Oracle: Strong EPS Growth Expected In 2025 And 2026, Watching Q4 Margins

Marlon Trottmann

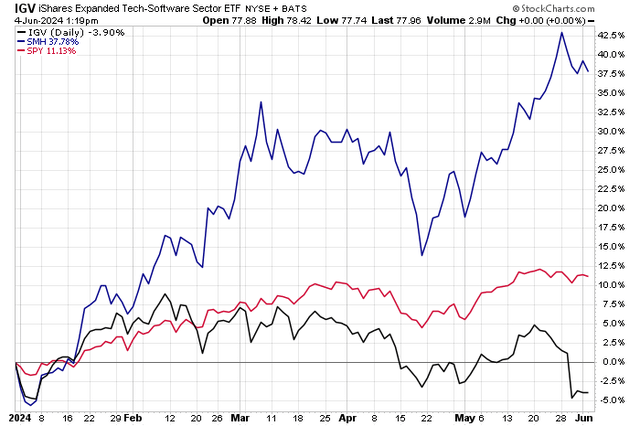

We are finally beginning to see some bifurcation in the AI arms race. While capex and corporate investment into the emerging technology remains robust, the “buy everything” zeitgeist has broken down in recent months. The winners are, of course, semiconductor stocks while the apparent losers, for now, include many software companies. The iShares Expanded Tech-Software Sector ETF (IGV) is now negative on the year, sharply underperforming the VanEck Semiconductor ETF (SMH) as well as the Information Technology sector and S&P 500 as a whole.

I am upgrading shares of Oracle (NYSE:ORCL) from a hold to a buy on valuation. Ahead of earnings next week, we need to see strong numbers from its SaaS applications and cloud infrastructure technologies and products. Specifically, its margins will be closely scrutinized along with the firm’s forward growth outlook.

Software Stocks Sag As Semis Surge in 2024

According to Bank of America Global Research, Oracle develops, manufactures, hosts, distributes, and services database, middleware, and applications software as well as hardware. The software business is now reported in two segments – Cloud services and license support and Cloud license and on-premises license. Services consists of consulting, education, and assistance so customers and partners maximize the performance of Oracle products. The hardware business consists of Oracle Engineered Systems (including Exadata), servers, storage, and more.

Back in March, shares of Oracle surged to all-time highs following a strong Q3 2024 report. Quarterly non-GAAP EPS of $1.41 inched past the Wall Street consensus outlook of $1.38 while revenue of $13.3 billion, up 7% from year-ago levels, was about in line with estimates. It was indeed a healthy third quarter with a rebound in its cloud growth segment, with a very impressive 49% jump in Oracle Cloud Infrastructure (OCI). That’s what analysts expected, however, and the company’s cloud margins left something to be desired – perhaps that is why shares eventually pulled back after the massive 11.7% surge in the session after the release.

Moreover, the management team’s Q4 guide was a little soft, pointing to just a 4-6% revenue increase YoY. Overall enterprise spending may be too focused on AI and less so on Oracle’s bread-and-butter offerings. But with partnerships including Microsoft’s Azure, the future still looks decent for Oracle. That’s evidenced by the company choosing to invest over $8 billion in Japan to meet cloud computing and AI demand. Furthermore, UBS recently mentioned ORCL on its AI stock list.

Looking ahead to next week, the options market has priced in a 5.8% earnings-related stock-price swing when analyzing the at-the-money straddle expiring soonest after the Q4 release, according to data from Option Research & Technology Services (ORATS). Operating EPS is seen at $1.65, which would be close to unchanged from the $1.67 of EPS reported in the same quarter last year. Key risks include a downturn in enterprise spending if we see a deterioration in the macroeconomy and increased competition from the likes of IBM (IBM) and Microsoft (MSFT).

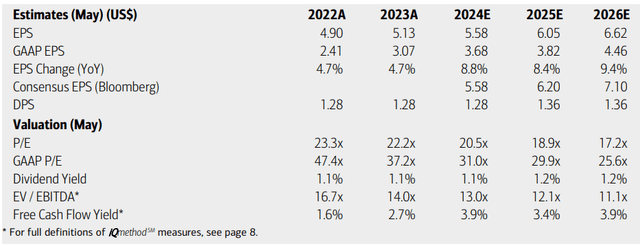

On valuation, analysts at BofA see earnings having risen by about 9% this year, with continued high-single-digit EPS growth through 2026. The current Seeking Alpha consensus operating per-share earnings figures are slightly more sanguine compared with what BofA projects. Analysts are also bullish on the firm’s future top line, with annual jumps approaching 10% by 2026.

Dividends, meanwhile, are forecast to increase at a modest clip over the next handful of quarters while Oracle’s EV/EBITDA multiple is seen declining into the low teens while free cash flow should be on the rise in the next two years.

Oracle: Earnings, Valuation, Dividend Yield, Free Cash Flow Yield Forecasts

If we assume $6.24 of non-GAAP EPS over the next 12 months and apply a 22 multiple, then shares should trade near $137, making the stock undervalued today. Given the better EPS growth rate today versus earlier in the year, and with the stock about flat since I last analyzed it, a correction in time has taken place. The same 2.0 PEG ratio that, I thought, was appropriate last winter results in an attractive, though not stunning, GARP play today.

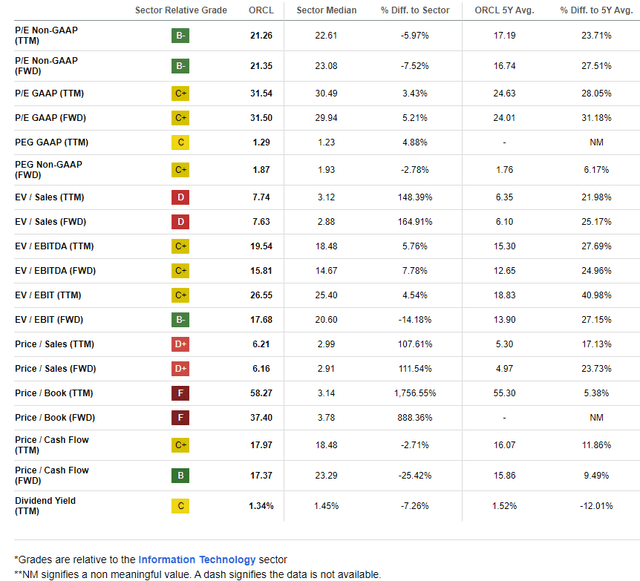

Strong Growth Ahead Warrants a Low-Mid 20s P/E

Compared to its peers, ORCL sports a weak valuation grade, but when taking its growth forecast into account, I assert that its intrinsic value is intriguing at the very least. Additionally, Oracle is a free cash flow stalwart with a solid balance sheet.

The sellside has likewise been impressed, indicated by a high 22 EPS upgrades in the past 90 days compared to just 3 downgrades. Finally, share-price momentum has been lukewarm, and I’ll detail important price points on the chart to monitor later in the article.

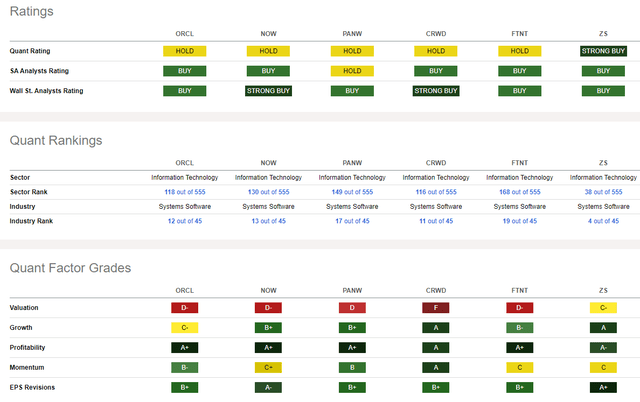

Competitor Analysis

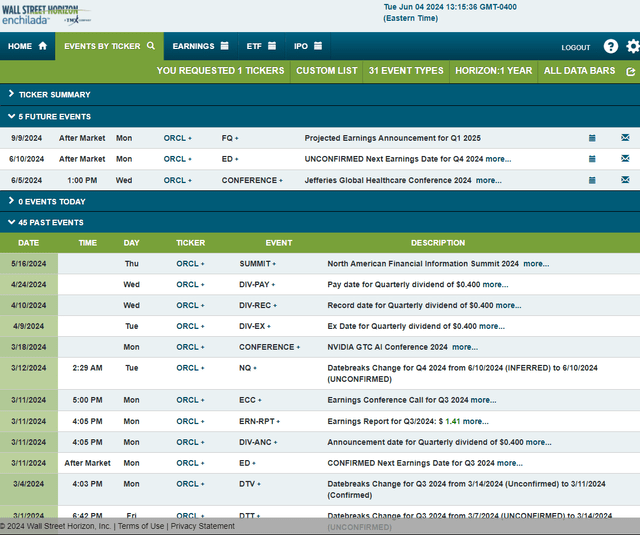

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2024 earnings date of Monday, June 10 AMC. The management team also presents at the Jefferies Global Healthcare Conference 2024 from June 4-7 this week, which could also bring about some stock-price volatility.

Corporate Event Risk Calendar

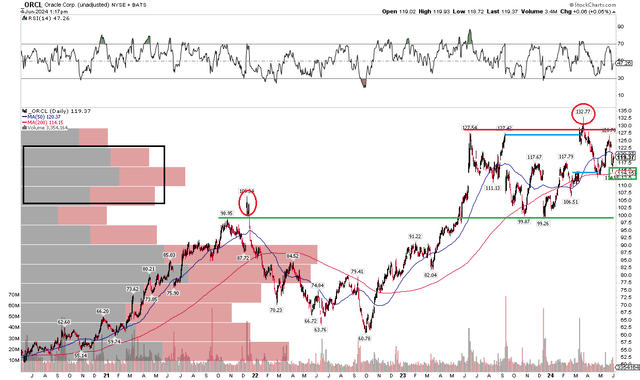

The Technical Take

I mentioned a “correction through time” earlier. What I mean is that earnings are on the incline (Q4’s slight EPS dip notwithstanding), while shares have merely traded sideways for the better part of the last year. Notice in the chart below that A pullback from the previous peak above $127 found support at the late-2021 high. I’ve annotated the graph with a pair of red circles, which indicate bearish false breakouts. The latest one leaves the software stock vulnerable to a move under its long-term and flat 200-day moving average. If we see a breakdown under $114, then we could see a retest of the late-2023 nadir under $100.

But an upside breakout would target about $155 based on the $28 range in the past six months. Be on the lookout for a potential gap in price post-earnings – the stock has a history of moving significantly in the session after reporting, but then filling said gaps over the ensuing weeks.

Overall, ORCL has underperformed the SPX and tech sector, and key support is seen near $114 with resistance in the $127 to $133 range.

ORCL: Shares Consolidating Near Highs in 2024, $114 and $99 Support

The Bottom Line

I have a buy rating on Oracle. I see its valuation has improved enough today to warrant an upgrade. The chart still has work to do, but the choppiness so far this year has key levels for investors to watch with earnings on tap next week.