Public Storage Has Crashed: Buy, Hold, Or Sell? (NYSE:PSA)

iantfoto

Public Storage (NYSE:PSA) is one of the most popular REITs in the world, and it is easy to understand why:

- Individual investors see their self-storage properties all over the place, giving them a sense of familiarity with their real estate.

- It has a very strong balance sheet, which is a clear advantage in today’s environment.

- Self storage properties have historically generated consistently high returns in all market environments, including even recessions.

- The REIT has a very large scale with a $50 billion market and a listing on the S&P500 (SPY), reducing risks.

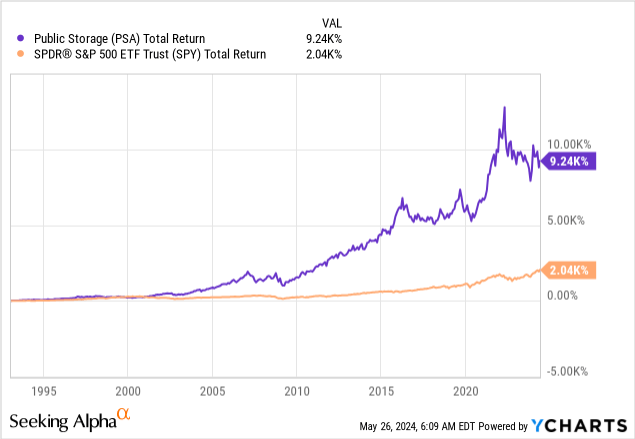

- PSA has a multi-decade track record of steady dividend growth, and it has also massively outperformed the rest of the REIT market:

Public Storage

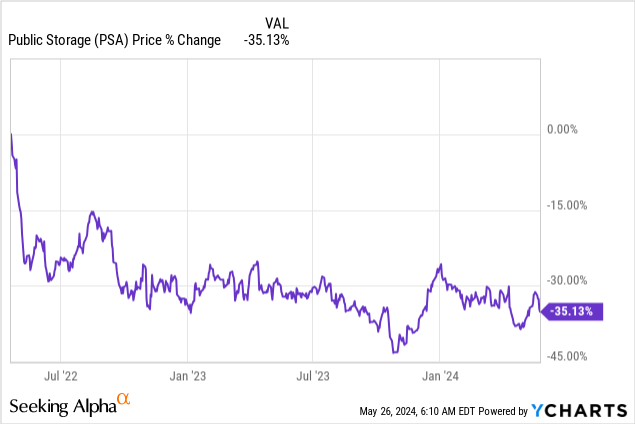

But this strong reputation did not shield PSA from the REIT bear market that began in 2022. It took down every REIT, including even the best of them.

As a result, PSA is down 35% since the beginning of 2022, and that’s despite growing its cash flow by 25% since then. This essentially means that its valuation has been cut in half:

Is now a good time to buy its stock while it is discounted?

Or should you sell before it drops even further?

I am generally very bullish on REITs (VNQ) and this may lead you to think that I would be a buyer here, but I am not and here are three reasons why:

Reason #1: Significant oversupply risk

The pandemic led to a boom in demand for self-storage space because of four key reasons:

- Suddenly people needed to make space for a home office

- Older generations passed away and left a lot of stuff behind

- People bought a lot of new toys for the outdoors

- Finally, a lot of people moved around from one city to another.

Moreover, this boom in demand happened at a time when very little new supply was being built, and as a result, the market was severely undersupplied, allowing PSA to significantly hike its rents and grow its occupancy rates.

But this then attracted a lot of developers in the self-storage space, and now the company is facing the exact opposite environment.

The demand is normalizing as the world gradually returns to normal, with increasingly many people returning to the office, selling their toys, and moving less than they did in prior years.

At the same time, a huge wave of new supply is hitting the market, putting it in a state of oversupply.

As a result, PSA’s same property NOI dropped by 1.5% in the first quarter, and that’s after suffering in 2023 already. Its occupancy also dropped by another 0.8% to 92.1%.

And unfortunately for PSA, this challenging environment will likely last for a while longer because there’s so much supply coming in, and that COVID-fueled demand wasn’t all sustainable:

Public Storage

Its management points to things getting better in 2025 and 2026, and they are probably right.

But I fear that if we go into a recession, the demand might not be quite as recession-resistant as it was in the past because the rents of self-storage are today far higher. In previous recessions, it was easier to simply ignore the storage expense because it was a smaller percentage of your income, but following the massive rent hikes of the pandemic, more people will probably stop their leases as they look to cut down on spending.

Finally, over the long run, I have another concern about self-storage space, particularly in the USA.

Today, there is 10x more storage space in the US than in the UK and 40x more than in continental Europe. I believe that some of this vast difference can be explained by cultural and geographic reasons.

But I do think that consumer spending in the US will gradually move more and more from buying “things” to buying “experiences” instead. Europeans don’t buy as many toys, but they spend more on experiences, and I see American people going in that same direction.

The “experience economy” is growing rapidly, I don’t see this ending, and it is a long-term headwind for self-storage facilities. Not only that, but the “sharing economy” is also growing rapidly, and it is also a headwind for self storage facilities. Example: if you can easily rent an RV and the cost of that is reasonable, you are less likely to buy one for yourself.

Reason #2: Too big for its own good

I have previously explained that scale has advantages. It leads to lower expenses, better access to capital, and lower risk.

But past a certain point, economies of scale turn into diseconomies of scale, and I have often used Realty Income (O) as an example for this.

Its growth rate has slowed down because it is a lot harder to grow from a $50 billion base than from a $5 billion base. New acquisitions don’t move the needle as much anymore, and you need to acquire a huge amount of new properties just to keep the ball rolling. You then lose flexibility, agility, and bargaining power with property sellers, leading you to likely lower your underwriting criteria and pay more than you would have otherwise.

Well… PSA is just as big as Realty Income and therefore, I think that its size is likely to slow down its growth in the future as well. I would rather own a much smaller self storage REIT.

Reason #3: Better opportunities elsewhere, including in its peer group

PSA’s valuation has dropped considerably since the beginning of 2022.

Even then, it is today priced at 17x FFO, which does not strike me as “cheap” when considering that it is facing some severe headwinds and that its cash flow is declining.

There are plenty of REITs that are priced at lower multiples and are actually growing their cash flow. To give you an example, Big Yellow Group (OTCPK:BYLOF / BYG) is the leader in the UK, and it is priced at 16.5x, despite enjoying far better long-term growth prospects.

Therefore, I have a hard time justifying an investment into PSA.

Sure, it is not priced at a “bubbly” valuation anymore like it was in 2021, but that does not make it cheap today. I still expect it to do relatively well over the long run, but I just think that some other REITs will do a lot better and for this reason, I have no interest in owning PSA at this time.