Zillow: Surging Rentals Helps To Affirm The Bull Case For This Housing Super App (Z)

DreamPictures

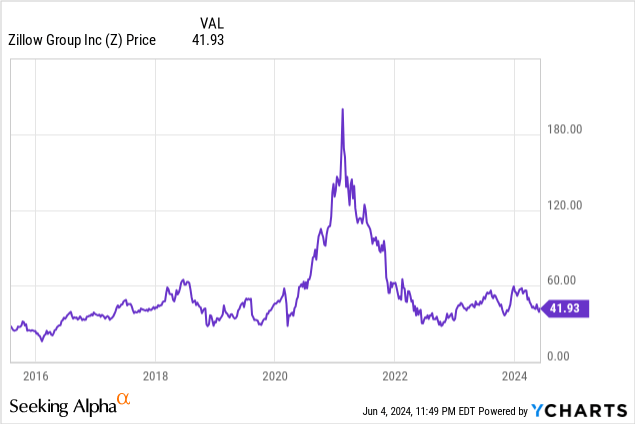

For several years now, Zillow (NASDAQ:Z) has been in the doldrums. The real estate company has dealt with an overhang of weaker housing demand post-pandemic, plus the uncertainty with the upcoming enforcement of the NAR ruling change that upends the traditional buyer/seller agent fee split. Against this backdrop, shares of Zillow have lost more than 25% of their value year to date, sharply underperforming the S&P 500.

A recent Q1 earnings release did little to assuage investors of a Zillow recovery. Yet amid the sharp drop, we think there is plenty of opportunity for investors to re-assess the bull case here.

Zillow isn’t just about home sales; it’s the housing super app that is agnostic to transaction type

I last wrote a bullish note on Zillow in March, back when the stock was still trading in the low $50s. Since then, after a ~20% share price drop, I’ve added more to my Zillow position and I am reiterating my buy rating on the stock.

One of the particular growth drivers that Zillow has been focused on recently, and one that in my view investors don’t give the stock enough credit for, is its surging revenue growth in rentals. Growth in this space makes sense, after all: with interest rates elevated and housing affordability in the U.S. continuing to be strained, more and more people are renting for longer.

Zillow’s Rentals business is now just on the cusp of generating half a billion dollars in annualized revenue; it’s also just shy of 20% of the company’s overall revenue stream. It’s also growing at faster than a 30% y/y clip.

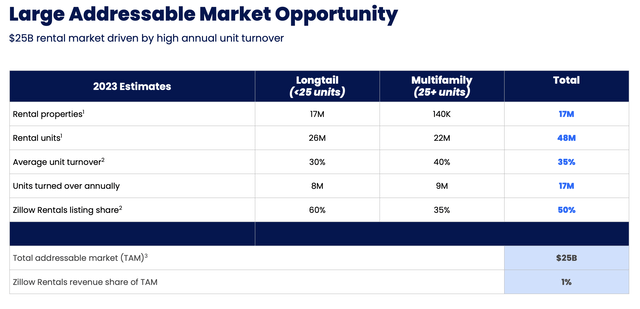

Amid this, Zillow believes its Rentals business addresses a gargantuan $25 billion TAM – into which it’s only 1% penetrated. Take a look at the chart below:

Zillow Rentals TAM (Zillow May investor presentation)

Why we think this is important is because it underlines Zillow’s key mission: it’s building what it calls the “Housing Super App,” which is agnostic to whether its site visitors are buyers or renters. Zillow has found a way to monetize them both.

Here is my updated long-term bull case on Zillow:

- Zillow Group has a broad portfolio of platforms across Zillow, Trulia, StreetEasy, and HotPads. Zillow has built an ecosystem rich with real estate data that has become the forefront of online real estate for users, whether they are looking to buy, rent, or sell. Traffic across these websites exceeds two billion visits per quarter.

- Tremendous inbound traffic is nearly all organic. Management cites that 80% of Zillow’s inbound traffic is organic, indicating that the company doesn’t have to do much in the way of advertising to draw eyeballs to its varied sites.

- Multiple routes to monetization across these sites- With all this traffic, Zillow’s ability to generate tertiary revenue is broad. Currently, the majority of Zillow’s business comes from advertising fees paid by real estate agents, but the company is also expanding into distributing mortgage products as well. In the future, Zillow could offer a full suite of “after-market” home add-ons, including house insurance, moving services, furnishing/interior decoration services, and others.

- Zillow has returned to being a pure low-capital Internet services company with no home-flipping risks. Zillow’s decision to stop purchasing homes (its ill-fated iBuying segment) in 2022 will put the spotlight on its high-margin Residential segment.

Stay long here and keep adding to your Zillow position during this dip.

Q1 download

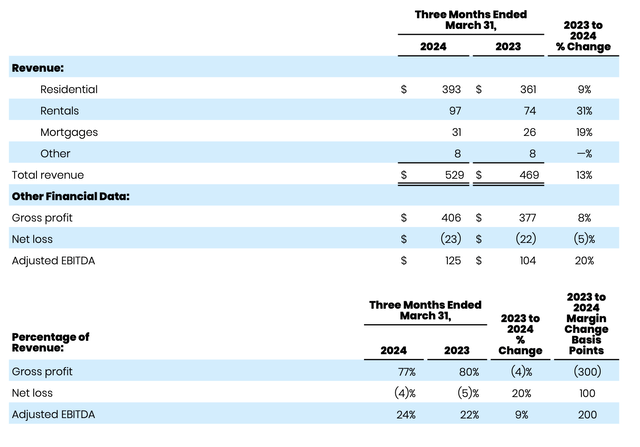

Let’s now go through Zillow’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Zillow Q1 highlights (Zillow Q1 earnings release)

Total revenue grew 13% y/y to $529 million, well ahead of Wall Street’s expectations of just $508 million (+8% y/y).

We note that amid the doom and gloom surrounding the real estate industry, we shouldn’t ignore the fact that prior-year comps are also getting easier for Zillow. The Residential business, which contains Zillow’s primary moneymaker (Premier Agent, where real estate agents compensate Zillow for both inbound traffic and closed deals sourced through the Zillow site), actually saw growth accelerate to 9% y/y, after growing just 3% y/y in Q4 and declining y/y in Q3.

The company has invested heavily into technology to make the browsing process on Zillow as seamless as possible. It is beginning to roll out Listing Showcase nationwide, which features homes with larger pictures and amplified exposure to Zillow customers. The company’s site notes that homes listed with Showcase (which are not to exceed 10% of all listings in any given market) have a 20% better likelihood of signing a buyer within the first 14 days on market and also sell for 2% more.

Rentals, meanwhile, grew 31% y/y to $97 million in revenue. Though the company has initially focused on what it called “Longtail” rentals with fewer than 25 units and property managers that control only one or two properties, the company has seen success in converting large multifamily properties as well, with 46% y/y growth in multifamily specifically.

And we shouldn’t ignore mortgages, either. We need to give Zillow credit for the fact that the Mortgages business is operating against the backdrop of depressed home sales, so the 19% y/y growth to $31 million in revenue is remarkable. Per CEO Rich Barton’s remarks on the Q1 earnings call on mortgages:

Serving more high-intent customers with financing drives conversion and increases our addressable market. By integrating Zillow Home Loans with our Premier Agent partner network, we are providing a more seamless experience for customers, agents and loan officers.

Our efforts to integrate financing throughout the customer journey have accelerated purchase mortgage growth with $601 million in purchase loan origination volume in Q1, a more than 130% year-over-year increase despite a persistently challenging mortgage rate environment. We expect continued purchase mortgage growth as we expand integration with Premier Agent partners and roll out more enhanced markets.

Across the combined 13 enhanced markets we had at the end of Q1, Zillow Home Loans continues to see double-digit adoption rates, which contributes to growing revenue per transaction year-over-year. These signals reinforce our confidence that our strategy is working. And I’m pleased to share that this month we are expanding to a total of 19 enhanced markets and we are on track to reach our target of 40 by the end of the year.”

We note as well that Zillow’s adjusted EBITDA grew 24% y/y to $125 million, while adjusted EBITDA margins of 24% saw 2 points of operating leverage y/y versus a 22% margin in the year-ago Q1.

Key takeaways

The narrative on Zillow of late has focused on pessimism and weak real estate sales, but we should give Zillow due credit for both the re-acceleration in Residential revenue plus double-digit growth across Rentals and Mortgages. Rentals, in particular, has a long trajectory for growth ahead of it, with the business currently growing north of 30% y/y in a massive $25 billion TAM. Stay long here and use the dip to add to your Zillow holdings.