CGDV: A Solid Low Risk ETF With Market Beating Returns Potential (NYSEARCA:CGDV)

marrio31

Capital Group Dividend Value ETF (NYSEARCA:CGDV) appears to be one of the best options for those who have low risk tolerance but seek to outperform the tech-driven bull run. A number of reasons make it a classic pick for high-risk adjusted returns, including its portfolio strategy of holding stakes in fundamentally strong dividend-paying large cap value and growth stocks from various sectors. CGDV’s smart portfolio management strategy enables its shares to perform well in both bullish and bearish market conditions. Its total returns outperformed the broader stock market index in the last twelve months, with expectations for the extension of momentum in the short and long-term. Therefore, I initiate coverage of the Capital Group Dividend Value ETF with a buy rating.

Stock Market Outlook and CGDV

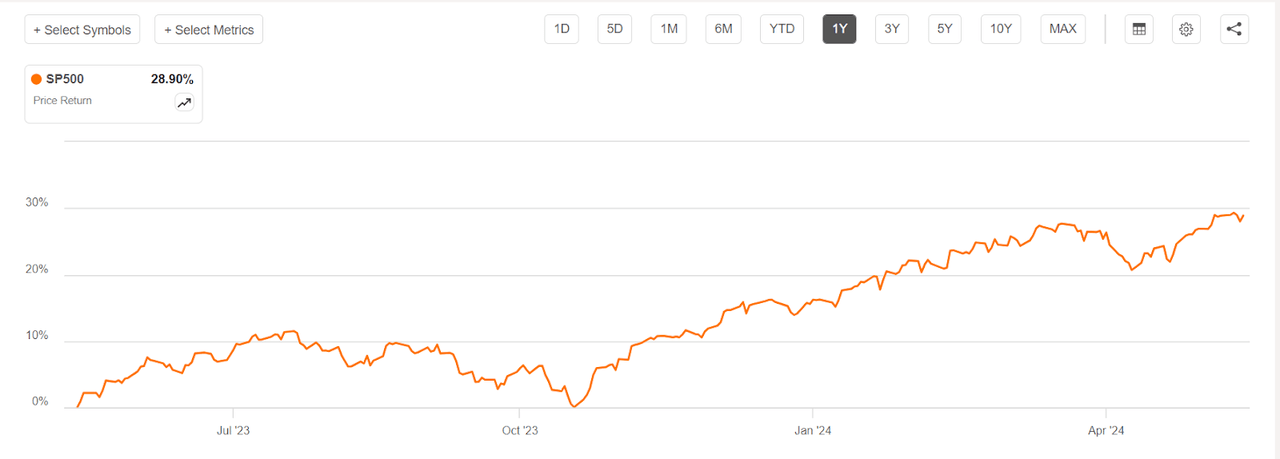

S&P 500 price change (Seeking Alpha)

The US stock market extended its last year’s bull run into 2024, hitting record highs numerous times due to impressive gains from the tech stocks along with a positive contribution from the rest of the S&P 500 sectors. It appears that robust earnings growth trends, improving business activity and deteriorating credit risk continue to outpace concerns over the Fed’s policy of holding rates at a peak level for a longer time. The financial sector has also begun witnessing increased loan activity and declining credit losses. Meanwhile, the cooling inflation and job market hint at economic stabilization and prospects for rate cuts in the second half of 2024. Currently, Wall Street’s bottom-up 2024 price target for the S&P 500 is around 5900 points, reflecting an upside of more than 12% from the current level.

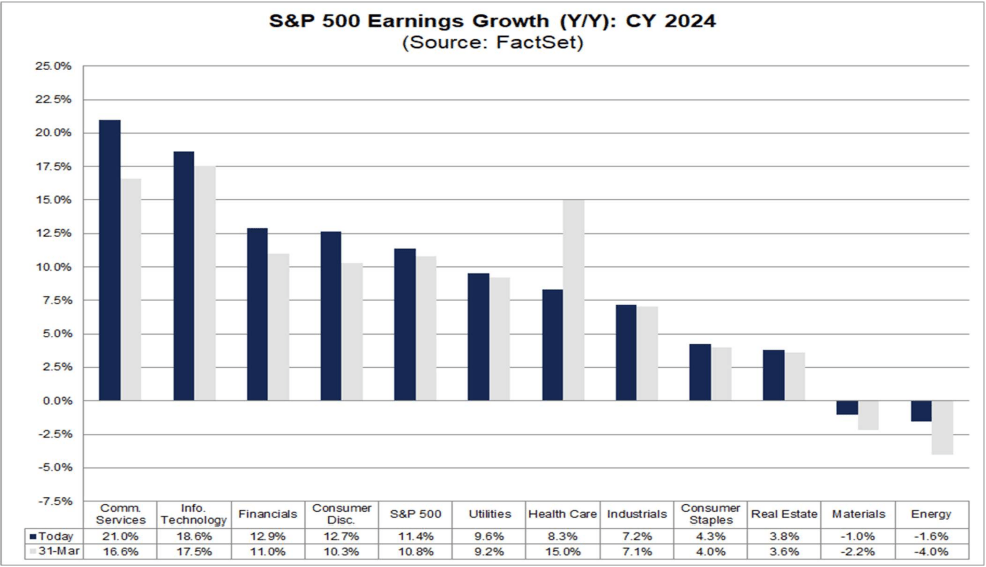

Earnings forecast (FactSet)

I also believe that the uptrend is likely to extend because corporate earnings growth is anticipated to expand throughout 2024. In the first quarter, the S&P 500’s earnings grew 6% year-over-year, beating the consensus estimate of 3.4%. Analysts are expecting earnings growth of 9.3% for the second quarter, 8.3% for the third, 17.6% for the fourth quarter and 11.4% for the full year. Moreover, earnings growth rates are likely to bolster in 2025, with an expectation of a 14.2% year over year increase. Consumer cyclical, technology, and communication stocks are likely to be the biggest contributors. Therefore, it appears that large cap tech stocks from these sectors are likely to lead the uptrend, a scenario in which low beta or defensive stocks are likely to struggle in catching up with the rally. We have already seen this trend since the bull run began in early 2023. Defensive nature dividend stocks and ETFs lagged significantly behind the S&P 500 and tech-heavy NASDAQ.

Keeping in view of the current trends and forecasts, low to moderate risk tolerance investors need to find ways to capitalize on a bull run without taking a significant risk. I believe investing in Capital Group Dividend Value ETF could be one of the best ways to achieve high risk adjusted returns. Its share price rally of 31% outperformed the broader market index while dividend yield of 1.5% helped it push total returns to 34%. Last year, its dividend increased by 31% year over year.

How Does CGDV Offer High Risk-Adjusted Returns?

A number of factors lower the risk factor associated with an investment in CGDV. For instance, it is an actively managed ETF, which enables investors to capitalize on the performance of various sectors and lower the risk factor associated with a single stock. The second and most important factor is its portfolio management strategy. Investors have also expressed confidence in the ETF as it was ranked among the most active ETFs last year. Its assets under management swelled to $8.2 billion as of May 2023 from slightly over $2 billion at its launch in 2022 while the trading volume of 1.45 million shares is significantly higher from the median of 38.42K shares. Moreover, YCharts reported that it was also among the top-performing income-centric equity ETFs based on performance and dividends.

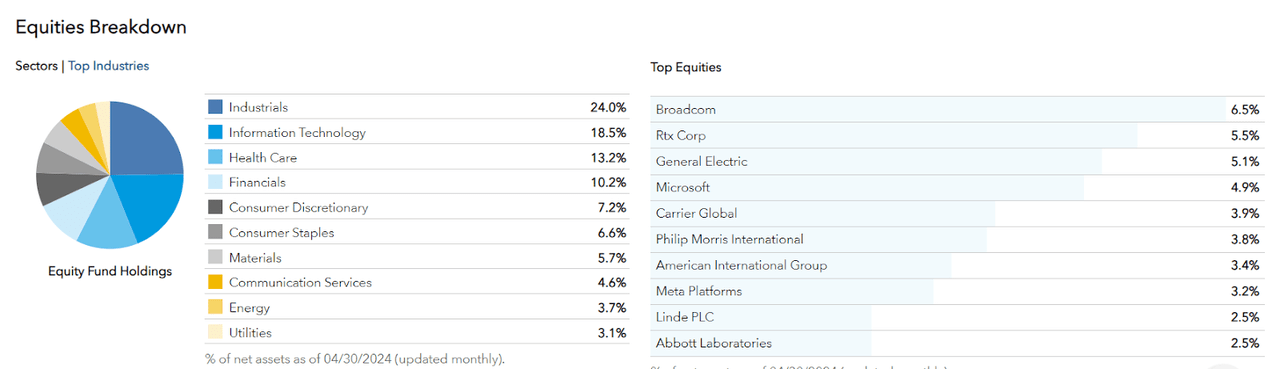

CGDV portfolio breakdown (capitalgroup.com)

Now let’s move on to its portfolio holdings to gauge its potential to generate high risk-adjusted returns. The fund invests in US domiciled large cap dividend-paying companies in the value and growth categories from across the S&P 500 sectors, with a major concentration in industrial, technology, healthcare and financials. The fund uses a bottom-up fundamental analysis strategy to create its portfolio. Its stake in well-established and top-performing tech stocks, such as Broadcom (AVGO), Meta Platforms (META), Microsoft (MSFT), Apple (AAPL) and others, positions it to capitalize on the tech-driven bull run. Meanwhile, its stake in industrial stocks, such as RTX Corp (RTX), General Electric (GE), Carrier Global (CARR) and General Dynamic (GD), improves its sustainability factor and lowers the downside risk during volatility.

Although healthcare companies underperformed last year, they are likely to return to positive earnings growth in 2024, which will fuel their share price and dividend performance. Its portfolio holdings in the healthcare sector include large-caps with a diversified revenue base, hefty cash flow and a strong history. Some of the key stocks from the healthcare sector are Amgen (AMGN), Abbott Laboratories (ABT), Abbvie (ABBV) and Gilead Science (GILD). What’s more, its stake in consumer staples and consumer defensive companies, such as Phillip Morris (PM), lowers the downside risk in bearish condition while offering steadily growing dividends.

Quant Rating and Valuation

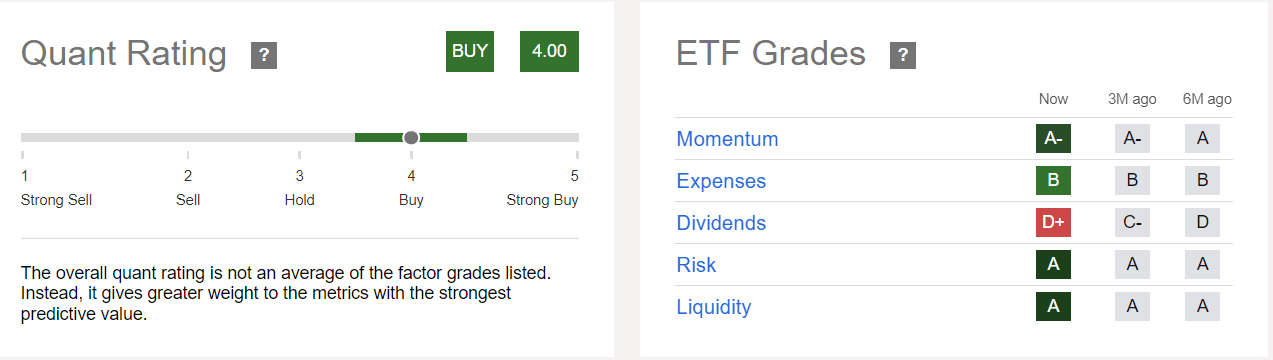

CGDV quant rating (Seeking Alpha)

CGDV earned a buy rating with a quant score of 4. As its shares outperformed the broader market index, the ETF received a negative A score on momentum. The higher momentum score technically bodes well for further upside. This is because stocks or ETFs with a high momentum are deemed to extend gains. In addition to momentum, the fundamental and financial factors also support the share price upside. Its expense ratio of 0.33 is also better given the median average of 0.49%. As I stated above that the ETF carries low risk due to its portfolio structure, the technical data, such as a low beta and standard deviation, also vindicates my stance. It earned an A score on the risk factor based on a quant rating. An A score on the liquidity factor is due the robust increase in its assets under management and trading volume compared to the median of all ETFs.

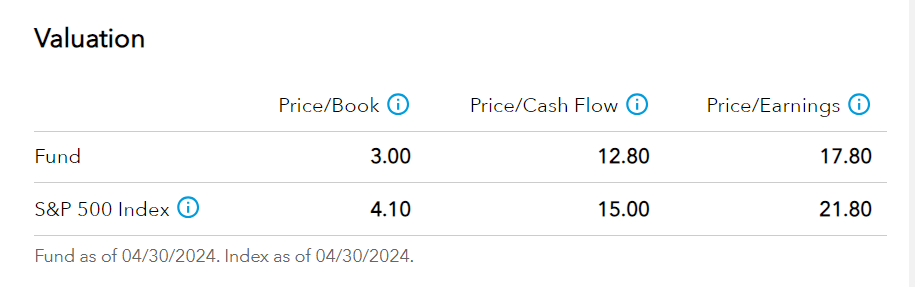

CGDV valuations (capitalgroup.com)

The prospects for its strong share upside and lower downside volatility are also backed by valuations. Despite outperformance in the last twelve months, CGDV’s shares are currently trading around 17.80 times earnings compared to the S&P 500’s 21.80 times. Similarly, its price to book and cash flow ratios are lower from the broader market index. While the tech and industrial stocks have higher valuations, the ETF’s stake in financials, healthcare, consumer staples and consumer defensive stocks helps in lowering the overall valuations. As earnings growth prospects are strong ahead for its portfolio holdings, its valuations are likely to remain within its historical average even if the price extends the upside momentum.

Peer Analysis

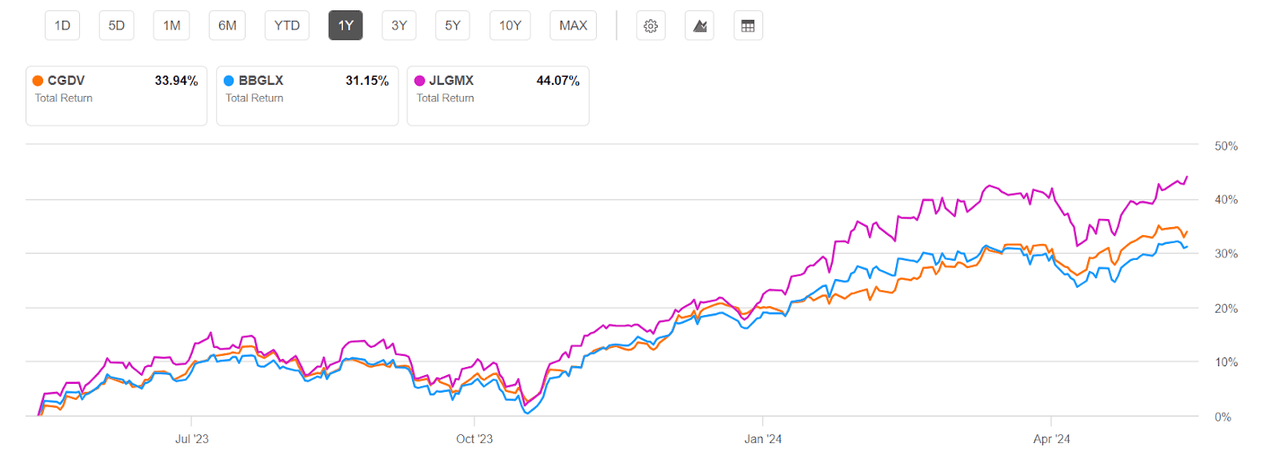

CGDV returns compared to peers (Seeking Alpha)

Its closest peers include Bridge Builder Large Cap Growth Fund Inst (BBGLX) and JPMorgan Large Cap Growth Fund Retirement (JLGMX). Although both of its peers performed well in the last twelve months, a high risk factor attached to these returns makes them less attractive for low to moderate risk tolerance investors. For instance, tech stocks from the information technology and consumer cyclical sectors account for 47% of the Bridge Builder Large Cap Growth Fund Inst (BBGLX) portfolio. In the case of JLGMX, the percentage of stake in these high beta sectors represents 63% of the overall portfolio. Meanwhile, CGDV offers a greater balance between growth and value stocks. Moreover, instead of tracking any benchmark, its focus on holding positions in fundamentally strong large cap dividend-paying stocks from various sectors increases its ability to generate high risk adjusted returns.

Risk Factors to Consider

There are a number of risk factors to watch when investing in CGDV, including economic volatility. For instance, if the Fed extends its strategy of holding rates at peak levels throughout 2024, there is likely to be a negative impact on economic growth and corporate performance. Higher for longer rate strategy could also increase the pressure on the financial sector and deteriorate asset quality. Besides the macro trends, some of its holdings in the tech sector are also exposed to valuation risk. Therefore, due diligence is required before making an investment decision.

In Conclusion

It’s not possible to fully mitigate the risk factor associated with any investment. In the case of the Capital Group Dividend Value ETF, the risk factor is low when compared to peers or growth ETFs. This is because of its smart portfolio management strategy of investing only in well-established companies with a strong fundamental outlook. On the other hand, its portfolio also appears well-positioned to benefit from the current and potential bull run due to exposure to growth and tech stocks. Therefore, CGDV appears like a solid investment option for low risk tolerance investors who seek to generate market-beating returns while lowering the risk factor.