The Ithaka Group Q3 2024 Commentary

monsitj

Market Review

The rally that started in late October, 2023, continued this quarter as we witnessed appreciation across multiple asset classes. In fact, at the end of the quarter the S&P 500 (SP500, SPX) posted its biggest year-to-date (“YTD”) advance of the 21st century. And despite the recent highly publicized “death of the traditional 60/40 portfolio,” Bloomberg’s global aggregate bond index is on track for its fourth best quarter of the 21st century. To attach some numbers to it, the S&P 500 was up 5.9% for the quarter and 22.1% YTD, the Russell 1000 Growth (“R1000G”) was up 3.2% for the quarter and 24.6% YTD, and the Dow was up 8.2% for the quarter and up 12.3% YTD. The strong 3Q returns marked a significant turnaround from earlier in the quarter when US recession fears and the unwinding of the yen carry trade caused significant market turmoil, during which the S&P 500 lost 8.5% over 14 trading days (Jul 16 – Aug 5). Ultimately risk assets recovered thanks to a dovish central bank pivot (see more below), stronger economic data, and a massive stimulus package from the Chinese Communist Party (“CCP”).

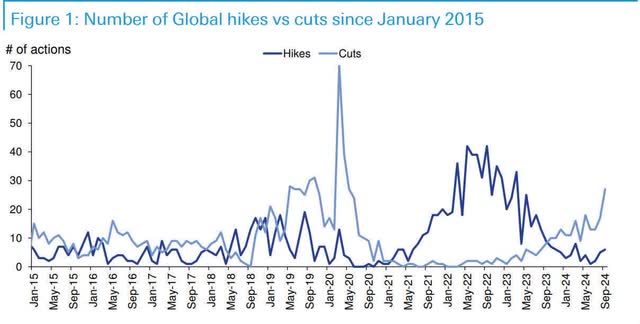

Source: Haver Analytics, Deutsche Bank.

The 2022-2023 Federal Reserve interest rate hiking cycle concluded this quarter, following 11 increases over a 30-month period that brought borrowing rates from a low of ~0% to a high of 5.25-5.50%. The Fed kicked off its easing cycle with a much-debated 50 basis point cut on the back of weaker data from the Labor Department, which printed a disappointing jobs report followed by a data revision that showed the U.S. added 818K fewer jobs in the 12-month period ended March 2024 than originally reported. This cut prompted a fury of global central bank activity, with September seeing a significant step-up in interest rate cuts from other central banking bodies (see chart above). The market’s knee-jerk reaction to the outsized Fed cut was to price in more consistent, aggressive cuts on a global basis. This thought has since been walked back, with the US 10-year (US10Y) yield rising from a low of 3.64% on September 17th to its current ~4.1%. As it stands today, the pricing-in of additional significant rate cuts looks aggressive, absent a US or European recession, but not aggressive enough if the long awaited recession does finally arrive. Adding fuel to the global-liquidity fire was the late September announcement from China’s central bank that it would be unveiling its biggest stimulative boost since the Covid-19 pandemic, which consisted of 20%-30% cuts in key policy rates, an increase in liquidity in the banking system, and mortgage rate decreases, all in an attempt to pull the economy out of its deflationary spiral and push growth back towards the CCP’s stated growth target of ~5%. Time will tell if these measures will stimulate weak credit demand to boost domestic consumption and support the country’s flailing property markets. Here at home, we may be at a tenuous point in the economic cycle. US inflation appears to be under control, thus warranting looser monetary policy. However, loosening too fast could lead to a step-up in borrowing and consumption, thus risking a re-acceleration of inflation. Time will tell if the Fed has indeed orchestrated its first soft landing in the past 30 years, or if the velocity and magnitude of its past rate-hiking decisions will finally tip the US into a broadly forecasted economic recession.

3Q24 Performance

|

PERFORMANCE (%) |

3Q24 |

1 YR |

3 YR |

5 YR |

ITD 1 |

|

Ithaka US Growth Strategy (Gross) |

0.4 |

42.3 |

6.1 |

17.7 |

17.7 |

|

Ithaka US Growth Strategy (Net) |

0.2 |

41.4 |

5.5 |

17.1 |

17.2 |

|

Russell 1000 Growth (“R1000G”) |

3.2 |

42.2 |

12.0 |

19.7 |

17.5 |

|

S&P 500 TR Index |

5.9 |

36.4 |

11.9 |

16.0 |

14.7 |

|

1 ITD = inception-to-date, annualized. Inception date is 1/1/2009. |

|||||

During the third quarter Ithaka’s portfolio underperformed in an up market, rising 0.4% (gross of fees) vs the R1000G rising 3.2%. Ithaka’s 280bps of underperformance was entirely due to stock selection, with a negligible tailwind from sector allocation. Our portfolio demonstrated modest breadth and depth, with 16 of 31 stocks held for the entire quarter, representing 49% of the names and 52% of the total portfolio’s weighting, outperforming our benchmark. This was not surprising given the narrowness of the market’s returns of late.

At the portfolio sector level Ithaka realized positive relative returns in one of the four major growth sectors in which we hold active bets, namely Financial Services. Within Financial Services, our outperformance was concentrated in one name, more than offsetting slight weakness in one of our payment networks. Adding to returns was our significant overweight to the sector. We realized modest returns in the Technology sector, with only six of fifteen holdings outperforming our benchmark. A significant chunk of our underperformance was due to our holdings across the semiconductor supply chain, with worries surrounding chip delays and geopolitics harming the industry.

Our slight underperformance in Health Care was driven by one holding that saw a significant sell-off following its second quarter earnings announcement (see top detractors). Consumer Discretionary was our largest source of underperformance, with four of our eight holdings underperforming in the quarter. Weakness was concentrated in our brick-and-mortar retailers, with concerns surrounding the health of the consumer and company-specific events leading to the relative weakness.

Contributors and Detractors

3Q24 TOP 5 CONTRIBUTORS (%)

| RETURN |

IMPACT |

|

|

ServiceNow (NOW) |

13.7 |

1.0 |

|

Mastercard (MA) |

12.1 |

0.7 |

|

Blackstone (BX) |

24.8 |

0.5 |

|

MercadoLibre (MELI) |

24.9 |

0.5 |

|

Apple (AAPLL) |

10.8 |

0.4 |

3Q24 TOP 5 DETRACTORS (%)

| RETURN |

IMPACT |

|

|

DexCom (DXCM) |

(40.9) |

(1.0) |

|

e.l.f. Beauty (ELF) |

(48.3) |

(1.0) |

|

ASML (ASML) |

(18.4) |

(0.6) |

|

CrowdStrike (CRWD) |

(26.8) |

(0.6) |

|

Chipotle Mexican Grill (CMG) |

(8.0) |

(0.3) |

Top Contributors

ServiceNow, Inc. (NOW)

Founded in 2004, ServiceNow has become the leading provider of cloud-based software solutions that define, structure, manage and automate workflow services for global enterprises. ServiceNow pioneered the use of the cloud to deliver IT service management (“ITSM”) applications. These applications allow users to manage incidents and to plan new IT projects, provision clouds, manage application performance and build applications themselves. The company has since expanded beyond the ITSM market to provide workflow solutions for IT operations management, customer support, human resources, security operations and other enterprise departments where a patchwork of semi-automated processes have been used with varying success in the past. ServiceNow’s stock appreciated in the quarter on the back of strong earnings that beat Street estimates on the top and bottom line, with the company pointing to strength in subscription revenues, cRPO, operating margins, and continued demand for the company’s AI products.

Mastercard, Inc. (MA)

Mastercard is one of two leading companies (along with Visa, which we also own) that helps match information and funds between banks that have relationships with card-carrying consumers and banks that have relationships with merchants, thus ensuring payment transactions are reliable and secure. Since the company’s founding in 1966, Mastercard has benefited from the growth in personal consumption expenditure, the strong secular shift from cash and checks to credit and debit cards, and a highly profitable business model that generates high incremental operating margins and hence ample and growing free cash flow per share. During the third quarter Mastercard’s stock outperformed as an in-line earnings announcement and strong global credit growth helped pull the stock out of a six- month consolidation.

Blackstone Inc. (BX)

Blackstone is one of the world’s leading alternative asset management firms with total assets under management (“AUM”) now in excess of $1 trillion. Over the past few decades Blackstone has evolved into one of the financial service industry’s largest asset gatherers, managing money on behalf of pension funds, insurance companies, and individual investors. The company remains at the forefront of financial innovation, steadily broadening its product offering over time. Today, Blackstone invests clients’ capital across four business segments: (a) Real Estate, (b) Private Equity, (c) Hedge Fund Solutions, and (d) Credit & Insurance. The stock’s relative outperformance in the quarter was mainly due to investor expectations that the private markets are beginning to un-freeze, which should lead to a step up in deal crystallizations (sales) for the company.

Top Detractors

DexCom, Inc. (DXCM)

DexCom is a medical device company focused on the design, development, and commercialization of continuous glucose monitoring (CGM) systems, primarily for people with diabetes.

Diabetes is a chronic, life-threatening disease for which there is no known cure. DexCom’s CGM system is superior to traditional finger-stick tests because it provides users with continuous data (including glucose trends and time spent in hyper or hypoglycemia) versus a snapshot in time. Dexcom’s stock suffered following its 2Q24 earnings announcement.

The company missed on the top line and cut forward revenue guidance from $4.20-$4.35B to $4.00-$4.05B. The cut was due to a step-down in revenue per customer in the US as well as a loss of market share in the company’s durable medical equipment (“DME”) channel. Management plans to refocus its sales efforts in the DME channel to win back lost share and also expects the revenue per patient headwinds to lessen as its new product, the G7, rapidly overtakes its prior generation products and becomes a majority of company revenues.

e.l.f. Beauty, Inc. (ELF)

e.l.f. Beauty is a multi-product-line beauty company that offers inclusive, accessible, clean, vegan and cruelty-free cosmetics and skin care products that target savvy Gen Z and Millennial customers. The company’s moat stems from offering a product that is high quality at affordable prices, employing an industry leading 13-week production cycle, and utilizing a disruptive marketing engine, which is heavily focused on viral growth through digital/social media. ELF’s underperformance in the quarter was due to its F1Q25 earnings announcement that featured an expected beat on the top and bottom lines, coupled with an unexpectedly tepid forward guidance. The guidance “miss” combined with the stock’s demanding valuation multiple provided short-term investors with a rationale to sell the stock.

ASML Holding N.V. (ASML)

ASML is a leading supplier of photolithography equipment used in semiconductor manufacturing, enabling the production of microchips at ever-smaller line widths. The company’s cutting- edge technologies, particularly extreme ultraviolet (EUV) lithography, play a critical role in producing the most advanced chips for applications like smartphones, data centers, and AI. ASML’s systems are vital for the semiconductor industry, helping to push the boundaries of Moore’s Law and drive innovation in electronics. Like most players in the global semiconductor space, ASML suffered from various government restrictions placed on sales of systems to countries considered adversarial to US interests. In particular, during the quarter ASML’s strong earnings report was overshadowed by the Biden administration telling its allies the US was considering imposing severe trade restrictions to limit ASML from selling/servicing lithography systems in China.

Transactions

During the quarter we initiated a new position in Palantir Technologies (PLTR) and eliminated both Align Technologies (ALGN) and Snowflake (SNOW). Our trailing 12-month turnover decreased to 11.8% while our trailing 3-year average annual turnover decreased to 12.1%. 1

Market Outlook

Ithaka claims no expertise in economic or market predictions, and top-down analysis merely plays a supporting role in our approach to investing. We typically take our cues on the economy and the markets from our companies’ management teams as they discuss their business prospects, and industry outlooks, during quarterly calls. During the third quarter 90% of our portfolio holdings beat top-line expectations and 81% beat bottom-line expectations, which resulted in the average stock falling ~1% , eight stocks increasing >5%, and nine stocks falling >5%. There was little skew in the quarter, but as usual it included fat tails. On their earnings calls, management teams continued to discuss the health of the consumer, AI roadmaps, and highly scrutinized (often pared back) capital spending plans, which has been the case since mid 2023. Outside of these prevalent themes, the market’s interest in the pending presidential election and the glide path of central bank interest rate moves have received heightened interest.

Presidential election years tend to be volatile times for the markets as investors try to discount: 1) who the winner will be, 2) the likelihood that administration’s policies get implemented, and 3) the impact these aforementioned policies would have on individual companies in a given industry. As you have heard us say before, we are not macro economists and we believe making such prognostications is problematic, at best. In an attempt to speculate as to the outcome, given what we currently know, it appears likely that Donald Trump will be our next president.

This speculation is supported by multiple polls of late showing Trump with a lead in the majority of the swing states and hence the electoral college. More importantly, in our minds, the betting website, Polymarket, has seen $1.6B wagered, which indicates Trump currently has a 54% chance of winning. As they say, people do tend to “put their money where their mouth is.” As for Trump’s economic policies, the main tenets include extending the expiring 2017 tax cuts, reducing corporate income taxes to 15%, some form of additional trade tariffs, and eliminating taxes on various forms of income, the largest being tips, overtime, and Social Security benefits. The near-term impact of these economic policies would likely put more money into the economy at a cost of even larger government deficits and growing national debt, which today stands at ~$35.7T and growing fast. What we do know is that until we get clarity on who the next president will be, market volatility, as measured by the VIX, will likely steadily increase. In fact, the average monthly volatility for US election years steadily increases from July and peaks in November, before falling back down to a more normal level in December.

Our market outlook section wouldn’t be complete without our obligatory musings on the Fed’s future policy decisions. The 30-month saga of rising and peaking interest rates has ended, with the Fed starting its easing cycle with a supersized 50bp cut in mid-September. Interestingly, since that cut the bond market has done nothing but sell off, with the 10 year yield rising 50bps over the past month. Mr. Market, who was desperate for rate cuts, seems to be having second thoughts about the inflation battle being won. Inflation hawks got some further ammunition when the September CPI number was released, which showed Core CPI increasing 10bps to 3.3% following two flat months at 3.2%. Couple an uncertain inflation picture with initial filings for unemployment hitting the highest since August 2023, and you can see why the Fed continues to be stuck between a rock and a hard place. As always, we end this letter acknowledging that one’s ability to digest, forecast, and accurately discount the above macro factors is pretty much an exercise in futility, and we therefore choose to stay fully invested and focused on our mission of creating wealth for our clients by owning, in size, the great growth stories of our day.

|

1 Turnover Rate indicates the frequency of changes to the portfolio, and is calculated as the greater of the buys or the sells during the period as a percentage of the assets under management at the time of each transaction. The calculation eliminates the effect of client-directed cash flows. Average Annual Turnover is calculated based on a trailing three year period. Risk Disclosure Past performance is not indicative of future results. The performance shown is for the Ithaka US Growth Strategy Composite. All fully discretionary taxable and non-taxable accounts are added to the composite following the first quarter in which their ending market values equal or exceed $0.5 million. Results of individual accounts may vary from the composite depending on account size, timing of transactions and market conditions prevailing at the time of the transaction. The gross-of-fee performance does not reflect the payment of management fees and other expenses that are incurred in the management of an account. The net-of-fee performance includes the payment of such fees and expenses. Gross-of-fee performance and net-of-fee performance both include the reinvestment of all distributions, dividends and other income. The performance shown is compared to the Russell 1000 Growth Index and the S&P 500 TR Index. The Russell 1000 Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those companies from the Russell 1000 Index with high price-to-book ratios and high forecasted growth as compared to other companies listed in the Russell 1000 Index. The S&P 500 TR Index is a market-capitalization- weighted index that measures the performance of 500 leading publicly traded companies in the U.S. The index tracks both the capital gains as well as any cash distributions, such as dividends or interest, attributed to the components of the index. These broad-based securities indexes are unmanaged and are not subject to fees and expenses typically associated with managed accounts. Individuals cannot invest directly in an index. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions Ithaka makes in the future will be profitable or will equal the investment performance of the securities discussed herein. Investing in securities entails risk and may result in loss of principal. Contact: info@ithakagroup.com 3811 N Fairfax Drive | Suite 720 | Arlington, VA 22203 Ph: 240.395.5000 | www.ithakagroup.com |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.