Simulations Plus: Declining Margins Are A Problem (NASDAQ:SLP)

Just_Super/iStock via Getty Images

Simulations Plus’ (NASDAQ:SLP) business continues to expand at a steady pace, driven by acquisitions and Service revenue. The company’s margins are under pressure, though, due largely to stock-based compensation and the amortization of intangibles.

While macro conditions remain a headwind, the use of biosimulation software is likely to continue rising for many years to come, due to its ability to reduce drug development costs and increase the probability of success. Simulations Plus should be one of the main beneficiaries of this, but there are a number of players in the space, and it is difficult to see meaningful differentiation amongst them.

I previously suggested that while Simulations Plus had a strong business and was targeting an attractive market, the company’s valuation and modest growth prospects made it an unappealing investment opportunity. Little has fundamentally changed since then, but the stock is down around 25%.

Simulations Plus is now more reasonably priced, but I question whether the company can generate strong returns for shareholders over the long run from current levels. Growth is only modest, and dependent on acquisitions and services.

Market Conditions

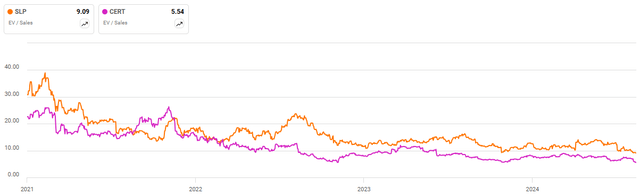

After a period of fairly pronounced weakness between the middle of 2022 and the middle of 2023, growth remains fairly steady across a range of vendors exposed to drug discovery and development spending.

Simulations Plus has suggested that the market funding environment continues to improve, particularly for companies with a drug candidate in the clinic. While the demand environment is improving, it is taking time for this to translate into bookings and revenue.

Spending strength also varies across companies and end markets. Biopharma customers have been trying to conserve cash by cutting back on R&D and prioritizing more mature assets. Simulations Plus remains cautious about large pharma client spending, which is important as pharma makes up the majority of the company’s client base.

Longer term, the biosimulation market is expected to provide roughly 10-15% growth annually, with Simulations Plus’ acquisition strategy potentially leading to a slightly higher rate of growth. The FDA Modernization Act 2.0 could also be a tailwind for biosimulation in coming years. The act allows the FDA to consider data other than animal studies, including computer-based modelling, when assessing pre-clinical candidates. Quantitative clinical pharmacology and structure-based approaches can be used to assess the risk of new drugs and are likely to see increased demand as a result of the act.

Figure 1: Drug Discovery and Development Vendor Revenue Index (source: Created by author using data from company reports)

Simulations Plus Business Updates

Simulations Plus is a leading provider of biosimulation, simulation-enabled performance and intelligence solutions, and medical communications for the biopharma industry. The company continues to introduce updated versions of its software, with broader capabilities and improved performance. Simulations Plus also continues to be an active acquirer, helping it to provide customers with a more comprehensive platform. This should help to increase customer spend, ensuring the company grows in line with the market or at a slightly greater rate. Consolidation of customer spend should also make the platform stickier, leading to higher margins over time, both through increased pricing power and an improved LTV/CAC ratio.

While not necessarily a direct competitor, Schrödinger (SDGR) is developing a computational solution for assessing the risk of a drug binding to off-target proteins. Schrödinger has already built accurate models for a handful of key off-target proteins and is using this solution internally. The company plans on expanding the number of off-target proteins in coming years.

Toxicity has traditionally been assessed using an experimental approach or machine learning models. The experimental approach is widely used, but is expensive and difficult to scale. Adoption of the machine learning approach has been increasing, but prediction accuracy can be poor when novel molecules are considered. Schrödinger’s approach allows a wider variety of molecules to be screened and has the potential to allow problems to be caught earlier on.

Schrödinger expects this product to be a meaningful contributor in coming years. While this would be more of a competitive offering, Schrödinger’s solutions remain complimentary, essentially addressing different problems and stages of the drug discovery and development lifecycle.

Recursion (RXRX) is another example of a non-direct competitor that could negatively impact Simulations Plus at some point in the future. Recursion is trying to industrialize drug discovery by generating massive biological and chemical datasets and analyzing them using AI. Recursion aims to predict relationships between billions of disease models and therapeutic candidates, including mechanism of action. As part of its efforts, Recursion is exploring the use of its image data to predict ADMET liabilities of promising compounds. Given the scale at which Recursion is operating, it is possible that it ends up leading the effort to predict drug efficacy and toxicity in-silico. Simulations Plus has previously suggested that companies taking this approach have had limited success so far.

Recursion also recently announced that it plans on acquiring Exscientia (EXAI), another AI-enabled drug discovery company. Exscientia integrates primary human tissue samples from its precision medicine platform into its drug discovery workflow. This allows Exscientia to understand the action of drugs on diverse patient cells. As a result, Exscientia is able to predict the efficacy of treatments using AI and patient samples. While this is an underdeveloped area at the moment, Exscientia could use its data and algorithms to guide patient selection for trials and drug marketing.

For any of this to represent a serious threat to Simulations Plus, Recursion would need to begin offering its capabilities to other biotech and pharma companies as a service. I believe there is a high probability that Recursion will open up parts of its tech stack in time to realize more value from its platform. This isn’t an immediate concern for Simulations Plus, though.

Pro-ficiency Acquisition

Simulations Plus recently acquired Pro-ficiency for 100 million USD in cash. Pro-ficiency is a provider of simulation-enabled performance and intelligence solutions for clinical and commercial drug development. Pro-ficiency generated 15 million USD revenue in 2023 and expands Simulations Plus’ TAM to 8 billion USD. The acquisition is expected to be accretive to fiscal 2025 EPS.

Pro-ficiency addresses areas like clinical trial operations, medical affairs and commercial. Its software leverages AI and aims to:

- Accelerate clinical trials and reduce their cost

- Reduce protocol deviations

- Improve market awareness of drugs

Pro-ficiency’s solutions will be offered through a Clinical Simulations and Medical Communications unit and will help Simulations Plus offer customers more comprehensive solutions.

Financial Analysis

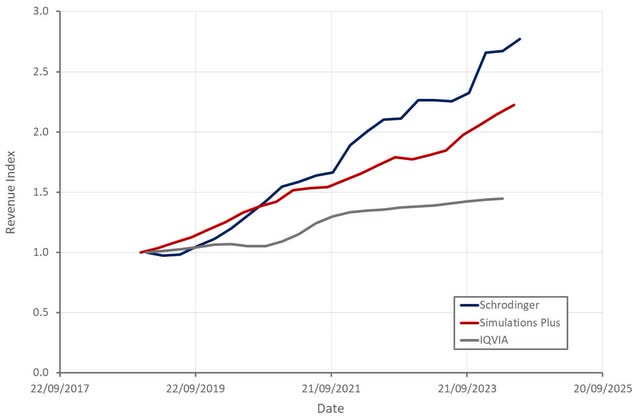

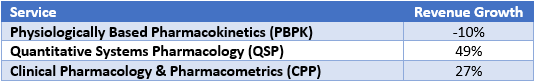

Simulations Plus generated 18.5 million USD revenue in the third quarter, a 14% increase YoY. Software revenue grew 12% YoY in the third quarter, driven by both new logos and upsells. There have been some headwinds from churn amongst small biotech customers, though, and the Asian market continues to lag overall growth.

Table 1: Software Revenue Growth (source: Created by author using data from Simulations Plus)

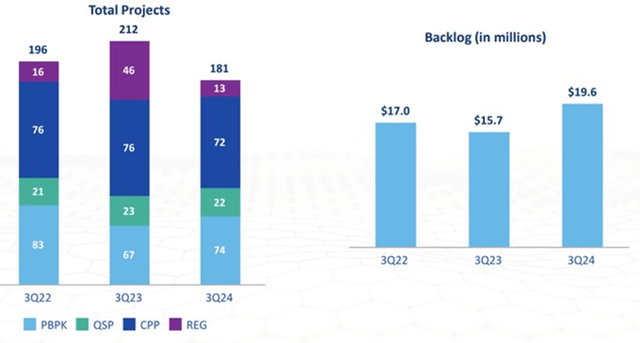

Services revenue was up 18% YoY in the third quarter, along with solid bookings and a healthy pipeline of opportunities. Total backlog was 19.6 million USD at the end of the third quarter.

Services revenue is being driven by QSP and CPP, with QSP growth benefitting from immunology and cancer model projects. The PBPK business unit has been hit by client sourced data delays, which are impacting the initiation of contracted projects.

Table 2: Service Revenue Growth (source: Created by author using data from Simulations Plus) Figure 2: Simulations Plus Services Performance Metrics (source: Simulations Plus)

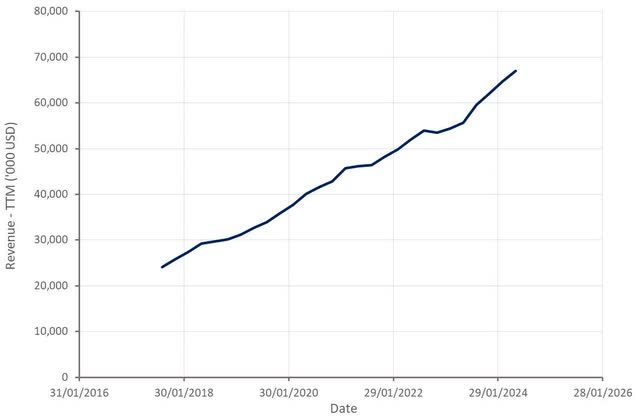

Simulations Plus expects 69-72 million USD revenue in FY2024, an increase of 15-20% YoY. Pro-ficiency is expected to contribute 3 million USD in FY2024 and 15-18 million USD in FY2025. This implies something like a low single digit percentage organic growth rate in the fourth quarter.

Figure 3: Simulations Plus Revenue (source: Created by author using data from Simulations Plus)

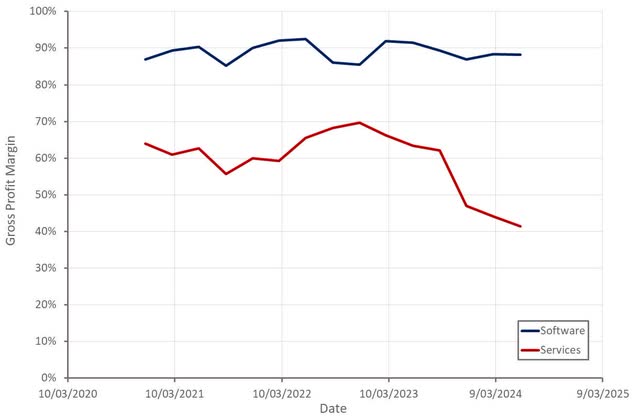

Simulations Plus’ gross margin was 71% in Q3, down from 82% in the prior year comparable quarter. This decline was driven by the Services segment, where gross margins fell from 63% in Q3 FY2023 to 41% in Q3 FY2024. The drop in Services gross margin was attributed to a shift in personnel costs from SG&A to cost of revenue.

Pro-ficiency will also provide a modest gross margin headwind going forward, as its software margins are closer to 80% versus 90% for Simulations Plus. Pro-ficiency’s business is also more heavily weighted towards services. Simulations Plus believes that there is a viable path to 90% software margins for Pro-ficiency, though.

Figure 4: Simulations Plus Gross Margins (source: Created by author using data from Simulations Plus)

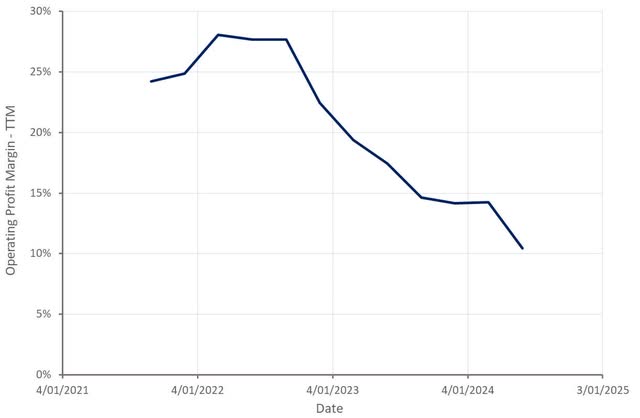

Simulations Plus’ operating profit margin was 10% in the third quarter, down from 25% in the prior year comparable quarter. The drop in operating margin is due to a combination of modest growth, declining gross margins and rising operating expenses. Given the recent acquisition of Pro-ficiency, I would not be surprised to see this trend continue.

Despite moving some personnel costs from SG&A to cost of sales, the burden of operating expenses has continued to rise. R&D expense only totals around 7% of revenue, which is relatively low for a simulation software company. The rise in operating expenses has been driven by general and administrative costs, which now total 41% of revenue.

Figure 5: Simulations Plus Operating Margin (source: Created by author using data from Simulations Plus)

Conclusion

The biosimulation market is highly fragmented and underpenetrated, providing SLP with both organic and inorganic growth opportunities. Simulations Plus also has high renewal rates and pricing power, supporting growth and profitability.

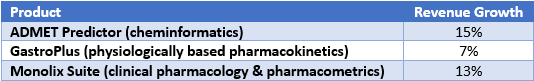

While Simulations Plus’ share price is down significantly, its revenue multiple remains relatively high given the high contribution from services. High multiples for these types of companies often stem from recurring revenue, along with the stickiness of the software and the resultant high margins. This is somewhat questionable for Simulations Plus, though.

Simulations Plus will probably generate reasonable returns for investors longer term from current levels, but the company will likely need to get its costs under control before the stock moves significantly higher. I continue to believe that there are companies operating in similar parts of the market that offer better growth opportunities and are more reasonably priced.

Figure 6: Simulations Plus EV/S Ratio (source: Seeking Alpha)