Global Ship Lease Is Still A Solid Hold (NYSE:GSL)

SHansche

My Thesis

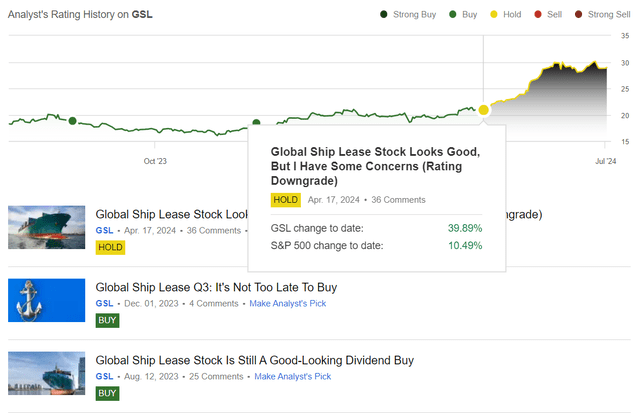

You’re now reading my 6th article on Global Ship Lease, Inc. (NYSE:GSL) stock here on Seeking Alpha. In my last article, I downgraded the stock to “Hold.” Initially, I was of the opinion that the company’s growth potential seemed limited given the microeconomic indicators and the state of the container shipping industry. I assumed that once the Red Sea crisis was over, the stock was likely to fall due to potentially weaker operating revenues and earnings caused by an influx of ship supply entering the market. However, recent developments have shown that the crisis is not over yet, which is why my downgrade was unsuccessful. Although I did not advocate selling the stock, only holding it, one could argue that while my “hold” rating was justified, it might have been better if I had left it unchanged.

Seeking Alpha, Oakoff’s coverage of GSL

However, today I have decided to reaffirm my “Hold” rating – it still bothers me that GSL’s driving force is limited by the microeconomics of the industry if we take the Red Sea crisis out of the equation.

My Reasoning

First of all, we must recognize the current strength of the container shipping industry. Maritime transport in general has seen significant developments in recent weeks. These changes have resulted from the need to bypass the usual routes through critical passages such as the Cape of Good Hope – this need has led to a sharp increase in charter rates.

Market indicators confirm the strength of the market during the 1st half of 2024. Time charter rates in June are up 113% compared to the end of 2023 as liner operators have attempted to find the ships needed to accommodate the longer distances via the Cape of Good Hope.

[Source]

As some maritime officials said a few days ago, Yemen’s Houthi rebels likely launched a drone attack damaging a Liberia-flagged container ship off the coast of Hodeida in the Red Sea on Sunday, as reported by Seeking Alpha News. So this incident continued the trend of shipping disruptions this year, with increased attacks likely causing further diversions and sustained disruptions in the Red Sea, driving up shipping rates. The attacks have lasted longer than I previously expected, making it difficult to predict when they might end. The positive effect on charter rates therefore continues to accumulate and increases the probability of good profits for GSL and its peers from day to day – which is why the stock price is rising so strongly.

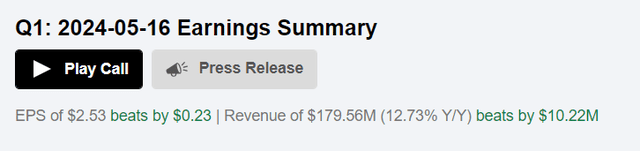

In fact, GSL is already feeling the positive effects of the ongoing crisis in the Red Sea. Looking at the results for the first quarter of 2024, we see that the operating revenues reached $179.6 million, an increase of 12.7% compared to the previous year. Operating costs (OPEX) didn’t increase significantly, allowing the company to report an adjusted EBITDA of $125.4 million – an increase of 19.5% YoY. Also thanks to a significant reduction in non-operating expenses (a cut in half basically) and stock repurchases, GSL was also able to increase its EPS by 25.7% YoY, exceeding analysts’ original expectations by a very wide margin:

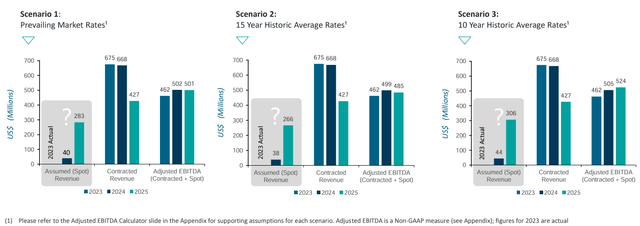

The demand side appears to be strong: now the firm’s diversified charter portfolio, with $1.6 billion in contracted revenues after adding $54.6 million in contracted revenue through new charters and extensions through Q1 2024. According to internal scenarios, the future earnings forecast suggests that the situation will be stable or improve in comparison with 2023, even though there are many ships up for recharter in 2024.

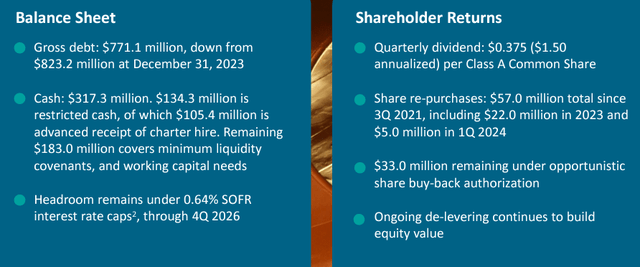

GSL’s still-solid marginality allowed it to repurchase Class A common shares for $5.0 million, with $33.0 million remaining in its share buy-back authorization. I believe we can expect continued share buybacks this year at least given the company’s strong liquidity, with $317.3 million in cash and a reduction in gross debt from $824.2 million to $771.1 million in the last quarter. The company’s dividend of 5.18% (estimated for a few years ahead) also seems to be well covered by its operating capabilities.

Everything looks fantastic, so why am I rating GSL as a “Hold” amid all that?

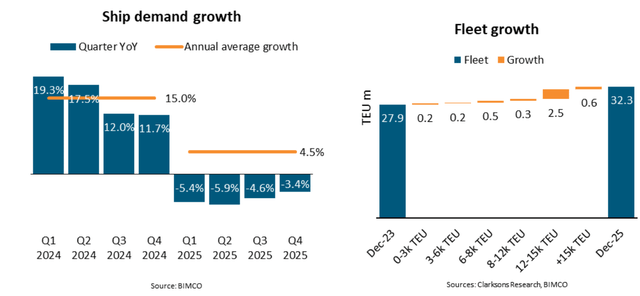

According to BIMCO (the source I cited above), the total fleet will grow by 25% over the next 3 years (from 2023 to 2025), the highest growth rate since the three years from 2011 to 2013. Given the cyclical nature of the industry, this represents a significant shift in the balance between supply and demand. According to the same source, demand in 2024 is currently strong, but it’s unlikely that it will be able to build on this year’s success the following year. Consequently, one side of the equation will move in the opposite direction, which could lead to an imbalance, especially if we take the Red Sea crisis out of the equation.

I hold BIMCO’s analysts in high regard and regularly read their reports – they come to the same conclusion when looking at the forecast supply and demand dynamics on the market.

Looking ahead, we expect freight rates and time charter rates to follow the predicted supply/balance development, ie begin to weaken during the 2nd half of 2024 and weaken further during 2025. Secondhand prices should follow a similar pattern whereas newbuilding prices will largely be depending on contracting activity in other sectors.

Many readers will wonder why we shouldn’t take the disruption caused by the Red Sea crisis into account when deciding whether or not to “buy” the GSL. In my opinion, in order to sleep peacefully without worrying about our portfolio, we need to focus on the microeconomics and the overall situation of the industry, rather than relying on the persistence of the current extreme situation in a particular region.

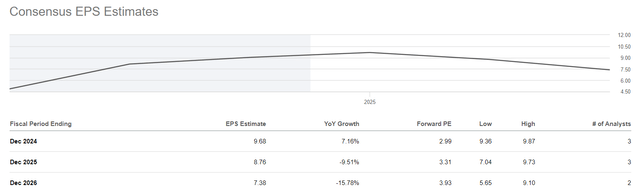

I’ve to give credit to the company’s valuation, as it already partially reflects the expected slowdown in growth in 2025 and 2026. Analyzing the projected P/E multiples, I see that GSL is currently trading at around 3x for 2024, around 3.33x for 2025, and almost 4x for 2026. This indicates a significant discount to the current valuation, and as long as the Red Sea situation continues to dominate, the company is likely to remain undervalued.

But again, we can’t predict when the crisis will end. One thing is clear to me though: once it does, analysts’ EPS forecasts will likely shift dramatically lower, leading to a more negative outlook and a sharp change in the stock price.

As long as the situation persists, we can assess the growth potential of GSL: My technical analysis suggests that the stock could rise to the next resistance zone in the coming months, which is about 41% above current prices. This seems justified when we look at the company’s multiples: If the Wall market starts to assess the current 2025 forecasts as too pessimistic due to the ongoing crisis, an expansion of the 2025 P/E multiple to 4-4.5x could indicate significant growth potential.

TrendSpider Software, Oakoff’s notes added

Nevertheless, the above calculations are subject to considerable risk and are not influenced by the microeconomic situation in the industry, while the main tailwind (the Red Sea crisis) is impossible to forecast. This makes the situation surrounding the company very uncertain.

Therefore, I think “Hold” is an appropriate rating for GSL stock right now.

Concluding Thoughts

I believe GSL stock should remain a solid “Hold” so to speak. This is not a negative assessment of the stock’s future growth prospects. Rather, it’s a cautionary note for those considering large purchases at current highs. Despite the company’s strong financials, solid contract revenue, and management’s efforts to please investors through share buybacks and reasonable dividends, investing heavily now is risky, in my view. The primary reason the stock might rise significantly in the near future is the ongoing Red Sea crisis, which is unpredictable – therefore, I urge everyone to be prudent. I’d say: continue to hold the stock in your portfolio, but avoid overweighting.

Good luck with your investments!