Antero Midstream: Solid Business But There Are Better Picks Out There (NYSE:AM)

Art Wager

Antero Midstream (NYSE:NYSE:AM) is a midstream energy operator with a market cap of just over $7 billion. AM portfolio assets are comprised of gathering pipelines, compression facilities, interests in processing and fractionation plants, and water handling systems. AM is also active in establishing joint ventures to grow enter into larger projects without assuming full risk. Here the most notable JV of AM is formed together with MPLX LP (NYSE:MPLX), where the underlying operations are around developing and operating large scale processing and fractionation assets.

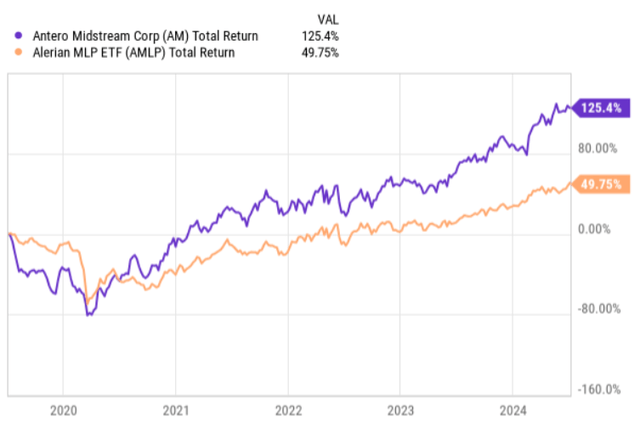

If we look at the historical five-year total return performance and compare it with the overall midstream segment, we will clearly see how consistently AM has generated alpha over the relevant index. In the chart below it is evident that really starting from early 2020, AM has assumed a strong and upward-sloping return trajectory.

Such a notable gap in the registered returns could raise a question on whether AM’s valuations have gone too far from the underlying value. In fact, relatively recently UBS cut its rating on AM from buy to hold referring to the fact that the risk and reward profile has reached an equilibrium.

Moreover, the current dividend yield offered by AM is not that enticing compared to what we can find in the midstream space. Currently, AM yields only 6.1%, which is circa 120 basis points below the yield of Alerian MLP ETF (NYSEARCA:AMLP) index.

Let’s now assess the underlying fundamentals of AM to determine whether it makes sense to go long here.

Thesis

At its core, AM is a rather similar business to its peers such as Enterprise Products Partners (NYSE:EPD), Enbridge (ENB), Energy Transfer (NYSE:ET), MPLX, etc. The business model is built on durable natural gas infrastructure assets, which enjoy almost a permanent demand profile with the only exceptions in the cash generation stemming from potential operational failures. Other than that, AM is able to generate consistent and periodically growing cash flows that are backed by sound contracts.

The only aspects that materially distinguish AM from its peers are the following two:

- 100% of AM’s cash generation is underpinned by fixed-fee contracts, thus mitigating the commodity risk factor.

- As opposed to most of its peers, AM is almost fully focused on natural gas segment, which is inherently more favorable from the valuations perspective (i.e., introduces a greater predictability in the business).

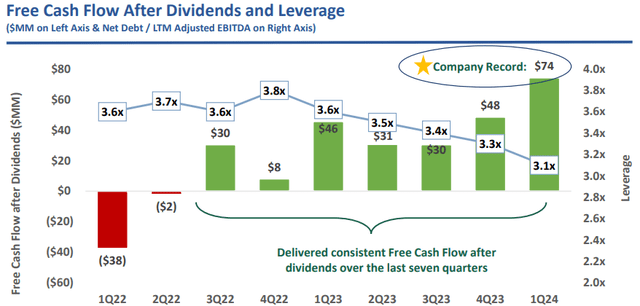

Moreover, as for most of midstream companies, the recent financial performance for AM has been very strong. For example, Q1, 2024 was a record quarter for AM, with the organic growth landing at a 4% and 6% in gathering and processing volumes, respectively, compared to last year. In terms of the EBITDA generation, AM registered a double-digit EBITDA growth, while achieving a double-digit declines in the CapEx spend. As a result of these dynamics, AM landed record free cash flow levels of $182 million and $74 million if we adjust for the dividend payments.

Here the chart below captures nicely how AM has been sticking to a free cash flow focused strategy since Q3, 2022, when it started to consistently register surplus results (after accounting for dividend distributions).

Antero Midstream Investor Presentation

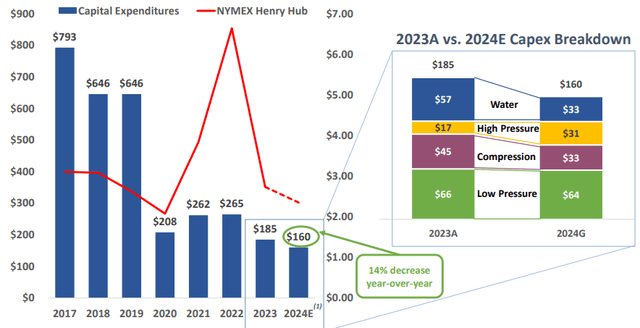

Part of this is obviously driven by the previous CapEx programs coming online and AM’s success in organic growth, but one of the key reasons is clearly the reduced CapEx spend.

Antero Midstream Investor Presentation

What we can notice in this CapEx related chart is that AM remains rather committed on decreasing the organic CapEx even further, which should per definition leave more liquidity at AM’s books to either de-risk the balance sheet or conduct buybacks.

The commentary in the recent earnings call by Brendan Krueger – CFO of Antero Midstream – offered an interesting color in this regard:

Yes. Thanks for the question. This is Brendan. I think as we’ve talked about on past calls as well, I mean, we look at everything in terms of return and on overall capital. So, as we approach this 3x leverage target, as we mentioned, second half of this year, we’ll look to — it will be positioned us well to buy back shares or pay down further debt or execute for the bolt-on acquisitions. We’ve got the $500 million program out there, as you mentioned, and we do see attractiveness in our shares still today. So, as we sit here today, share buybacks would continue to make a lot of sense, but we’ll certainly evaluate that as we as we hit that 3x target, hopefully, in the second half of this year.

Apart from the organic CapEx spend, there is also an M&A component that might temporarily drive the surplus cash generation levels of AM lower. For instance, May this year, AM announced that it has ventured into a bolt-on acquisition of assets in Marcellus Shale at a ticket size of $70 million.

While this might introduce some challenge for AM to keep de-risking the balance sheet and / or enjoy growing surplus cash flow levels, we have to keep in mind that fundamentally the M&A transactions are accretive and in AM’s case typically of a small scale. Even looking at the comment above by Brendan Krueger, we can see that the management remains committed on bringing the net debt to EBITDA at 3x.

Speaking of the balance sheet, currently, AM carries a net debt to EBITDA of 3.1x, which is not the lowest level in the sector, but still an indicative of a sound capital structure. On top of this, AM has no debt maturities in 2024 and 2025, and the one, which comes due in 2026 is related to the credit revolver.

The bottom line

All in all, Antero Midstream business is strong and underpinned by sound financials both from the cash generation and capital structure perspective. The fact that all of the contracts are based on fixed-fee and that the operations are almost fully based in natural gas segments should warrant some premium. While the balance sheet is not the strongest in the sector, the distant debt maturity profile in combination with a focus on de-leveraging render AM interesting also from this angle.

However, with all of this being said, I am still hesitant to go long AM. The reason is simple – in general, I agree with UBS’s view that the upside potential is largely exhausted. The recent run-up in the share price has pushed the valuations higher accordingly (EV/EBITDA of 12x, which is on the high end in midstream space), making the dividend yield of ~ 6% relatively unattractive.

For me, there are better midstream alternatives out there, where the dividend yields are higher, balance sheets stronger and growth prospects rather similar to what Antero Midstream has outlined. Below are just three examples, where I have issued buy thesis: