Don’t Be Fooled By Baidu’s Discount, Cloud Wars And Geopolitical Jitters (BIDU)

zorazhuang

Baidu (NASDAQ:BIDU)’s core business has been stagnating for years and the iQIYI business, with its own idiosyncratic issues and lower margins, has not been able to move the needle. There are arguably strong tailwinds in the AI Cloud segment, which is currently caught in the middle of a price war among Chinese tech giants. In this article, I share my view on why it’s not time to jump in yet.

Increasingly Diversified

Baidu is a stock used to own in 2016-2018. It was unloved, it had a strong competitive position and potential growth options. I haven’t touched it since and think it’s a risky one to own here. The business has certainly decelerated sharply from the high-growth phase of 2005-2015, and the stock is 65% to 70% off its peak valuations in 2018 and 2021 despite USD EBT around all-time highs, reflecting lackluster growth expectations and increased risk premiums due to geopolitical tensions.

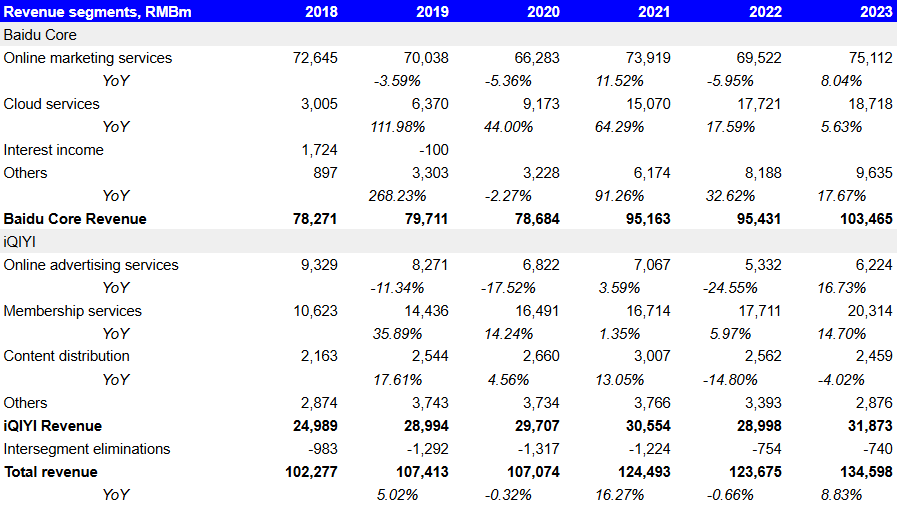

Despite diversification investments over the years, Baidu retains a core cyclical component of online marketing revenue that accounts for ~54% of total revenue and ~72% of Baidu Core revenue (which excludes iQIYI).

Baidu’s online marketing services include Baidu’s P4P platform, an online marketplace that introduces internet search users to customers, who pay a fee based on click-throughs for priority placement of their links in the search results. Baidu also offers feed online marketing services that help customers target relevant feed users, and performance-based and display-based online marketing services.

This segment is relatively mature and growing at 3% YoY as of Q1’24, below China’s reported GDP growth of 4.5%, but accounts for the lion share of Baidu’s reported profits. Besides online marketing, Baidu Core generates revenue from smart devices and services, non-marketing consumer-facing services and intelligent driving.

More specifically, Baidu’s mobile ecosystem includes a portfolio of over twelve apps, including Baidu App (a central hub for various services), ERNIE Bot (an AI assistant for PC and mobile offering multi-round conversations), Haokan (short-form video) and Baidu Post, an open platform aggregating diverse third-party content, facilitated by AI to connect and empower communities.

AI Cloud offers a full suite of cloud services (IaaS, PaaS, SaaS) for enterprises, public sectors, and individuals with AI-powered solutions.

Intelligent Driving & Other Growth Initiatives encompasses autonomous driving (Apollo Go ride-hailing), Baidu Apollo auto solutions, electric vehicles JV Jidu Auto with Geely, Xiaodu smart devices powered by DuerOS smart assistant, and AI chips.

With Legacy Business Stagnating, New Businesses Need Momentum

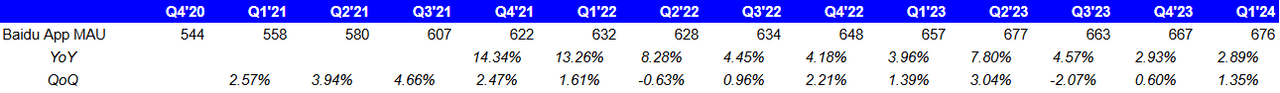

The core of this large segment remains the Baidu App, which has 667m MAUs as of Q1’24. The main driver of revenue is Managed Page, a hosted mobile alternative for website owners that accounts for ~51% of Baidu Core online marketing revenue. Despite being a relatively mature app with a very large penetration, it is still managing to grow MAUs at moderate rates (~3% YoY in Q1’24) but with a sharp deceleration in the past few years.

With flattening MAU trends, Baidu faces the difficult task of needing to drive a combination of increasing engagement and monetization to drive meaningful revenue growth in online marketing services, which doesn’t seem to be going anywhere, as online marketing services revenue is only marginally above 2018 levels and has experienced lots of volatility. Trends are even weaker in USD, given the volatile but weak trend in the yuan in the same period.

Company Filings, Author

What Baidu Core can rely on to generate revenue growth are Cloud services (~18% of Baidu Core) and the Others segment (~9% of Baidu Core), which is expanding mainly thanks to Self-Driving Services and Xiaodu smart devices and services.

Cloud Between AI Boost and Price Wars

Baidu has been leading the AI cloud market for a while but is potentially facing intensified competitive pressure. The Cloud services business had decelerated from the strong growth of 2018-2021 to a low of ~6% in 2023 (culminated in a decline in Q3’24) but is experiencing a potential re-acceleration (+11% in Q4’23 and +12% in Q1’24) helped by gen-AI and foundation models, which accounted for 6.9% of AI Cloud in Q1’24. As businesses need an AI infrastructure for model training, fine-tuning and AI-native app development in the cloud, demand for Baidu’s AI cloud offerings is likely to continue to expand. However, this sub-segment is still relatively small with annualized revenue of ~RMB 1.3bn as of Q1’24, meaning it should double sales to make a ~1% difference to Baidu’s total revenue. Based on management commentary, growth in Baidu’s Cloud AI could be margin-accretive as the group plans to phase out low-margin products and also expects normalized margins for Cloud AI to be higher than for the legacy businesses.

However, this might not be so easy. Competition among Chinese tech players has been intense across all segments and has often managed to hold down growth prospects and profitability of tech players otherwise exposed to strong tailwinds. Tech giants Tencent, Alibaba, Xiaomi, JD.com, Huawei, Kingsoft and Telecom, among others, compete in this space.

Alibaba Cloud started a price war in February, slashing prices by as much as 55% on over 100 core public cloud products. This has continued with new rounds of price cuts among Chinese tech players, including recent cuts by Bytedance, Alibaba, Tencent, JD.com and Baidu itself.

While growth in the space is potentially attractive, price wars are not what I want to see, especially if the segment is supposed to drive revenue growth and margin expansion for the group.

The Baidu Core segment was experiencing margin expansion throughout the 2020-2023 period, reaching a high of 26% in Q3’23 before starting to weaken, declining to 23.6% in Q1’24. Further pricing pressures in the growing Cloud segment don’t help margin expansion prospects and arguably leave potential for misses given consensus expectations of significant margin expansion in the next few years.

iQIYI – Changing KPIs and Idiosyncratic Challenges

iQIYI has a strong position in the Chinese market as the leading provider of online entertainment video services in the country. The platform has over 40,000 professionally produced titles and a diversified video library with drama series, movies, variety shows and other content. Despite its strong position, iQIYI has been reporting declining revenue as the Chinese video streaming market is taking a hit and deflating from the COVID era.

Revenue from advertising is growing 6% YoY as of Q4’24, while performance ads are growing double digits and content distribution revenue is growing at 27% YoY. The negative is that membership service revenue (~60% of revenue) is under pressure and declined 13% in Q1’24. The fact that the business will stop reporting quarterly average subscriber numbers and ARM (average revenue per membership) to focus on membership revenue might also be concerning in my view. ARM comes from six quarters of consecutive growth and the change in KPIs is generally a potential red flag as businesses rarely remove or change key KPIs when they are expected to improve. I think this is especially true for struggling businesses. There might be temporary factors behind the YoY weakness such as difficult comparisons with the previous year and the surge in travel and offline entertainment during the first Chinese New Year holiday post COVID pressuring online activities and revenues.

However, significant structural pressure from the growth of short-form and live-streaming video content remains. This is not a problem exclusive to iQIYI, as shown by Alibaba recently writing down $1.2bn off its own video streaming segment Youku after a lackluster performance. With TikTok facing increasing challenges and potential bans, there is a risk that its management might increasingly shift focus to the domestic Chinese market, further intensifying pressures on iQIYI and other SVOD players.

Valuation, Geopolitics and Downside Risk

Besides the core topics of intensifying competition and boost from AI, I think a key matter for BIDU not addressed enough is its largely misunderstood risk/profile.

Investors often tend to believe that low multiple businesses generally present less downside risk than those with higher multiples. This might be particularly wrong for Baidu and other US-listed Chinese names. Looking at Baidu’s multiple of 12x earnings, or the forward one at 10x FY’24 EPS, might suggest the downside is limited. The risks of an investment like Baidu in the current environment cannot be overemphasized. The tensions around Taiwan’s independence could escalate into a Chinese invasion. Although a rational analysis of cost and benefits might lead many to think this is unlikely, Russia’s invasion of Ukraine demonstrated these developments are difficult to predict and are not always based on logical arguments or good strategic thinking. The consequences are also often misunderstood. China would likely face sanctions and reduced involvement with its major trade partners (EU, United States, Japan, South Korea). More importantly, investors in Chinese instruments such as BIDU shares could see their investment wiped out should the Chinese government take actions against the Variable Interest Entity structure. While this risk has always been there with US-listed Chinese stocks like Baidu, it grows significantly together with geopolitical tensions.

When investors assess a potential investment in Baidu, they should always consider that there is a potential 100% downside case scenario that is not linked to Baidu’s financial trends, balance sheet, or overall fundamental performance. While investors often think that a low valuation protects the downside, this is not the case with Baidu and similar stocks.

There remains an upside scenario in case tensions fade quickly and lead to a repricing of the stock upward, which I believe is unlikely.

Conclusion

While Baidu’s core business has been stagnating for years and the iQIYI business faces its own idiosyncratic challenges, Cloud AI could have been a catalyst for growth thanks to the strong tailwinds but is caught in the middle of a price war among Chinese tech giants.

The risk/reward profile of an investment in BIDU remains largely misunderstood and is affected by the VIE structure and geopolitical risks. The low multiples don’t really provide an opportunity unless we expect swift improvements on the front of geopolitical risks or a reacceleration/margin expansion for the larger parts of the business.

I don’t think it’s time to jump in, but I will keep following BIDU and plan to update on my thinking around it.