scares Mr. Market more than a post-bankruptcy stock taking on debt, no matter how good the reason is (and believe me, they had one heck of a good reason). The merger with Crescent Energy should resolve all of these issues and more.

Kimmeridge Energy, though, saw a chance to make a quick profit on the situation and even nominated board members. But oftentimes, these quick profit schemes backfire on long-term shareholders after the activist is gone.

The Deal

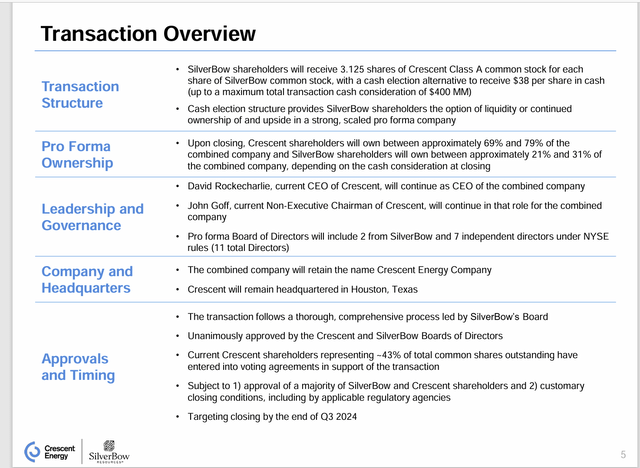

SilverBow Resources shareholders will receive 3.125 shares of common stock for each SilverBow stock. This is actually a combination of two undervalued companies into a larger company, with the hope that the size and the operating skills of KKR & Co. (KKR), which manages Crescent, will enable the shareholders to achieve better value. This should also take care of the post-bankruptcy discount that often plagues stocks like SilverBow.

Crescent Energy Offer For SilverBow Resources Summary (Crescent Energy SilverBow Resources Takeover Presentation)

Even though SilverBow Resources acquired the Chesapeake Energy Eagle Ford leases that were considered oily, SilverBow was known as a gas producer at a time when natural gas prices were low. That is not the case for Crescent Energy, which has a balanced portfolio. There should be a valuation increase for SilverBow Resources shareholders just from that consideration.

Shedding The Past

Undoing a company reputation (or changing that reputation for the better) takes time and a track record. SilverBow only recently acquired enough assets to be considered something other than a natural gas producer, whereas Crescent Energy has had that balanced production between oil and gas for some time. As a result, Crescent Energy (post combination) will have an easier time showing increased value from this combination.

Crescent Energy is a relatively new company itself. But the Non-executive Chairman is John Goff, who is a well-known investor. Clearly, running the company is KKR, which has unequalled access to a lot of talent throughout the organization to back up the people actually running the company.

None of that guarantees success. But KKR is well known for combining acquisitions into something more valuable than the separate pieces. Rarely can investors invest alongside experience like John Goff and KKR in a public company.

Debt

SilverBow had a lot of debt for the size of the company. The corresponding debt ratio was not bad as they obtained a very good price in purchasing the Chesapeake assets. However, the market hates a lot of debt compared to equity in this industry right now.

The combined company is a very different story, as Crescent Energy had far more equity compared to the amount of debt.

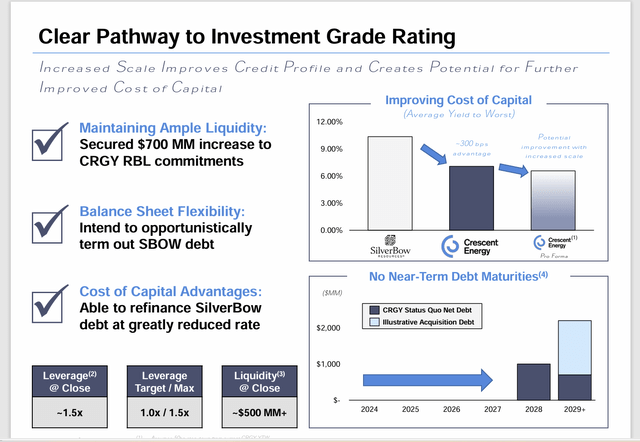

Crescent Energy Post Combination Debt And Outlook (Crescent Energy SilverBow Resources Takeover Presentation)

The current Crescent Energy management has a goal to obtain an investment grade rating. Clearly, management figured out how to do that while acquiring these assets. Note that one of the advantages of the combination is a lower interest rate, which alone is going to lower costs while saving a lot of money.

Add to that the fact that KKR is known for fast deleveraging of acquired assets. The debt market has a lot of confidence in the ability of KKR to handle debt. This is one of the reasons for that lower interest rate.

Operations

While KKR is known for leveraged buyouts and creating value, less known is the operating ability of KKR to achieve those ends because its main reputation on Wall Street is as a dealmaker.

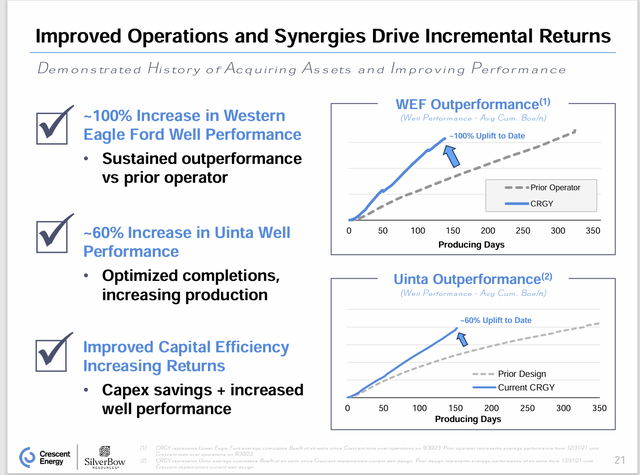

Crescent Energy Operational Improvement History Of Previously Acquired Acreage (Crescent Energy SilverBow Resources Takeover Presentation)

SilverBow Resources has not owned the acquired Chesapeake acreage all that long to make really any kind of material improvements. Before that, Chesapeake did not consider the properties to be core holdings and therefore likely ignored the potential of the properties. But this is precisely what Crescent Energy management is looking for. The combined company will have the same chance to replicate the history shown in the slide above to the benefit of the post combination shareholders.

Crescent Energy has focused upon being a “roll-up” company for the highly fragmented Eagle Ford. The Eagle Ford often outperforms the Permian because the Permian became the “place to be.”

The result was a function of a type of overcrowding. Too many operators had the idea of expanding production in the past. This resulted in pricing discounts and costly trucking of product as midstream capacity became unavailable. Meanwhile, the Eagle Ford production was getting a premium to its posted price.

A consolidation strategy like Crescent Energy is executing will not result in a big demand jump that would cause sales price discounts. If anything, overall production would likely decline a bit as uneconomical acreage becomes less active during that consolidation process. One of the side effects of consolidation is that where (for example) 20 rigs were running before consolidation, that same acreage under one operator might be more efficiently developed with 8 rigs and longer more profitable wells.

Other Combination Benefits

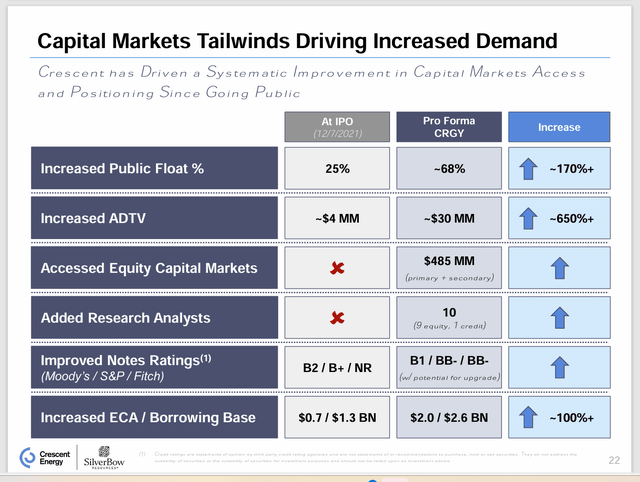

The combined company has a slightly better credit rating for debt offerings than was the case during the initial public offering.

Crescent Energy Capital Markets Benefits Post Merger (Crescent Energy SilverBow Resources Takeover Presentation)

The post combination entity, Crescent Energy will still have shares that will need to become public. However, the greater number of shares outstanding with the public will make that a far less disruptive event than was the case in the initial public life of the company.

Summary

A share offering by Crescent Energy allows SilverBow shareholders to participate in any operating efficiency gains in the Eagle Ford. KKR is known for unlocking value post combination. This could well be a superior path for the shareholders to follow.

It was going to take some time for SilverBow management to bring debt levels down to market acceptable levels, even though the debt ratio was decent. There was the additional issue for SilverBow management of a post-bankruptcy company acquiring debt, no matter how justified. These issues should be less of a concern with the post combination company.

SilverBow management had wisely engaged in diversifying the production away from natural gas. But a reputation as a company with balanced production between natural gas and oil was going to take a while. Crescent Energy is known as a company that already has that balanced production.

Increasing Ability To Export Natural Gas

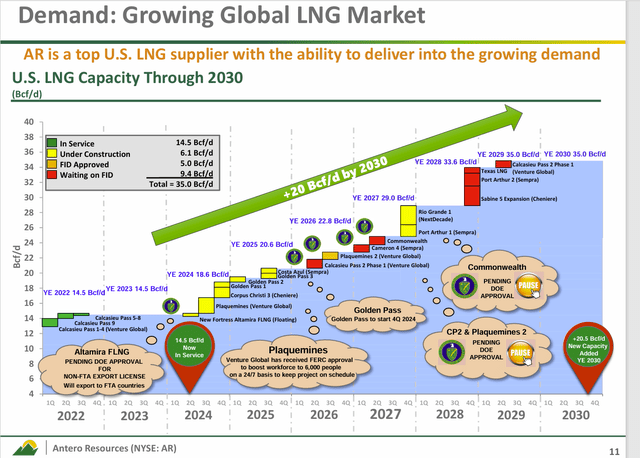

The combined company may well benefit from the considerable expansion underway to increase LNG export capacity.

Antero Resources Natural Gas Export Capacity Additions (Antero Resources Natural Gas Fundamentals Presentation May 2024)

The considerable expansion of natural gas export capabilities may well allow for the usually oversupplied North American market to join the far stronger world market eventually.

Natural gas prices (NG1:COM) are probably at a cyclical low. The combined company should benefit from the coming natural gas pricing recovery. This would be another way that the combined company would benefit from the increasing value of the production.

My own personal recommendation would be to consider this as a strong buy consideration combined with approving the merger. I think that the combined company has a far better chance of unlocking value than SilverBow does as an independent company. KKR is probably one of the best managers in the business, with likely unequalled resources. They are also excellent at building companies and selling them for a good profit.

KKR generally only gets involved when they can at least triple their money over five years. This pays for their expertise while covering the risk they are taking. Investors can get in at a price lower than the initial stock price offering when it begins trading. This allows an extra measure of safety in achieving a profit.

Risks

KKR and John Goff have a great reputation. But that does not guarantee future success as a team in this case. I do like the chances, though.

Any upstream company is subject to the low visibility and volatility of commodity prices. A sustain and unexpected downturn could materially impact the future of the company.

Any company that grows rapidly for any reason, let alone acquisitions, is riskier than normal. Both KKR and John Goff have a lot of experience building and selling companies. While that should reduce the rapid growth risk, there is no assurance that logistical considerations of rapid growth will not overwhelm management. Any acquisition could prove disappointing.

The loss of a material senior officer should be reduced given the personnel resources available through KKR. However, it still exists as a potential risk.