RLI Corp: Results In Spite Of Expected Competition (NYSE:RLI)

InterNetwork Media/DigitalVision via Getty Images

RLI Corp. (NYSE:RLI) was indicating that competition might be coming in for some of the major money-making sectors, which we acknowledged as a reason for caution in our last article. However, in the segments where competition was expected, they seem to have been able to acquire business in new verticals at more rational prices without much issue, and growth continues to be excellent. SG&A is still a little high on continued tech investments and likely on customer acquisition, but performance is improving. Moreover, we expect that the coming quarters which feature more renewal activity and provide more cash flows should drive some further yield from the reserve portfolio than we are seeing so far. Performance continues as does its aristocrat traditions with the dividend, but the valuation is just too premium for us to ever be interested as cigar-butt investors.

Q1 Earnings

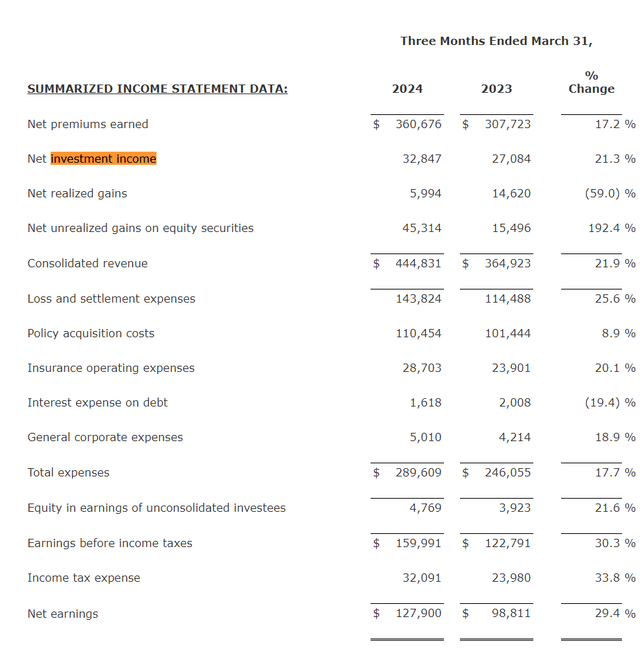

Let’s begin with a less complex point. The overall investment income performance is up around 21%. Based on cash accumulation and YoY changes in rates, a better performance was actually expected. With renewals coming later in the year, after this Q1, new cash should be driven into these high yield reserve portfolios to generate some incremental growth. Nonetheless, insurance is clearly a sector that is benefiting from the higher rates.

As far as the overall underwriting is going, net premiums are up significantly, which was not exactly the expectation since in the last quarter there was indication of mounting competition in casualty, but also in E&S generally.

Overall premiums earned grew by an excellent 17.2%, driving overall net earnings growth by offsetting some of the higher claims this year from storms and wildfires.

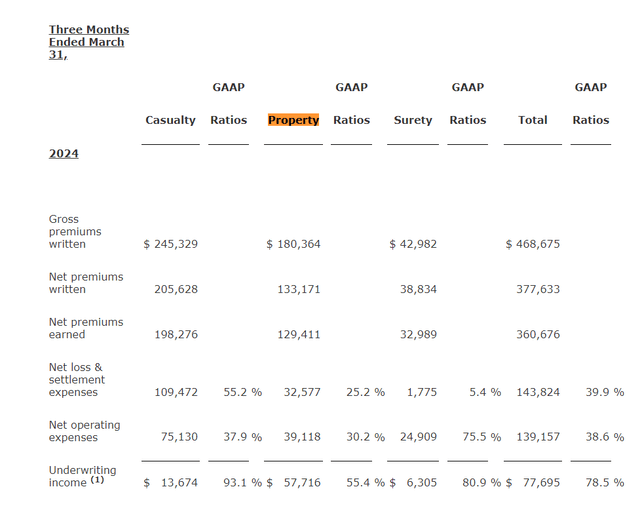

In property, premiums grew by 14%. Hurricanes are a big business for RLI, and this exposure reduced somewhat since a lot of insurers and their agents are beginning to push into this market, which being a niche market, has had for some time attractive dynamics. Hurricane rates were still up 25% in the quarter, but those increases are slowing.

Hawaii is still a good market, though, where quite a lot of insurers abandoned the market after taking hits on wildfires. RLI is picking up a lot of that business and earning brownie points by staying an important vendor to businesses and residents there. Pricing is good, and approvals are coming in so that they can push deeper into this market.

Property is one of the larger segments by net premiums earned after casualty, so we do note the comments of agents in particular getting aggressive and promotional with pricing and limits in the markets here, particularly in E&S property markets like hurricane insurance. This is a major moneymaker and growth engine for RLI, so it’s not great news to hear that pressure is continuing to mount here. Nonetheless, they are getting overall rate and volume growth in property still, it seems.

Moving onto the next segment of surety, gross premiums grew by 12%. The market is solid since there are high material costs, and continued service of these markets is allowing RLI to refine its models to deal with the market changes in construction. There is a lot of demand for surety since a lot rides on these building projects nowadays. With refinancing concerns and other liquidity concerns due to the capital environment, surety is getting a further boost.

In the casualty segment, which is the largest by net premiums, premium growth was 13% with pricing only up by 7%. Transportation, which has pretty large trucking contracts, managed to score some lumpy wins and premiums there grew by 27%. But other areas were quite weak, as telegraphed in the last call, such as executive products where premiums declined in total, driven in part by volumes but also shrinking rates. That’s the sort of setup that RLI will start moving away from.

Nonetheless, overall casualty rates have accelerated incrementally from last quarter’s 5% growth. Personal umbrella was also a strong area in addition to transportation, with a 13% rate increase. While transportation was a welcome win this quarter, if a contract doesn’t renew, the concentration of customers in this business means that it would show in the results.

Bottom Line

RLI was maybe a little early to telegraph the pressures in E&S which impacts surety and also the property segment. Things are still going well there. Also, transportation came in strong, even though that was another area where, in the last quarter, there was some comment on mounting competition. The business is chunky, though, so there could be some unpleasantness if anyone doesn’t renew. Surety, while a smaller business, seems to be in a structurally good place for now. They are continuing to make their record on dividends a growing one on an annual basis, and this is likely where some of the premium on their stock comes from, with P/Bs at around 4x. The underwriting discipline and specialty markets are probably factors as well. However, with P/Bs only somewhat above 1x being a reasonable standard for the industry, we cannot abide by the valuation even if the quality may justify it for now because it implies a decade of performance and growth to be a fair valuation. While the track record is good, we just don’t bet on track records.