Lineage Stock Might Be Cold, But Fundamentals Have Potential (NASDAQ:LINE)

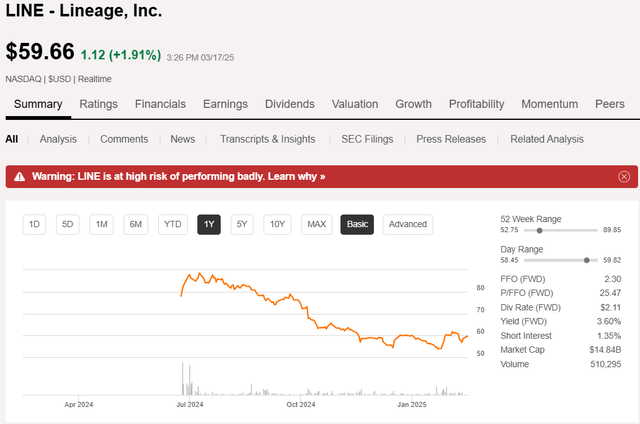

Lineage Logistics (NASDAQ:LINE) is the world leader in cold storage with 3.1 billion cubic feet of dedicated real estate. It IPOed in June 2024 at $78 and has dropped precipitously to $59.66.

The IPO valuation was a little bit aggressive, but the stock has gotten interesting at the now lower price, which represents a 17X multiple on consensus 2025 AFFO of $3.51.

At an intriguing valuation, we put in some due diligence and here are our findings:

Brief overview of LINE thesis

LINE has potential for exceptional growth from a combination of market share gains, margin expansion and occupancy growth at existing facilities. If successful in realizing its potential, the growth far exceeds what is priced in at a 17X multiple.

Offsetting the great potential are current oversupply of cold storage facilities, uncertain near-term inventory levels, and potentially elevated risk to the stock as a large portion of pre-IPO shares unlock and join the float.

We are presently neutral on LINE but are watching it closely as certain events could swing the stock firmly into an opportunistic investment. Let us begin with an industry overview, follow with LINE’s growth potential and idiosyncratic risks and conclude with a discussion of what could tip it toward a buying opportunity.

Industry Overview

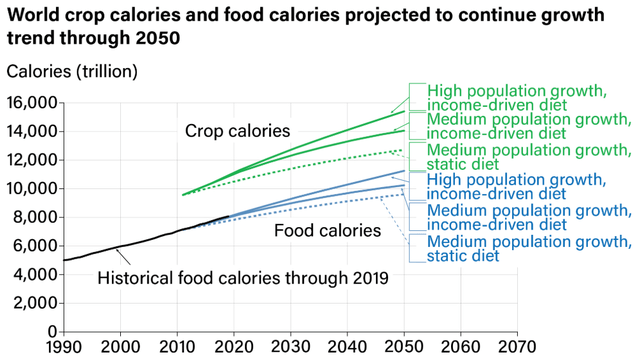

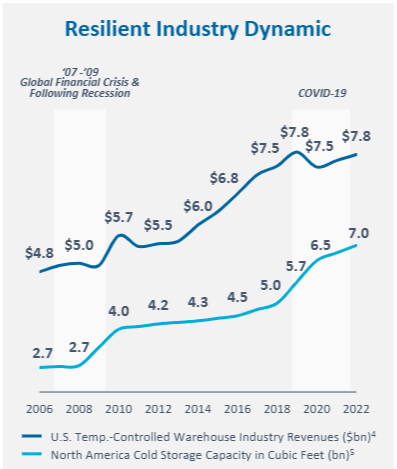

Demand for cold storage has increased steadily throughout its history. Going forward there are 2 potential drivers of continued growth.

- Global food demand

- Higher share distributed via temperature control

Global food demand has steadily risen for centuries. It increases with both population growth and income growth. The USDA has estimates of continued growth through 2050.

Cold storage services both restaurants and food from home, so as an industry it is largely indifferent to restaurant trends. There are, however, 2 tailwinds which suggest the portion of food distributed with temperature control will increase.

- More cost-effective

- Less preservatives

With inflation and particularly food inflation as a major concern for much of the population, Americans are looking to save money at the grocery store. The frozen food section is one of the most cost-effective ways to shop. Anecdotally, I recently bought a 10 pack of frozen waffles for $3.56 and got 5 meals out of it.

Frozen food is generally cheap across a variety of food types, vegetables, pizzas, fruit, pre-made meals. Frozen food lasts much longer before it needs to be sold and consumed, which means there is far less waste in the supply chain. Less waste means a higher percentage of what is produced actually gets sold, such that the equilibrant price per unit sold is reduced.

In addition to wanting to save money, people are becoming increasingly aware of the chemical risks in their diet. Preservatives are often cited as one of the risk factors, and people are increasingly trying to avoid consuming too many preservatives.

Temperature control naturally preserves food by slowing food decay and bacterial growth, so frozen food often contains less preservatives than equivalents that would be stored at room temperature.

Overall, I would anticipate the percentage of food globally that utilizes temperature-controlled logistics to rise.

Demand looks great for cold storage, but developers seem to be well aware of the demand trends and in combination with the free money of the zero interest rate environment, building got a bit out of control during and following the pandemic.

LINE

As seen above, cold storage capacity shot up more than 40% since 2019.

Higher interest rates have ended the free money era and restored rationality to cold storage development, but some projects started earlier are still in the pipeline.

As such, the outlook on supply looks quite similar to that of apartments. New building has slowed considerably, but existing pipeline will keep new supply high through the end of 2025.

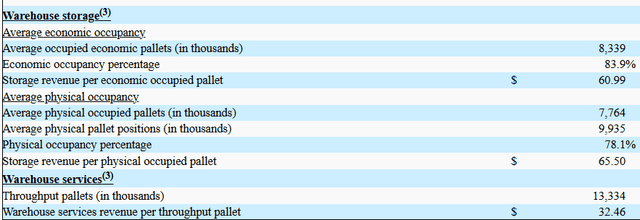

Due to the supply wave discussed above, the industry is currently oversupplied and that is reflected in occupancy rates of the cold storage REITs. Lineage, for example, has physical pallet occupancy of 78%.

Growth potential

Lineage is well positioned for 3 sources of growth

- Occupancy recovery

- Margin expansion

- Accretive consolidation

LINE’s warehouses earn returns for storage as well as servicing.

Servicing throughput has been strong, while storage revenues have suffered a bit from a combination of oversupply at an industry level and odd inventory behaviors among tenants.

Since the pandemic, supply chains have been challenged, with suppliers alternating between lean “just-in-time” models and carrying larger inventories to ensure having product available for customers.

Presently, most tenants are on the lean end, with inventory levels abnormally low. Low inventory is exacerbating the industry level oversupply of cold storage, which is why physical occupancy is so low.

Both of these problems should be corrected over time.

Due to the remnants of the pipeline, cold storage square footage will likely remain oversupplied through the end of 2025 and start to normalize in 2026-2027.

Inventory can potentially correct much faster, with LINE estimating a return to normal seasonality in the near-term per CEO Greg Lehmkuhl’s commentary on the earnings call:

“Our 2025 guidance assumes normal seasonality from today’s historically low inventory levels with no market improvement”

There was a significant back and forth between analysts and LINE on the call, revealing that the term “no market improvement” does not mean flat but rather absolute increases throughout the year per normal seasonal patterns.

The analysts seemed to think this was an optimistic outlook, as these normal seasonal trends have not really been in place since COVID.

As such, the timing of occupancy will depend on inventory levels, restoration of normal seasonality, and reduced new supply going forward. Over the next 5 years, however, occupancy should rise significantly.

Margin improvement

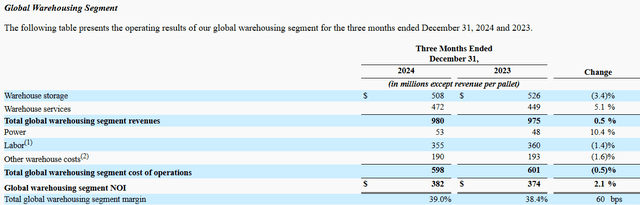

LINE’s margins are already reasonably good at 39%.

S&P Global Market Intelligence

One of the advantages of being the global leader with a dominant market share is that there are synergies in customer network and overhead gets spread over a larger revenue base. The size of Lineage also makes it worthwhile to invest in operational improvement and automation.

This is where margins can grow going forward.

Labor is a huge part of the cost equation, with warehouse labor expense in 4Q24 coming in at $355 million against revenues of $980 million.

Currently, 82 of LINE’s 488 warehouses are automated. As automation is perfected and more warehouses are converted, we anticipate labor expense as a percentage of revenues declining.

Additionally, Lineage is rolling out a program it calls LinOS which is proprietary software that guides and optimizes warehouse activity. Lehmkuhl describes it on the earnings call:

“Our LinOS initiative is on track, and our early pilots are exceeding expectations. As a reminder, LinOS is our proprietary warehouse execution system that we’ve developed and already implemented in multiple automated facilities and have begun piloting in our conventional buildings. The software uses patented and proprietary algorithms that are a result of many years of development and collaboration between our data science, technology and operations team.

Our belief is that LinOS will transform warehouse operations, resulting in significantly higher performance for customers while accelerating efficiency improvements. Our early pilots are both exceeding our efficiency expectations and being positively received by our hourly team members and warehouse leadership. Our teams are genuinely excited about how this technology can transform our operations.”

Efficient operations and scale make consolidation potentially very accretive. Lineage can buy up smaller competitors at a normal EBITDA multiple, but to the extent that there is a delta in operating efficiency between LINE and the small peer, the purchase might be unusually accretive.

We have seen similar things in self-storage, where stronger operators like the REITs could buy up mom-and-pop self-storage and increase NOI 20%+ within months.

I believe a similar opportunity exists in cold storage.

LINE is by far the largest, followed by Americold (COLD) and then there is a steep drop-off into an otherwise fragmented industry.

Overall growth

Occupancy growth and margin growth have a multiplicative effect when it comes to AFFO/share and given the potential for substantial improvement in each metric, LINE could have explosive growth.

Certain aspects of the growth, such as global food demand and a waning of new competing developments, are largely locked in at this point, while others remain uncertain.

I think there is real potential for normalcy in tenant inventories, and I am intrigued by LinOS and other operating efficiencies. However, I would like to see a bit more evidence before counting this portion of the growth.

If these turn out favorably, LINE’s AFFO/share growth could come in far ahead of what is priced in at 17X AFFO.

Risks to investment in LINE

The company will face tough comps in 1Q25 and 2Q25.

Normal seasonality is weakness in the first half and strength in the 2nd half. Recent years did not follow that pattern, so if we assume 2025 is a normal year the first half will look weak relative to 2024 and the 2nd half will look strong.

Combined with the already present downtrend in LINE stock, this seasonality-driven weakness in Q1 and Q2 could potentially be interpreted harshly.

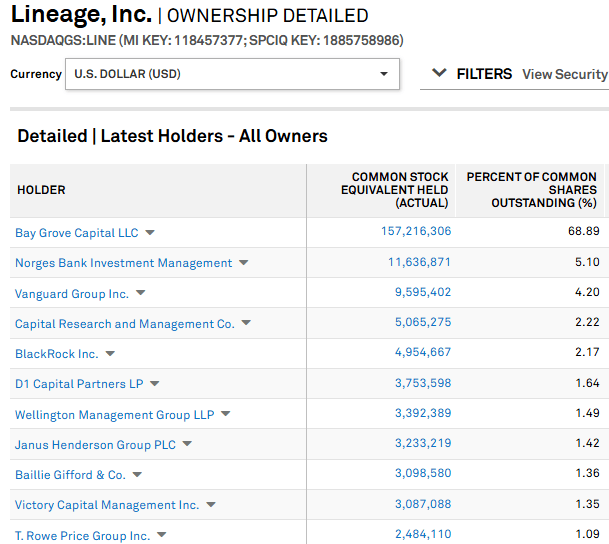

LINE has a rather unusual ownership for a large cap REIT. Roughly 2/3 of the shares are still owned by pre-IPO investor Bay Grove Capital.

S&P Global Market Intelligence

These shares are mostly locked up in the form of OP units or other common share equivalents and will unlock over the 3 years following the IPO described here in the 10-K:

“Units will transition from the control of BGLH’s subsidiary, the LHR, through (i) Cash Settlements of such equity in amounts that are expected to be material and (ii) Securities Settlements for all remaining amounts of such equity, resulting in the transfer of control of all such securities to the underlying legacy investors who will then determine the timing of their future disposition of such securities.”

In my opinion, this creates 3 risks for investors:

- Expiration of lock-ups could cause selling pressure as previously locked shares are potentially sold.

- Some of the units may convert into cash rather than common shares, which could cause lumpy cash needs and perhaps force public issuance.

- With a majority vote, BG Capital has full control of the company, which reduces the power of public investors.

The bottom line

Cold storage has a great long-term fundamental outlook. LINE’s position as market share leader, along with their proprietary operating efficiency, positions them for potentially explosive growth.

I think this company could be worth far more than the current market price, but before diving in and buying shares, I want a little bit more clarity that operating initiatives are effective and that the lock-up expirations go smoothly.

We will watch the LINE closely and strike if the iron gets hot.