M&G: New Deals In Previously Run-Off Businesses (OTCMKTS:MGPFY)

We Are

M&G (OTCPK:MGPFY)(OTCPK:MGPUF) is an asset management and increasingly an insurance play as it re-enters its bulk annuity business. We see some offset of run-off there in addition to the higher return on the excess assets. There should be continued lift in that business as the new annuity buy ins become recognised on a full-year basis and as YoY prevailing rate growth continues to lift the business, where we focused on rate effects in our previous coverage. On asset management, we do expect continued pressures as bond performance will have been volatile in this quarter on the upward translation of the yield curve again, although perhaps some other performance improvement in the smaller equities franchise as the rally in markets broadens out, particularly in the US. M&G’s AM (asset management) business model means that it’s easiest to go straight to the very bottom line to understand valuation, meaning to look at the dividend yield which reflects a final shareholder yield with a fair bit of upside considering the insurance growth as a lever.

Earnings

In our last article, we started focusing on the fact that the rate effects were having a meaningful impact on the insurance business. To an extent, it was a surprise because some of that business was in run-off and had been becoming a smaller part of the scope of M&G operations.

Since the H1, there have been significant developments. They have started up their BPA (bulk purchase annuity) business again, which was basically being winded down, where they get paid premiums to insure defined benefit plans of pension plans. They insured an internal scheme for a premium of almost 300 million GBP. That premium is in the process of being earned. The life business also booked a similar buy-in deal with its M&G’s own pension scheme of similar size. This is why the annuities and other businesses are growing so quickly.

The other part of the life segment, which is all just insurance ultimately, are the traditional with-profits funds, which are basically insurance pools that payout bonuses depending on the performance of the pool’s invested assets. So it’s basically an insurance product with an AM lilt. This part of the business grew less extravagantly than the BPA business, which has gone from being terminal to being a new strategic growth area, mainly owing to the higher prevailing rates and what would be a significant boost to income on the reserve assets in these businesses.

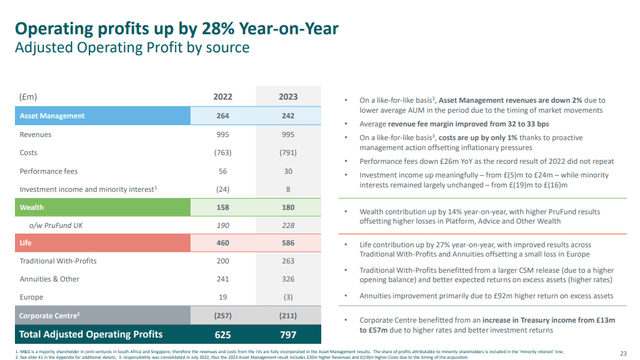

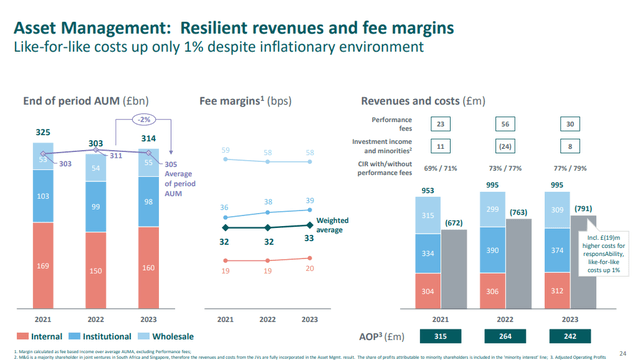

In general, AM activities are being mostly harangued by a combination of higher costs, mitigated by cost savings programmes that are not finished yet and may help driven incremental cost stability, as well as lower performance fees. The AUM situation is actually stable, and they were also helped by better performance in investment income thanks to higher rates and stronger equity owned asset values.

Bottom Line

There is still more to be gained YoY from a broadening in performance of equity markets. There is also around 20 million GBP in improvements that can be made on a run-rate basis in cost savings programmes that will have some incremental contribution, although we still expect some inflation in the cost structure which is highly levered to labour. There is also still latent earnings growth to be made on what will be higher average rates in 2024 compared to 2023, affecting primarily the insurance income.

However, there is the fact that since the FY results, we have also seen an upward translation in the yield curve, at least in the US, which will affect their large AM franchise in fixed income. Performance fees are not something we’d expect a big recovery from.

While asset management has these challenges of higher costs as well as continued passive competition, M&G is managing the situation well enough, and the resumption of the BPA business is something that we are particularly excited about. They can sustain their 9.87% dividend on the current rate of generated capital with liquid assets flat YoY and using that as a measure of yield and its reciprocal as a valuation, which is a fair approach when it comes to AM plays due to prop funds and other considerations that impact net incomes, M&G is not uncompelling. Comparing that yield to a couple of other European retail AM plays, like Azimut (OTCPK:AZIHF) and Anima (OTC:ANNMF), M&G offers around twice the dividend yield, and maybe their focus on franchises in fixed income can open the door to other growth markets like private credit. We aren’t crazy about AM in general on the structural issues of inflation and competition, but among them M&G is interesting.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.