Fannie Mae And Freddie Mac Preferred: My Favorite Trump Trades (FMCC)

Boarding1Now

Will Donald Trump Win?

Close call. Today it is a virtual tossup. Just to name any potential bias: I am unaffiliated with any party, haven’t voted for either of them in the past or contributed to either campaign and have no plans to support either in the future. I did donate $1 to Doug Burgum, who might become Trump’s running mate, but that was in no small part due to his offer to pay me back $20.

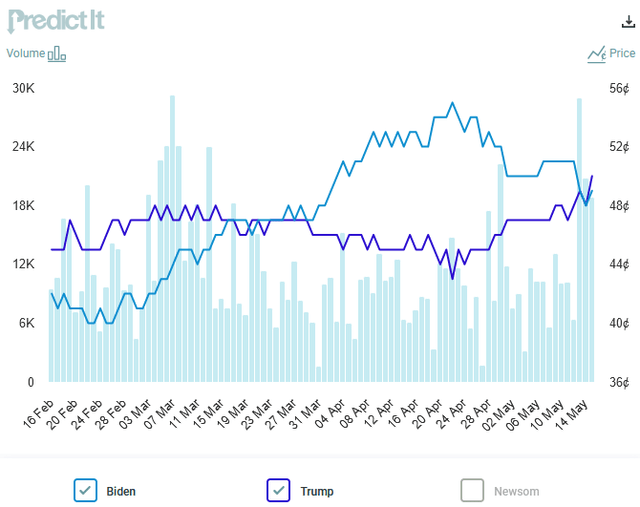

President Biden shows signs of faltering. They are within the bid-ask spread on betting markets:

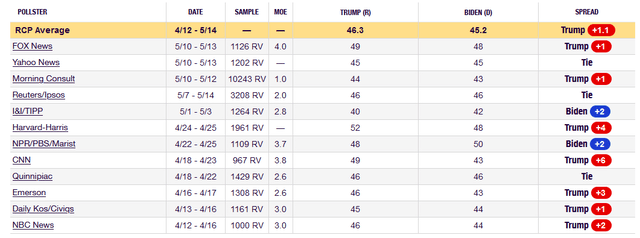

The poll average shows Trump ahead by about 1%.

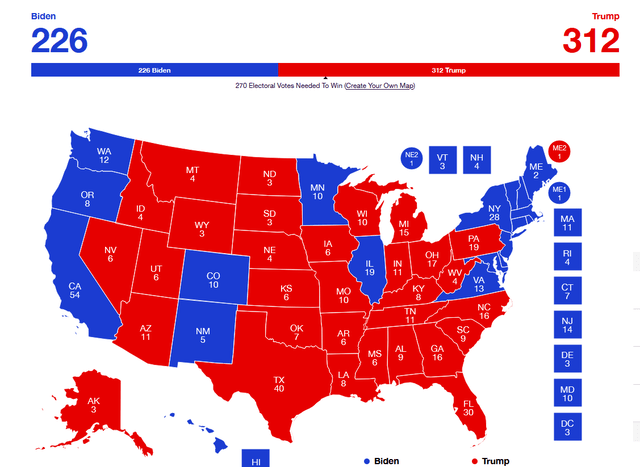

The incumbent’s woes look worse when looking at the map:

History’s least popular president is running as an incumbent, challenged by history’s second least popular president. Lots could happen in terms of political, economic, health, and legal developments to tip the balance either way. But Biden is unlikely to pick up any new states and could lose quite a few; sunbelt states such as Nevada, Arizona, and Georgia appear to be slipping unreachable already. It may be time to prepare your portfolio for another round of President Trump.

If So, What’s The Trade?

Earlier this year, I answered this question:

How else might one bet on Trump? Both President Biden and Trump are big spenders; there aren’t a lot of actionable items on taxes and spending. But Biden uses the administrative state to regulate more aggressively. There is a possibility that we see both the end of the Chevron Doctrine deferring to regulators at the Supreme Court at around the same time as the end of the Biden administration. So, companies that have suffered under aggressive regulatory burdens could flourish. One of the most leveraged bets on Trump is Fannie (OTCQB:FNMA, OTCQB:FNMAS, OTCQB:FNMAT) and Freddie (OTCQB:FMCC, OTCQB:FMCKJ, OTCQB:FMCCH); they’ve suffered under Biden but could have a route to realizing value under Trump. Their prefs have more ways to win than common.

Caveat

If Biden wins, Fannie/Freddie privatization will have to wait for at least another four years.

Conclusion

As an advocate of limited government, free enterprise, rule of law, and individual liberty, I am politically homeless (or as we are now told to say “politically unhoused”). I have no dog in this fight. But I’m preparing for a Trump win.

TL; DR

I own some OTCQB:FNMAS, OTCQB:FNMAT, OTCQB:FMCKJ, and OTCQB:FMCCH; you might want to too.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.