JAAA: High Yield, Low Duration Make It An Attractive Option

Lauren Nicole/DigitalVision via Getty Images

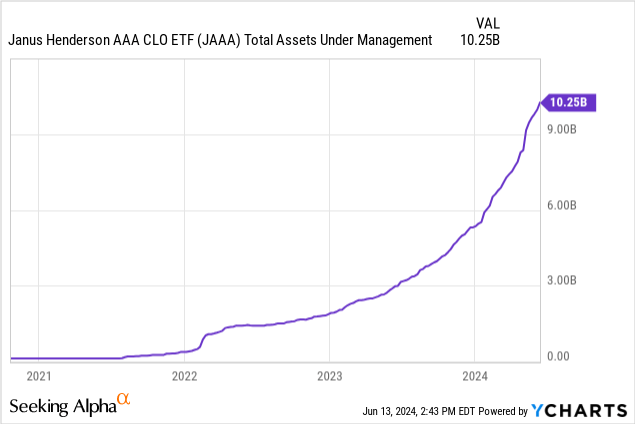

Janus Henderson AAA CLO ETF (NYSEARCA:JAAA) has been gaining popularity in the realm of fixed-income ETFs. Since the beginning of 2022, JAAA’s AUM has skyrocketed to $10.25B.

So what makes this ETF so popular? Its holdings, AAA CLOs, have some unique characteristics that make it desirable to own in the current rate environment. Before we dive into what these characteristics are and why JAAA is a Buy, let’s go over JAAA’s holdings.

Holdings

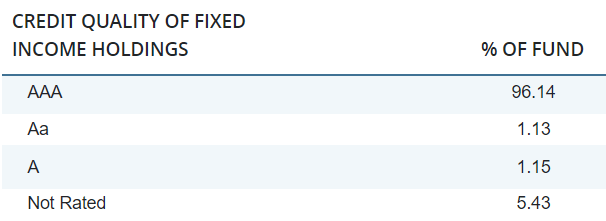

JAAA’s holdings aren’t complicated. JAAA owns 369 CLO tranches, the vast majority of which are AAA.

JAAA’s Holdings by Credit Rating (janushenderson.com)

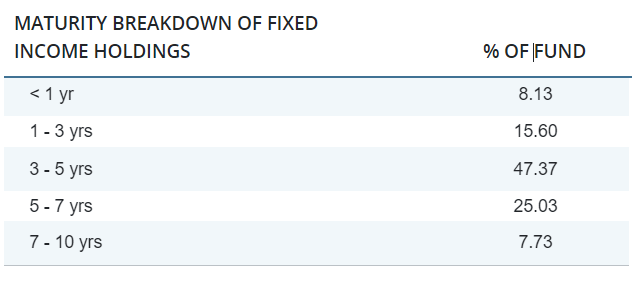

Of the 369, almost half of them have maturities of 3-5 years. JAAA’s weighted average maturity is 3.99 years.

JAAA’s Holdings by Maturity (janushenderson.com)

Finally, as CLOs are floating rate instruments, JAAA’s effective duration is 0.21 years, minimizing most interest rate risk, which we will discuss in more detail later.

Going back to the credit ratings of JAAA’s holdings, AAA CLOs have an impressive history. The most shocking statistic in my opinion is that no CLO note originally rated AAA has ever defaulted. CLOs have been around for 30 years, through the dot-com bubble, 9/11, the GFC, and COVID-19, and not a single AAA CLO has defaulted. For AAA CLOs to be affected, there has to be a massive number of defaults. I believe this excerpt from Professor Michael Roberts really shows how safe the AAA tranche is.

If lenders were to recover $0.40 on the dollar for loans in default, then 60% of the loans in CLO portfolios would have to default before the AAA-rated tranches would even begin to lose money. To put that number in context, the cumulative default rate for risky debt during the worst three years of the Great Depression (1931-1933) was 31%.

CLOs

For those not familiar with CLOs, they are Collateralized Loan Obligations. Put simply, the CLO manager buys corporate loans, then sells tranches, from the AAA tranche (least risky) to the Equity tranche (most risky), to investors. The coupon payments work like a waterfall, AAA tranches get the priority, then AA, then all the way down to the Equity tranche. CLOs are also floating rate. This means their coupon payments are reset periodically at a predetermined spread to an index (commonly SOFR or LIBOR). This is where the first unique quality comes in.

Duration

JAAA’s duration, which indicates interest rate risk, is very low. This is because if rates go up or down, the CLO’s coupon will reflect the rate change after its floating rate resets, usually every quarter. This isn’t always a desirable quality. When rates fall, fixed-rate debt prices rise, leading to capital gains, while floating-rate bonds will experience very little appreciation. But when rates rise, floating rate instruments, such as JAAA, will experience very little depreciation, while fixed-rate debt will suffer much more.

In the current economic environment, I think low duration is attractive for two reasons. The first is that yields are very volatile right now. Just take a look at the 10-year treasury yield over the last 6 months.

Adding JAAA, a low-duration product, to your portfolio can help limit volatility. The other reason I like low duration is while I see mid and long-term yield volatility continuing, I don’t expect much change to short-term lending rates for a while. The Fed has indicated only 1 rate cut this year, and I’m skeptical of even that. CPI last month came in a bit lower than expected, but the Fed is going to wait as long as they can before rate cuts. While CPI coming down is a great sign of a slowing economy, there are other reports suggesting the opposite, like the recent jobs report.

If short-term rates do stay the same, or even get cut once, JAAA will offer a high yield for low risk.

Yield

The other factor that makes JAAA particularly compelling is its impressive yield. Right now, JAAA has a 30-day SEC yield of 6.67%, well over the current SOFR rate of 5.31%. There’s a 136 bps spread between the two. And as stated before, I don’t expect JAAA yield to fall much for a while. I’m very skeptical that the Fed will cut rates before the election. And if they do cut rates once, the yield will still be enticing. A 25 bps drop in yield isn’t ideal, but it doesn’t make JAAA lose its attractiveness, especially since the yield on other low-risk options will fall in tandem.

Duration and yield comparison

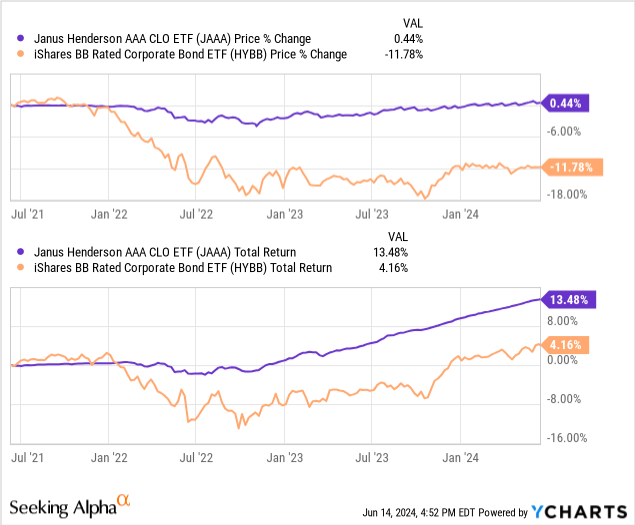

It’s helpful to compare ETFs with similar yield and duration to JAAA to put it into context. I’m not comparing the ETFs to show that one is better than the other, but just to show how JAAA compares. Let’s start with yield. HYBB is a high-yield bond ETF that owns BB-rated corporate bonds.

| JAAA | HYBB | |

| Yield | 6.67% | 6.47% |

| Duration | 0.21 | 3.48 |

JAAA has a higher yield than HYBB, with far less interest rate risk. The charts below show the total price change and total return of the 2 ETFs over the last 3 years.

The charts make the duration difference very apparent.

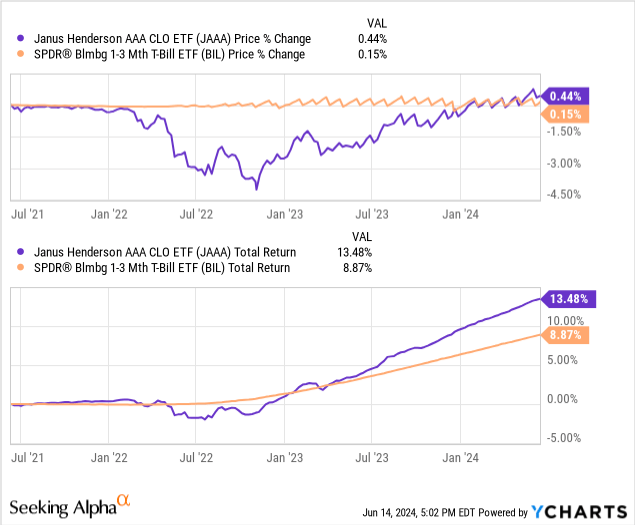

To compare JAAA to an ETF with a similar duration, I’ll use BIL.

| JAAA | BIL | |

| Yield | 6.67% | 5.21% |

| Duration | 0.21 | 0.12 |

JAAA’s yield is 155 bps higher than BIL’s, for just about a tenth of a year higher duration. While their durations are similar, the difference is still meaningful.

As the chart above shows, BIL does have far less price volatility, but for some, the added yield makes JAAA worth it.

JAAA’s yield is far above that of other low-duration products. JAAA does have relatively high reinvestment risk, but to lock in these yields with longer maturity vehicles, you have to take on far more risk and likely enter the non-investment grade market. JAAA’s high current yield and low default risk make it a great option among fixed-income ETFs.

When to pivot

Eventually, when rate cuts appear more imminent, other opportunities may become more enticing than JAAA. When to get into longer-duration products to benefit from capital appreciation is a tricky question. As of now, I think short duration is the way to go until at least January 2025. Once that time comes, JAAA will need a reevaluation.

Conclusion

JAAA offers diversification to a fixed-income portfolio. Its high yield combined with low duration makes it attractive. Its yield is likely to remain high for at least the next 6 months. AAA CLO tranches have an extremely impressive history. No AAA tranche has ever defaulted, and there would have to be extreme circumstances for one to do so. I rate JAAA a buy.