AppFolio Stock: Addresses The Challenges Property Managers Face (NASDAQ:APPF)

Lordn/iStock via Getty Images

Summary

I am positive on AppFolio (NASDAQ:APPF). My summarized thesis is that the APPF solution helps small and medium-sized property managers address the challenges they face in improving operational efficiency without incurring a huge cost. The current environment, where the labor market is tight and mortgage rates remain high, is a major growth tailwind for APPF, and this should support robust growth over the foreseeable future. Long-term, the TAM is large enough to sustain APPF growth as well.

Company overview

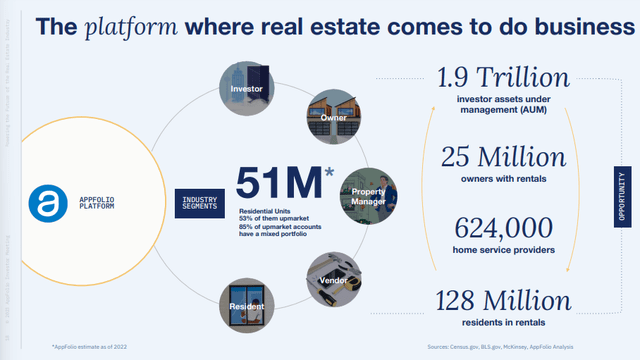

APPF is a cloud software platform that offers solutions designed to help property management customers increase the efficiency of their operations. The APPF platform basically connects various stakeholders in ecosystems, such as investors, owners, property managers, vendors, and residents. Through the platform, APPF provides relevant solutions to each party (as listed above). As of FY23, APPF serves 8.2 million units over a customer base of 19.7 thousand customers. APPF is also a profitable company, with adj EBITDA margin of 16% in FY23 and 28% in 1Q24.

Sticky product with strong value proposition

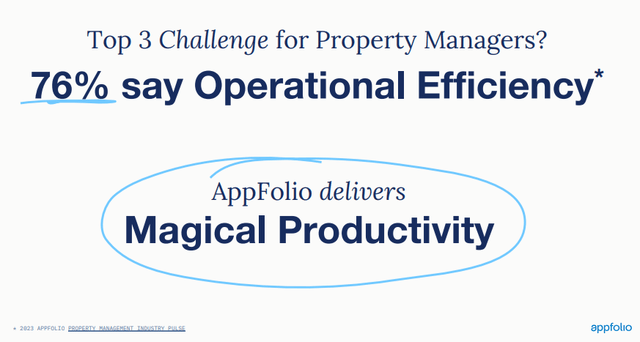

APPF targeted customers are small and medium-sized property managers that have 50 to 499 units under their belt (in line with APPF current units/customers of about 416 units as of FY23). The problem with small property managers is that they do not have sufficient resources to invest in the best digital solutions to improve their operational efficiency, which is one of the top 3 challenges faced by property managers. As such, many of the workflow processes, like entering invoices, typing in work orders, and other accounting processes, are still done manually. Naturally, this exposes property managers to human errors, and the constraint on productivity is the amount of labor one can hire. The indirect impact of relying on manhours to deal with such processes is that it takes away time that the property manager can use to address residents’ concerns. For readers that have stayed in a property that is being managed, you would have experienced the pain of not getting any response to the problems you are facing at the property (for instance, payment issues).

APPF is able to solve a large part of the challenges as its platform simplifies a bunch of the workflow processes; as such, manhours can be allocated to service residents. This leads to better work efficiency (better profitability) and happier residents (less reason for residents to move out). The current macro environment, where the labor market is tight, is a tailwind for APPF, as adopting digital solutions is the best way to improve productivity without incurring huge costs in order to meet the increasing demand for housing rentals (as it is cheaper than buying a home today).

More importantly, APPF becomes very sticky once it gets embedded into the underlying workflow processes. Firstly, it takes time for employees to learn how to use the platform from scratch, so once they have gotten used to APPF, it is a hassle to retrain everyone again. Secondly, property managers are using APPF to connect with other stakeholders in the ecosystem as well. As such, replacing APPF would mean disruptions for these stakeholders as well.

Growth runway supported by large TAM

In terms of the growth runway, I don’t think there is a need to worry about this, as the US has one of the largest real estate markets in the world. As of APPF 2023 investor meeting presentation, there are 128 million residents in rentals, 25 million owners with rentals, and 624,000 home service providers. Of which, 51 million are directly addressable by APPF today (which implies APPF has penetrated around 16% as of 1Q24, where it served 8.3 million units). With the rising level of population, I expect the US continues to see a strong need for additional housing, both in the multi-family and single-family segments of the market, which means more need for property management services (and therefore the need for what APPF offers).

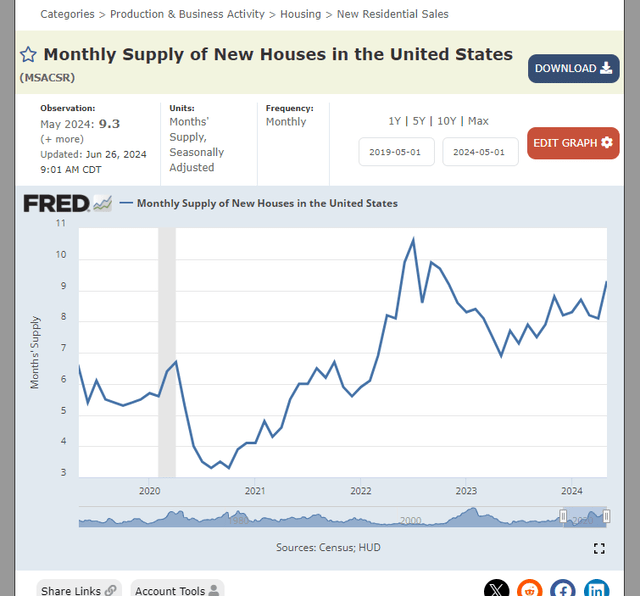

In the near term, because of the high mortgage rate environment, the cost of buying properties is relatively high compared to renting, and this should drive more activity in the rental market. This aside, the high mortgage environment has also driven huge demand for new homes, as existing home owners are reluctant to list their homes for sale (if they do, they need to refinance at a higher rate). Considering that the majority of current homeowners have their mortgage rates set below 4%, there is a long way before this group of homeowners is incentivized to refinance their mortgage. This puts a lot of demand pressure on new homes (as can be seen from the chart above). This is great for APPF because every new home is a potential unit to be managed.

Very strong financial performance

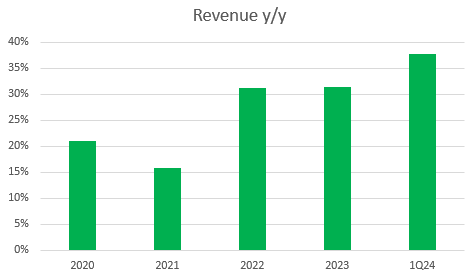

Source: Author’s calculation

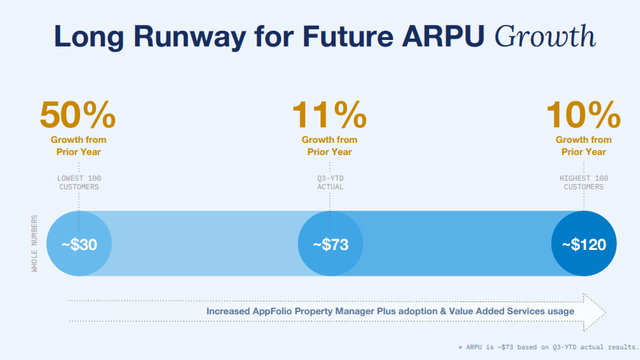

APPF growth performance has been solid despite the macro turmoil, where it grew revenue by >30% over the past 3 years, and 1Q24 even saw acceleration to 38%. What was notable is that the major growth driver was the increase in average annual revenue per unit (ARPU) (which grew from $67 in FY20 to $87 in 1Q24), suggesting that APPF is seeing more adoption of modules by customers over time.

There are three major implications from this. First, APPF is able to expand to capture more of its customers wallets over time, suggesting plenty of room for ARPU to grow. The second is that APPF becomes stickier as it gets further entrenched in the workflow of these customers. Lastly, the unit economics of each customer become a lot more attractive (profitable) as the incremental cost of delivering each module is minimal, and this can be seen from the strong gross margin expansion traction over the past few years (from a low 60% to 66% in 1Q24). Consequently, APPF was able to expand its adj EBITDA margin from 5% in FY22 to 28% in 1Q24.

Looking ahead, APPF is about to report its 2Q24 earnings in 2 weeks, and I am positive that growth can continue to stay at this robust level. In the previous earnings call, management even raised its FY24 guidance by $10 million to $770 million at the midpoint, which I take as a strong sign of confidence that growth momentum has continued into 2Q24.

Moreover, just a few weeks ago, APPF announced that embedded generative AI became available to all users through two key products: Realm-X Assistant (a co-pilot that automates time-consuming tasks) and Realm-X Messages (which helps sort through routine communications). I think APPF customers are likely to embrace the new solutions as they have historically shown a willingness to adopt APPF AI tools (>90% of APPF customers use one or more AI tools). This should further enhance the APPF value proposition to customers, further set it apart from legacy solution providers, and make it easier to sell to prospects.

Mentioned in the 4Q23 earnings call: 93% of our customers now use one or more AI-enabled features or services through AppFolio Realm. That’s twice the adoption of just one year ago, demonstrating the value our customers are realizing from Realm.

Valuation

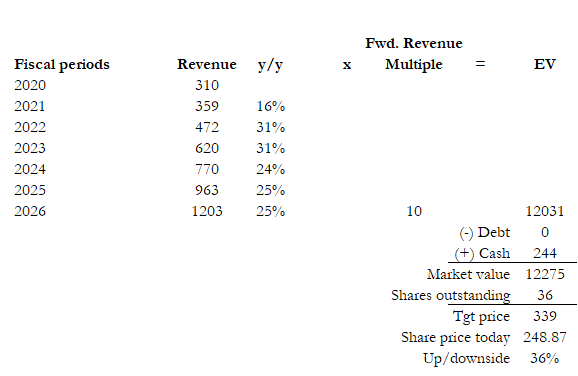

Source: Author’s calculation

I believe APPF is worth 36% more than the current share price. My target price is based on FY26 $1.2 billion and a forward revenue multiple of 10x.

Revenue bridge: There are no compelling reasons to believe APPF growth will slow down over the next few years, as it enjoys macro tailwinds and provides a strong value proposition to property managers. Given the large TAM, there is sufficient room for APPF to continue growing at mid-20% easily (benchmarked against FY24 growth guidance).

Valuation justification: I used forward revenue multiple because it is easier to compare to the APPF historical trading range. I believe APPF should trade at 10x forward revenue, which is its 10-year average, despite the slower growth head (which previously was >30%) because the business is a lot more profitable today than in the past. The improved profitability should more than balance out the slower growth, as adj EBITDA margin went from 15% in FY20 with 21% growth to adj EBIDA margin of 28% in 1Q24 with a mid-20% growth outlook (note: APPF traded at as much as 16x forward revenue in FY20). That said, given the difference in interest rates today, it is very unlikely that the market will value at 16x again, but we don’t need that to happen anyway. (At 10x, the upside is good enough.).

Investment Risk

While APPF benefits from the growth in the size of property managers as more units are added to their respective portfolios, market consolidation is not a tailwind for APPF. Because of the nature of APPF’s customers, who are small and medium-sized managers, they tend to be acquisition targets for larger managers. In this case, it is very likely that the buyer may choose to implement software that it is currently using (which is probably not APPF as large managers are not APPF focused), which will mean customer loss for APPF.

Conclusion

My positive view on APPF is due to its platform directly addressing the challenges faced by small and medium-sized property managers. APPF helps to improve operational efficiency without significant cost increases, and this is particularly important given the current tight labor market. In the near-term, the high mortgage rates are a major tailwind for APPF, and over the longer term, the large TAM offers a significant growth runway.