Who Should And Shouldn’t Buy 6%-Yielding Realty Income Stock Before Q1 Results (NYSE:O)

RomoloTavani

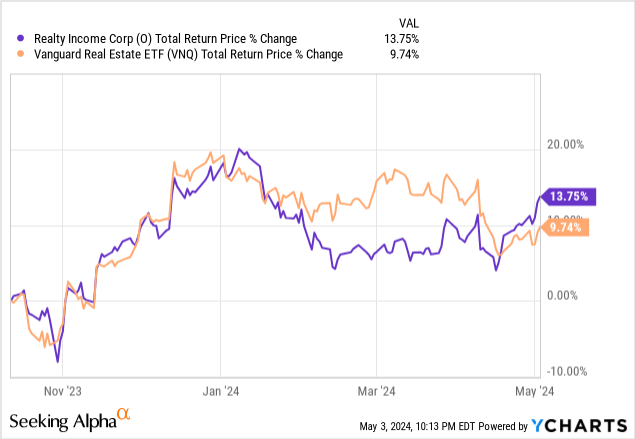

Back on October 12, 2023, I called Realty Income (NYSE:O) a strong buy because it had dipped significantly, offering a dividend yield of over 6%, an expected roughly 3% per share CAGR moving forward, and was trading at a 14% discount to its NAV despite historically trading at a premium to NAV. This presented a very attractive risk-adjusted opportunity to deploy capital for risk-averse, income-focused investors, given the uncertainty facing the economy and the geopolitical scene that could spiral out of control at any time. That confidence was proven justified, as since then the stock has returned nearly 14% in total returns in just a little over six months, meaningfully outperforming the broader REIT index (VNQ) during that period:

However, with the stock’s Q1 earnings on tap for Monday, May 6th, and the stock price up meaningfully since my previous article, I am going to take a fresh look at the stock to see if it’s worth buying ahead of Q1 earnings.

Why O Stock Is Not A Buy Ahead of Q1 Earnings

First, here are some commonly cited reasons why Realty Income is not a good buy right now. The biggest reason is that interest rates remain high due to persistently high inflation. So far in 2024, it appears that the Federal Reserve is not likely to cut interest rates anytime soon. Moreover, figures like Jamie Dimon are warning of interest rates soaring, potentially even reaching as high as 8%. Given that Realty Income invests in long-term, very conservative real estate leases with low single-digit contractual rent escalators per year, it tends to trade as a bond. So, when interest rates rise, its stock price falls, and its growth rate tends to decrease as its cost of capital increases. Meanwhile, when interest rates fall, Realty Income’s stock price tends to rise along with the broader bond market. As a result, this is likely not a very positive macroeconomic environment for Realty Income to thrive.

On top of that, Realty Income, being by far the largest triple-net lease REIT, needs to make bigger acquisitions each year to maintain its growth rate. While it does generate some organic growth through its contractual rent increases and retained cash flow, these combined only deliver two to three percent per share annual cash flow growth because the rent escalators are only one to two percent on average, and retained cash flow typically only contributes another one, at most two percent per year in growth.

As a result, management is presented with a challenging decision: (1) it can either dramatically reduce its growth rate and simply acquire far fewer properties by simply reinvesting its retained cash flow, or (2) it can invest in lower-quality properties or properties outside of its circle of competence in order to achieve creative spreads altogether to its current roughly 7% weighted cost of capital. It appears that management has taken a combination of both. In recent years, it has made acquisitions like VEREIT, Spirit Realty Capital, and CIM Real Estate Finance Trust. On top of that, it has also entered the casino space in an attempt to drive growth. However, this year, as cost of capital has gotten so high that spreads are relatively unattractive, it is only plan to acquire $2 billion worth of assets, which is a sharp drop-off from the $10 billion it acquired in 2023. As a result, it appears its portfolio quality is gradually being diluted and its growth rate is also unlikely to sustain its historic levels in the near term.

Analysts forecast that through 2028, its AFFO per share will grow at about 3% per year. This is not bad, but it is important to note that the quality of its portfolio is likely going to continue to decline gradually as it pursues this growth and if interest rates indeed do remain higher for longer, it may be challenging to achieve even that level of growth.

Another reason why it is not a particularly attractive buy at the moment is because its discount to NAV has now closed, and it is priced roughly in line with its consensus net asset value. So, it is less likely that it will achieve meaningful valuation multiple expansion going forward, leaving its 5.7% forward dividend yield with this roughly 3% per share expected CAGR in the coming years to generate the entirety of its total returns. As a result, it is likely to generate around 9% annualized total returns. This is a pretty good return for a low-risk defensive stock like Realty Income, but it is not something that is going to make me jump out of my seat and label it a strong buy either.

Why O Stock Is A Buy Ahead of Q1 Earnings

On the other hand, the case for conservative income investors to buy Realty Income is still fairly strong because its attractive dividend is likely to grow at a pace that matches or even slightly beats inflation for the foreseeable future, even if not much faster than inflation. Moreover, it has a 29-year dividend growth streak, making it an attractive choice for those looking for dependable income. On top of that, it pays dividends monthly, which many retirees like as it makes it easier for them to budget and fund their monthly expenses.

O also still has a high-quality portfolio, as 89% of its rent comes from tenants that are recession-resistant and/or e-commerce resistant, 40% of its rent comes from investment-grade tenants, and it has nearly 15,500 real estate properties in its portfolio, giving it incredible diversification so that any single tenant or property issue is likely going to be just a drop in the bucket for the company. With an A-minus credit rating, it also still has a bit of a cost of capital advantage over some of its competitors. As a result, it remains one of the main reasons it’s a great sleep-at-night investment for retirees looking for a stable and growing income.

Investor Takeaway

There is a very legitimate argument that other REITs in the NNN REIT sector offer similar stability and more attractive total return profiles, such as W.P. Carey (WPC) whose rental income has much greater indexation to inflation and Agree Realty (ADC) which has a lower leverage ratio, a better overall tenant profile, and a better growth outlook than O does.

However, overall Realty Income continues to be a buy (though it is no longer a strong buy in my view) as it heads into Q1 earnings given its attractive yield, decent growth profile, and conservative balance sheet and real estate portfolio. While I do think that there are better options out in the triple-net lease space for total return-oriented investors (including myself), for investors who simply value dividend growth track record, immense diversification, an A-minus credit rating, and the monthly dividend, O is hard to beat.

That being said, investors in the stock should be keeping a close tab on how management is planning to address a higher for longer interest rate environment and listen on the Q1 earnings call for any updates on how it plans to continue driving growth in an elevated cost of capital environment. If O veers too far out of its traditional circle of competence, its status as the blue-chip of blue-chip dividend growth REITs may be put into jeopardy at some point.