Goldman Sachs BDC: 12% Yield And Re-Rating Potential (NYSE:GSBD)

JayLazarin

Goldman Sachs BDC, Inc. (NYSE:GSBD) has enjoyed a nice surge of new investment commitments in the first quarter that is poised to lead to higher net investment income in the future.

Furthermore, the business development company comfortably covered its dividend payout of $0.45 per share per quarter with net investment income and the portfolio kept performing well.

Goldman Sachs BDC’s low non-accrual ratio, strong excess dividend coverage and moderate valuation help make a solid value proposition for passive income investors.

I view Goldman Sachs BDC as undervalued and think that the BDC could sell for a 1.10-1.15x net asset value premium if the company’s credit quality does not deteriorate.

My Rating History

Goldman Sachs BDC received a Hold stock classification from me last time I reviewed the business development company due to its robust dividend coverage and solid interest income growth.

Taking into account that the BDC has seen a substantial increase in gross originations (which is poised to lead to portfolio income growth), portfolio quality looks good with a non-accrual ratio of only 1.6% and that persistent inflation might further delay rate cuts, I think that a ‘Buy’ rating is justifiable.

Portfolio Review

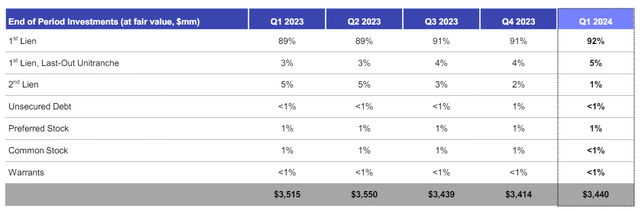

Goldman Sachs BDC’s portfolio remained heavily invested in First and Second Liens, which makes the BDC one of the most heavily First Lien-concentrated business development companies that I have covered in recent years.

First Liens and Second accounted for 98% of the company’s $3.95 billion investment portfolio as of March 31, 2024. Goldman Sachs BDC also remained heavily invested in floating-rate loans (99.4%) which could set the company up for interest income growth if the central bank avoids cutting short-term interest rates in 2024.

End Of Period Investments (Goldman Sachs BDC)

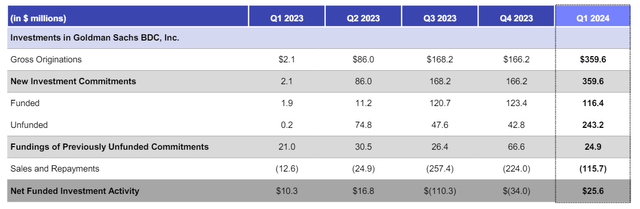

Goldman Sachs BDC originated $359.6 million in new investments in the first quarter, up 116% YoY, thanks to strong demand from the BDC’s portfolio companies. As a consequence, Goldman Sachs BDC had its first quarter of positive net funded investment activity since 2Q23.

Net Funded Investment Activity (Goldman Sachs BDC)

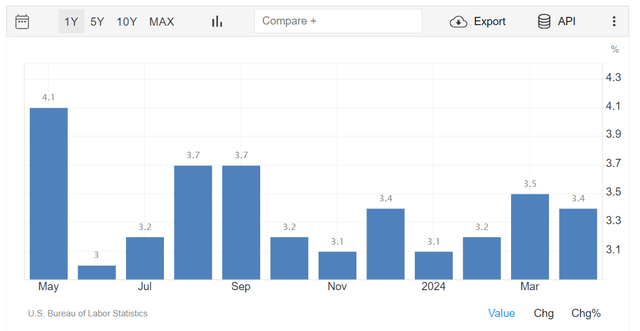

A driver of GSBD’s income growth in 2024 could be the central bank, if it continues to abstain from interest rate cuts. Inflation eased a bit in April, with consumer prices rising 3.4% compared to 3.5% in the prior month, but the decline in inflation is probably not significant enough to push the central bank over the rate-cutting edge.

Thus, the central bank may stick to its current policy of doing nothing, which in turn could benefit Goldman Sachs BDC’s floating-rate investment portfolio.

Inflation (U.S. Bureau Of Labor Statistics)

Dividend Coverage Is Still Looking Very Good

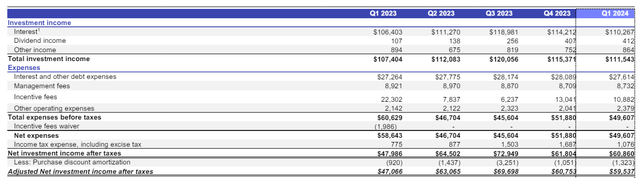

Goldman Sachs BDC’s interest income is still growing, thanks to the company’s aggressive floating-rate posture that continues to pay big dividends. GSBD earned $110.3 million in interest income in 1Q24, up 4% YoY. Its adjusted net investment income increased even more (26% YoY) to $59.5 million, primarily because of lower incentive fees.

Adjusted Net Investment Income (Goldman Sachs BDC)

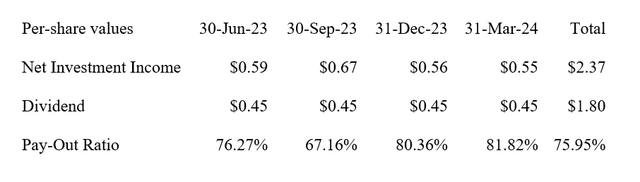

Goldman Sachs BDC continues to represent strong value of our passive income investors looking for recurring income based on a dividend coverage perspective.

The business development company earned $0.55 per share in net investment income in the first quarter, which translates into a dividend pay-out ratio of just 82%, reflecting a 1.44 percentage point decline in coverage QoQ.

With that said, though, due to Goldman Sachs BDC funneling previous repayments back into new investment commitments, the company’s net investment income could be set for a rise in the near term.

Dividend (Author Created Table Using BDC Information)

What Valuation Is Appropriate For BDC

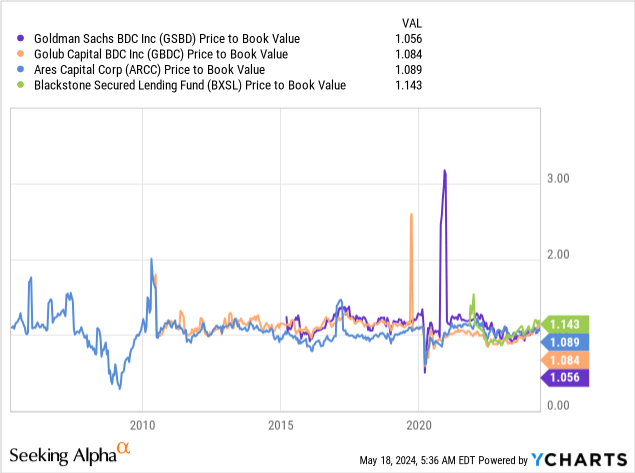

I have long maintained that high quality business development companies with good dividend coverage (80% or lower in terms of pay-out ratio) and growth in originations are deserving of a premium valuation.

Goldman Sachs BDC is presently valued at a 6% premium to net asset value, which could potentially expand to 1.10-1.15% when taking into account the strength of originations, the explicit focus on First Liens as well as the BDC’s considerable excess dividend coverage.

The BDC reported a net asset value of $14.55 as of December 31, 2023 which thus equates to an intrinsic value range of $16.00-16.73. With the stock presently selling for $15.36, I think that not only is the 12% dividend yield sustainable, but that passive income investors have an opportunity here to also earn capital appreciation.

Peer BDCs with high floating-rate investment percentages and First Lien-focuses, like Golub Capital BDC, Inc. (GBDC), Ares Capital Corporation (ARCC) and Blackstone Secured Lending (BXSL) all sell for higher net asset value multiples.

What Risks Must Passive Income Investors Consider

I do see a risk with regard to the business development company’s large floating-rate exposure, which has driven net investment income gains in the last two years when the central bank aggressively pushed short-term interest rates up to counteract skyrocketing inflation.

A moderation of inflation is the single biggest excuse for the central bank to slash interest rates, which would then likely have a detrimental effect on Goldman Sachs BDC’s net investment income growth, particularly since the BDC is aggressively positioned toward floating-rate investments.

This is presently not the case as inflation has proven to persistently hold up over 3%, but any change in the inflation trend to the downside could make rate cuts much more probable.

My Conclusion

Goldman Sachs BDC is a well-managed business development company that maintained an aggressive floating-rate posture in the first quarter.

The BDC saw a considerable increase in new investment commitments in 1Q24 which is poised to lead to higher net investment income in the future which potentially could improve the BDC’s dividend coverage situation.

The present dividend coverage profile is already good, so I don’t see the dividend at risk, particularly not with the BDC seeing such an origination boost in the first quarter.

Goldman Sachs BDC is deserving of a higher NAV multiple when taking into account the growth in originations and net investment income. Thus, I am modifying my stock classification from ‘Hold’ to ‘Buy’.