Tarsus Pharmaceuticals: Strong Execution In Eye Disease Treatment (NASDAQ:TARS)

Pgiam/iStock via Getty Images

Tarsus Pharma (NASDAQ:TARS) has an approved drug for a mite infestation eye disease called Demodex blepharitis and multiple late-stage assets in its pipeline. Its key molecule is called lotilaner, an antiparasitic widely used in veterinary medicine for the treatment of ticks, mites and other infestations. It’s available in oral tablet forms and is known to be effective in animals. Tarsus has 3 product candidates, all of which are various formulations of lotilaner, developed in a form suitable for human use.

Last year, when I covered it, I said that while the company had good data and nice execution, the market potential of the target indication was unclear.

However, according to their most recent annual report, an estimated 25 million Americans suffer from DB, and XDEMVY is the first and only FDA-approved treatment for Demodex blepharitis and “is considered the definitive standard of care.”

That’s a large target market. In my article, I had noted – and provided some proof of – how tea tree oil or TTO might be an effective and inexpensive treatment for the demodex infestation. An optometrist who read my article said that TTO is not only not effective, but it could also be harmful to our meibomian glands, which produce a lipid-rich substance called meibum, which plays a crucial role in maintaining the health of the eyes. The study this user referred to was a 2022 Harvard + Beijing study, link here, which said:

T4O, even at levels 10-fold to 100-fold lower than demodicidal concentrations, is toxic to HMGECs in vitro.

T40 is another name for the TTO extract. This study did say that T40 was effective as a demodicide. But it just wasn’t safe in vitro. While this study, being non-human, is not conclusive, I believe the burden of proof is low here, and we’re not looking for “conclusive.” A safety concern is enough for an unapproved medicine to lose against an approved and effective drug.

Going back to TARS, the stock is up 65% right now from last year, and at one time was up 3x. The market has clearly sided with the company on this one.

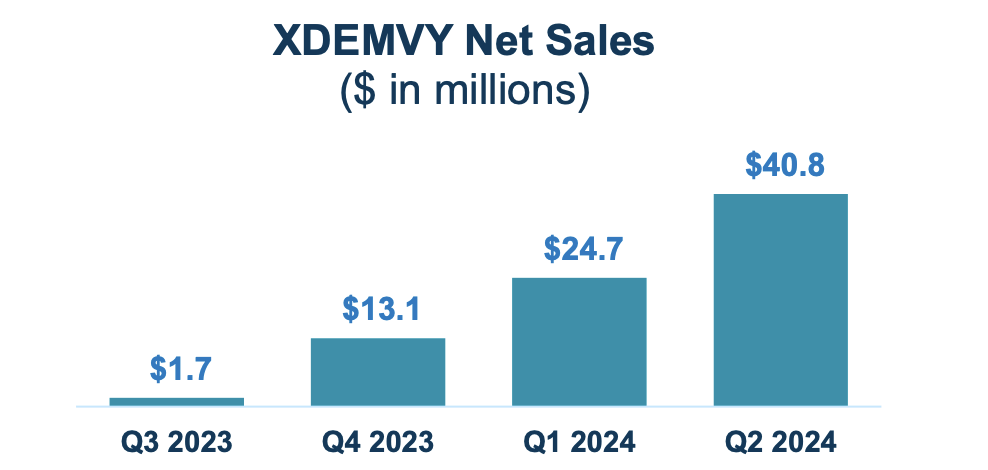

As for their revenue figures, they have done very well. Here’s the chart:

Corporate Presentation

The company sees a $1bn opportunity in the initial addressable segment alone. They estimate 1.5 million US patients already diagnosed with DB, and another 1.2 million, 2.2 million and 2.3 million patients with Dry Eye Disease, Cataract and Contact lens respectively who also have DB. Together, this constitutes a >7M market, and the company values it at more than $1bn.

Rest of the pipeline

The same molecule, TP-03, is in a phase 2 trial in Meibomian gland disease (MGD’). It’s also in trials in China for DB in partnership with LianBio (LIAN), although the future of this is uncertain, see 10-K, page 27. A second formulation, TP-04, is in phase 2 targeting rosacea. A third formulation, TP-05, is in phase 2 targeting Lyme disease.

Lyme disease is a bacterial disease caused by the bite of infected deer ticks. In February, TARS published positive proof of concept data from this study. As the company said, ticks needed to be attached to the skin for 36 hours before the disease could be transmitted. So the company evaluated TP-05’s ability to kill ticks within 24 hours of their being attached to the skin. As it turned out, 97% of the ticks died within 24 hours at the higher dose, while only 5% died from placebo. This effect was retained for an entire month, which means the medicine can take care of your tick bite problems during an entire tick season.

According to the company, “Over 30 million Americans are considered to be at high or moderate risk of contracting Lyme disease, and there are approximately 300,000 – 400,000 cases in the U.S. each year.” Lyme disease is usually treated with antibiotics. Obviously, this happens after the disease occurs and is detected. TP-05 appears to be preventive because it kills not the Lyme disease bacteria but the vector itself, before it can cause an infection. That is potentially a very attractive addition to the therapeutic armamentarium.

Coming to TP-03 in MGD, approximately 30-40 million Americans have this disease that is caused by the infestation of another type of demodex mite and may cause permanent damage to the tear glands. MGD has no approved pharmacologic therapies. In a phase 2 trial completed late last year, TP-03 demonstrated “a statistically significant improvement in two objective measures of the disease and was well tolerated following treatment for 12 weeks with TP-03.” The company is pursuing regulatory discussions with the FDA.

TP-04, an aqueous gel formulation of lotilaner, has been tested in rosacea and found to be safe and effective.

Peers/Competition

There are several approved and emerging treatment options for demodex-related diseases. In MGD, Bausch + Lomb and Novaliq offer NOVO3, which was approved in May 2024 to treat dry eye disease (DED) associated with Meibomian gland dysfunction. The molecule was approved following phase 3 trials that met all primary and secondary endpoints.

AZR-MD-001, a program from Azura Ophthalmics, is in phase 3 clinical trials targeting MGD. Last year, the molecule met co-primary endpoints in a randomized phase 2 clinical trial. Azura, a privately held company, also has other programs in demodex related diseases.

Financials

TARS has a market cap of $977mn and a cash balance of $323mn. Revenues were $40.8 million. Research and development (R&D) expenses were $12.3 million while selling, general and administrative (SG&A) expenses were $58.8 million. These SG&A expenses, the company says, were just $20.3 million for the same period in 2023. The increase, they say, was “due primarily to $11.0 million of compensation-related expense (including non-cash stock-based compensation), $13.8 million of commercial and market research costs related to the commercial launch of XDEMVY, and $13.6 million of increased IT, legal, professional and other corporate expenses.”

I must say that the company might want to be more careful with their increasing expenses.

Taking these expenses as they are, and extrapolating, they have a cash runway of four or five quarters. However, as sales increase, the additional cash will certainly add to their cash runway.

Patent situation

The primary concern for this company is its intellectual property. Lotilaner, the key molecule, was approved by the FDA for veterinary use in 2017 under the brand name Credelio. It was developed by Elanco Animal Health (ELAN), a leading company in animal healthcare.

Tarsus licensed IP related to Lotilaner from Elanco in 2019. If you read the 10-K, starting at page 25, you will see that the terms of the license are extremely lenient. Elanco has apparently gifted them this molecule for human formulation at throwaway prices. Compare the milestone payments TARS has made or will make to Elanco (less than $10mn total, plus another $75mn in future sales related milestones) for what appears to be a $1 billion molecule, with what they’re getting from LianBio for their China partnership ($82mn upfront plus milestone and another $30mn approx), and you will be amazed.

The associated patents are valid till 2032 or so. The company has not disclosed which patents are valid till what year, but has only given the extent; which is more or less standard practice.

Risks

Like I have indicated, the patent situation is something of a risk. Their core patent relates to lotilaner, and this has been licensed from Elanco for a small sum. Moreover, the patent estate is held only for another 6-8 years, which limits their market opportunity.

Another risk is the sudden spurt in G&A expenses since the approval, which seems to be a lot for a company of this size. Although there’s no rule, as such, it has been my experience that companies spend more on R&D than on SG&A. Here, R&D has stayed more or less fixed at around $12mn for over a year, while SG&A has significantly increased.

There’s also some competition in some of the target indications, notably MGD, which will have to be considered.

Bottom line

TARS has a market cap of ~$1bn and a target market also valued at $1bn. That’s an attractive ratio. They have upcoming catalysts and strong data in the programs they are pursuing. There are some risks that I just discussed, but overall I think TARS is a good bet at current prices with a two-year window.