Earn An ‘Embarrassing’ Amount Of Cash Flow From These Contrarian Picks

MarsBars

A recent article highlighted keys to success for Amazon (AMZN) CEO, Andy Jassy, in which he attributed the following points to an ’embarrassing’ amount of success. Specifically, he remarked on the following points in which a career professional should be able to confidently answer ‘yes’ to:

- Do you work hard?

- Are you more can-do than naysaying?

- Do you do what you said you were going to do?

- Can you work in a team?

These are all admirable traits and while they don’t translate in the same to success in the investment world, I believe answering ‘yes’ to the following questions can be attributed to an ’embarrassing’ amount of cash flow for income investors.

- Is the stock trading at a reasonably low valuation compared to history, peers, and the market?

- Does the stock have a long history of paying dividends?

- Is the dividend well-covered?

- Does the company have a safe leverage profile?

The above characteristics can be good guiding principles for investors as they navigate choppy market waters. Specifically, the first point relates to what’s considered to be ‘Contrarian Investing’, by which investors go against the prevailing market trends. Stocks and sectors go in and out of favor from time to time, and investors can take advantage of negative market sentiment by buying quality companies at discounted (sometimes heavily) prices.

In this article, I explore contrarian and undervalued ideas in various sectors that throw off way above market average yields that could generate an ever-growing stream of income in for investors, so let’s get started!

High Income Opportunities Abound

Some of the most obvious high-yielding opportunities revolve around REITs, which have been beaten down in price over the past 12+ months, as the market has digested and accepted the notion that interest rates will remain higher for longer.

High-yield savings accounts and bonds result in competition for perceived slowing-growing REITs, which are sometimes regarded as being ‘bond proxies.’ The investment rationale for Treasury Bonds is that they are ‘risk-free’ compared with a guarantee of principal protection over riskier equity investments.

With beat down in price, net lease REITs like Realty Income Corp. (O), NNN REIT (NNN) and W. P. Carey (WPC) are now yielding well in excess of their historical norms, with yields ranging from 5% to 6%, and they are also trading at P/FFO valuations in the 11.9x to 12.6x range, sitting well below their P/FFO valuations in the 15 to 20x range before the Federal Reserve began hiking rates in 2022.

While higher rates do result in higher cost of debt for net lease REITs, it’s worth bearing in mind that cap rates on new acquisitions have also risen. In fact, WPC’s CEO recently noted that bid-ask spreads have narrowed this year, creating more attractive investment opportunities when it comes to sourcing acquisitions from private sellers.

This is reflected by its weighted average 7.4% going-in cash cap rates on acquisitions that WPC has seen so far this year, and Realty Income is not far behind with 7.3% initial cap rates on their acquisitions.

At the same time, high quality REITs have strong balance sheets as reflected by A- and BBB+ credit ratings for Realty Income, NNN REIT, and W.P. Carey, respectively. This results in an attractive cost of debt relative to higher leveraged players. In fact, W.P. Carey was able to issue Euro bonds this year at 150 basis points lower than what it’s able to get in the U.S., and Realty Income is seeing strong investment spreads of 340 bps over this cost of capital, which is well above its historical spread of 150 bps.

Plus, with dividend payout ratios ranging from 69% for NNN to 74% for Realty Income, and 76% for WPC, these REITs retain plenty of retained income after the dividend with which they can use to fund external growth without the need to excessively tap public markets.

As a bonus kicker with respect to REITs, I also like Rexford Industrial (REXR) which presents a higher growth alternative compared to net lease REITs which are locked into long-term contracts ranging from 10-12 years (with around 2% annual rent escalators).

Industrial REITs like Rexford Industrial carry shorter term leases, thereby enabling them to set higher rental rates to match local market inflationary trends. Rexford Industrial is focused on the supply constrained Southern California market, and this is reflected by the 34% cash rent spread on new and renewal leases that it saw during the first quarter.

While REXR yields ‘just’ 3.4% at present, it’s expected to grow the dividend at a higher rate compared to net lease REITs for the above-mentioned reason. At a P/FFO of 19.2, it trades well below its historical P/FFO of 28.3, as shown below.

REXR’s 19.2 P/FFO valuation also compares favorably to peer Prologis’ (PLD) P/FFO of 20.3, despite REXR having higher projected annual FFO/share growth in the 8-15% range over the next 2 years, comparing favorably to PLD’s -3% to 10% FFO/share growth over the same time frame. While PLD is also worth owning for its higher diversification, REXR appears to be the slightly better buy at this time.

Opportunities In Energy

Energy Stocks have been net winners over the past 3 years as oil prices have greatly rebounded since reaching lows in 2020. In fact, since the Dow index dumped Exxon Mobil (XOM) in 2020, the stock has tripled in price, whereas Salesforce (CRM), which replaced XOM in the Dow, is down by 16%, with much of the downturn being a result of lackluster Q1 2024 results and outlook.

With a 23.7x forward PE and 0.17% dividend yield, CRM remains far pricier compared to XOM, which carries a much lower forward PE of 12.8 and a 3.2% dividend yield. Alternatively, Chevron (CVX) sports the same PE ratio of 12.8 and carries a higher dividend yield of 4.0%. However, I prefer XOM out of the 2 as names as CVX carries with it the overhang of the Hess (HES) deal, as XOM has challenged the merits of the CVX and HES tie-up on its right of first refusal on HES’s stake in Guyana.

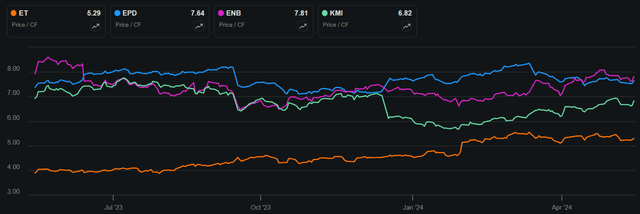

Investors who prefer a higher yield may want to consider midstream energy companies like Enterprise Products Partners (EPD), Enbridge (ENB), Energy Transfer (ET), and Kinder Morgan (KMI), which focus on natural gas. These names sport higher yields than XOM and CVX and offer higher cash flow stability due to their largely contracted and/or fee-based revenue streams.

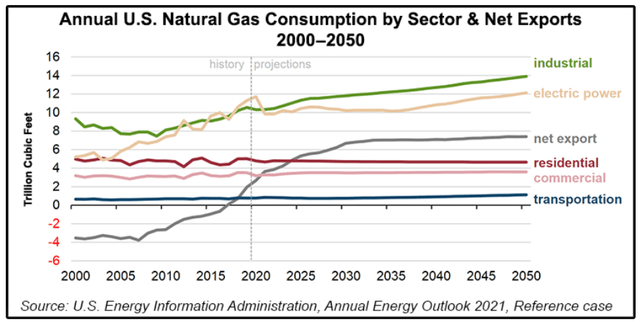

The aforementioned midstream companies currently offer 6-8% dividend yields (or distribution yields in the case of EPD and ET, which issue Schedule K-1s) with the support of mission-critical natural gas infrastructure that will be needed for decades. According to the Energy Information Administration, U.S. natural gas exports along with uses for industrial and electric power are expected to grow through the end of this decade and beyond and stay strong through at least 2050.

All of the aforementioned midstream names carry healthy balance sheets with credit ratings ranging from BBB for Energy Transfer to A- for Enterprise Products Partners, and they pay yields ranging from 7% to 8% that are well-covered by cash flows.

Energy Transfer and Kinder Morgan also appear to be the cheapest of the bunch, with Price-to-Cashflow of 5.3x and 6.8x, respectively. However, Enterprise Products Partners and Enbridge are not pricey, either, considering their moat-worthy asset bases.

EPD is set to benefit from its SPOT export terminal project that it’s developing, which would enable to load two supertankers at a single time, and which received a deep water port license in April of this year. ENB, meanwhile, is integrating its natural gas distribution facilities that were purchased from Dominion Energy (D) last year, and should see incremental cash flows from electric power demands on natural gas in the coming years and decades, as referenced by EIA earlier.

Opportunities In Healthcare

The pharmaceutical sector is filled with haves and have-nots, when it comes to weight loss drugs associated GLP-1. This is reflected by the very high valuations at which the leaders in this emerging class of drugs trade at, with Eli Lilly (LLY) and Novo Nordisk (NVO) trading at forward PEs of 60 and 39, respectively.

At the same time, other names like Bristol Myers Squibb (BMY) and Pfizer (PFE) have been left in the dust. BMY has a forward PE of just 5.7, based on management’s forward PE guidance for $7.25 at the midpoint of range for full-year 2024, and PFE has a forward PE of just 12.2 based on 2024 estimates, and analysts expect 16.7% EPS growth next year.

While both names have had to content with near-term issues such as the loss of exclusivity of Revlimid for BMY, and the decline in COVID vaccine sales for PFE, both continue to reinvent themselves as what pharmaceuticals have to do on a continual basis to stay relevant in an ever-changing healthcare landscape.

For BMY, this includes newer drugs like Reblozyl, Eliquis, and Opdualag that have picked up the slack for older ones like Revlimid, and a pipeline that includes development around a drug to treat Alzheimer’s, a disease that afflicts 7 million people in the U.S. alone.

In addition, BMY recently saw an encouraging FDA approval for the use of its blockbuster drug, Opdivo, to treat bladder cancer, and this could extend the useful life and revenue stream for this particular drug. Plus, BMY is working with SystImmune to develop a new class of cancer drugs called ADC, short for antibody drug conjugates, for the treatment of lung and bladder cancer.

Likewise, Pfizer is also reinventing itself with its acquisition of Seagen last year, which makes it a formidable player in the aforementioned class of ADC drugs to target cancer cells. ADC drugs are difficult to manufacture, requiring complex steps. This could mean that after PFE establishes expertise in this space, it could retain some pricing power even after loss of exclusivity due to the difficulty in replicating production.

Meanwhile, both BMY and PFE carry strong balance sheets with ‘A’ credit ratings from S&P. They also yield 5.8% (for BMY) to 5.9% (for PFE), with dividend payout ratios of 33% and 72%, respectively. I would expect for PFE’s payout ratio to trend down over time as it brings pipeline drugs to market.

Investor Takeaway

While we can’t all be as successful professionally as the Amazon CEO mentioned earlier in the article, there are multiple avenues for success that don’t have to follow a straight line. For investors, success can mean aligning smart purchases with guiding principles when it comes to undervalued stocks with quality business models, a respectable dividend yield that’s well-covered, and a strong balance sheet. With the aforementioned names exuding those traits, I believe investors could do well to buy into them at present for potentially high income streams and total returns for years to come.