LRT Capital Management February 2025 Investor Update

Attributions and Holdings as of 3/3/2025

|

LRT Global Opportunities |

Return Attribution |

||

|

Top Twenty Holdings (%) – As of 3/3/2025 |

Return Attribution (%) – February 2025 |

||

|

Interactive Brokers Group, Inc. (IBKR) |

3.32 |

Long Equity |

-7.21 |

|

Asbury Automotive Group, Inc. (ABG) |

3.30 |

Hedges |

3.61 |

|

Group 1 Automotive Inc. (GPI) |

2.98 |

Unlevered Gross Return |

-3.60 |

|

UnitedHealth Group Incorporated (UNH) |

2.96 |

Leveraged Gross Return |

-9.89 |

|

Wyndham Hotels & Resorts, Inc. (WH) |

2.84 |

Net Return |

-9.97 |

|

Darden Restaurants, Inc. (DRI) |

2.82 |

||

|

Landstar System Inc. (LSTR) |

2.74 |

Beta contribution |

-0.47 |

|

Simpson Manufacturing Co., Inc. (SSD) |

2.64 |

Alpha contribution |

-9.50 |

|

Primerica, Inc. (PRI) |

2.59 |

Net Return |

-9.97 |

|

Crown Castle International Corp. (CCI) |

2.53 |

||

|

Colliers International Group Inc. (CIGI) |

2.51 |

Top Contributors – February 2025 |

|

|

Chemed Corp. (CHE) |

2.44 |

iShares Core S&P Small-Cap (IJR) |

|

|

Sun Communities Inc. (SUI) |

2.33 |

Vanguard Small-Cap ETF (VB) |

|

|

Petróleo Brasileiro S.A. – Petrobras (PBR-A) |

2.27 |

iShares Russell 2000 (IWM) |

|

|

RLI Corp. (RLI) |

2.07 |

iShares Core S&P Mid-Cap (IJH) |

|

|

Corporación América Airports S.A. (CAAP) |

2.04 |

Chemed Corp. (CHE) |

|

|

Toro Co. (TTC) |

2.00 |

Sun Communities Inc. (SUI) |

|

|

Casey’s General Stores, Inc. (CASY) |

1.88 |

Vanguard Mid-Cap ETF (VO) |

|

|

Comcast Corporation (CMCSA) |

1.86 |

Phillips 66 (PSX) |

|

|

Google Inc. (GOOGL) |

1.83 |

||

|

Top Detractors – February 2025 |

|||

|

Top Holdings Total (% of total long exposure) |

49.94 |

Cognex Corporation (CGNX) |

|

|

Total Long Holdings |

82 |

The Trade Desk, Inc. (TTD) |

|

|

Comfort Systems USA Inc. (FIX) |

|||

|

Hedges (%) – As of 3/3/2025 |

Asbury Automotive Group, Inc. (ABG) |

||

|

iShares Core S&P Mid-Cap (IJH) |

-9.53 |

Integrated Electrical Services, Inc. (IESC) |

|

|

Vanguard Mid-Cap ETF (VO) |

-10.81 |

UnitedHealth Group Incorporated (UNH) |

|

|

iShares Russell 2000 (IWM) |

-18.20 |

TriNet Group, Inc. (TNET) |

|

|

iShares Core S&P Small-Cap (IJR) |

-18.88 |

Colliers International Group Inc. (CIGI) |

|

|

Vanguard Small-Cap ETF (VB) |

-20.22 |

||

|

Overall Net Exposure (%) |

67.89 |

||

|

Beta-adjusted Net Exposure (%) |

37.38 |

||

Source: Bloomberg, Sentieo.

Numbers may not add up due to rounding. Net returns are net of a hypothetical 1% annual management fee (charged quarterly) and 20% annual performance fee. Individual account results may vary due to the timing of investments and fee structure. Please consult your statements for exact results. Please see the end of this letter for additional disclosures.

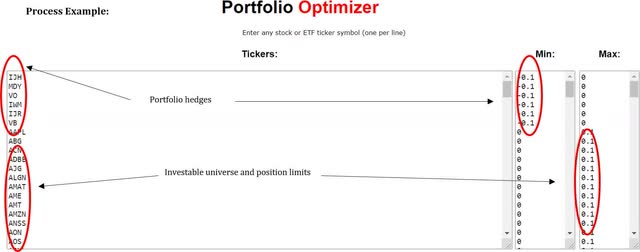

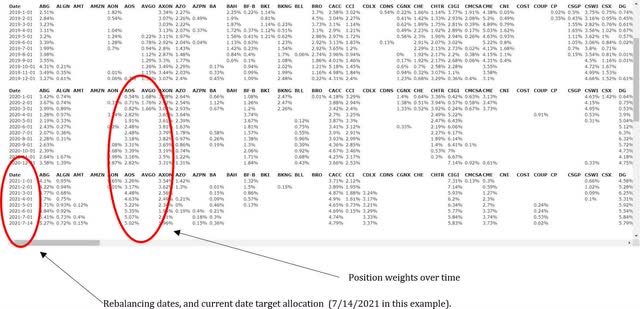

Appendix I: Portfolio Construction Software Overview

LRT separates the discretionary and qualitative process of selecting the equity holdings from the portfolio construction process which is systematic and quantitative.

Our quantitative process considers each position’s contribution to portfolio volatility, contribution of idiosyncratic vs. systematic risk and portfolio factor (size, value, quality, momentum, vol, etc.) exposures.

The system outputs target portfolio weighs for each position. We trade mechanically to rebalance the portfolio each month to the targeted exposures. This eliminates emotions, human biases, and overconfidence risk. Visit https://www.lrtcapital.com/risk/ to learn more. Visit: https://hubs.ly/Q02kfbbK0 to see more examples.

Example system output:

Disclaimer and Contact Information

LRT Capital Management, LLC is an Exempt Reporting Adviser with the Texas State Securities Board, CRD #290260. Past returns are no guarantee of future results. Results are net of a hypothetical 1% annual management fee (charged quarterly) and 20% annual performance fee. Individual account returns may vary based on the timing of investments and individual fee structure.

This memorandum and the information included herein is confidential and is intended solely for the information and exclusive use of the person to whom it has been provided. It is not to be reproduced or transmitted, in whole or in part, to any other person. Each recipient of this memorandum agrees to treat the memorandum and the information included herein as confidential and further agrees not to transmit, reproduce, or make available to anyone, in whole or in part, any of the information included herein. Each person who receives a copy of this memorandum is deemed to have agreed to return this memorandum to the General Partner upon request.

Investment in the Fund involves significant risks, including but not limited to the risks that the indices within the Fund perform unfavorably, there are disruption of the orderly markets of the securities traded in the Fund, trading errors occur, and the computer software and hardware on which the General Partner relies experiences technical issues. All investing involves risk of loss, including the possible loss of all amounts invested. Past performance may not be indicative of any future results. No current or prospective client should assume that the future performance of any investment or investment strategy referenced directly or indirectly herein will perform in the same manner in the future. Different types of investments and investment strategies involve varying degrees of risk-all investing involves risk-and may experience positive or negative growth. Nothing herein should be construed as guaranteeing any investment performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. For a more detailed explanation of risks relating to an investment, please review the Fund’s Private Placement Memorandum, Limited Partnership Agreement, and Subscription Documents (Offering Documents).

Indices are unmanaged, include the reinvestment of dividends and do not reflect transaction costs or any performance fees. Unlike indices, the Fund will be actively managed and may include substantially fewer and different securities than those comprising each index. Results for the Fund as compared to the performance of the Standard & Poor’s 500 Index (the “S&P 500”), for informational purposes only. The S&P 500 is an unmanaged market capitalization- weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent

U.S. equity performance. The investment program does not mirror this index and the volatility may be materially different than the volatility of the S&P 500.

This report is for informational purposes only and does not constitute an offer to sell, solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. Any offer to sell is done exclusively through the Fund’s Private Placement Memorandum. All persons interested in subscribing to the Fund should first review the Fund’s Offering Documents, copies of which are available upon request. The information contained herein has been prepared by the General Partner and is current as of the date of transmission. Such information is subject to change. Any statements or facts contained herein derived from third-party sources are believed to be reliable but are not guaranteed as to their accuracy or completeness. Investment in the Fund is permitted only by “accredited investors” as defined in the Securities Act of 1933, as amended. These requirements are set forth in detail in the Offering Documents.