Keywords Studios: A Potential Buying Opportunity Amid Valuation Divergence (OTCMKTS:KYYWF)

hobo_018

Keywords Studios (OTCPK:KYYWF) is a creative services provider to the gaming industry, being in the business of offering technical and creative services (which include art creation, game development, QA testing, localization, translation, marketing, player support, and audio services) to the video game and digital media industries for over two decades. Keywords Studios operates an outsourced business model with a network of over 70 game studios around the world. The company operates in three main divisions: Create, Globalize, and Engage. The Create division focuses on game development, art services, and audio development. The Globalize segment offers QA testing and localization services. The Engage segment focuses on marketing and player engagement.

My last coverage of Keywords Studios six months ago looked at the company’s expansion over the last few years, the company’s new revolving credit facility (RCF) in that period, and the effect the RCF had on the company’s cash flow and M&A opportunities, considering the company is a serial acquirer of gaming studios. I recommended a “hold” rating in the last article.

I believe that a hold is a prudent rating for this stock. For investors considering a gaming stock, monitoring KYYWF’s performance until the end of the fiscal year [FY23] is a wise approach to gauge the industry’s momentum and this stock’s potential. For investors who already have KYYWF in their portfolio, holding onto the stock is a reasonable strategy. The YTD price decline may present an opportunity for potential recovery, especially with the expected industry turnaround in the second half of the year.

Excerpt from my last KYYWF article

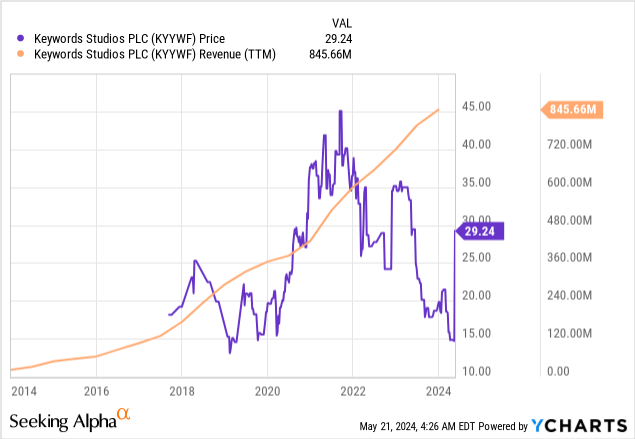

Since that coverage, Keywords Studios has released its full-year 2023 and Q4 FY23 earnings report. This article will focus on key data from these two reports and KYYWF’s price decline and valuation divergence since the last coverage. Revenue has continued to grow QoQ, but the stock price has not enjoyed the same momentum.

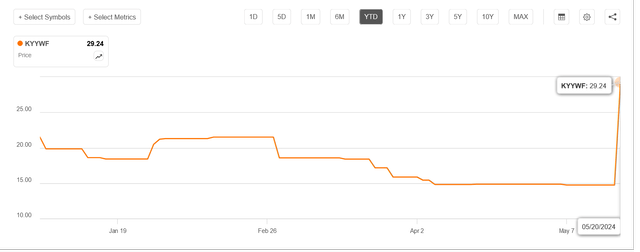

May 20 price surge on EQT acquisition news (Seeking Alpha)

The stock experienced a sudden price surge, jumping over 100% today (May 20) on market open, following the news of an acquisition discussion with Europe-based investment company EQT in a deal that values Keywords Studios at over £2.2 billion. Despite the sudden price surge, I will focus on the organic price trend of this stock since my last coverage and also talk about the likely trajectory of the stock if the proposed deal goes through or falls through.

Keywords Studios MRQ Overview

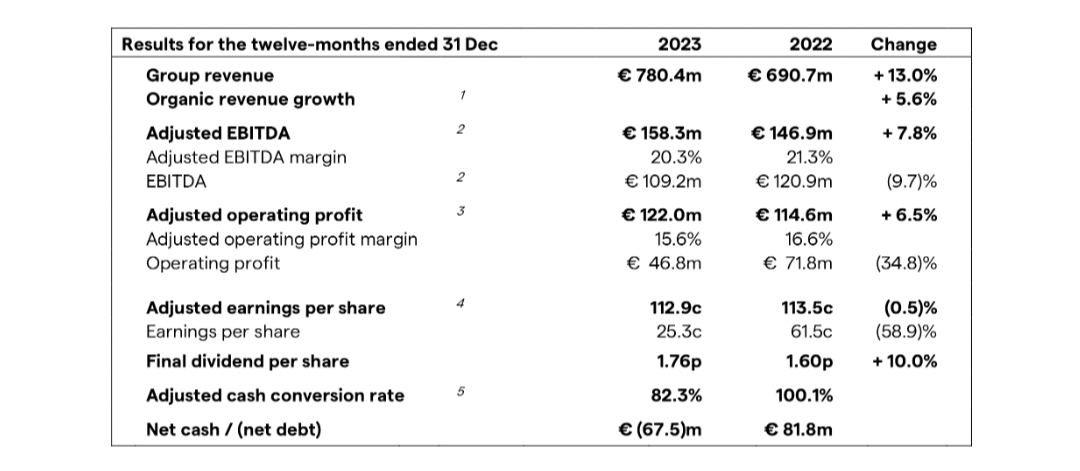

FY24 Income (Keywords Studios earnings report)

Keywords Studios reported record revenue for the full year 2023 and has maintained revenue growth in the past year despite mixed performance in the gaming industry. 2023 was not the best of years for the gaming industry. The industry experienced slow growth, generating around $184 billion in revenue at a mere 0.6% YoY growth over 2022 – an effect of the post-pandemic gaming activity slump. However, 2023’s marginal growth is an improvement over 2022’s decline. Studio activities also took a hit with the months-long Hollywood Strike in 2023.

Despite the general headwinds in the gaming and entertainment industries, Keyword’s Studios recorded impressive 13% YoY sales growth in FY23, with organic growth of 5.6%. The company has seen double-digit annual growth for the past ten years. Keywords Studios has reiterated its €1 billion near-term yearly revenue target. At the growth rate seen, I believe the company could be reaching this goal in the next two fiscal years with the current double-digit annual revenue growth.

For FY23, Keywords Studios delivered margins ahead of guidance and saw an impressive cash conversion of 82%. Now, cash generation is the cornerstone of the company’s financials and growth, as the company is big on accretive M&As for its ongoing growth and expansion. Keywords Studios heavily reinvests cash into its business.

The Create division is Keywords Studios’ largest and most important division, with strong margin delivery. Create saw 22% revenue growth. The Globalize division saw a 4% decline in sales; the decline was mainly influenced by the Hollywood strikes. The Engage division saw 2% organic growth. However, if M&As are considered, the division grew by 44% in FY23. Three major acquisitions helped propel the expansion of the Engage division. The acquisitions of Helpshift, Los Angeles-based social media agency Digital Media Management (DMM), and communications agency 47 Communications will boost Keywords Studios’ marketing offerings and the Engage division moving forward.

On the bottom line, though Keywords Studios has maintained profitability, it has also shown earnings variability (EVAR) quarter to quarter for over two fiscal years. I think the company’s EVAR is one of the causes of the stock price divergence to its ever-expanding top line. My interpretation of this divergence is that investors may have reacted to the inconsistency in earnings performance despite the company’s revenue growth. More so, as a dividend-paying stock, which is most likely held by more income-oriented investors, EVAR could be interpreted as a risk to dividend sustainability; hence, the stock’s poor price performance (until today’s rally).

Takeaway

While KYYWF may have seemed like a natural ‘buy’ given its historical valuation and stock price divergence over the past three years, today’s sudden surge prompts a reassessment, which leads me to maintain a ‘hold’ rating.

The EQT deal isn’t finalized yet. EQT had previously proposed an acquisition on four separate occasions, which Keywords had earlier rejected. EQT has until June 15 to make a formal takeover proposal. If the deal materializes, the current holders of this stock stand to benefit. On the flip side, if the deal falls through, I expect some serious price volatility for this stock.

Looking beyond the proposed deal, I believe FY24 will be a much better year for Keywords Studios. The company has enough dry powder from its cash conversion in FY23 and its existing RCF to embark on more astute accretive M&As. Also, with the Hollywood strikes now resolved, there will be ramp-ups as the dust fully settles going into FY24. The company will likely see a boost in studio activities and a return of activities to the Globalize division, which was largely affected by the strikes.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.