Microsoft: The Q4 Results Should Surprise You (NASDAQ:MSFT)

FinkAvenue

My Thesis

Microsoft Corporation (NASDAQ:MSFT) is expected to report its Q4 results on July 30, 2024. I expect a strong performance from the company’s OS and cloud businesses, as well as some strength in the search segment (Bing) even though it is still far behind the Google (GOOG) search. On the other hand, MSFT’s Q4 report could be perceived negatively by the market mainly due to possible comments from management about large investments in integrating AI into the company’s systems, similar to what we have seen recently with Google.

Despite the company’s high valuation ahead of its earnings report, I view the business growth prospects favorably; based on these prospects, I assign Microsoft stock a “Buy” rating today.

My Reasoning

First off, let’s review the MSFT’s results for Q3, published at the end of April 2024.

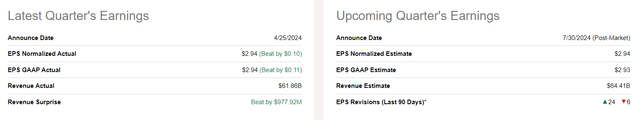

In Q3 fiscal 2024, Microsoft’s consolidated revenue reached $61.9 billion, a 17% YoY increase (the same amount in constant currency), with EPS rising 20% YoY to $2.94 (thanks to fewer shares outstanding and EBIT margin acceleration of nearly 200 b.p. YoY). The consolidated top-line growth was primarily Azure-driven, also supported by strong performance across some other various segments that I’ll detail further. So the company’s Q3 results beat both key consensus estimates and led to mainly upward earnings revisions for Q4, according to Seeking Alpha data:

Now speaking about Microsoft’s business areas in more detail, I’d like to note that Azure and other cloud services grew by 31% YoY, outpacing the 2023 growth rates thanks to “increased demand for AI services and a higher mix of in-period revenue recognition”, according to the press release. Microsoft’s Intelligent Cloud as a consolidated business segment went up by 21% YoY as the server and cloud services revenue growth rate started to accelerate, amounting to 24% in Q3 (way higher than in previous quarters).

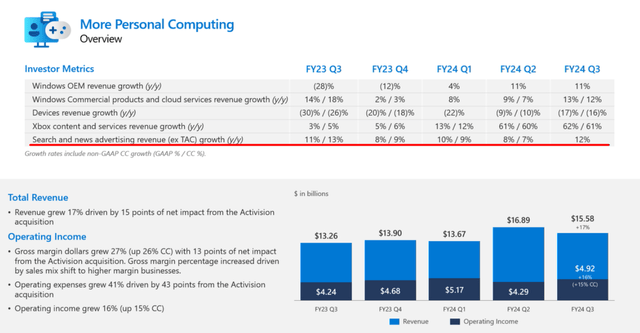

Sales in the More Personal Computing (MPC) segment amounted to $15.6 billion (+17% YoY), which was boosted by the acquisition of Activision, which contributed significantly to sales in the gaming segment. On the other hand, Activision also had a negative impact on the OPEX side, although the resulting EBIT increased by 16% year-on-year. What struck me was the acceleration of the various investor metrics in this segment. From what I see, the MPC is definitely gaining traction. We can expect that once the negative impact of the Activision deal on margins subsides, MSFT will be able to continue to benefit from the existing trends in the gaming industry, as it is now the leader in this space.

MSFT’s IR materials, Oakoff’s notes added

The Productivity and Business Processes (PBP) segment generated revenue of $19.6 billion, up 12% on the previous year, mainly due to the strength of Office 365 Commercial (+15 YoY). In contrast to the previous segment, operating costs increased only marginally (by just 1%), which helped PBP to increase its EBIT by 17%, although the investors’ metrics didn’t look as exciting as in the case of MPC or Cloud.

At its recent Build developer conference (May 2024), Microsoft presented AI-powered PCs called Copilot+ PC. These PCs, which also include the Surface tablet and devices from other manufacturers using Windows, have smaller AI models for local tasks and access to Microsoft’s cloud for more demanding tasks. This approach combines local data processing with the power of the Azure cloud. CEO Satya Nadella said he views AI as a crucial platform shift for Microsoft. Copilot+ PC is positioned as a competitor to Apple’s (AAPL) MacBook Air and offers new AI features such as ‘Recall’, which scans and captures screen content to process and search locally, with privacy controls in place. Developers can also use Copilot+ PC to create on-device software. I think this is a critical step for the long-term future of the company. It is essentially about creating a product through the synergy of two segments and making another attempt to open up a new market for the company and thus diversify its business structure even further.

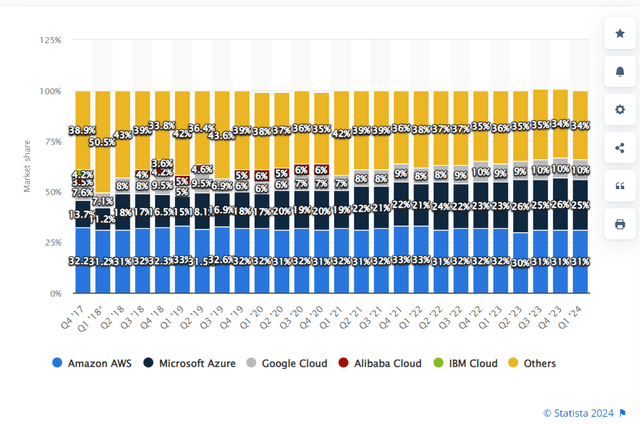

At the same time, it’s impossible to ignore Azure’s strength, as its market share keeps growing by bounds and leaps: according to the Motley Fool, between the 4Qs of FY2017 and FY2023, Azure’s global cloud infrastructure market share increased from 14% to 26% as Microsoft’s cloud offerings were eating up the market share of Amazon’s (AMZN) AWS and smaller peers. Now Azure’s market share stabilized at 26-25%, but given the continued management’s attempts to reach synergies from other business segments, I believe we may see some expansion because other cloud providers may lack the existing efficiencies of Microsoft’s ecosystem.

In the short term, regarding expectations for the 4th quarter of 2024, I think we should anticipate a strengthening of the company’s position in cloud & computing technologies. Despite high competition with Google and Amazon, I expect an acceleration in Azure revenue growth and continued stability in this segment’s margins.

Additionally, concerning Microsoft’s efforts to reclaim market share in the search business, Bing should show positive results. According to Statcounter, its share has gradually grown recently, reaching 3.72% of the global market. While this may seem insignificant, for Bing it represents a real victory — last year, this search engine’s market share was only 2.77%, so we’re facing a relative growth of approximately 34%, which is a lot.

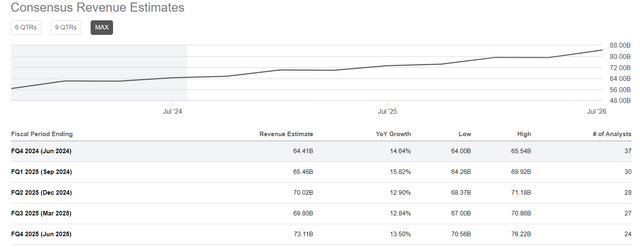

When it comes to the management guidance, I should note that during the previous earnings call, Microsoft expected revenue growth in PBP to be between 9% and 11% (in constant currency), Intelligent Cloud to grow between 19% and 20%, and MPC to grow between 10% and 13%. It looks like the market’s expectation is matching these figures relatively correctly:

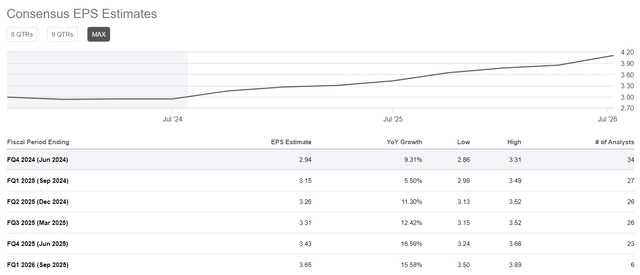

Although MSFT wanted to increase CAPEX materially, it guided for over 2% increase in EBIT margin, reflecting “disciplined cost management and efficiency improvements.” Therefore, I believe that the existing momentum should allow Microsoft to maintain relatively stable margins compared to last year. In that case, my question is: why is the EPS consensus lagging the growth rate of sales by almost 2x?

With all of that said, I believe Microsoft has a very good chance of beating the current EPS consensus, especially since stock buybacks are continuing in full swing.

However, it’s important to understand that the market’s reaction to the company’s results will largely depend on management’s comments. I expect that CEO Nadella will again discuss the significant capital expenditures for the development of cloud technologies and artificial intelligence. This could potentially scare off a significant portion of investors due to the looming uncertainty and growing competition in the market.

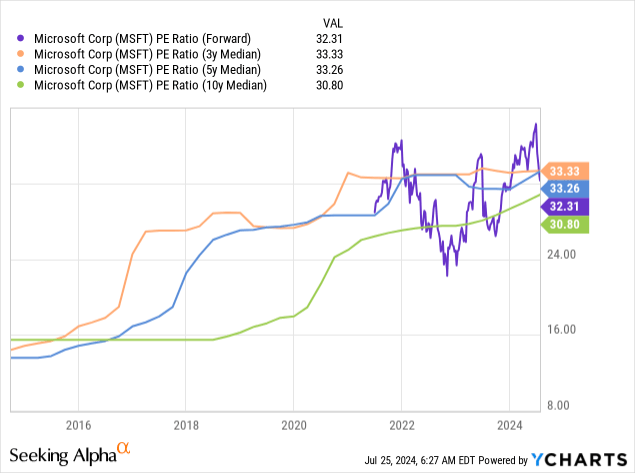

I hear some people say that the company’s valuation has become incredibly high. While there may be some truth to this, in my opinion, based on next year’s earnings forecasts, the current forwarding P/E ratio of 32.3x is within mid-to long-term ranges. So in general, this makes the company more fairly valued than overvalued.

That being said, the market expects the company’s EPS to grow at a CAGR of 11% over the next 7 years, so the current multiples might be simply justified by relatively higher growth rates.

So based on the combination of the above factors, I’ve decided to give Microsoft stock a “Buy” rating ahead of its fiscal Q4 2024 report.

Risks To My Thesis

I see some major risks to my bullish thesis to date.

On June 25, the European Commission sent Microsoft a “Statement of Objections,” accusing them of breaking EU antitrust rules. The EC’s preliminary finding suggests that Microsoft “unfairly bundled its Teams application with Office 365 and Microsoft 365 suites, giving Teams an advantage over competitors like Slack and Zoom.” This investigation isn’t new, though — it started back in July 2023 after a complaint from Slack. According to the source, the EC believes that by “bundling Teams, Microsoft restricted customer choice and stifled competition.” Although Microsoft later offered some suites without Teams, the EC deemed this change insufficient. If the EC confirms the allegations, it could ban the practice, fine Microsoft up to 10% of its annual global revenue (over $10 billion), and impose other penalties. In my opinion, the legal risks like this shouldn’t be ignored. You may imagine fines like 10% of sales are a great headwind that may hurt MSFT’s future EPS projections and result in a severe slump in its market cap.

Another important risk factor to consider when analyzing the company is its valuation. I have already mentioned that the argument that a multiple above 30 times earnings can be considered high is partly true. If we look at the 2017–2018 standards, we can see how highly valued the company is today. However, Microsoft is an entirely unique company today than it was 5–10 years ago; it’s a giant of an entirely different scale and with much better growth prospects, in my view. Anyway, if the market suddenly sees these growth prospects as illusory, MSFT’s valuation can collapse rapidly. So it’s essential to never forget this and always analyze what’s going on around the firm, as the competition never sleeps in this industry.

The Bottom Line

Despite several obvious risks, due to a combination of factors, I see that Microsoft has far more opportunities for expansion than risks associated with its valuation or high competition. The company’s current position in the OS market doesn’t suggest any serious problems in the next 5 to 10 years. I’m impressed with how the company’s cloud segment is developing and how it is trying to conquer other markets through synergies with its various existing segments.

In the short term, I believe today’s consensus forecasts for EPS growth in Q4 2024 are a bit on the low side, so I think that Microsoft can beat them on July 30. However, a lot will depend on management’s comments. In any case, I believe in the company’s long-term success and therefore rate it a “Buy” today.

Good luck with your investments!