iA Financial: Under-The-Radar Dividend Growth Plus 3.7% Yield (IAG:CA)

skynesher

iA Financial Corporation (TSX:IAG:CA) (OTCPK:IAFNF) is a little-followed Canadian life insurance company with a long history, solid growth potential, a good balance sheet, and attractive dividend growth prospects that trades at a cheap valuation.

(All numbers in Canadian dollars unless indicated otherwise)

Introduction

iA Financial can trace its history all the way back to 1892. That was the year Alliance Nationale opened its doors in Montreal with just $10,000 in assets.

In 1905, Industrial Life Insurance Company was founded in Quebec City. Both companies grew for decades inside their home province before eventually merging in 1987.

The combined company continued to grow, eventually demutualizing in 2000. That move paved the way for it to list on the Toronto Stock Exchange, debuting there in 2000.

The company has moved away from its roots as a Quebec life insurer, especially since its IPO. It has made more than 40 acquisitions, expanding first across Canada and then, more recently, into the United States. Main acquisitions in the United States include purchasing United Family (2008), American-Amicable (2010), Helios Financial (2018), IAS (2020), and Vericity (2024).

Even though iA Financial has expanded into the United States, it’s still mostly a Canadian concern. Approximately 80% of revenues come from the company’s Canadian operations, which are split into Wealth Management and Insurance, Canada divisions.

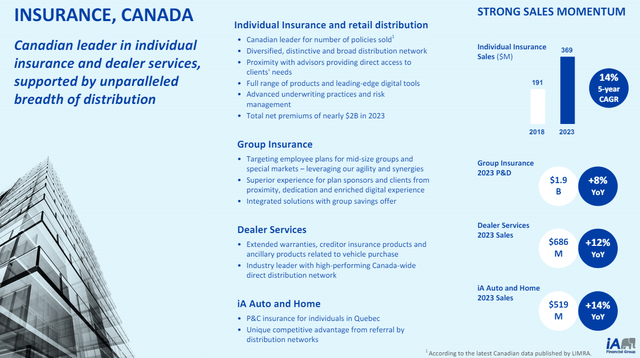

Let’s start with the Canadian insurance operations, which have grown into a true coast-to-coast powerhouse. iA Financial is the Canadian leader in insurance policies sold, with some $2B in net premiums in 2023. Individual insurance sales have grown by 14% per year over the last five years, too. And the company also has robust group insurance and car dealer services divisions in Canada. It also offers property and casualty insurance in its home province of Quebec.

iA Financial investor presentation

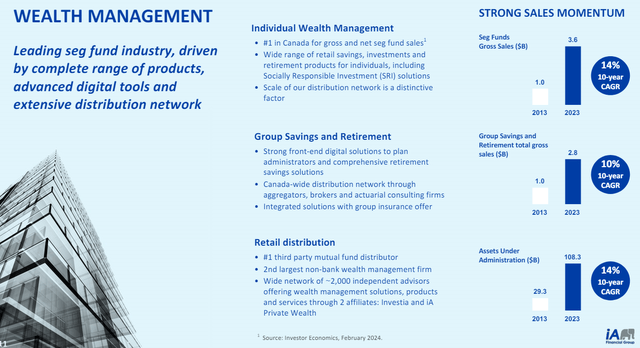

The other part of the company’s Canadian operations is wealth management, a division that has also delivered some pretty robust growth over the last few years. It has a fleet of more than 2,000 independent financial advisors, and is actively acquiring other wealth managers – including Laurentian Bank’s investment broker division. It has grown to become Canada’s second-largest non-bank wealth management firm.

iA Financial investor presentation

Investment thesis

The investment thesis here is fairly simple. Investors are buying a high-quality insurance stock for a very reasonable price.

What makes iA Financial a high-quality stock? There are three factors that combine to elevate it over its peers, including:

- A history of superior returns

- Good growth potential via acquisition

- A solid balance sheet

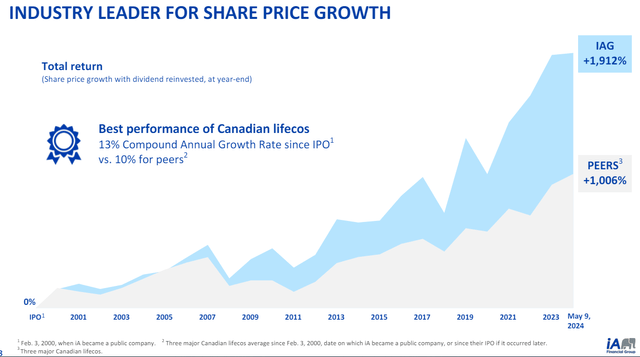

Let’s start with IA’s history of excellent returns. Since its February 2000 IPO, the stock is up 1912% versus an average of 1006% return posted by its peers. That works out to a 13% CAGR since the IPO, versus total returns of about 10% a year from its peers.

We’ll note these results are through May 9th, 2024.

iA Financial investor presentation

iA Financial’s peers include Great-West Lifeco, Sun Life Financial, and Manulife Corporation.

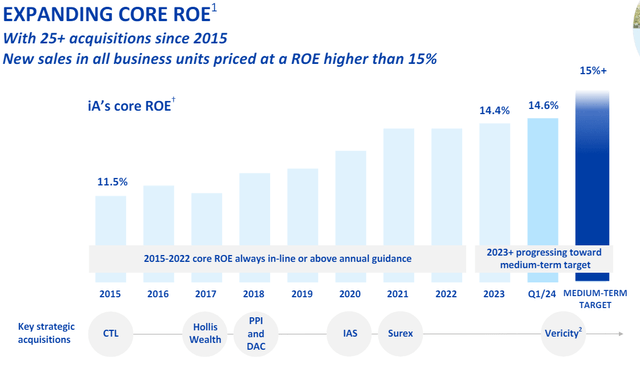

Much of this outperformance can be attributed to iA Financial’s focus on growth. The company has made a series of acquisitions over the years, with the growth plan really accelerating after 2015. It has grown earnings per share by about 10% per year from 2015 through 2023, and it has a medium-term goal to continue growing earnings per share by at least 10% per year.

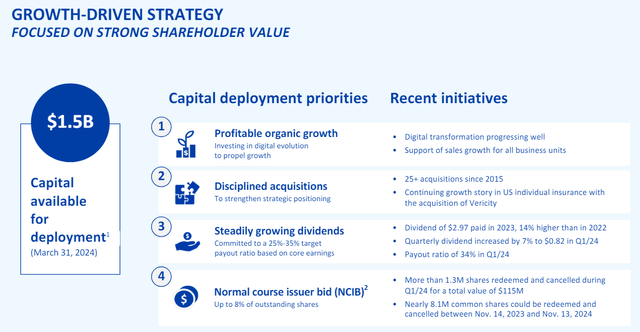

The company makes it clear it prioritizes growth as a capital deployment priority, but it also wants to pay a steadily rising dividend and repurchase shares. It has put aside $1.5B in capital available for deployment in 2024.

iA Financial investor presentation

There are always risks in a growth-by-acquisition plan. It takes discipline to make prudent acquisitions, and sometimes good deals just aren’t out there. Patience isn’t always rewarded either, with many investors adopting a “what have you done for me lately” approach to these types of stocks.

Saying that, I’m confident that iA Financial can keep acquiring solid assets at reasonable prices. The financial space is incredibly fragmented, so opportunities are constantly presenting themselves. And the company has a history of making smart acquisitions.

One way we can confirm iA Financial’s solid acquisition history is by looking at the company’s return on equity. That metric has been steadily marching higher since 2015 as acquisitions done at higher returns on equity impact the overall return on equity for the entire company.

Improving returns on equity has been a priority for iA Financial’s management, and the company has made progress. Recent returns on equity are very close to the company’s 15%+ target.

iA Financial investor presentation

The company is a prudent acquirer which always has one eye on its balance sheet. It is conservatively managed, and the company takes pride in its solid financial health.

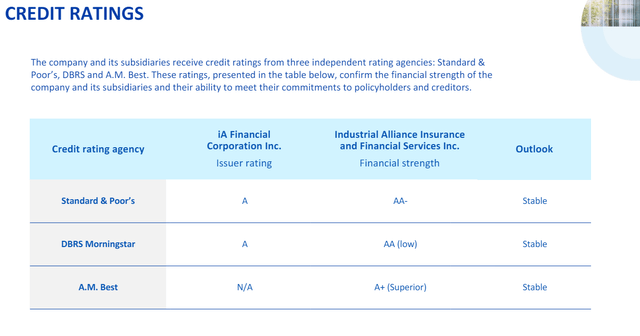

It has a solvency ratio of 142%, which is well above its 120% operating target. The company’s peers have solvency ratios in the 120-130% range. It also has a low debt ratio of 14.3% and a coverage ratio of 18.5x.

Debt rating agencies are also fans, giving iA Financial A ratings on its debt, which is comfortably in investment grade territory. This further confirms the company’s good financial footing.

iA Financial investor presentation

Valuation

iA Financial offers a nice combination of growth with a very reasonable valuation.

The company has consistently grown its bottom line since the 2000 IPO. More recently, it has continued expanding its net income, increasing core earnings from $4.21 per share in 2015 to $9.31 per share in 2023.

Analysts project further growth. According to Seeking Alpha’s earnings page, a total of 8 analysts are projecting the company to earn $10.26 per share in 2024, with earnings increasing to $11.35 per share in 2025.

That puts the stock at an attractive valuation of just 8.6x forward earnings. The forward P/E ratio drops to just 7.6x on 2025’s earnings, too.

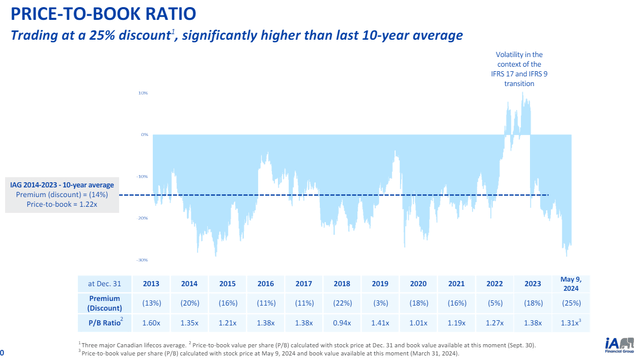

The company is also trading at a significant discount on a price-to-book basis – at least when compared to its peers. Its recent price-to-book value was 1.31x, a discount of approximately 25% versus an average of its three large peers. iA Financial does traditionally trade at a discount versus its peers, but the recent gap is much larger than normal and was close to a 10-year-high.

iA Financial investor presentation

One other tool I like to use as a quick valuation metric is the company’s dividend yield. A dividend yield significantly above the 10-year mean suggests a stock that’s undervalued.

The current dividend yield is 3.8%, higher than the mean of 3.2%. But we’re still considerably under peak yields in 2020.

Giving back to shareholders

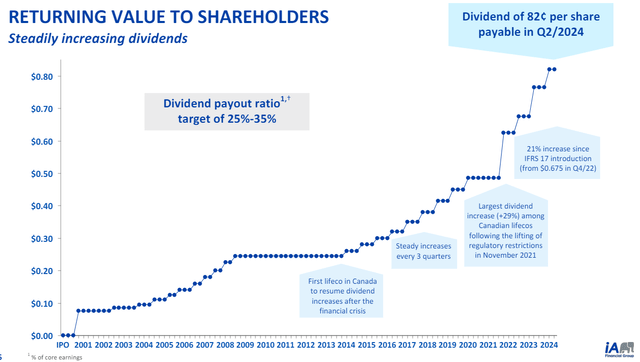

iA Financial has become one of Canada’s top dividend growth stocks.

It has a demonstrated history of consistent dividend increases, with the only interruptions to that streak coming after the financial crisis of 2008 and in 2020-21, when Canadian regulators forbade the country’s banks and life insurers from hiking their dividends. Even then, it held dividends steady.

iA Financial investor presentation

It hasn’t cut the dividend in its history as a publicly traded company.

Since 2022, it has maintained a policy of hiking the dividend every three quarters instead of every four quarters, which has been a nice bonus for shareholders looking for dividend growth.

I’ll also highlight the company’s payout ratio. Based on the current dividend of $0.82 per share each quarter and projected 2024 earnings of $10.26 per share, the forward payout ratio is approximately 32%. It not only indicates a safe dividend, but it also gives confidence in further dividend hikes.

The company isn’t just giving back to shareholders via dividends. Management has consistently communicated to investors they feel the stock is undervalued, so the company is repurchasing its shares. It repurchased approximately 4M shares in 2023, which reduced the share count by 3.8%. It kept the party going through the first quarter as well, eliminating a further 1.3M shares.

It has authorization to repurchase up to 8.1M common shares until November 14th. Look for more share repurchases, especially if the company can’t find any acquisitions.

Risks

Like any insurance company, iA Financial generates float that it mostly invests in bonds. That large bond portfolio is exposed to interest rates, meaning the stock would react negatively in a world where interest rates plunge quickly.

It also has a $2.9B real estate portfolio that is 48% invested in office space. Although it is just a small part of the overall investment portfolio – which is valued at approximately $41B – many investors don’t want any office exposure in their portfolio.

As mentioned earlier, a big part of iA Financial’s growth plan is acquiring other financial companies. There are multiple risks associated with that, including acquiring a dud, paying too much, or simply not being able to find any suitable targets.

Finally, like any life insurance company, iA Financial is at risk if a new pandemic or natural disaster causes a large number of unexpected deaths.

The bottom line

iA Financial is consistently overshadowed by its larger Canadian life insurer peers. It has a market cap of $8B, versus $35B+ market caps offered by its peers. It offers a lower dividend yield than its three larger competitors as well, something that scares off many yield hungry income investors.

But there are good things happening behind the scenes. The growth-by-acquisition plan is working. New acquisitions are consistently growing the bottom line and boosting return on equity. The low payout ratio (combined with that growth potential) gives the company good dividend growth prospects. And at just 8.6x forward earnings, the price paid for all those things is extremely attractive.

iA Financial is a core holding in my portfolio I plan to keep around for a very long time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.