ARKK – Risky Does Not Equal Reward (NYSEARCA:ARKK)

SimonSkafar

The ARK Innovation ETF (NYSEARCA:ARKK) has been around since 2014. I wasn’t aware of the fund until Cathie Wood, the CEO and CIO of Ark Invest, started showing up on CNBC touting the results of her fund.

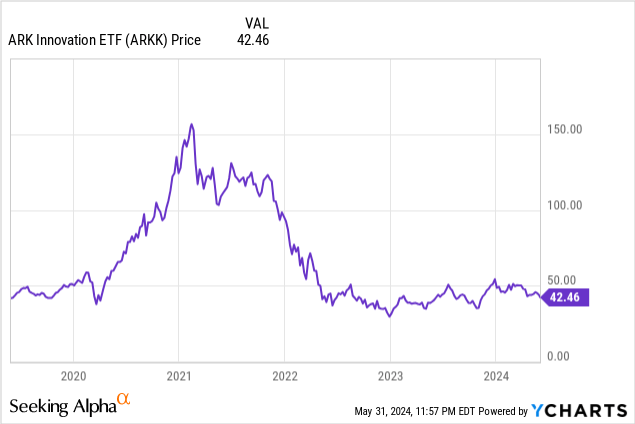

As you can see below, ARKK’s results were stellar in the early 2020’s but have substantially lagged in recent years as the ETF’s price has fallen:

I’m not as negative on Woods and ARKK as many other analysts but I do believe investors would be better suited allocating funds elsewhere. Let’s dig into the details of the ETF and I’ll explain why I’m not bullish on this particular investment.

Risk Doesn’t Equal Reward

As many know, the ARK Innovation ETF focuses on investing in “disruptive innovation.” In the fund’s description, it goes on to state the fund invests in products or services that can potentially change the way the world operates. I’ll get into the specific areas the fund likes to invest in later on, but I think investors can tell from this description these types of investments are high risk. The public companies ARKK invests in have the “potential” to change the world, but also have a higher likelihood of failing.

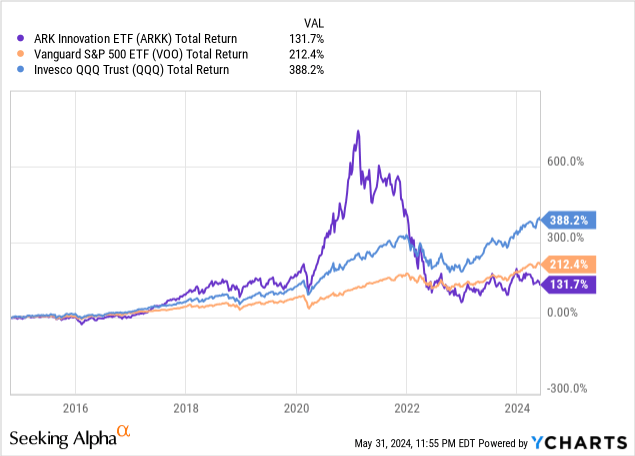

A simplified investing take is that if you are allocating funds to a riskier asset, you would expect a higher reward.

If you can compare ARRK’s performance to what I would describe as less risky ETFs such as the Vanguard S&P 500 ETF (VOO) and Invesco QQQ Trust (QQQ), you’ll see ARKK is not providing superior returns:

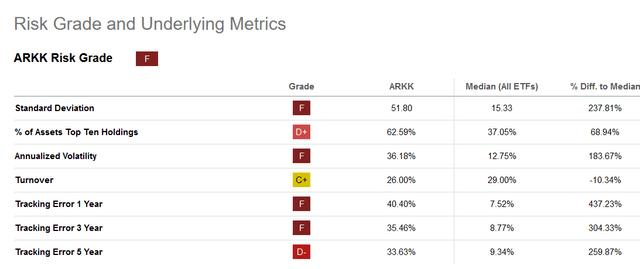

Furthermore, if you review Seeking Alpha’s risk grade and associated metrics you can see Wood’s ETF has been given a “F” grade:

Seeking Alpha

One of these metrics, I’d specifically like to discuss in more depth is turnover. Currently the turnover percentage of ARKK is 26% which is close to the median for all ETFs. If you compare ARKK to the other two ETFs I have listed above, ARK is higher than QQQ which has a turnover percentage of roughly 22% and much higher than VOO which has a turnover percentage of 2%.

As a long-term investor, I prefer to have an ETF with a lower turnover. Legendary investor Terry Smith of Fundsmith stated in his book, “Investing for Growth” that one of his ten golden rules for investing is dealing as infrequently as possible. Albeit Smith’s writings predate Robinhood (HOOD) and the emergence of zero fee trading, but I still think Smith’s rule holds water (Smith still follows this rule from what I’ve found as his fund has a turnover percentage of 10%). In my opinion, lower turnover relates to higher conviction in a company and better due diligence. I understand unforeseen issues may arise that change the narrative of an investment thesis such as management changes, macro-economic conditions, or new competition in a market. However, it seems Wood and her team are making some odd moves that make you question the decision making of the fund.

For instance, Wood added Nvidia (NVDA) to her fund a few years ago which I would certainly state is a company creating “disruptive innovation.” However, due to her lack of conviction she sold early and missed out on huge potential profits.

To provide another example of questionable logic, Wood purchased significant shares in one of her top holdings, Uipath (PATH) the day before the company reported Q1 2025 earnings. The stock plummeted the next day as the company’s CEO resigned. Obviously, Wood likely didn’t know about the resignation but it seems a questionable time to buy shares.

As stated on the ARK Invest’s website, the goal is to have annual turnover of 15% but Wood and her team have clearly been making more changes to the fund. This brings into question the fund’s analysis and filtering process coupled with the fund’s decision making. I only shared two examples of Wood’s recent activity but by running a simple Google search or a search within Seeking Alpha, investors can find plenty more examples of some head-scratching decisions.

Fund Structure

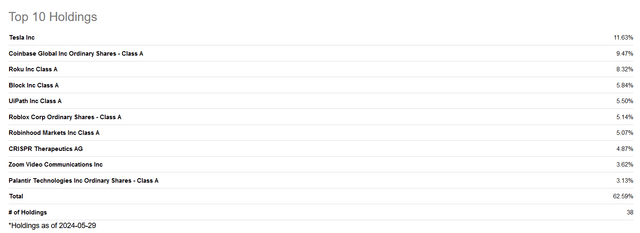

As mentioned above, the fund focuses on disruptive innovative and has a focus on several key areas. These areas include, genomics and DNA technologies, fintech, robotics, automation, and artificial intelligence.

As of May 29th, the fund’s top ten holdings are as follows:

Seeking Alpha

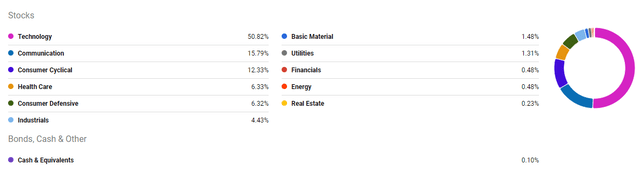

ARKK currently has 38 holdings and as you can in the graphic below, the holdings are distributed fairly evenly between five sectors:

Seeking Alpha

I think it’s highly likely that of these 38 holdings, one or more will be massive winners. However, my issue is that I’m unsure if Wood and her team have the patience or the conviction to hold that winner given the fund’s turnover percentage and recent performance. Rather than invest in ARKK, this is what I would do as an investor.

Shotgun Approach

As another analyst stated, Wood is going with a “shotgun” approach, trying to hit as many of these disruptive areas as possible. I agree that’s what ARKK is trying to accomplish but it hasn’t worked the last few years.

If investors want a similar approach, there are two particular ETFs which I think are more suitable for investors compared to ARKK, the Vanguard S&P 500 ETF (VOO) and Invesco QQQ Trust (QQQ).

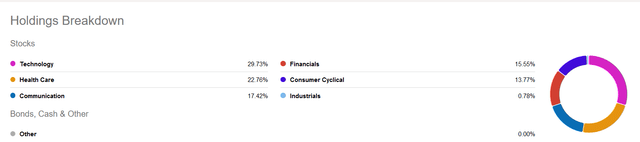

QQQ is great alternative for more risk seeking investors yet as you can see from the risk metrics on Seeking Alpha it’s a slightly safer investment with a “C+” rating:

Seeking Alpha

I think QQQ can provide investors with an opportunity to invest in many of the disruptive investing theme categories ARKK does as well, such as artificial intelligence, robotics, fintech and automation.

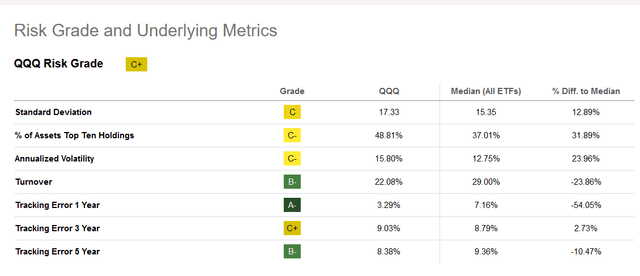

Below are the top ten holdings for QQQ as of May 30th:

Seeking Alpha

Despite being large caps, I still believe many of these companies such as Nvidia (NVDA) and Microsoft (MSFT) will be leaders in categories such as AI.

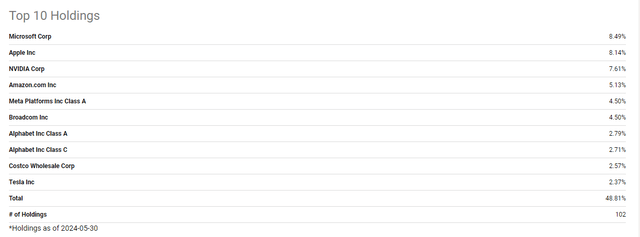

One downside to QQQ is that it’s very tech heavy as you can see below:

Seeking Alpha

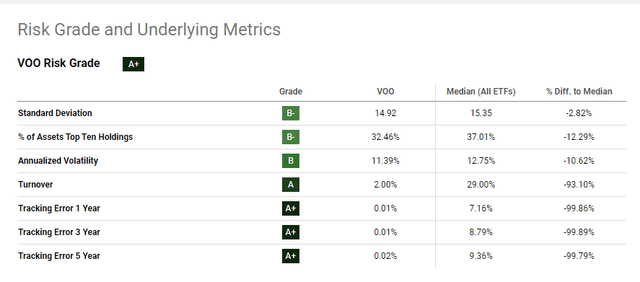

My personal favorite ETF to invest in is VOO. As you can see from Seeking Alpha’s risk metrics, it’s a far safer alternative compared to QQQ and especially compared to ARKK:

Seeking Alpha

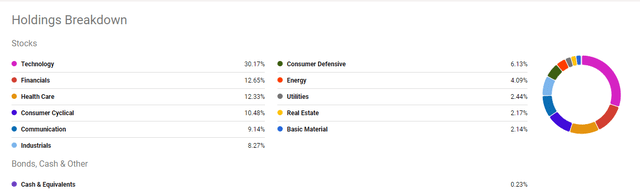

Additionally, although VOO is still roughly 30% tech, it’s much more diverse compared to QQQ:

Seeking Alpha

When it comes to my investing style, I like to invest most of my capital in more risk averse investments which makes VOO an excellent choice. As the metrics above indicate, this is a less riskier ETF compared to ARKK yet this ETF has returned more to investors. Additionally, in comparison to QQQ I like that VOO is less tech heavy.

Bitcoin & Specific Thematic Investing ETFs

Wood is a Bitcoin bull and so I believe some of her investments are proxy Bitcoin plays, Coinbase is the obvious proxy and to some extent Block (SQ) and Robinhood (HOOD) are as well. Rather than buy the proxies I’d simply buy Bitcoin itself if you’re a believer in the asset. I have a small portion of my individual capital allocated to Bitcoin.

I think some categories are harder to invest in. Personally, I think Genomics and DNA technology is a particularly difficult investing theme given it’s hard to know which company will be successfully in these early days. I think the Ark Genomic Revolution ETF (ARKG) is as good as any ETF when it comes to investing in this specific area.

Additionally, Ark Invest has several other more specific themed ETFs such as ARK Autonomous Technology and Robotics (ARKQ) and ARK Fintech Innovation ETF (ARKF). These may be good opportunities for investors looking to invest in a specific area. However, I’m more inclined to buy VOO or QQQ instead of one of these specifically themed ETFs.

Conclusion

ARKK ETF is for high risk, high reward investors and as of the late the rewards haven’t been there.

I think Wood and the Ark team seem to lack conviction and are struggling to identify “disrupters” worthy of holding for a significant amount of time.

I think there are better funds than ARKK such as QQQ for investors willing to take on more risk or VOO for those seeking less risk and more diversification.

Investors should determine their risk tolerance and find a particular investment or investments that allow that investor to sleep peacefully at night.

For me, I plan to stick with more of a sure bet in VOO, invest in a few high-quality founder-led companies and allocate a small percentage of capital to Bitcoin.