Federal Realty Investment: The Opportunity Is Still There After Q1, 2024 (NYSE:FRT)

Feverpitched

Early April this year I wrote an article on Federal Realty Investment Trust (NYSE:NYSE:FRT) – Federal Realty Investment: Attractive Moment To Enter This Dividend King. As the name implies, my recommendation was to enter FRT. While more details can be found in the article, the key reasons for this were the following:

- Depressed multiples relative to the historical level.

- Narrowed premium relative to closest peers such as Realty Income Corporation (NYSE:O) and Agree Realty Corporation (NYSE:ADC).

- One of the lowest FFO payout levels in the industry, which should enable enhanced growth prospects (price and income wise).

- Relatively attractive yield, which is not that common given the investment grade balance sheet, conservative FFO payout level and inherently defensive business.

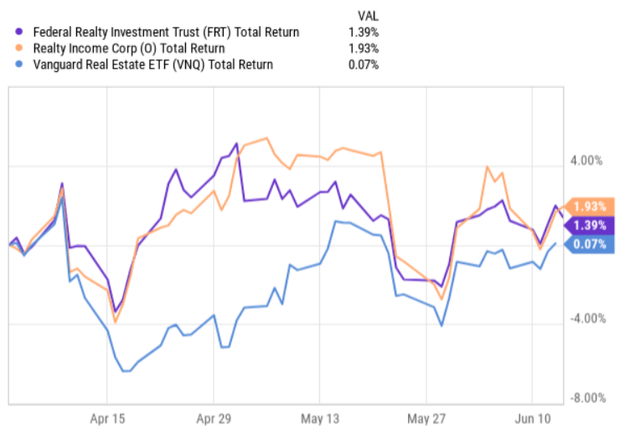

Since the publication of the article, FRT has delivered positive returns slightly outperforming the broader REIT market. Yet, all in all, the share price movement has been insignificant implying that the opportunity is likely still there.

Some time ago, but after the issuance of my article, FRT circulated Q1, 2024 earnings deck, which did not cause any major share price reaction.

Let’s now review the details of this earnings release and try to understand whether there are any meaningful data points that could potentially justify a revised rating.

Thesis review

The quarterly report come in strong with the key metric – FFO per share – increasing 3.1% relative to the level that was recorded back in Q1, 2023. This has happened despite the challenging financing markets, where each refinancing bring higher interest expense, which, in turn, puts a downward pressure on the FFO generation.

A major driver behind the higher FFO was the strong dynamics at the property operating income end, which was up by 5.6%. In terms of the property segments, the residential portfolio was the one, which delivered the strongest same store growth – just above 6%. The same-center growth on the retail end landed at 3.8%, which is also not that bad and a clear indicative of a resilient demand for FRT’s retail properties.

In the context of the retail segment, it is also worth mentioning that the lease rollovers made during Q1 have enabled FRT to charge higher rents (by circa 9%). In this respect, the management succeeded in growing the occupancy level by roughly 70 basis points in the shop and retail space. As of Q1, 2024, the relevant occupancy metric landed at 91.4%, indicating that there is still a room for upside potential. As a result of this and favorable momentum in other FRT business / property segments, the anchored lease percentage ended at 95.8%, where according to the management there is another 200 basis points to be realized over the foreseeable future.

In the recent earnings call Donald Wood – Chief Executive Officer – gave an additional color here supporting the thesis of experiencing positive boost to FFO from the stronger occupancy levels:

Those two components combined at 94.3% leased overall, pretty strong, but as we’re demonstrating room to grow. We take a very proactive approach to leasing and often lease space well in advance of an existing lease expiration or vacancy, all in the name of improved tenant health and merchandising mix and as an insurance policy towards potential gaps in future cash flow. We’ve got some impactful anchor renewals coming up later this year and early next that should continue the positive trajectory.

During the Q1, FRT conducted 104 retail lease deals that together were written at 9% higher cash basis rent than the final year of the previous tenant or 20% on a straight-line basis. Yet, the most critical thing in this context was the stipulated cash rent bumps, which are definitely one of the highest in the retail REIT space. The contractual rent bumps for the deals negotiated in the first quarter landed at 2.3%, which also boosts the weighted average contractual rent bumps for the entire retail portfolio higher to circa 2.25%. This is very important to appreciate since having an embedded rent escalator at this level really helps FRT grow the business in an organic fashion.

Plus, what was very interesting during the Q1, was FRT’s M&A activity, where FRT has assumed more ambitious steps in the inorganic growth front.

Donald Wood confirmed here as well that FRT sees an enhanced opportunity set in the M&A space, which will likely keep the FFO growth component strong:

It’s an interesting and unique time in the acquisition marketplace right now. While there is a limited supply of Federal Realty type opportunities out there, there’s also less viable competition for those centers than there has been historically.

Now, the key advantage of FRT is its balance sheet in combination with conservative FFO payout ratio that allows to make these M&A transacations by using sizeable amounts of internal cash generation and cheap debt without sacrificing the overall capital structure.

Speaking of the balance sheet, during Q1 FRT carried out relatively notable refinancings at an amount of $485 million (3.25% exchangeable notes offering). After this, there are no major maturities remaining until 2026, which will allow the top-line to more directly feed into the FFO generation without being offset by rising interest expense component.

Finally, as a result of the aforementioned dynamics and strong momentum in the underlying business, the management tightened and increased the 2024 FFO guidance by 5% (midpoint rate of change basis). Furthemore, the comparable growth outlook was also lifted higher from 2% to 3.5%.

The risks

If we look at the potential risks to my bull thesis of FRT, then we have to appreciate the following aspects.

First, even though there are no material debt maturities until 2026, if the interest rates really remain higher for longer, FRT will have to inevitably experience a downward pressure on its FFO generation once these refinancings start to kick in. Yet, this aspect is based on macro dynamics, which are hard to predict and, in my opinion, should not serve as a basis for avoid the investment now, especially if the strategy is to capture decent and growing dividends.

Second, as of Q1, 2024 roughly 77% of FRT’s exposure came from retail property segment, which is inherently more sensitive to the economic dynamics and is fully exposed to the pressures coming from the e-commerce end. Yet again, if we peel back the onion a bit, we will notice that the retail factor for FRT is de-risked through the following components: Top 10 tenants all have investment grade balance sheet, close to 80% of the retail properties are grocery anchor based, and, most importantly, these properties are subject to best-in class demographics in terms of the household per square mile and median income levels.

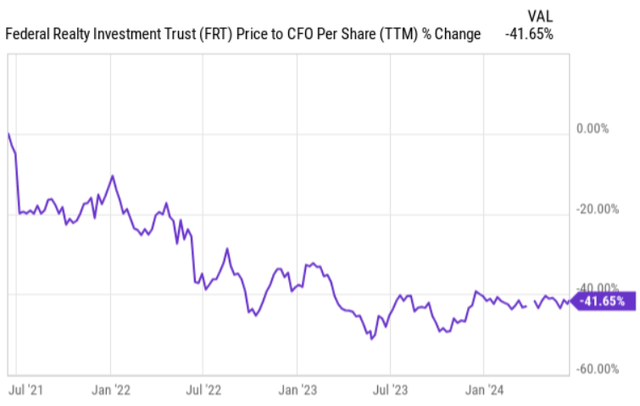

Third, the valuation aspect could be considered a potential risk that keeps FRT’s share price muted on a go forward basis. For example, currently FRT trades at P/FFO of 15x, which implies a premium of 11% to the relevant sector average. However, here I would like to emphasize a couple of things. By looking at the chart below, we can see that the current multiple is trading ~40% below the level, where it was 3 years ago before the Fed initiated its restrictive monetary policy. Granted, the reason why the multiple has contracted is justified and the same dynamics have also been relevant for other peers, but the fact is that in a scenario of declining interest rates, there is definitely an embedded potential to capture juicy returns from the multiple expansion.

Another point of consideration is that the premium of 11% really is not that high if we factor in some of the key advantages of FRT. For example, FRT’s debt to EBITDA level is circa 21% below the sector average, while the dividend yield is almost in line with the sector average of 4.35%. Also, on the FFO growth front, the consensus estimate for 2024 – 2025 period is 70 basis points above of what the market has assumed for the sector peers.

All in all, I would not agree that FRT is overvalued relative to the other choices in the sector. At the same time, I would agree that FRT is not the right pick for extracting sizeable returns from the price appreciation. Instead, it should be treated as a sustainable dividend king, which embodies the necessary characteristics to keep the dividend growing, while gradually stimulating a growth in the share price mainly through enticing rent escalators and ample FFO retention.

The bottom line

Since the moment when I published my article on FRT, the stock price has remained more or less flat, while the core fundamentals have improved. During the Q1, FRT managed to grow the FFO per share by ~3% despite the fact that a notable chunk of debt was refinanced at slightly higher interest rates, which introduced some headwinds on the bottom line. Otherwise, FRT continued to register sound like for like growth, further expansion in the occupancy levels and very favorable leasings spreads in combination with stipulating one of the highest cash rent bumps.

On a go forward basis, the FFO growth should be strong given the back-end loaded debt maturity profile, significant cash rent bumps, improved occupancy levels and positive boost from the M&A.

In my opinion, Federal Realty Investment Trust is still a buy with even improved growth prospects from here.