DFIC: There’s A Better Alternative In DFAX (BATS:DFIC)

Klaus Vedfelt

I recently covered an ex U.S. equity ETF from Dimensional called Dimensional World ex U.S. Core Equity 2 ETF (DFAX). While researching that ETF, I came across a similar one from the same sponsor, the Dimensional International Core Equity 2 ETF (BATS:DFIC). The latter is about the same size as the former, but it looked like it had some advantages. After a much closer look, however, I still see DFAX as the superior fund, and this article should reveal why.

A Standalone Look Makes DFIC Look Attractive

Seen in isolation, DFIC’s characteristics certainly look attractive. Benchmarked against the MSCI World ex USA IMI Index (net div.), it offers a reasonable expense ratio of 0.23%. Normally, I wouldn’t worry about this particular cost because the total return is net of all expenses, so if the total return can outperform the market, I’m not one to nitpick over a few basis points. Of course, when you’re comparing it to another fund, that has to be factored in, but relative to the median ETF expense ratio of 0.49%, this is pretty inexpensive.

Another aspect I liked about the fund was its 2.41% dividend yield. Due to the fact that International funds haven’t been performing too well over the past year or more against the broader market, this is a crucial consideration. At the very least, I’d want to see a figure that amply complements the fund’s price return.

I also liked the ETF shares’ liquidity. With nearly a million shares changing hands daily, this is liquid enough if you want to initiate or even exit a relatively large position. Some investors don’t care about that because their portfolios are smaller, so it’s more of a consideration for institutional investors and high net worth individuals. I felt I should mention that because Seeking Alpha’s elite subscriber base has more than a few of those, judging by some of the comments I’ve read across a range of articles on diverse securities.

In addition, I liked the fact that the fund holds more than 4,000 international securities, giving it ample diversity across industries and countries. One thing I didn’t like is that much of the fund’s money is invested in Japan and the UK, both of which entered technical recessions in late 2023 but recently emerged with stronger numbers. In the UK, first-quarter GDP increased 0.6%, technically pulling it out of the recessionary zone, while Japan’s Recession Indicator is still considered to be at low levels after a recent revision. Both countries are of interest here because DFIC invests 36% – more than a third – of its cash in the stock of Japanese and British companies via ADRs.

While the UK seems to be in better shape, Japanese economist Yutaro Shimamura advises caution:

The probability has remained at a very low level, which might reflect the well-performed state of Japan’s economy. But, the future could be dismal depending on the path of the two indices below. First, shortages of skilled labor forces in construction and inflationary costs of materials have persisted even though the Total Floor Area of New Housing Construction Started in April had a positive contribution to the LCI. On the other hand, the latest investigation indicates the Consumer Confidence Index has already registered a negative contribution for May.

How Does DFIC Compare With DFAX?

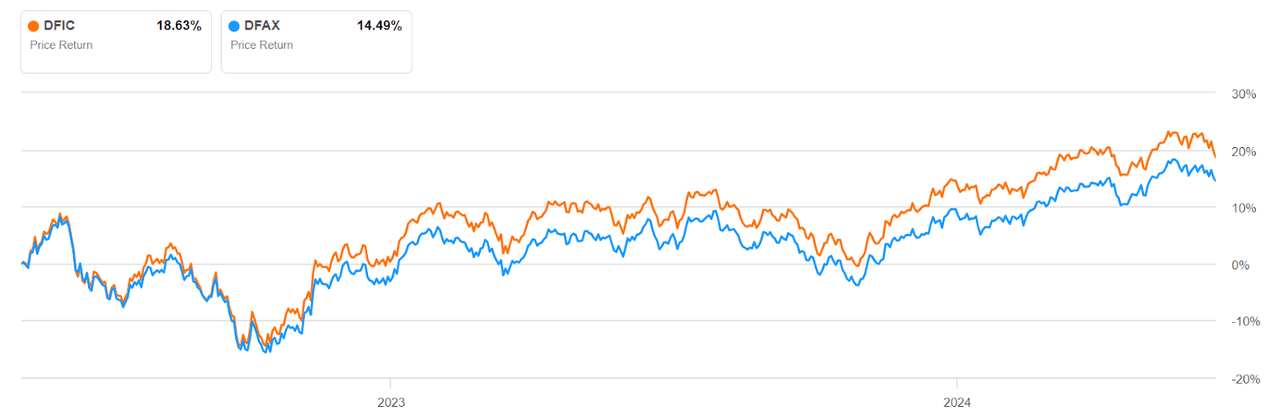

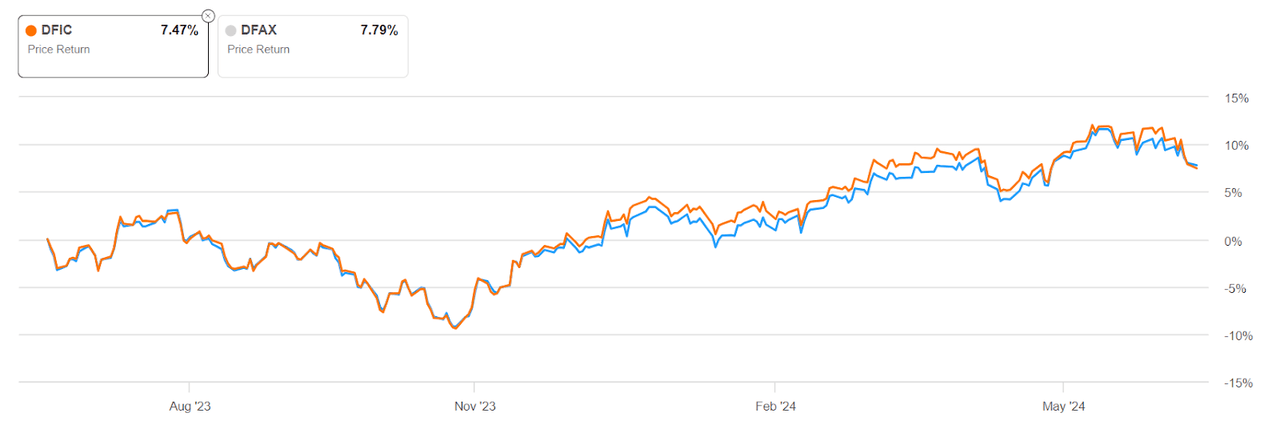

On the surface, DFIC looks like the better bet with its lower expense ratio against DFAX’s 0.28%, double the share liquidity, and a superior 2Y return of 18.63% against DFAX’s 14.49%. Comparatively, it would seem that DFIC would be preferred over DFAX. However, there are some important areas where DFAX seems like it will be more resilient if the U.S. economy should take a downturn.

The first point is DFAX’s diversification. Although it does invest heavily in both the UK as well as Japan, it invests less than 25% of its cash in companies domiciled there. As at the end of Q1, both funds reduced their Japanese holdings, but DFIC still has 22.6% invested in Japanese securities, while DFAX only has 16% exposure to that market. That translates to $1.4 billion for DFIC vs $1.1 billion for DFAX. That’s not a small difference, which is why I favor DFAX over DFIC on that point.

The second point is that DFIC holds about 4.4k stocks, while DFAX holds over 9.5k stocks. That diversification will serve you well if there’s global economic turmoil. But that’s not even the kicker. More importantly, DFIC doesn’t offer any exposure to emerging equity. This is something I discussed in my DFAX article, and it’s important for investors to have that hedge against developed economies tanking. Emerging economies tend to bounce back faster than more mature economies after economic recessions, which is why I suggested DFAX as being a sound hedging vehicle for U.S.-equity-heavy portfolios that currently rely on the broader U.S. market – or worse, are heavily weighted to tech megacaps.

That’s my thinking, but to be fair to DFIC, I should elaborate on the positive I briefly touched upon at the beginning of this section. First, I do see DFIC as the better performer in the current economic climate. That’s very likely due to the lack of EM exposure, but it has led to the fund outperforming DFAX by a significant margin over the past two years. However, if you zoom in to a one-year time frame, DFAX outperformed DFIC, albeit marginally. Here are graphs of the two timelines under consideration.

SA

SA

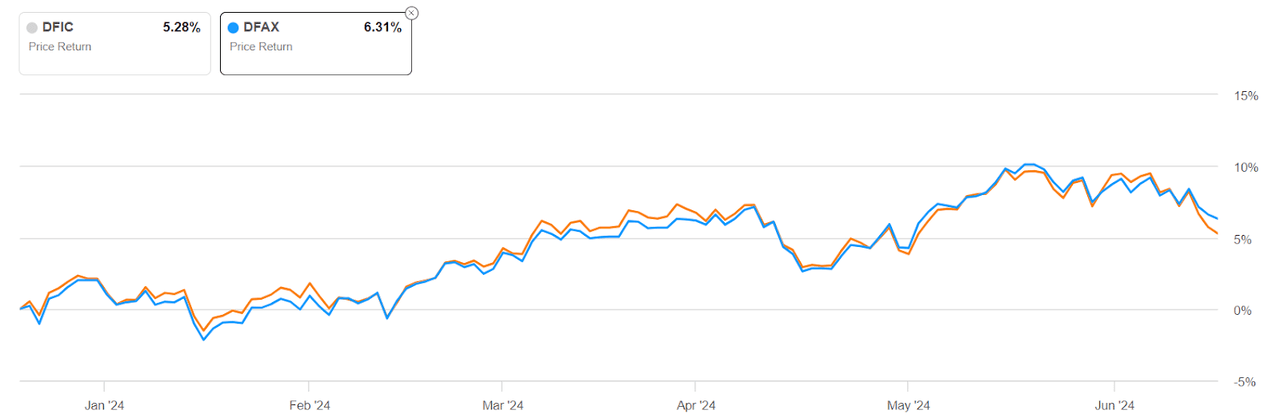

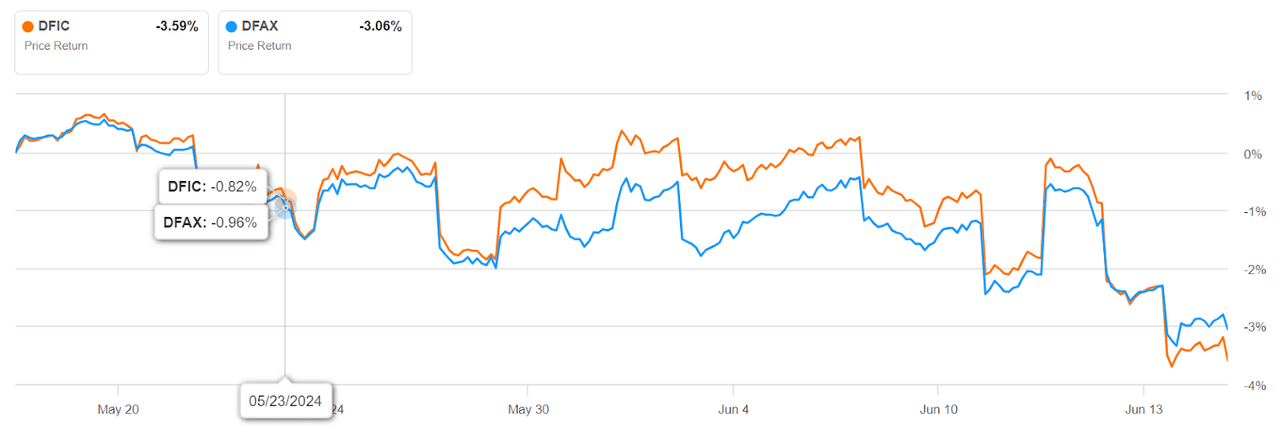

Zoom in even further into the 6M and 1M total returns for each of these funds, and one thing is clear… despite the poor 1M performance by both funds, DFAX still comes out on top with a total return of -3.06% against DFIC’s -3.55%.

SA

SA

This, now, tells me a couple of things. First, the current environment might not be ideal for either ETF. Second, DFAX is showing more resilience as the economy gets more volatile. That’s important because you’d essentially be using this fund as a hedge against your high-growth portfolio. You can already see the broad market weakening over shorter and shorter time frames.

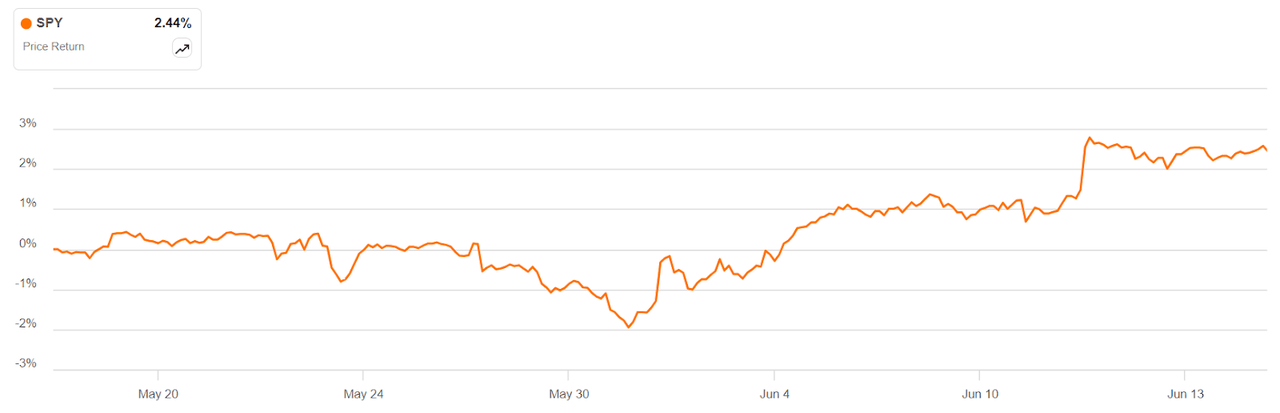

SA

If you look at (SPY) over the past one month, it’s only gained 2.44%, and you can see the inherent volatility as it struggled to give us that kind of minimal yield. As we head into the second half of the year, I believe that volatility and the investor uncertainty underpinning it will become more pronounced.

The Bigger Economy Picture

To be clear, I’m not saying that a weak U.S. market is automatically going to boost EM companies, but it does give them an opportunity to rerate against the SPY and eventually deliver stronger relative returns. The reason, which I discussed in the earlier article I keep referencing, is that foreign central banks and their monetary policies are increasingly becoming decoupled from the U.S. economy, and with interest rates still high in more EMs, particularly in Asia and Latin America where DFAX has significant exposure, those central banks have more levers to pull than the Fed.

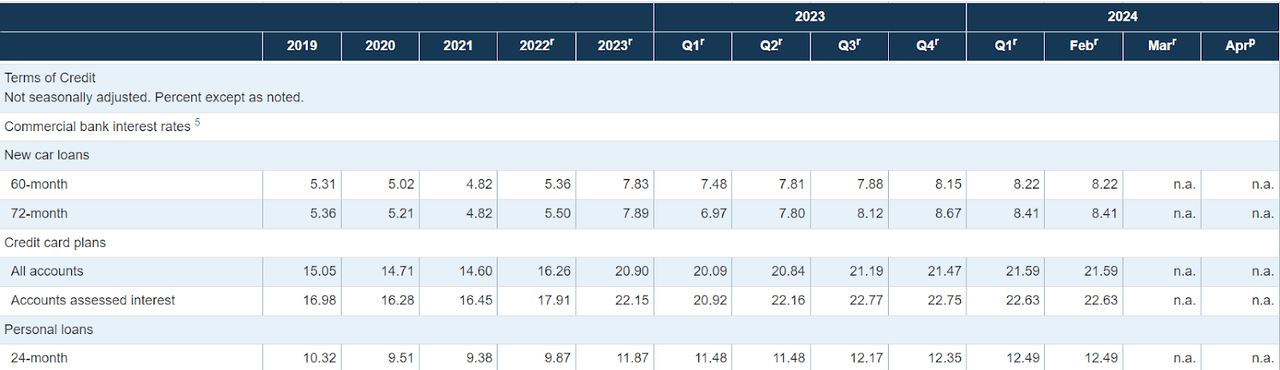

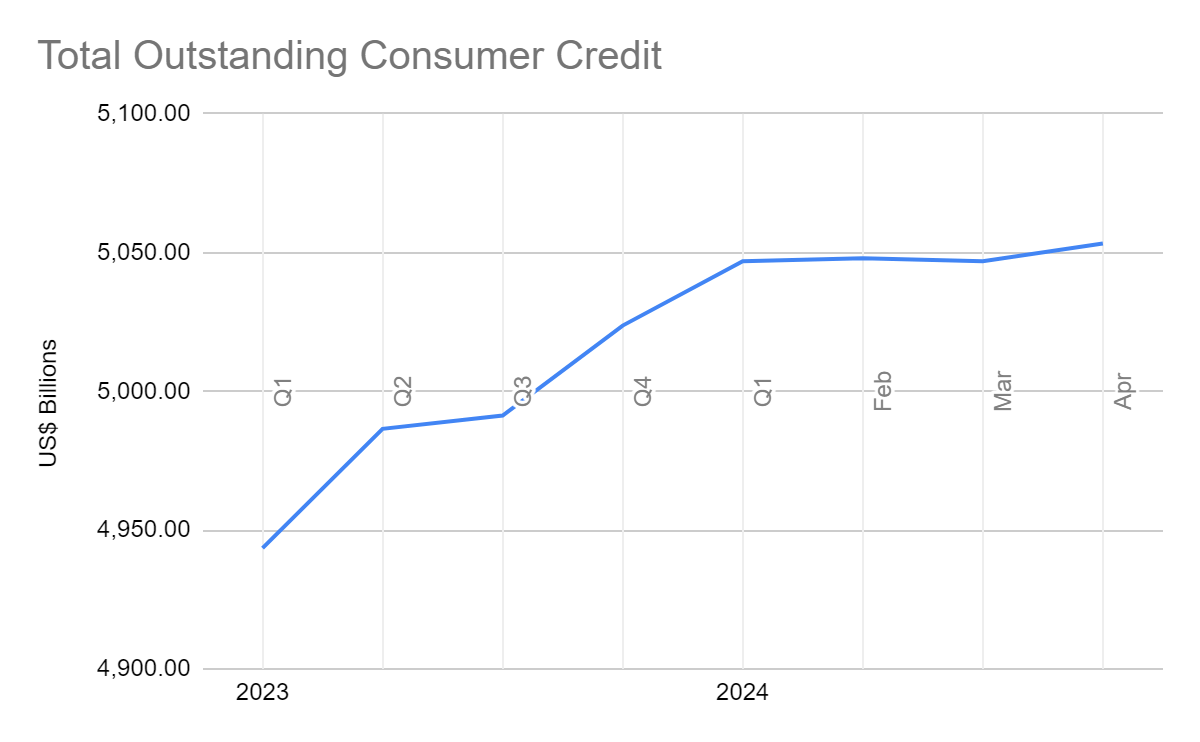

To expand a little on that, the Fed right now is caught between a rock and a hard place. On the one hand, keeping interest rates high for too long will affect poorer segments of American society, and that could tilt things in favor of a ‘people’s president’. With the cost of credit at 3-year highs (could be worse if you take pre-2019 rates), it’s understandable that consumers are now wary of new debt, as indicated by the flatter slope over the first few months of 2024 in the graph below the table below.

Federal Reserve

Data from the Federal Reserve, Chart by Author

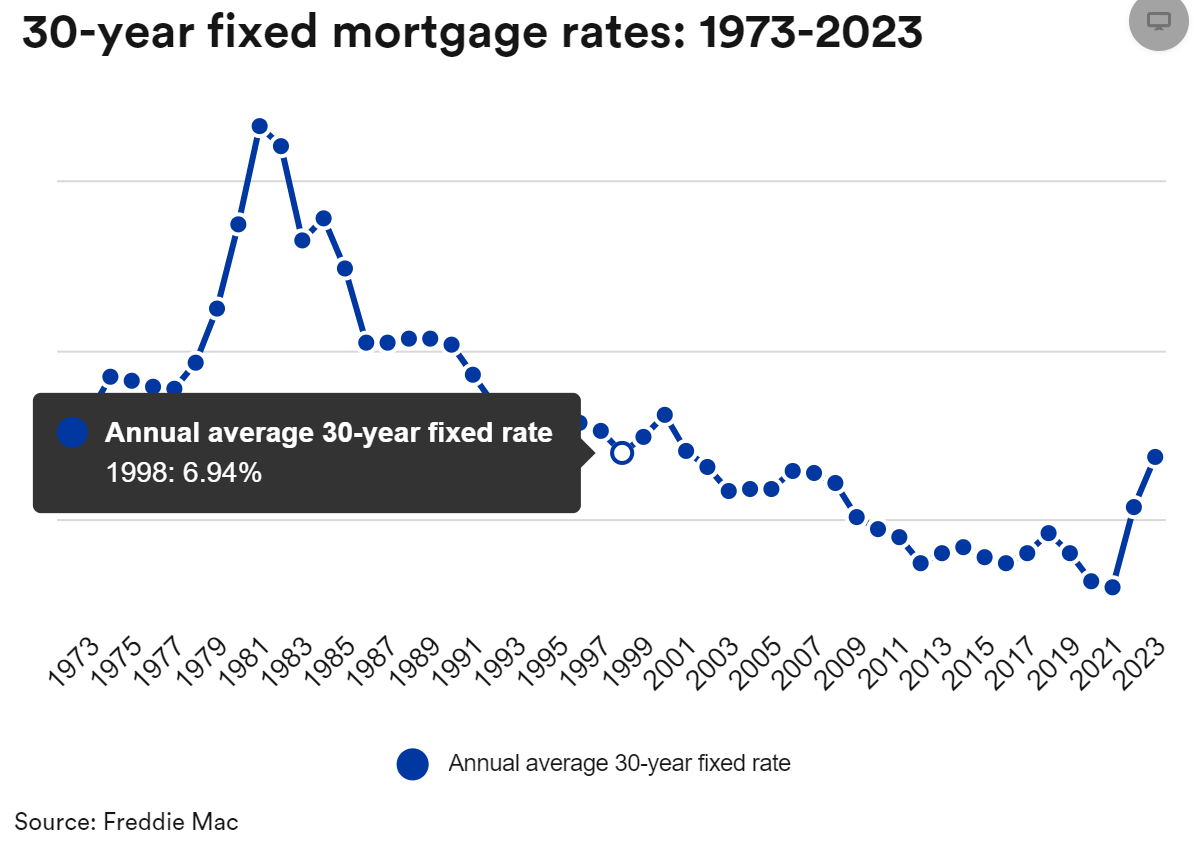

Mortgage rates look no better, and by the end of 2023 they were already at 20-year highs, as you can see below.

Freddie Mac via Bankrate

It’s not a pretty picture because the Fed has to hold rates high even as the populace struggles with high outstanding debt from their past and high interest rates in their future. Refinancing at these rates would be counterintuitive because, as Zillow reported a year ago:

According to our survey, around 90% of mortgage holders reported having a rate less than 6.00%, about 80% of mortgage holders reported having a rate less than 5.00%, and almost a third reported a rate less than 3.00%.

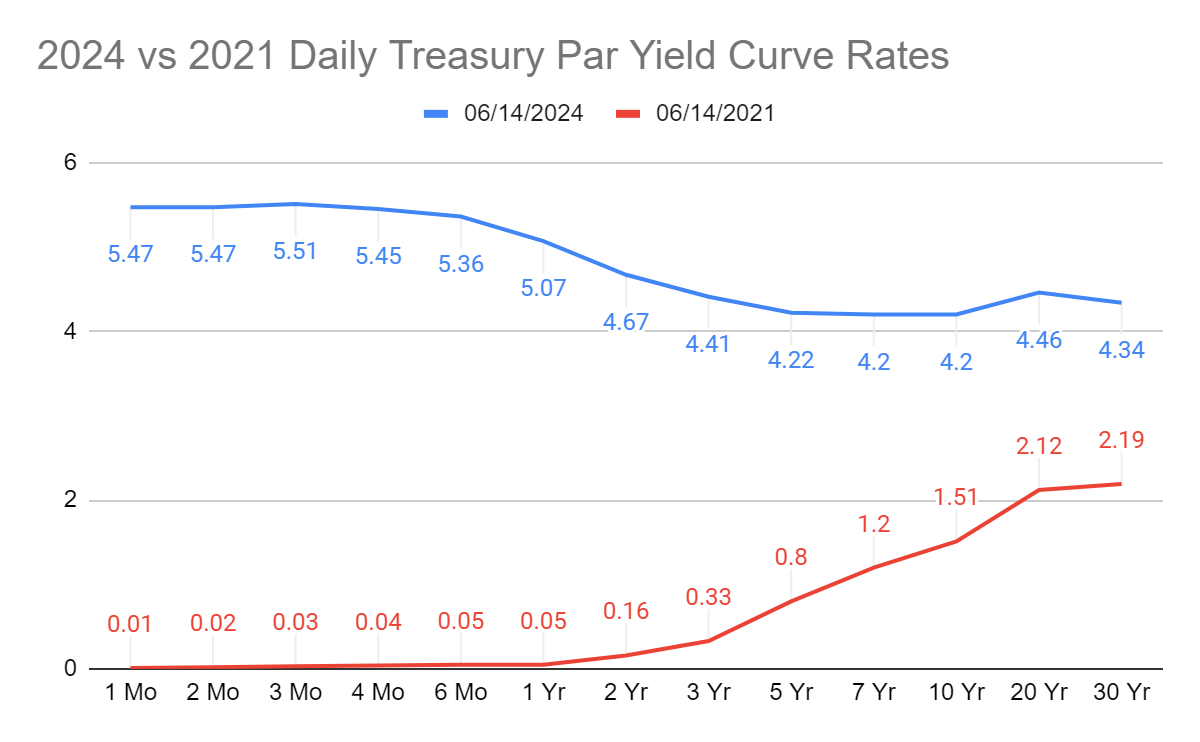

That’s the Fed’s rock. Its hard place is that cutting rates too quickly or by too much could result in the economy heating up again and undoing its ultimate goal of trying to bring down inflation. Unless the rate cuts are slow and gradual, that could very well happen. The other risk is that cutting rates too quickly gives foreign central banks an advantage. Since their own rates are still high (even though the ECB has started its rate cuts), investors are likely to move their funds overseas for better yields. Ironically, the inverted yield curve is what seems to be holding the economy together. Economic duct tape, to coin a crass yet more or less accurate phrase!

U.S. Department of The Treasury

My Concluding Remarks for the DFIC vs. DFAX Narrative

In the current situation, the best way to hedge your growth portfolio is a) with a value portfolio comprising U.S. securities – value stocks with sound fundamentals trading below their intrinsic value, and b) with a secondary hedge comprising International and EM securities, as a failsafe for any major disturbances in the U.S. economy.

For the first hedge, I’m recommending the iShares S&P 500 Value ETF (IVE), which I wrote about in my recent article on the Dimensional US Marketwide Value ETF (DFUV), which should be published just ahead of this article, so apologies for not including a link. You should be able to see it in my author profile.

For the second leg of that hedging strategy, I’d suggest DFAX, for which I recommended a Buy. I’m not giving that same rating to DFIC, however, because I’ve already discussed why I don’t see it as delivering superior returns in the event of a reversal between developed and EM markets. It might not be a complete reversal, but I do expect the spread between their yields thinning out as EM economies leverage their high interest rates against any potential rate cuts by the Fed.

I’d like to make it clear that the U.S. economy has weathered worse situations than this and might still come out smelling like roses. That’s my upside risk to this whole thesis of economic reversal. I don’t think America’s dominance in the economic or socio-political spheres are likely to diminish overnight. However, there have been chinks in its armor for a long time, and the next few years might be the time that those chinks are tested and retested by the world’s other global economies. Not immediately, but in the absence of a crystal ball, the best I can say is that it’s an educated guess.

That’s the reason I’m not recommending that you sell off your growth stocks right now. Enjoy your strong growth stocks while the going’s good, but be ready for the time when the going’s not going to be so good. And if the U.S. economy continues to do well, and you lose money on these value and overseas hedges, just think of it as insurance well bought. To paraphrase American satirist and cartoonist Kin Hubbard: “Fun is like life insurance; the older you get, the more it costs.”