The Bottom Fishing Club: Alkermes Has Great Value And Safety (NASDAQ:ALKS)

RichVintage/E+ via Getty Images

I have been concentrating my research on the pharmaceutical sector of the market over the last several weeks. I just posted my reiteration of the solid bullish arguments for owning Pfizer (PFE) here. A large number of prescription-drug names appear to be an inflection point, where defensive, safety-minded capital has been flowing. My technical momentum work suggests a major turn higher could be at hand for the industry, after several years of punk to lower performance.

The reversal reasoning could be a bear market on Wall Street generally the rest of 2024 is about to flip the investment interest scales from growth (Big Tech – AI chasing) to value themes. The nearly recession-proof business models for drug makers, and historical outperformance during rotten drops in the S&P 500, suggest increasing your exposure to companies like Alkermes plc (NASDAQ:ALKS).

Alkermes reported slightly weaker-than-expected Q1 results several weeks ago, and the stock quote is down close to -30% since February. The good news for investors is the company: (1) remains highly profitable from royalties plus the sale of four drugs, (2) maintains one of the strongest balance sheets in the pharmaceutical industry, (3) has decent growth potential from existing prescription writing trends and at least one promising drug under development, and (4) can be purchased at a price level that I believe offers real bargain value for your money.

So, if capital is flowing into the sector in the months ahead, and Alkermes stands out as a better-than-typical pick vs. peers, the chance for serious outperformance of U.S. equities absolutely exists today. Let me explain some of my logic.

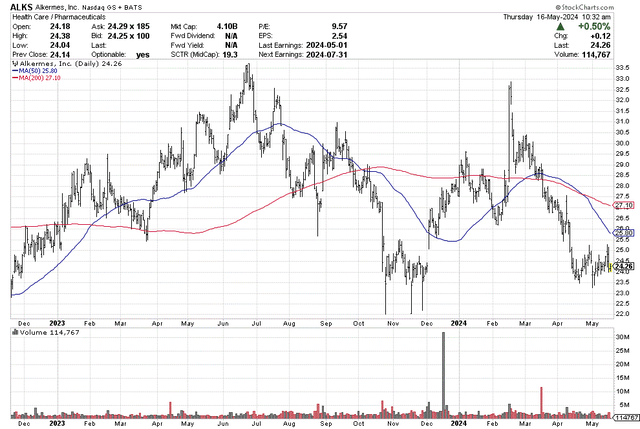

StockCharts.com – Alkermes, 18 Months of Daily Price & Volume Changes

The Business

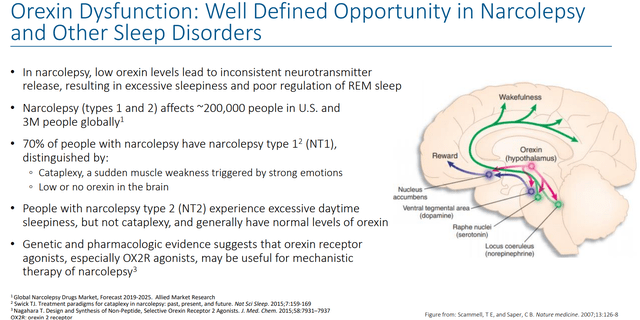

Alkermes is focused on a portfolio of patented therapies to treat alcohol dependence, opioid dependence, schizophrenia and bipolar I disorder, with a pipeline of clinical and preclinical candidates in development for neurological disorders like narcolepsy.

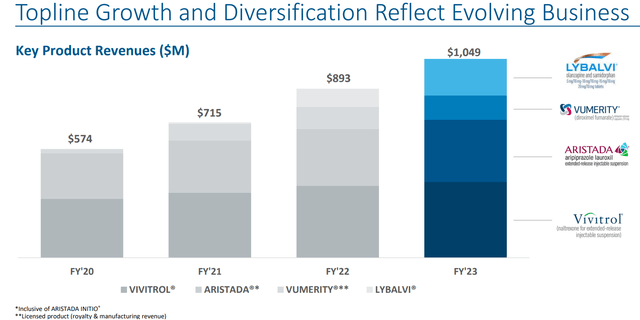

Outside of collaboration agreements and royalties, the majority of company sales are essentially generated from four products: Vivitrol, Aristada, Lybalvi, and Vumerity.

Alkermes – April 2024 Corporate Presentation

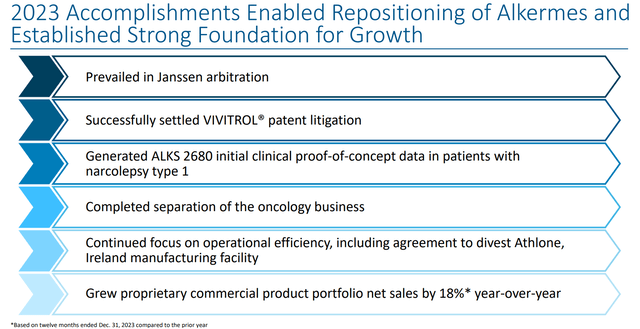

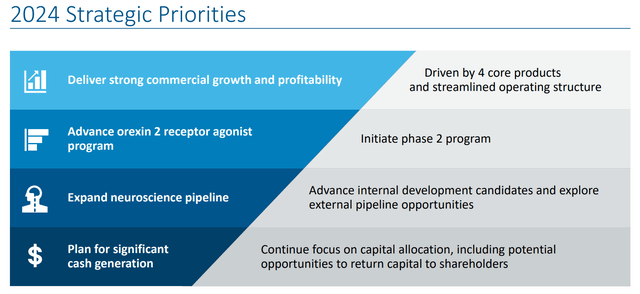

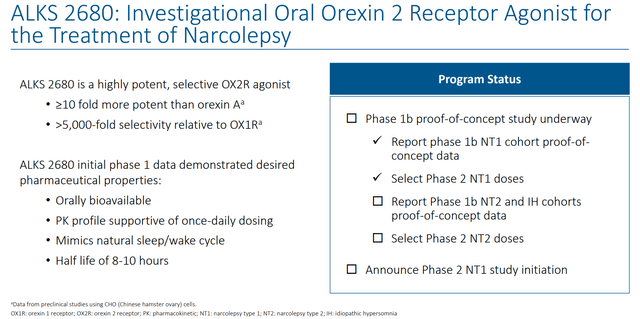

A summary of 2023 accomplishments and 2024 goals is found in the latest April Corporate Presentation. Below, I have pulled the slides that explain operations best. The top prospect for R&D is ALKS 2680, a narcolepsy sleep disorder medicine about to enter Phase 2 trials.

Alkermes – April 2024 Corporate Presentation Alkermes – April 2024 Corporate Presentation Alkermes – April 2024 Corporate Presentation Alkermes – April 2024 Corporate Presentation Alkermes – April 2024 Corporate Presentation

Strong Balance Sheet

The Alkermes balance sheet is in terrific shape to fund future growth or make small bolt-on acquisitions of promising drugs in the neuroscience field. Having lots of cash, earning 5% for nearly risk-free interest yield, is not the worst asset to be holding, with all the risks for the economy and world this year.

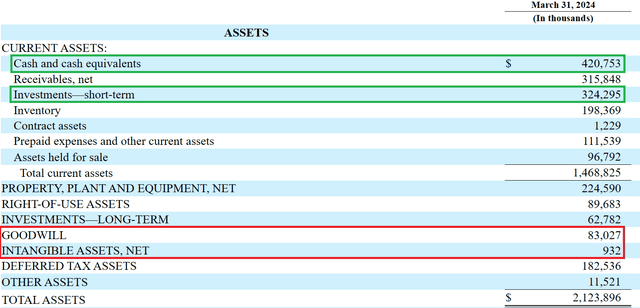

With $745 million in cash vs. $290 million in debt, and $1.47 billion in current assets vs. $869 million in total liabilities at the end of March, the company possess an “A+” conservative balance sheet setup vs. peers in the pharmaceutical industry.

Measured against today’s $24 share quote, $7 of this price is backed by net tangible book value. Few diversified pharma names have any tangible book value in comparison, with drug acquisition costs creating plenty of goodwill and patent-protected research generating equally massive sums of intangible “assets” on the balance sheet for most large outfits.

I have highlighted the substantial cash position in green and very low goodwill/intangible numbers in red from the Alkermes Q1 2024 balance sheet below. Both are major equity investment positives in my view.

Alkermes – March Quarter 2024 SEC Filing, 10-Q

The Undervaluation Argument

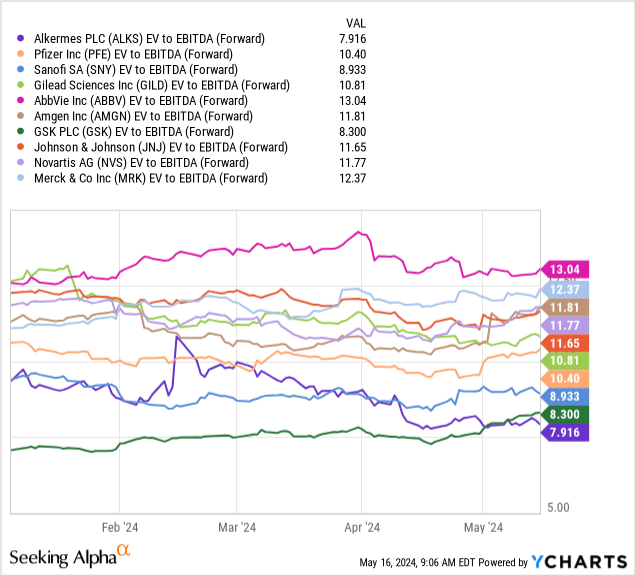

After we account for the overflowing cash position and limited debt due, the “enterprise valuation” is where I am focusing my attention in terms of valuing the business. EV ratios to EBITDA and Revenues are incredibly low, for a company with sound management, high profit margins, diversified drug sales, and a stable to slow-growth future. Really, it is hard to find a peer or competitor in the pharmaceutical industry with a similar foundation today, at such a low valuation. Sure, you can find other midsized pharma names with lower EV ratios. However, they have peaking income levels, serious patent lawsuit risk, or rotten balance sheets.

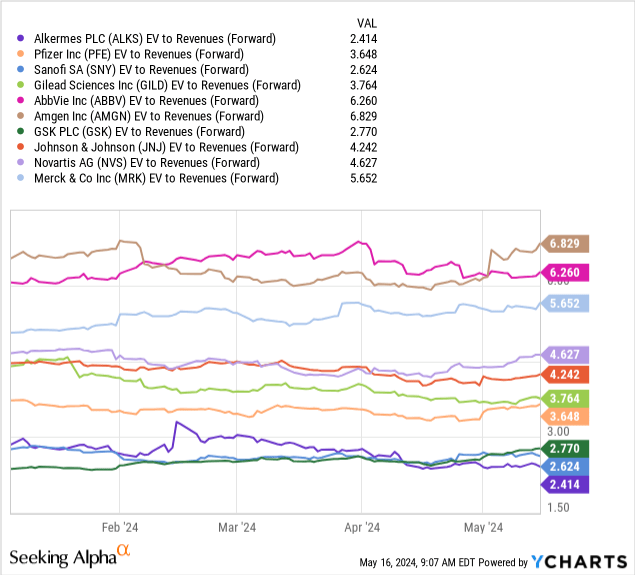

Even when we compare operating results to the well-diversified Big Pharma names, Alkermes jumps out as having super-cheap value on the current stock quote. On either EV to EBITDA (8x forward estimated 2024 results) or EV to Revenue (2.4x forward estimated 2024 results) calculations, ALKS jumps out as a true bargain. My sort group includes Pfizer, Sanofi SA (SNY), Gilead Sciences (GILD), AbbVie (ABBV), Amgen (AMGN), Glaxo-Smith-Klein PLC (GSK), Johnson & Johnson (JNJ), Novartis AG (NVS), and Merck (MRK).

YCharts – Alkermes vs. Big Pharma Names, EV to Forward EBITDA Estimates, Since Jan 2024 YCharts – Alkermes vs. Big Pharma Names, EV to Forward Revenue Estimates, Since Jan 2024

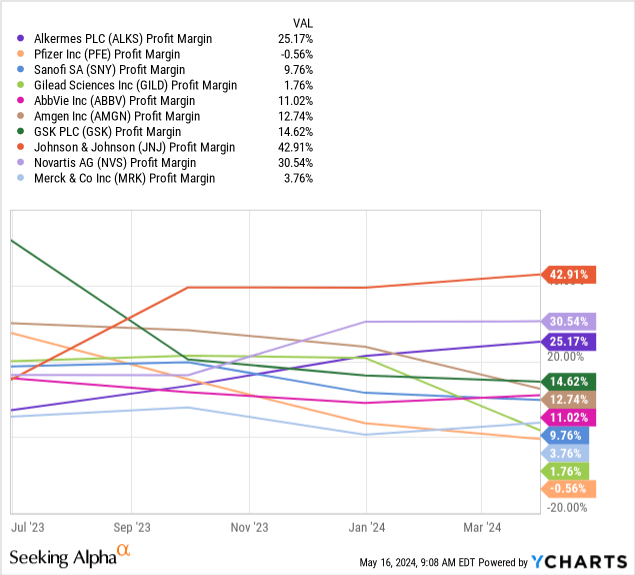

More good news for shareholders, profit margins from the Alkermes business setup are high and rising over the last couple of years (the company was not profitable from operations before 2021). Right now, the ALKS final after-tax margin ranks as one of the strongest in the patented drug-making industry at 25%.

YCharts – Alkermes vs. Big Pharma Names, Final Profit Margin, 1 Year

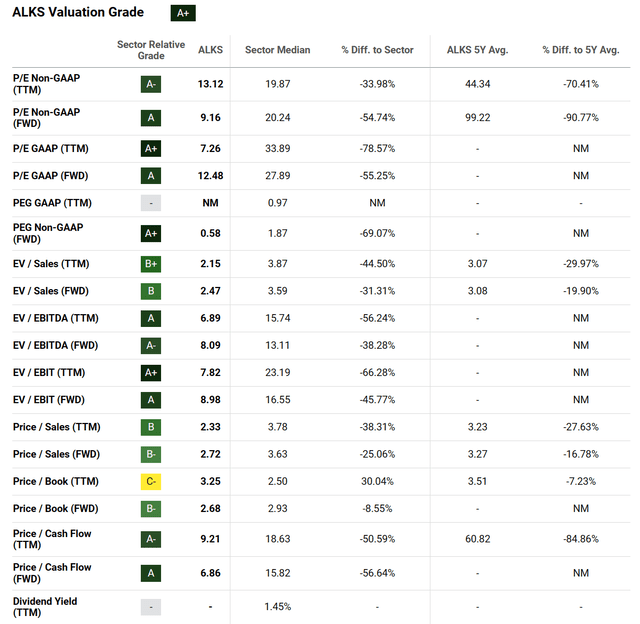

When you consider the entire valuation dataset, Seeking Alpha’s computer-sorting formula puts an “A+” Valuation Grade on Alkermes in May 2024. If you are looking for honest underlying business worth on your investment in the drug industry, with a sound balance sheet, and diversified sales as support, Alkermes should be near the top of your research list.

Seeking Alpha Table – Alkermes, Quant Valuation Grade, May 16th, 2024

Final Thoughts

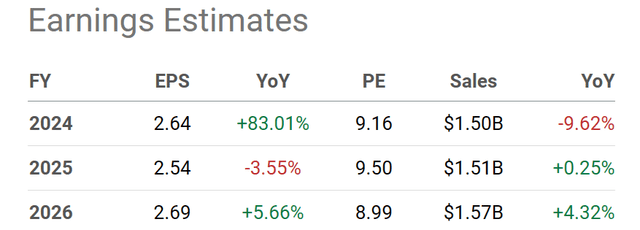

Alkermes is definitely not a high-growth pick. Earnings and sales are expected to plateau after this year, until new products are brought to market (which will take several years) or an acquisition/merger decision is made by management.

Seeking Alpha Table – Alkermes, Analyst Estimates for 2024-26, Made May 16th, 2024

For sure, Alkermes itself could be a takeover target, with its significant cash holdings creating a very low enterprise value for anyone purchasing the whole business. In fact, I believe the odds of a bid for this underfollowed equity asset are quite high the remainder of the year.

Absent a suitor appearing, I am still forecasting a meaningful drive to the upside in the ALKS share quote soon. For share price targets, those buying around $24 a share now could effectively front-run approaching capital flows into the pharma space during a bear market on Wall Street. A $30-35 price may become reality in 6-12 months. Nothing spectacular for investment gains, but a +25% to +45% advance in price will be award-winning if the S&P 500 tanks -20% or -30% into early 2025. All told, that’s my buy logic in a nutshell.

I believe a fair valuation of shares with price trading at 12x to 14x EPS of $2.50 in a recession makes plenty of sense. That’s still a value-rich earnings yield of 7% to 8%, with loads of cash, steady operating results, and promising drugs under development.

What’s the downside? Regular risks on investment in the pharmaceutical area are part of the Alkermes story. Future lawsuits cannot be discounted out of hand, either from customers experiencing side effects or other patent owners with similar creations on the market. While management has done a wonderful job of getting ALKS to material operating profitability, an ill-advised purchase of R&D assets cannot be ruled out.

In addition, stock market crash risk is a thing this year. With the general valuation level of U.S. equities high and rising (record price to sales, sky-high CAPE ratio, extraordinarily stretched market value to GDP output, etc.), a downside resolution of overpricing could be wicked and scary at some point. ALKS would equally suffer in such a crash scenario.

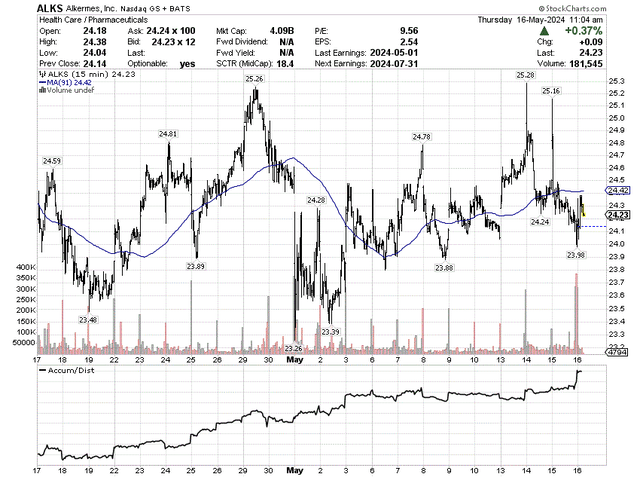

Overall, I feel the timing for bottom fishing is now. One of my favorite intraday screens for buying/selling is drawn below. I am looking at 15-minute increments of the Accumulation/Distribution Line. Simply put, a rising line represents serious buying, even if price has not begun to trend higher. It doesn’t always work successfully in predicting price, but this short-term indicator is another positive to consider in the research process. Despite a flat quote over the last 30 days, a robust intraday ADL is hard to ignore.

StockCharts.com – Alkermes, Intraday Accumulation/Distribution Line, 30 Days

I rate Alkermes a Buy, and own a small position in my diversified portfolio. It represents defensive healthcare and pharmaceutical exposure, which should be supported by capital inflows exiting overextended tech-growth names throughout the last seven months of 2024.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.