3 Big 10% Yields Face Off From Annaly Capital Management (NYSE:NLY.PR.F)

You should get to enjoy this puppy. He’s much better than most of the images in this database.

Uwe Krejci

3 Share Comparison

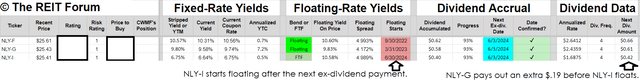

Here’s a table from the spreadsheet we use for analyzing shares:

The REIT Forum

That’s not all of the columns, but it gives you several key elements.

Each share offers a substantial dividend yield and a quarterly payout.

We’re going to focus on the 3 shares from Annaly Capital Management (NLY).

Most importantly, it covers the ones I want to talk about here.

We’re focusing on NLY-I (NYSE:NLY.PR.I) vs. NLY-G (NYSE:NLY.PR.G).

NLY-G pays out an extra $.19 (rounded) in the next ex-dividend date (early June).

Thereafter, NLY-I will have an annual rate that is higher by $.20425 per share.

Since NLY-G costs $.02 more than NLY-I, the investor who bought NLY-G is ahead by $.17 after the first ex-dividend (assuming a tax-advantaged account to eliminate taxes).

If NLY-I is not called in under 1 year from early June 2024, then the investor in NLY-I will be ahead. If they get four full dividends, NLY-I beat NLY-G.

Odds Skewed

Will Annaly decide to call NLY-I (NLY.PR.I)?

It’s possible.

But if that happens, the investor in NLY-I still earns a positive return. Not much, but a small gain beats a poke in the eye.

The annualized yield-to-call looks dreadful at 0.5%, but that’s because the shares are callable starting at the end of June.

Yeah, if shares are called right away, the investor gets a disappointing return. They would earn a mere $.02.

Not good, but that’s not going to damage your portfolio.

What About NLY-F?

NLY-F and NLY-I are priced fairly relative to each other. Is it perfectly even? No, but the gap in valuation is only a few pennies. I favor NLY-F slightly.

The argument I made for NLY-F over NLY-G could also be made for NLY-F over NLY-G.

Infact, the argument actually provides even better support for NLY-F (since it beats NLY-I by a few pennies).

NLY-F only costs an extra $.18 compared to NLY-G. The first dividend lets the investor recover $.05 of $.18.

In just over nine months, NLY-I will have paid out more than $.20 in extra dividends vs. the $.18 premium in the share price.

Risk Profile

No change in my view on the credit risk.

The preferred shares still have enough coverage for me to be very comfortable.

The assets are still easy enough for us to value.

I don’t see any risk of NLY suddenly blowing up or pausing their dividend (common or preferred).

The common dividend would have to be paused entirely (not just reduced) for NLY to avoid paying out the preferred dividend.

That’s good. These shares are also cumulative. I don’t like to cover non-cumulative preferred shares.

Who Wants These Shares?

I think the preferred shares for the mortgage REITs are generally offering superior investments to many of the common shares.

The floating yield is around 10.6% for NLY-F and NLY-I. That’s an attractive return.

As an alternative, investors could also look to baby bonds. NLY doesn’t have baby bonds, but there are other baby bonds for the sector. The yields are a bit lower, but the baby bonds have maturity and there’s no option to suspend the payments.

For reference, NLY didn’t have to suspend their preferred dividend during the pandemic. That was a pretty rough time for mortgage REITs. That’s favorable for the overall risk profile.

Conclusion

I think NLY-F and NLY-I are valued fairly. They’re flirting with the buy-under price. We’re talking about a few pennies in either direction. Since they’re right on the edge, I’m just tagging everything as neutral for the article.

I think NLY-G is less attractive. The difference in share prices (and next dividend payment) will be recovered within the next four dividend payments.

However, it isn’t bad enough to warrant an actual bearish rating.

Looking out over the next 12 months, NLY-G probably pays out over 9% in dividends. Even if rates are cut slightly, it would be over 9%. Do I think NLY-G’s price is going to decline that much? It could happen, but I don’t think it’s a high probability.

This is where things get awkward. I think investors in NLY-G are better off with either of the other shares. However, I’m not forecasting NLY-G to achieve negative total returns. Could happen (primarily with a recession increasing credit spreads), but not a high probability. So hammering a share with a “bearish” rating when you’re projecting it to deliver single-digit positive returns (above 0%, below 10%) is dumb.

Consequently, I would focus on this as a “relative value” analysis.

For investors considering opening a position in one of the shares, pick NLY-F or NLY-I.

For investors in NLY-G, it depends on the tax consequences of swapping shares.

A huge tax bill would ruin this idea. But if there’s no tax bill, then I would definitely favor the share that you would rather have in a year.

There’s plenty of things we didn’t cover about preferred shares. I’m not going to repeat everything. That would be boring. If you want to know more about preferred shares, here’s a guide for readers.