Peloton: Surging Profitability, But Churn Remains An Issue (NASDAQ:PTON)

Morsa Images

So far, the Q2 earnings season has spawned a number of unlikely rebound stories, Peloton (NASDAQ:PTON) being chief among them. The exercise bike manufacturer, once one of the hottest trades during the pandemic when sharp demand drove the company to supply shortages, has since struggled with weaker sales and declining membership.

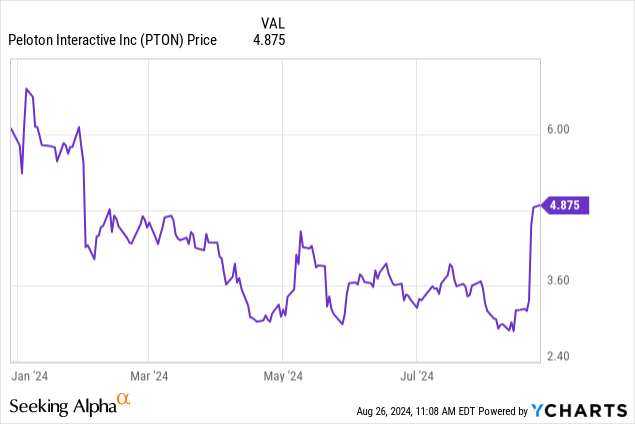

Year to date, shares of Peloton have lost ~15% of their value, but the stock has shot up more than 50% after reporting fiscal Q4 (calendar Q2) results that showed profitability getting back on track:

I last wrote a neutral opinion on Peloton in June, when the company was still trading in the mid-$3s. Since then, management has achieved a significant turnaround in profitability while issuing a strong outlook for FY25 (the year for Peloton ending in June 2024). My enthusiasm for these accomplishments, however, is tempered by Peloton’s rally since then (blunting its valuation advantage) as well as its continued bleeding of paid memberships. As such, I continue to see a balanced bull and bear case for Peloton and I am reiterating my neutral position on this stock.

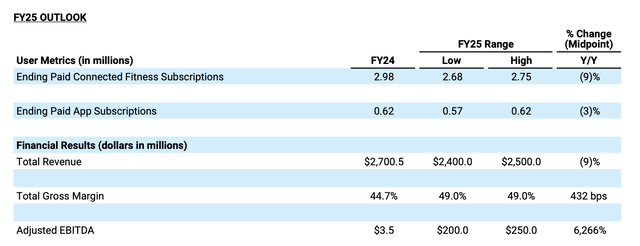

First, we’ll discuss Peloton’s valuation against its latest outlook. What pleased investors the most is that for FY25, the company is guiding to $200-$250 million in adjusted EBITDA: After just barely breaking even in FY24 (we’ll discuss the drivers for profitability improvement in the next section). Still, however, the company is expecting revenue to decline and its membership base to shrink.

Peloton FY25 outlook (Peloton Q4 shareholder letter)

Meanwhile, at current share prices just south of $5, Peloton trades at a market cap of $1.93 billion. After we net off the $697.6 million of cash and $1.50 billion of debt on the company’s latest balance sheet, Peloton’s resulting enterprise value is $2.73 billion.

Assuming the company hits the midpoint of its adjusted EBITDA range for the year, Peloton stock currently sits at 12.1x EV/FY25 adjusted EBITDA. Certainly, the stock isn’t expensive when the S&P 500 is still trading at a ~20x P/E multiple, but neither is Peloton a screaming value stock. We should consider the company’s numerous fundamental risks in conjunction with its valuation:

-

Continued decline in membership. The company has shifted its focus away from hardware sales and into growing subscription revenue. It continues to lose members every quarter, suggesting that its product isn’t quite sticky.

-

Macroeconomic headwinds. A Peloton is an expensive purchase, and amid the potential for a deeper U.S. recession later this year, sales may slow down even further.

-

Plan to monetize secondary market sales may backfire. The company recently instituted a new $95 initiation fee for Peloton members who buy bikes secondhand (up a double-digit percentage y/y in the most recent quarter), which may slow or deter aftermarket sales – an important source of new member growth.

I’d be more comfortable entering into this stock at a mid-single-digit multiple of EBITDA, and as such, I’m comfortable remaining on the sidelines for now.

Q4 Download

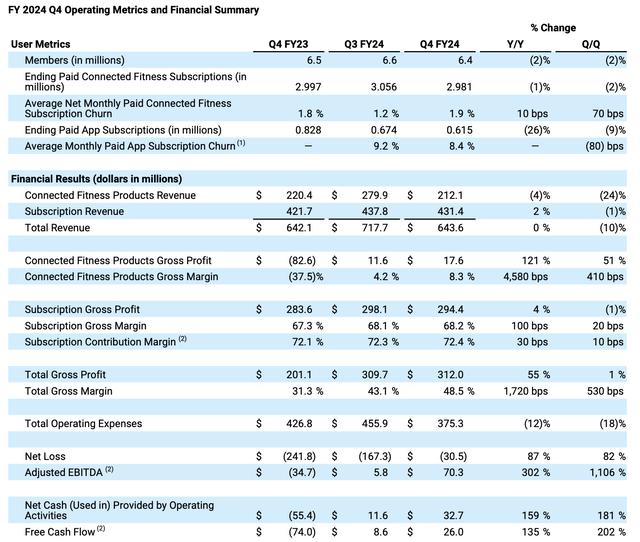

Let’s now go through the highlights of Peloton’s most recent quarter in more detail. The Q4 earnings summary is shown below:

Peloton Q4 results (Peloton Q4 shareholder letter)

Peloton’s total revenue grew 0.2% y/y to $643.6 million, the first quarter that Peloton showed growth (or at least, non-negative y/y comps) since Q2 of FY22. The company also beat Wall Street’s expectations of $627.4 million (-2.3% y/y) by a meaningful 250bps margin.

Subscription revenue grew 2% y/y, while hardware revenue declined -4% y/y. The company’s paid membership base, meanwhile, lost 75k subscribers quarter over quarter – after adding 52k members in Q3. The core issue here is pricing, as last quarter, legacy pricing expired for some of the company’s older customer cohorts, prompting a spike in churn. The company has also pulled back on marketing spend to prioritize profitability. The company notes that its customer acquisition costs have been improving, and in addition to that, it has found that it’s resonating better with men. Per co-CEO Chris Bruzzo’s remarks on the Q4 earnings call:

In Q4, we delivered additional cost savings by reducing our media spend year-over-year. We’ll continue to optimize our media investment in fiscal ’25 to improve our efficiency, which is an important priority for us, because while our Q4 LTV-to-CAC ratio of 1.5x improved significantly compared to Q4 last year, it is still below our 2x to 3x target range. We have more work to do. These efforts are providing additional upside to the bottom line, as we reduced total sales and marketing expense by 26 million, or 19% year-over-year in Q4.

We’re also seeing early signals that our approach to reach men via marketing is resonating. We saw significant improvements in awareness of our strengths and cycling disciplines for men in the quarter.

As previously mentioned, the company’s plan to kick off a $95 initiation fee for new Peloton members who bought their bike secondhand may provide a boost to subscription revenue, but it may also deter secondhand buyers who are an important source of new app sign-ups (up 16% y/y in Q4). Used Peloton bikes range in price, but a cursory search on eBay (EBAY) yields used results between $500-$1,000 in price: so this new fee represents roughly a 10-20% increase in the hurdle for a prospective new subscriber.

The profitability front, however, is where Peloton made the most significant improvements. Gross margins rose 17 points y/y to 48.5%. This was helped by a revenue mix shift toward subscriptions, but underlying hardware gross margins also jumped to 8.3%, from -37.5% in the year-ago quarter. The company has noted a benefit from exiting its North Carolina manufacturing operations, while new product launches in the company’s Precor subsidiary (a maker of commercial gym equipment) have also boosted sales and margins.

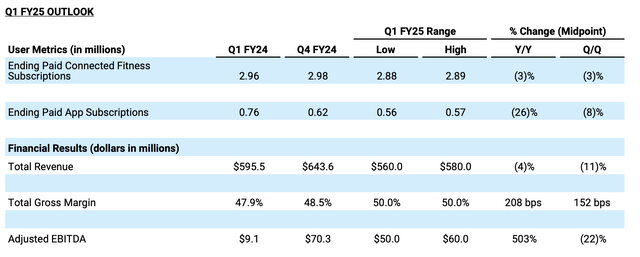

As a result, the company’s adjusted EBITDA soared to $70.3 million (an 11% margin), versus roughly breakeven in the prior quarter and a -$34.7 million loss in the year-ago Q4. Management expects this streak of profitability to continue, with its Q1 guidance implying $50-$60 million in adjusted EBITDA at a 10% midpoint margin:

Peloton Q1 outlook (Peloton Q4 shareholder letter)

Key Takeaways

There’s no doubt that Peloton has found stable footing on a few fronts, including hardware gross margins and a return to subscription revenue growth (driven by price increases as well as secondary market fees). Still, however, I worry about continued churn in the company’s subscription base, while a potential recession may greatly squeeze down new buyers in the very important holiday season ahead. Continue to maintain caution here and remain on the sidelines.