GreensKeeper Value Fund Q4 2024 Letter

Galeanu Mihai

Marshmallows

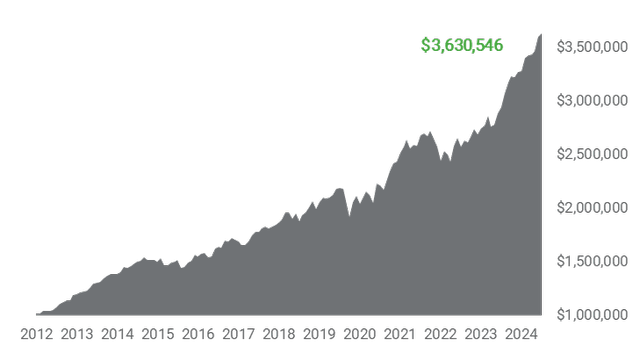

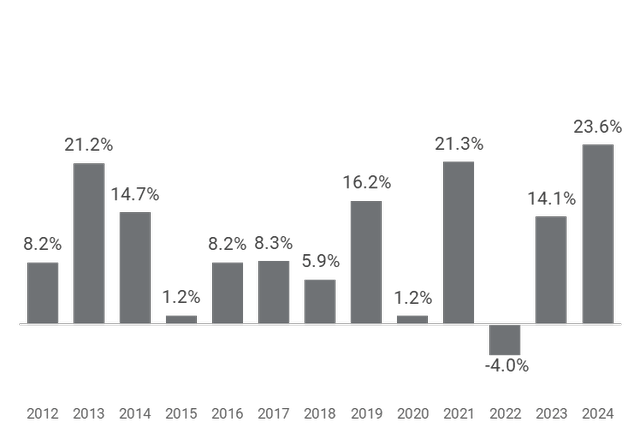

The Value Fund finished the year +23.6% net of fees and expenses. We were well-positioned as the US dollar strengthened against most major currencies, including the Canadian dollar, lifting our returns by approximately 8% for the year.(1)

Excellence isn’t about occasional brilliance – it’s about consistent execution.— Shane Parrish (Farnam Street)

We finished the year slightly ahead of the S&P/TSX +21.7%, broadly in line with the DJIA (DJI) +24.8% and trailing the S&P500 (SP500,SPX) +35.7%.(2) It is worth mentioning that just five technology companies—NVIDIA (NVDA), Apple (AAPL), Amazon (AMZN), Meta (META), and Broadcom (AVGO)—accounted for almost half (46%) of the S&P500’s returns. Paraphrasing Frank Sinatra, we did it our way in 2024 by deliberately avoiding overpriced securities. We are mindful of risk and manage it by purchasing high-quality companies with a large margin of safety.

The current bull market and excitement about artificial intelligence, in particular, have led to high levels of risk- taking. A notable example of unleashed animal spirits is MicroStrategy (MSTR), whose business model relies on raising debt and equity capital to purchase Bitcoin (BTC-USD). Towards the end of the year, MSTR stock was trading at a 3x premium to the market value of Bitcoin on its balance sheet. We struggle to see how this won’t end badly for MSTR shareholders when risk appetites inevitably contract.

As valuations in the US markets have reached elevated levels, we increasingly find ourselves allocating our capital to more attractively priced businesses domiciled elsewhere. Since late 2023, our largest portfolio additions have been high-quality global businesses headquartered in Canada, France, Israel, Switzerland and the UK. Our portfolios will often be heavily US-weighted (that’s where most of the great companies are), but not always. We pivot to where we find value. We don’t follow benchmarks; we follow opportunity.

We remain agnostic to where our holdings are domiciled, provided that the country respects the rule of law and shareholder rights (a.k.a. “ the West”). It is also worth mentioning that all but one of these latest additions to our portfolios derive their revenues from a global customer base, with minimal reliance on their domestic economies.

Our approach of investing globally provides GreensKeeper with an advantage as we can opportunistically hunt for value when local markets sell-off. For reference, the MSCI Europe index currently trades at a forward P/E ratio of 13.2x compared to the S&P500, which trades at a forward P/E of 23.4x. We spend most of our time hunting in places where stocks are cheap.

Portfolio Update

The top contributors to the Value Fund in 2024 were American Express (AXP) +58%, Alphabet (GOOG,GOOGL) +35%, Berkshire Hathaway (BRK.A, BRK.B) +27%, Fiserv (FI)+55%, and Visa (V) +21%. As we have discussed these positions at length throughout 2024, we will focus our commentary on a few recent investments that made a meaningful contribution to our portfolio in Q4.

Our largest contributor to portfolio returns in Q4 was Automatic Bank Services (OTCPK:ABANF, SHVA) +59%. We initiated our investment in SHVA in August 2023 and haven’t previously disclosed it as we were waiting patiently for an opportunity to increase our holdings, which we did in Q3 2024. SHVA operates Israel’s local payment network, following a business model similar to portfolio stalwart Visa (V). SHVA holds a monopoly position in the Israeli credit card market, powered by a strong network effect of merchants and consumers transacting via SHVA’s systems. The Bank of Israel has previously encouraged Visa and Mastercard (MA) to enter the Israeli market. However, SHVA’s entrenched position is challenging to disrupt. Ultimately, Visa and Mastercard both chose to invest in SHVA instead, each holding a 10% stake (the maximum permitted by regulation).

Like Visa and Mastercard, SHVA’s scale leads to exceptional unit economics as additional transactions flow through their network at near-zero incremental cost. It’s an amazing business. However, a few recent challenges provided us with the opportunity to invest at an attractive price. First, SHVA was forced by Israeli regulators to separate from its sister company (inter-bank settlements operator Masab) in 2021. The separation resulted in increased overheads, additional capital spending on technology and increased headcount. The separation costs temporarily reduced SHVA’s margins, leading to a stock price decline as we started a position in the company. As we anticipated, the company raised its prices to compensate for its increased operating costs.

Fast forward two years, and more bad news arrived in the form of the 2023 Israel-Hamas war. The conflict resulted in lower transaction volumes across SHVA’s card network, putting temporary pressure on SHVA’s revenues and profits. However, with the company’s $47 million cash balance (no debt) and highly profitable business model, there was no question that SHVA would weather these challenges. We used the second sell-off as an opportunity to increase our position in September 2024.

Israel’s economy is gradually returning to growth, and SHVA’s revenues and profits are reaching all-time highs. Following a strong Q3 report, the market finally took notice of the company’s earnings power, and the stock re-rated and is now closing in on our estimate of its intrinsic value. We suspect SHVA will continue to compound at attractive rates in the years ahead. We thank fellow VALUEXer Shmuel Goldberg for bringing this gem of a company to our attention.

Recent portfolio addition, Lululemon Athletica (LULU) +45% was the second largest contributor to the Value Fund in Q4. As many fellow Canadians know, LULU has built an incredible brand by selling high-quality athleisure apparel. From its humble beginnings as a niche brand targeting Canadian yoga enthusiasts, LULU has expanded to selling a broad range of functional apparel across the United States, Europe, and Asia while adapting to fit local cultures.

LULU has consistently gained market share in North America, growing from less than a 3% share in 2017 to a 6.3% share in 2024 – second to only Nike (NKE). This growth has come remarkably efficiently, with returns on invested capital averaging 51% over the past 10 years. The company controls the customer experience by owning its retail stores (wholesale represents less than 10% of sales). At $1,608 in sales per square foot in 2023, LULU sits atop the rankings for real estate productivity across apparel retailers in the US. Owning distribution also allows the company to manage the brand and avoid discounting.

After a weak summer season driven by self-inflicted assortment missteps and a challenged US consumer, investors believed LULU’s best days were behind it as the stock declined 54% from its December 2023 peak. After a deep dive into the company, we came to a different view. With ample room to expand across Asia and Europe (markets that are as profitable as North America), the company should be able to increase its store count for years to come. Additionally, brand awareness remains low in the US at 31%. As LULU continues to improve its product breadth and menswear penetration (currently 23% of sales), we expect same-store sales to trend upwards. We thought the stock offered us many ways to win, and we initiated a position at the start of October at $264. Following a strong Q3 report, the stock quickly re-rated and now trades at $395.

While the quick +50% gain and adding another Canadian-domiciled company to the portfolio are great, what gets us really excited is our view that the intrinsic value of LULU’s business should continue to grow at an attractive rate for many years. Adding a quality compounder to the portfolio at an attractive entry price is difficult and something we consistently strive to achieve.

We weren’t perfect in 2024, and Elevance Health (ELV) -22% was our worst performer. The American healthcare insurer struggled during the third quarter as the industry grappled with healthcare costs rising significantly above historic levels. On the government side of the business (Medicaid, Medicare Advantage), reimbursement rates are typically set annually based on prior-year data. In periods of sharp cost increases, insurers’ margins suffer due to the time lag before reimbursement rates are adjusted to reflect the new environment. ELV is working with government agencies to match costs with rates, though this will likely take another three to six months to materialize. ELV’s commercial segment, which generates the bulk of the company’s insurance profits, continues to grow revenues with margins comparable to historical averages. ELV has proven it can adapt to changing government regimes, and we believe it will continue to do so with the incoming Trump administration. We are comfortable with our position and feel the market is significantly undervaluing ELV compared with our assessment of the business’s intrinsic value.

Another laggard for the year was Hershey Company (HSY) -12%. We purchased HSY in May after the stock came under pressure due to a historic rise in cocoa prices. Cocoa futures surged nearly 300% earlier this year as poor weather conditions and disease outbreaks in West Africa led to significantly reduced harvests. Commodity prices typically revert to the mean over time as farmers respond to high prices by increasing supply. However, increased regulations in Europe and Africa have left farmers hesitant to plant additional cocoa trees, keeping prices elevated. While the supply shock is lasting longer than we initially anticipated, we believe HSY will weather the storm better than competitors who face the same rise in input costs. Putting a stronger emphasis on products with lower cocoa inputs (e.g., Reese’s, Dot’s, Twizzlers) and raising prices are a few levers the company can pull. HSY leads the US chocolate aisle with a 36% market share and has been consistently gaining share over the past decade. With a pristine balance sheet and a strong management team, we believe HSY will maintain its leadership position as it waits for supply costs to normalize.

Overall, 2024 was another strong year for the Value Fund. We added three new companies to the portfolio: LULU, a starter position in luxury giant LVMH Moët Hennessy Louis Vuitton (MC.PA/LVMU) and HSY. We fully exited Cisco Systems (CSCO) as we thought the company was fully valued and were finding more attractive opportunities for our capital.

The Value Fund finished the year +23.6% (net) with a 1.5% net cash position and $33M of unrealized gains on its $64M of equity investments. Our average portfolio turnover for the past 5 years has been 11.8%, which implies an average holding period of 8.5 years. One of the benefits of our low-turnover portfolio and long-term approach is its tax efficiency. Once again, we were able to shelter all taxable income within the Value Fund in 2024. As a result, there was no year-end distribution and no tax payable by Value Fund clients.

Additional portfolio disclosures, including performance statistics, can be found on the pages immediately following this letter. Upon completion of MNP’s audit of the Value Fund’s financial statements in March, we will provide clients with a more detailed snapshot of the portfolio at year-end. Please see below for our top 10 holdings at year’s end.

GreensKeeper Value Fund Top 10 Holdings* and Sector

|

* As of December 31, 2024. The Value Fund’s holdings are subject to change and are not recommendations to buy or sell any security. |

The Sure Path to Riches

The ancient Romans had this wonderful adage: Festina lente (Make haste slowly).

The difference between long-term greatness and mediocrity isn’t in the spectacular moments. Yes, they help. But most of the freight is carried by consistent execution and avoiding critical errors.(3) Large and permanent losses impacting one’s portfolio put you on the wrong side of the power of compounding and are to be avoided at all costs.

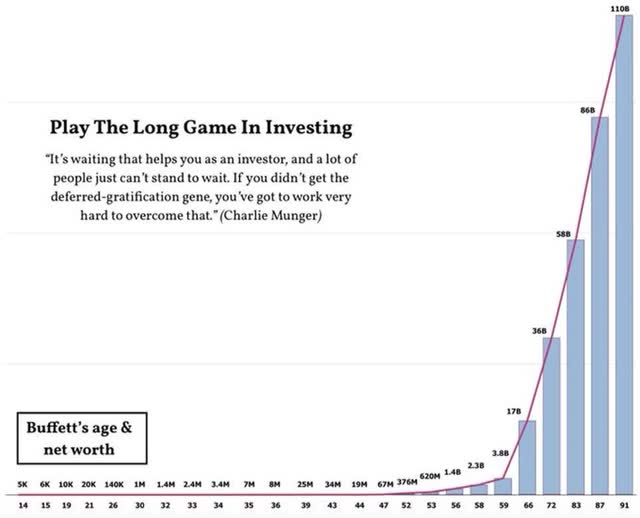

The formula for getting rich over time is clear and available to almost anyone! Use debt sparingly. Consistently spend less than you earn, invest the difference prudently and let time and compounding work their magic. But deferred gratification is hard, as demonstrated by the Stanford Marshmallow Experiment. As Shane Parrish said on a recent podcast, many people can’t help themselves and ask for trouble when they try to rush things.(4) Instead of following the sure path, we seek a life hack in today’s modern world of social media and short attention spans. Speculative assets like Bitcoin are a prime example.

I can’t recall the source, but someone once remarked that the real money is in the tail. This means that the power of compounding can lead to mind-blowing results in our later years. Despite being educated in mathematics and finance, I still find myself occasionally surprised about how capital compounds. The human mind has evolved for linear thinking and struggles with power laws. Charts can help:

As you can see, Buffett accumulated almost all his net worth after age 60! Even more remarkable is that these mind- blowing figures don’t include his donations to various charities over the years. By our math, his original holdings in Berkshire Hathaway (BRK.A) alone would be worth over $315 billion. Remarkable.

If you’re looking to make a financial New Year’s resolution, here’s one to try: Avoid the tempting siren call of speculative assets that are hot at the moment and instead invest prudently in cash-flow-generating businesses with sustainable competitive advantages (moats) that position them to grow their earnings over time. It may sound simple, but as the Stanford Marshmallow Test shows, deferred gratification is not easy for our species.

P.S. The same compounding formula works with knowledge. Keep investing in yourself!

Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Step by step, you get ahead, but not necessarily in fast spurts. But you build discipline by preparing for fast spurts. Slug it out one inch at a time, day by day, and at the end of the day — if you live long enough — like most people, you will get out of life what you deserve.— Charlie Munger

Q4 Zoom Town Hall and Annual Report

On February 19 at 7:00 p.m., we are adding a new event to our annual calendar: a Zoom video Town Hall where we will discuss last year’s results, our view of the current market environment and other investment-related topics. Michael Van Loon and I will highlight a few of our investments and take questions from the audience. We would also welcome any suggestions for topics you would like us to address on the call or questions you have. Feel free to email me directly at michael@greenskeeper.ca with your thoughts.

Clients and friends of the firm are welcome to attend, and we encourage you to invite others who may be interested in learning more about how we invest at GreensKeeper. For non-clients, please email Michelle Tait at michelle@greenskeeper.ca to request an invitation with all the details.

Upon completion of MNP’s annual audit of the Value Fund in March, clients will receive a copy of the Annual Report, which includes the details of the entire portfolio and the audited financial statements.

I think it is important to remind readers that GreensKeeper’s employees have their entire portfolio invested alongside the firm’s clients (in my case, it’s the bulk of my net worth). Perhaps you would like to join our growing client base. If so, please give me a call.

It has been another great year. Thank you for the opportunity to grow your wealth alongside our own.

Happy New Year!

Michael P. McCloskey | President, Founder & Chief Investment Officer