SiteOne Landscape – Wonderful Business, Terrible Valuation (NYSE:SITE)

Pgiam

Overview

SiteOne Landscape Supply (NYSE:SITE) is the type of business I look for. Capital structure is fortified by a strong balance and the co generates lots of cash flow. The economic moat is strong with scale and a historical track record of acquisitions. At current state the company seems fairly valued with a cash flow yield at 3.43%. With a soft market and the current election going on in the U.S., the yield could get higher making it more attractive. I would start to be interested in making a purchase of shares if the yield got closer to 5%. This is the perfect company to put on a watchlist for long-term investors looking for compounders. Below is my analysis as to why its a good business.

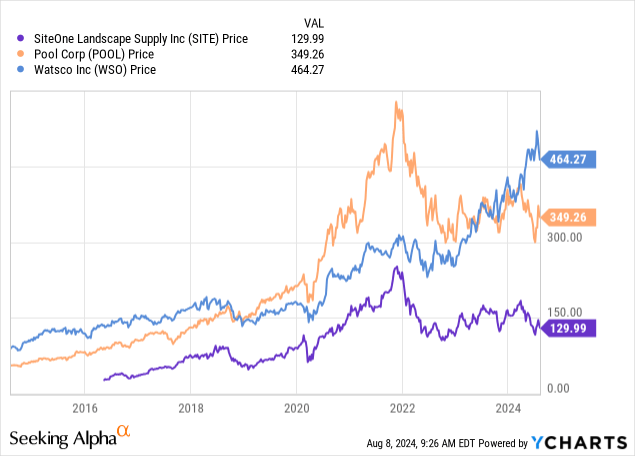

Large scale wholesale distributors in multiple industries have benefited over the past decade. SiteOne Landscape Supply is one of three I follow. Pool Corp. (POOL) and Watsco (WSO) are the other two. These companies have created a lynchpin position in the supply chain for their respective industries, which has created a virtuous circle for many stakeholders within.

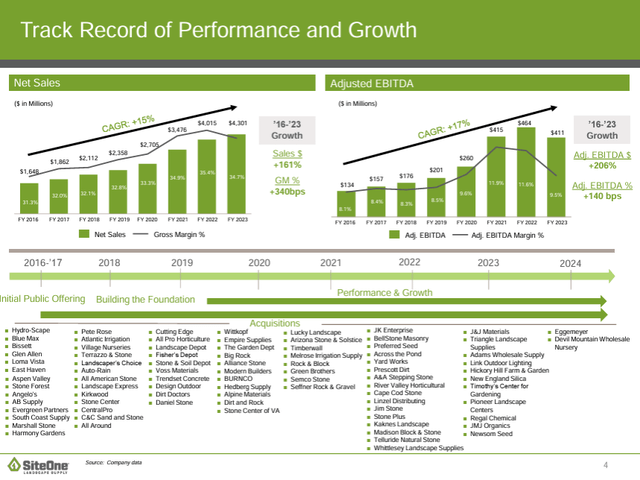

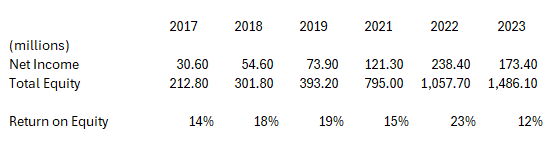

SiteOne’s beginning began at Deere and Company (DE) and was spun off back in 2016. The performance of the company has been strong since as we can see from above.

Business Model

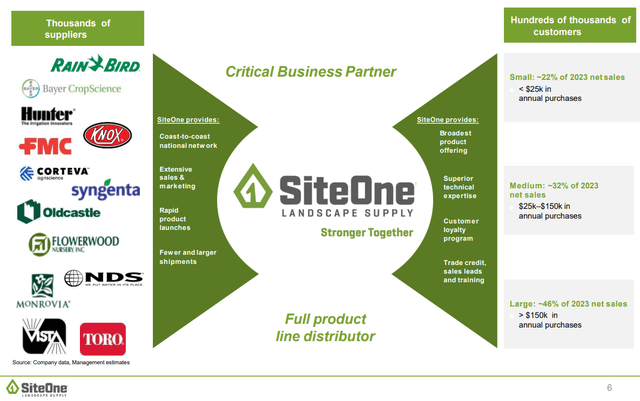

So why are large scale wholesale distributors such a good business model? They are a hub within a large supply chain between suppliers and customers, creating efficiencies which otherwise would be highly fragmented. SiteOne is the only company with full product line distribution for landscape supplies. They own 17% of the market share which is estimated to be at $25 billion. Geographically there are 710 branches and four distribution centers covering 45 states and six Canadian provinces, carrying approximately 160,000 SKU’s.

SiteOne allows thousands of suppliers to reach hundreds of thousands of customers. The real advantage is the distribution line between large scale suppliers and small to medium size customers. It is uneconomical from a direct to customer standpoint, especially with the small contractors who will potential have purchasing patterns that large supplier won’t want to deal with. SiteOne solves this problem. Landscape work is very local, so being able to consolidate costs and provide greater exposure to customers is a win win.

Manufacturers and suppliers benefits from:

- SiteOne’s extensive branch and warehousing locations allows immediate access to hundreds of thousands of customers.

- SiteOne has the scale to make large purchases reducing inventory risk for the suppliers and consolidating freight cost to the end customer.

- SiteOne has the experience with dealing with the end customer which is a task that can be costly from training employees to product support.

- Cross-selling synergies where projects can easily be done with multiple products needed for one project can be purchased and received on a timely basis.

End customers benefit from:

- One location with many product offerings.

- Employees with the technical expertise to help the customer or contractor with the projects they want/need done.

- Invested capital to offer businesses technology resources for project estimation tools and other support.

- Extend credit to end customers at favorable terms.

Financial Highlights

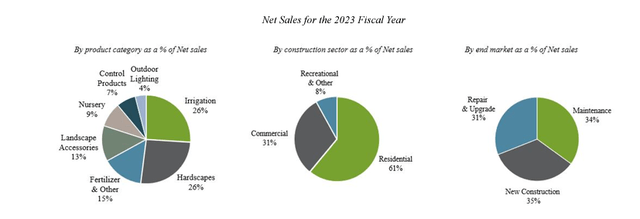

Net Sales Breakdown

Investors Relations Investor Relations

Sales CAGR of 15% and adjusted EBITDA CAGR of 17% over the life of the company so far highlights the position SiteOne has created. This is significantly above average performance and they have been able to maintain this growth for eight years.

The balance sheet is solid with very little debt when compared to the EBITDA taken in, generated $411 million of EBITDA in 2023.

Historical returns on equity are strong, but as profitability has been pressured the past year, so has returns on equity.

Seeking Alpha

2023 was a tough period for the landscape supply space with operating cost inflation and a softer market.

Strategy and Industry Dynamics

For any long-term investor they’re two areas I believe are worth the most time researching, understanding the business/moat of the organization and the strategy management is using to create value in the future. Some investors may say valuation is the most important and I wouldn’t disagree, but for the most part, looking at comparable valuation metrics to the industry and overall market can give you a good sense of where the company stands. Truly valuable information is found when information is synthesized into a cohesive summary of how is the business creating these financial metrics, and what management is doing to grow.

M&A has been a clear leading indicator of growing the business for SiteOne. Management has completed 96 acquisitions since 2014, adding 410 branches and $1.94 billion in annualized sales. As for being the established leading industry consolidator they want to leverage this position with their sourcing advantage of 80 plus leaders scouting for opportunities. In addition, historical data collected on prior deals allows them to leverage this data for favorable deals within their pipeline of potential acquisitions.

Management also wants to use a more decentralized approach from a corporate structure. Management likes entrepreneurial local area teams as geographically customers will have different landscape needs and can be ever changing.

Key talking points management has expressed recently:

- Continued organic growth

- Increase gross margins and reduce SG&A

- Continue executing accreditive acquisitions

- Improve cash flow through inventory management

A typical customer for SiteOne is a private landscape contractor that operates in a single market. Bringing a high-touch customer service model strengthen by a broad portfolio of products and convenient branch locations allows them to build long-term relationships. Acquisitions allows SiteOne to enter new markets and expand in already established markets. Each market can be different, but one thing is clear, that increased home sales and a strong economy will drive organic growth for SiteOne. A soft economy and housing market in 2024 has slowed down SiteOne. This will ebb and flow over a 10 year period which may create opportunities on the valuation front.

Valuation

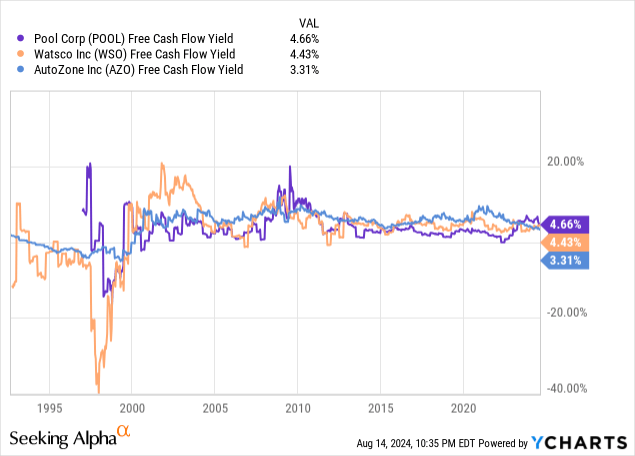

SITE FCF yield: 3.43%

Comparable distributors FCF yields.

All these comparables operate in different industries and have different market dynamics, capital structures, and profitability margins. They all have one thing in common though, which is they are market leaders as a wholesale distributor. Pool and Watsco look more attractively priced with the higher yields. As such, SITE from a valuation perspective is fairly valued to overvalued at current state from a comparable industry leader perspective.

Historical S&P 500 earnings yield is around 5% and the risk free rate sits close to 4%. SITE has shown characteristics of a durable company and should be valued above your typical S&P 500 company along with having a FCF yield closer to the risk free rate. When comparing these two data points with the most recent FCF yield data shows the company is fairly valued.

The last method that I would like to present in valuing the company is looking at the projected full year EBITDA valuation compared to historical trends. Management is projecting $380 million to $400 million in EBITDA for the current year. Using the low end of $380 million at an enterprise value of $7 billion giving an 18x multiple. Historical trends show a 20x multiple indicating a slight discount but not something to get excited about. I would argue the path to increase growth is becoming more difficult as the revenue base is much larger compared to five years ago and average EBITDA multiple should contract some based on growth metrics going forward.

Risks and Challenges

Economic Sensitivity: The business is influenced by economic conditions; wages, financial market conditions, and new home development all play factors on growth for SiteOne from a short-term perspective. Over the long-term these sensitivities even out and usually have a net positive over a 5 – 10 year period.

Execution risk: SiteOne does rely heavily on store expansion. Any missteps with acquisitions could significantly impact the financials and take years to turn the ship around.

Concluding Thoughts

SiteOne is a high quality business that has been a compounder over the last eight years as they’ve been gaining scale through consolidation. Valuation metrics at current state don’t look probabilistically favorable to have a buy rating on them. Comparable and historical valuation data shows no mispricing of the underlying security. They do have unique competitive advantages which is why I would put it on a watchlist for now.