JAAA ETF: A Defensive Play To Consider Amid Rising Market Volatility (NYSEARCA:JAAA)

Olivier Le Moal

I looked at the market this morning and decided that the Janus Henderson AAA CLO ETF (NYSEARCA:JAAA) deserves attention. The market has experienced a mini correction in the past week, with stocks and treasuries retreating abruptly. Moreover, the S&P VIX Index (VIX) has surged by more than 10% in the past five trading days, illustrating that the financial markets have experienced heightened implied volatility.

You might be asking why the above applies to JAAA ETF. In simple terms, JAAA ETF is a low-duration asset with protective attributes. As such, I decided to revisit our previous outlook on the Janus Henderson AAA CLO ETF.

Here are a few talking points to consider.

A Reminder Of JAAA ETF’s Strategy

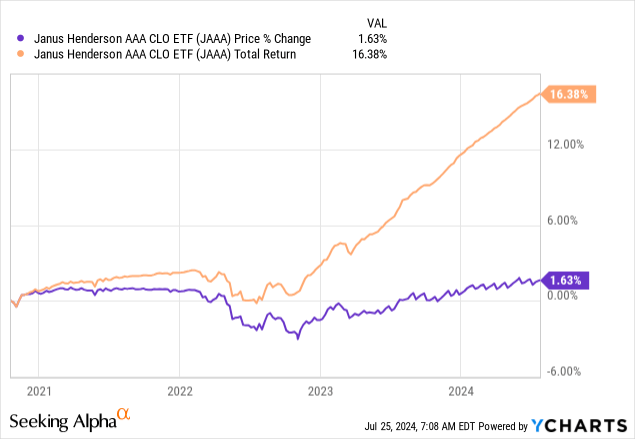

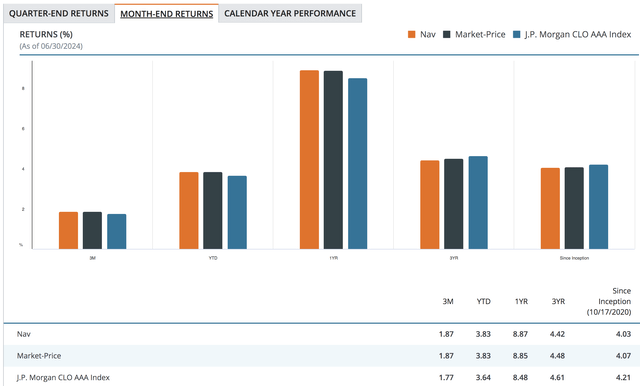

The JAAA ETF invests in investment-grade collateralized loan obligations, which are essentially leveraged loans. The fund tracks the J.P. Morgan CLO AAA Index but has some latitude for active management. Although the JAAA ETF’s price action should be considered, its dividends produce the bulk of its return.

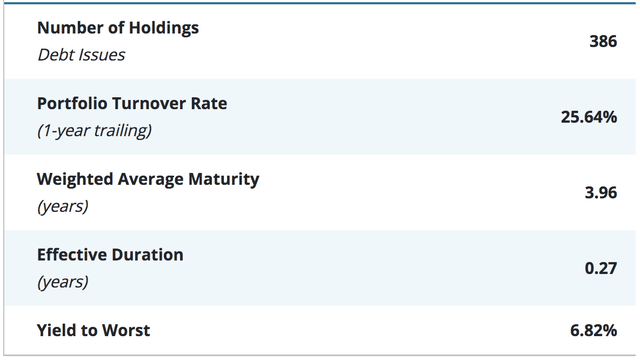

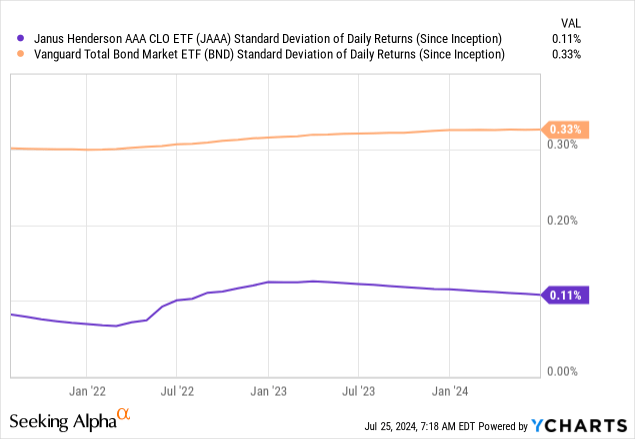

Furthermore, JAAA ETF has about 386 holdings and a turnover rate of 25.64%, showing that it rotates its portfolio but maintains low concentration risk. In addition, the ETF has an effective duration of 0.37, which I deem negligible, possibly explaining the ETF’s low price volatility.

Here’s a chart illustrating the JAAA ETF’s price volatility versus the Vanguard Total Bond Market Index (BND), showing that it is lower than that of a typical bond instrument.

Why I Like JAAA In The Current Market Environment

From an income-based perspective, CLO instruments like the JAAA ETF benefit from elevated interest rates and show minor price sensitivity relative to changes in interest rates. Moreover, its investment-grade exposure probably means it has less credit risk exposure than non-investment-grade vehicles.

I want you to remember the above because I’m about to discuss a separate topic before amalgamating the opening paragraph into the broader argument.

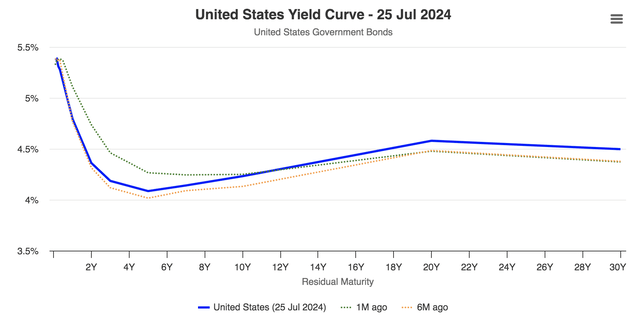

Current U.S. bond yields are highly volatile. This volatility probably derives from polarized speculation about interest rate policies and sharp movements in inflation. The yield curve illustrates my claim as it has shifted abruptly in the past months.

U.S. Yield Curve (worldgovernmentbonds.com)

The short end of the yield curve has dropped in recent months, concurrently introducing steepening of the curve, suggesting an interest rate pivot is lurking. Although a pivot is a reasonable expectation, I think uncertainty will prevail for now.

Now, let’s revert to the opening statement.

As mentioned, JAAA ETF’s low effective duration means the vehicle has low interest rate sensitivity. Low sensitivity is likely a positive attribute due to the volatility and uncertainty baked into the interest rate environment, as it allows investors to avoid much of the risk.

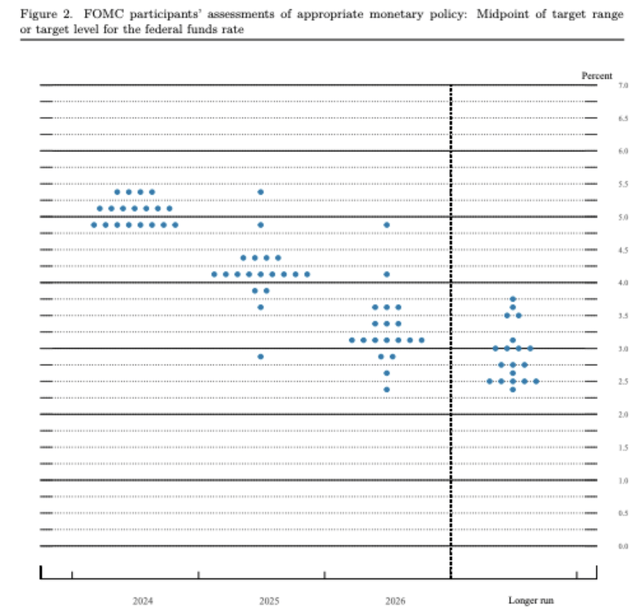

The following diagram shows the dot plot, illustrating the uncertainty baked into the interest rate environment (notice the dispersion).

The question now becomes: What about JAAA ETF’s dividend?

JAA ETF’s 30-day SEC yield is 6.6%, which is higher than its four-year average dividend yield of 2.78%. This is likely due to elevated interest rates. As such, dividend investors might naturally be worried about an interest rate pivot.

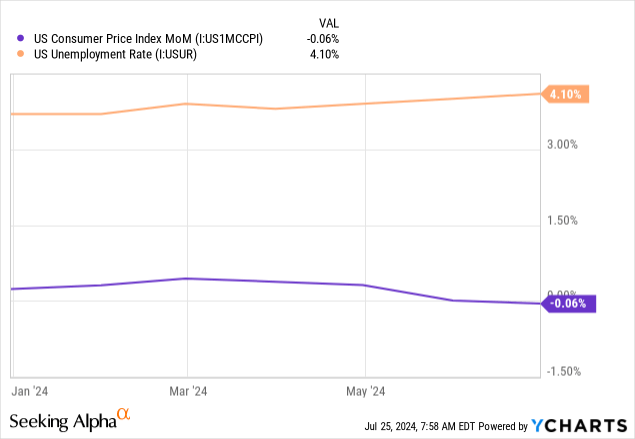

CPI in the U.S. has tamed, consumer confidence has waned, and unemployment numbers are ticking up. Thus, it would be reasonable to anticipate an interest rate pivot. However, I don’t think we’ll return to 2020/2021’s interest rate environment, where JAAA ETF’s dividend floored below 1%. In fact, I think we will see a moderate rate cut and fluctuating inflation, allowing JAAA ETF to retain much of the spreads on its CLO loans, resulting in sustainable dividends. Moreover, as mentioned before, its low duration might protect against broad-based market volatility.

A Few Comparables

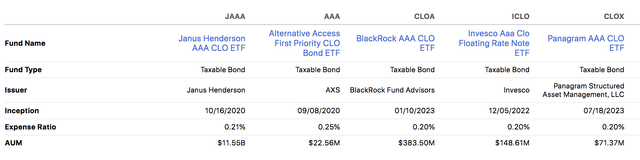

Let’s run through a few isolated peer comparisons to provide further context. I decided to use AAA ETF (AAA), CLOA ETF (CLOA), ICLO ETF (ICLO), and CLOX ETF (CLOX) as peer examples. However, note that this is only my selection; other peers exist.

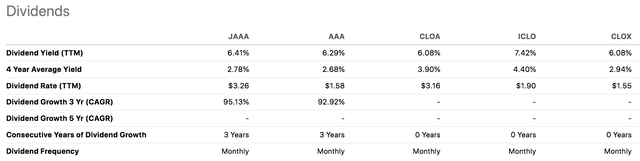

Dividend Yield

JAAA ETF’s trailing dividend yield and four-year average dividend yield are in line with those of its peers. Some of the smaller CLOs have higher yields. However, I enjoy JAAA ETF’s dividend sustainability and growth (versus its smaller peers).

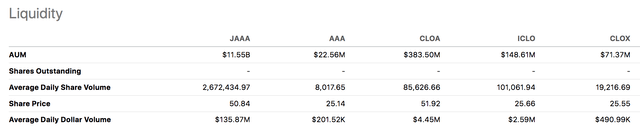

Liquidity

Compared to its peers, JAAA ETF has a large asset base. This could cause problems if a broad-based market crisis occurs, as unwinding might be challenging.

Furthermore, rebalancing the portfolio can be expensive. JAAA ETF’s expense ratio of 0.21% is in line with those of its peers, but that could change if rapid portfolio turnover is required. Sure, derivatives can be utilized to mitigate some of that risk, but that introduces basis risk.

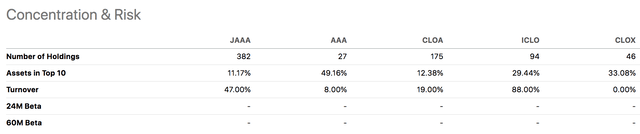

Concentration

The following diagram reiterates much of what I mentioned in the “liquidity” section. However, it tables an alternative argument: the ETF has low concentration risk. Lower concentration likely reduces its idiosyncratic exposure, meaning defaults of single issuers won’t impact its overall asset value as much as it would some of its smaller peers.

Valuation

The JAAA ETF has a history of trading in and around its net asset value (NAV). It has traded in line with its NAV during the past quarter.

I see no valuation risk or opportunity here. I reiterate the article’s main argument: I think we will see level price performance and sustainable dividends.

Market Price Vs. NAV (Janus Henderson)

Noteworthy Risks

I discussed some risks earlier in the article but wanted to create a discreet section to outline additional risk factors.

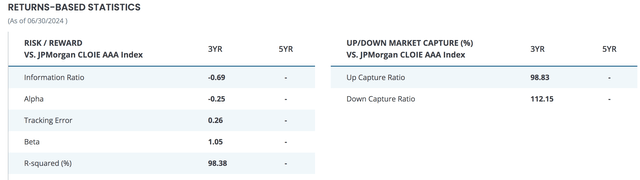

The following diagram communicates a few of JAAA ETF’s quantitative risk metrics; a discussion follows.

Risk Metrics (Janus Henderson)

As illustrated above, the JAAA ETF’s downside capture exceeds its upside capture, meaning that the ETF occasionally suffers from negative skewness. Furthermore, JAAA ETF has a negative Information Ratio, meaning its excess returns are lower than its excess volatility (versus its underlying index).

Lastly, although I argued that JAAA ETF’s dividends would be sustained, lower interest rates are a material risk factor, making lower dividends possible.

Conclusion

My analysis shows that the Janus Henderson AAA CLO ETF is a defensive play for investors seeking protection against a volatile interest rate and financial market environment.

The vehicle’s low duration means it has minor interest rate-driven price sensitivity, which I deem ideal for today’s market environment. Although a lower interest rate environment looks set, it’s unlikely that JAAA ETF’s dividend will crumble to the extent that it becomes an uninvestable asset.

I retain my bullish outlook.