BlackRock: Investing In The Largest Asset Manager In The World

georgeclerk

My thesis

Investing in industry leaders is inherently less risky. Industry leaders usually have the most powerful brands, which is a strong competitive advantage in acquiring new customers. Having a best-in-class reputation also allows leaders to charge premium prices for their products and services, which results in strong profitability. The asset management industry is about making money from money, meaning that the industry is likely to be ever-growing, which makes this industry interesting for investing. BlackRock (NYSE:BLK) is an undisputed leader in the industry, and no other publicly traded asset manager is close in terms of the size and reputation. Dominance in the market helps BLK in delivering consistent fund inflows, which fuels its revenue growth and strong profitability. Capital is distributed wisely by the management. BLK invests in future growth, which is evident from recent promising acquisitions. At the same time, BLK is quite generous in terms of share buybacks and the dividend growth record is impressive. BLK trades with a 14% discount, which makes it a compelling investing opportunity deserving a Strong Buy rating.

BLK stock analysis

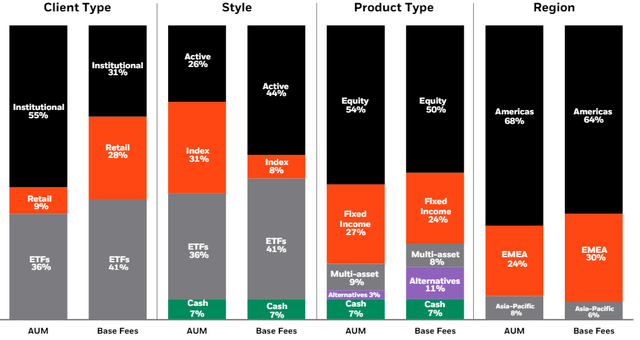

BlackRock offers investment management, risk management, and advisory services to clients globally, both institutional and retail. BlackRock’s set of products consists of separate accounts, mutual funds, the iShares series of ETFs, and other pooled investment vehicles. According to the latest quarterly report, the company’s assets under management (AUM) amounted to $10.5 trillion, which means it is the largest asset manager in the world. In the below bar chart, you can see how AUM is distributed across client types, styles, product types and geographic regions.

BlackRock’s AUM grew at around 13% CAGR since 2008, which I figured out from the data provided by Statista. BlackRock’s closest rival in terms of AUM is Vanguard, with $8.6 trillion as of the end of Q1. Unfortunately, Vanguard is not a publicly traded company and other asset managers are far below BlackRock in terms of AUM, according to Sovereign Wealth Fund Institute. Hence, conducting a peer analysis of key metrics might be impractical. Instead, it would be more reasonable to compare BlackRock’s business indicators with its historical performance.

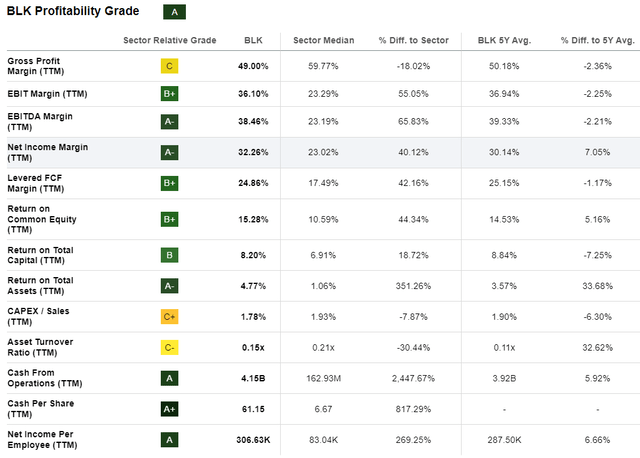

Since AUM has been discussed, I want to move forward to another crucial factor. Of course, I discuss profitability because the bottom line and free cash flow (FCF) are two key elements of creating value for shareholders. According to SA Quant, BLK’s TTM profitability is consistent with the company’s historical performance. For me as a potential investor, the bottom line matters the most. From this perspective, the TTM performance is around 210 basis points stronger compared to the past five years’ average. TTM levered FCF margin is slightly weaker compared to historical levels, but the difference does not look dramatic.

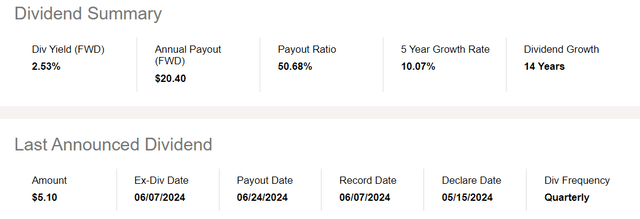

A 36% EBIT margin allows BlackRock to demonstrate impressive capital distribution activities with consistent dividend hikes and share buybacks. BlackRock declared a $5.1/share dividend on May 15, in line with previous one. According to the dividend scorecard, the forward yield is 2.5% and there were 14 consecutive years of dividend hikes. The company repurchased 0.5 million common shares for approximately $375 million in Q1 2024. As of March 31, there were approximately 5.3 million shares authorized to be repurchased under the existing share repurchase program. Since the company has a strong financial position, shareholders will likely enjoy more dividend hikes and further growth through buyouts.

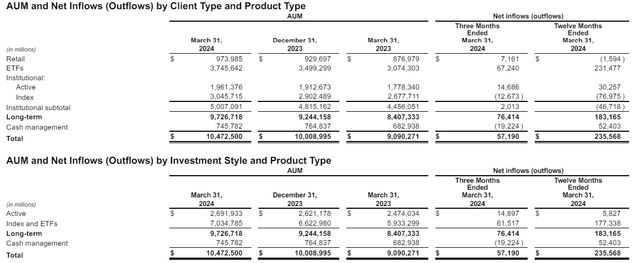

To summarize this part, BlackRock’s financial performance is robust. Strong performance supports the company’s balance sheet and distributes spare capital in a shareholder-friendly manner. The latest quarterly performance was also strong with a $9.81 adjusted EPS, jumping by 24% YoY. Revenue was slightly above the consensus and showed an 11.4% YoY growth. Revenue growth was mostly fueled by the growth in AUM and improved performance fees. First quarter net inflows of $76 billion were positive across active and index strategies, as well as each of BlackRock’s client and product types. In summary, BlackRock’s Q1 performance was robust, in my opinion.

However, for investors, future prospects are also crucial. We have to understand the company’s ability to sustain its growth. Having the status of the largest asset manager in the world is a solid asset, adding credibility to the company’s image. Having a strong brand will likely help sustain strong positive inflows.

In addition to a strong brand and reputation, which will likely help in ensuring further positive net inflows, there are a few more positive factors likely to contribute to AUM growth.

Apart from organic growth, BlackRock also works on enhancing the revenue mix from acquisitions. For example, on May 1, BlackRock completed the acquisition of SpiderRock Advisors. According to the management, this deal will help the company to expand its position in Separately Managed Accounts (SMA) solutions by offering wealth managers enhanced customization options.

Another step to diversify the company’s revenue mix is the buyout of Global Infrastructure Partners (GIP), announced earlier this year. This acquisition will likely create value for shareholders by establishing a leading infrastructure investment platform with combined AUM exceeding $150 billion. The GIP Transaction is expected to close in the third quarter of 2024 subject to regulatory approvals and other customary closing conditions.

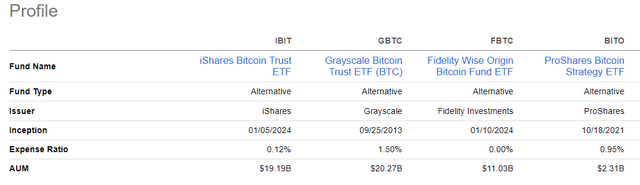

Besides strengthening the company’s business mix through acquisitions, the management also works on improving its ETF offerings. In January 2024, a largely anticipated spot Bitcoin (BTC) ETF started trading on NASDAQ under the iShares brand (IBIT). The ETF demonstrated an impressive start and is already very close to Grayscale Bitcoin Trust ETF in terms of AUM, despite being 11 years “younger”.

IBIT’s massive start adds me optimism around the growth potential of the iShares Ethereum Trust ETF, which is not trading yet but might be approved by SEC soon. Expanding iShares offerings into the largest cryptocurrencies is a strong strategic move because crypto asset management market is projected to grow at a CAGR of 21.7% during 2024-2031.

Intrinsic value calculation

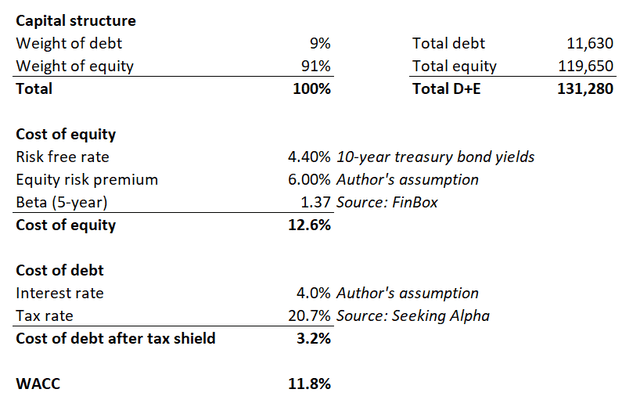

The discount rate is the number one assumption I figured out before simulating valuation models. In my working below, I clearly outline all the assumptions and sources I have used for my CAPM model. BLK’s WACC is 11.8%, and cost of equity is 12.6%.

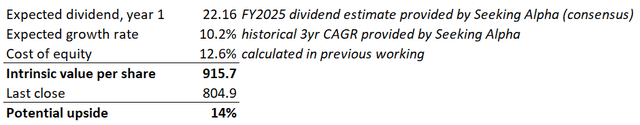

BlackRock’s dividend scorecard is impressive. This makes me select the dividend discount model (DDM) approach overdiscounted cash flow (DCF) modeling. For the DDM, the discount rate is the cost of equity, which is 12.6% for BLK. Year 1 dividend and expected revenue growth were obtained from the Seeking Alpha “Dividends” tab of BLK.

BLK’s intrinsic value per share is $915.7. The last close is $804.9, 14% lower than the intrinsic value. The discount looks attractive, especially considering the fact that we are speaking about the valuation of the world’s largest asset management firm.

Since there is no publicly traded close competitor to BlackRock, it is difficult to compare its valuation ratios to other players because it will not be fair to compare BLK with asset managers with AUM lower by multiple times. Therefore, looking at the current valuation ratios compared to historical averages appears to be a sound exercise. According to SA Quant, current multiples are very close to historical averages. This underscores the fact that BLK’s valuation is fair.

What can go wrong with my thesis?

BlackRock operates across the world with presence in almost all largest markets, which means the company is vulnerable to several risks of operating internationally. These include political and regulatory risks and vulnerability of financial performance to changes in foreign exchange rates.

Asset management is a labor-intensive business, where companies compete for top talents. Managing $10 trillion of clients’ funds means an extremely high level of responsibility. BlackRock’s powerful brand not only gives the company a competitive advantage in attracting new inflows, but also means high risks of losing its brand power. To sustain its leadership, the company needs to hire the most talented employees, which means paying a premium salary compared to the market. As wage inflation usually outpaces the headline CPI, there is the risk that BLK’s revenue growth can lag the SG&A growth.

Summary

I think that when an industry leader like BLK trades with a 14% discount, it is a no-brainer investing opportunity. Despite facing the problem of large numbers, BLK continues demonstrating decent AUM and revenue growth. Buybacks are likely to help the stock price, and the stock’s impressive dividend growth is sustainable.