Lovesac Stock: Still Attractive Despite Guidance Skepticism (NASDAQ:LOVE)

Dumitru Ochievschi/iStock via Getty Images

The Lovesac Company (NASDAQ:LOVE), the furnishings manufacturer and retailer, has slowed down the company’s growth due to challenges in the furnishings industry. Yet, financials continue at a healthy level, and I believe that Lovesac is positioned well to return to growth after the industry softness subsides with continued showroom expansion and other growth initiatives.

I previously wrote an article on the company, titled “Lovesac: Priced For Value, But With Growth”. In the article, published on the 17th of October in 2023, I initiated Lovesac at Buy due to the company’s undervalued, already demonstrated growth. Since, the stock has returned 58% compared to S&P 500’s return of 29% in the same period.

My Rating History on LOVE (Seeking Alpha)

Reported Financials Show Slower Growth, Still Outpacing Weak Industry

After my previous article, Lovesac has reported the rest of its FY2024 results. The fiscal year ended with a 7.5% revenue growth, down considerably from the 30.7% growth in the prior year. The EPS in FY2024 came in at $1.45, down from $1.66 in FY2023.

The company continued to scale its distribution network despite a soft industry to fuel future growth – total showrooms grew from 195 at the end of FY2023 into 230 at the end of FY2024, and in addition, Lovesac’s store pop-up activity increased from 113 pop-ups to 424 pop-ups. The showroom expansion required $28.7 million in capital expenditures in FY2024.

In Q1, Lovesac’s revenues turned downwards with a negative revenue growth of -6.1% – the industry’s softness finally caught up to Lovesac. The operating income fell from -$5.7 million in the seasonally slow quarter into -$17.9 million, as despite slower sales, operating expenses continued to scale due to the continued showroom expansion. After Q1, the trailing operating margin only stands at a thin 2.6%.

The results still continue to outpace the furnishings industry, where most companies are facing very sharp revenue declines. Hooker Furnishings’ (HOFT) revenues fell by -25.7% in the same fiscal year where Lovesac still grew by 7.5%, and the most recent quarter also followed with a -23.2% decline. Bassett Furniture’s (BSET) revenues declined by -19.7% in FY2023, and have continued to decline by -17.0% in the most recent quarter.

While the Q1 results show a worse performance than FY2024 showed for Lovesac, I believe that the company is still poised to return into great growth with an industry recovery. Showrooms continued to climb by 16 in the latest quarter, and while the performance showed a thinner outperformance compared to the industry, the decline shouldn’t worry investors when looking at the long term.

Guidance Expects Sequential Recovery – Investors Should Have Healthy Skepticism

Lovesac reaffirmed the FY2025 outlook, expecting $700-770 million in sales in the fiscal year. The lower bound of the range represents stagnant revenues, whereas Q1 showed a -6.1% decline and fiscal 2025 only has 52 weeks compared to Lovesac’s 53-week fiscal 2024.

Many other companies in the industry also guide for gradual improvements. For example, Arhaus (ARHS) had a -9.5% comparable growth in Q1, but guides for -4% to -2% in the total year. RH (RH) guides for a revenue growth of 8-10% despite a -1.7% decline in Q1, although RH’s guidance has been met with skepticism from analysts. Other companies continue echoing a very cautious tone, waiting for interest rate cuts and a housing market recovery.

I believe that Lovesac could still well miss the current revenue guidance, also likely leading to a miss of the $1.06-1.59 EPS guidance and the $46-60 million adjusted EBITDA guidance. The industry seems to remain soft, and Lovesac’s continued showroom investments could potentially not aid sales enough to offset the incredibly soft demand in FY2025. Yet, a miss wouldn’t be detrimental in the long term, as Lovesac’s overall growth story is in my opinion still incredibly likely to continue successfully after the industry woes subside.

Updated Valuation: LOVE’s Still Attractive

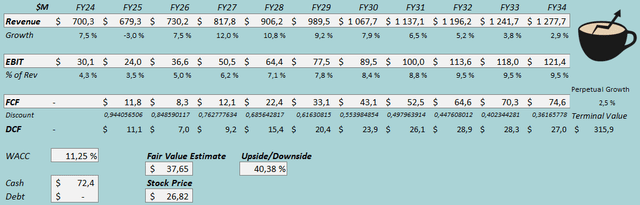

I updated my discounted cash flow [DCF] model to account for the industry softness, but also adjusted the cost of capital down very significantly from a previously incredibly high estimate.

In the model, I now estimate a -3% revenue decline in FY2025, representing a slight miss of the reaffirmed guidance. Afterwards, I estimate the growth to resume with an industry recovery, showing a total 6.2% CAGR from FY2024 to FY2034 with a 2.5% perpetual growth afterwards.

For the EBIT margin, I now estimate softness in FY2025 but still estimate good margin expansion afterwards into a 9.5% EBIT margin from operating leverage and an industry recovery leading to better comparable sales. The company should eventually generate very good cash flows, but I estimate a poorer conversion initially due to the estimated growth’s capital requirements.

DCF Model (Author’s Calculation)

The estimates put Lovesac’s fair value estimate at $37.65, 40% above the stock price at the time of writing – the stock still has great upside despite already returning well. Despite slightly lower financial estimates, the fair value estimate is up from $24.31 previously due to a significantly lower cost of capital, with the market now requiring smaller returns and with my updated beta estimate that represents Lovesac’s risk profile better. The cash position has also been improved.

Even with the upside, investors should note the possibility of a lowered guidance and continued industry weakness, that could still act as a major short- to mid-term risk for the stock.

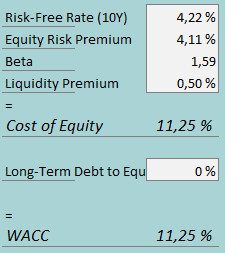

CAPM

A weighted average cost of capital of 11.25% is used in the DCF model, down dramatically from 17.48% previously due to a significantly lower risk-free rate, equity risk premium, and beta. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

Due to Lovesac’s current interest-bearing debt-free balance sheet, I estimate a 0% long-term debt-to-equity ratio. To estimate the cost of equity, I use the 10-year bond yield of 4.22% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I now use the average of Seeking Alpha’s 1.96 beta estimate for Lovesac, 1.02 for Haverty Furniture (HVT), and 1.78 for Arhaus, creating a beta of 1.59 as I believe that Lovesac’s recent market beta isn’t representative of the long-term sustainable risk level. With a liquidity premium of 0.5%, the cost of equity and WACC both stand at 11.25%.

Takeaway

Lovesac’s growth has slowed down due to industry weakness, whereas the company is still expanding showrooms underneath overperforming the industry. The company’s FY2025 guidance could see downside as it seems to expect quite a good sequential recovery from Q1 despite persisting industry struggles, acting as a short-term risk. Still, I see the investment as a great risk-to-reward case especially in the longer term, as the valuation is still attractive. As such, I remain with a Buy rating for Lovesac.