CSHI ETF: Great Place To Park “Longer” Term Cash

DanBrandenburg/E+ via Getty Images

Regardless of who you are as an investor, it’s recommended to have at least a small cash position set aside to respond to various market and personal conditions. Now, it’s important to understand that when people recommend having cash positions, it’s not always physical cash. Many people also count treasury bills, high-yield savings accounts (HYSAs), certificates of deposits (CDs), and other similar assets as cash positions. The idea is to put money in interest-generating positions where your money is highly liquid and retains its value with zero or extremely little volatility.

One of my favorite places to park “longer-term” cash is the NEOS Enhanced Income 1-3 Month T-Bill ETF (NYSEARCA:CSHI). The idea with a “longer-term” cash position is setting aside cash for opportunities. It’s a position where you hold cash indefinitely unless a superior investment opportunity arises, such as if a great piece of real estate comes to the market or a company’s stock suddenly becomes undervalued. CSHI is an excellent asset for these cash positions because they can handle slightly increased volatility in return for higher long-term returns and distributions. It’s a fund that consistently yields between 100 and 150 basis points more than the U.S. 1-3 month treasury bill rate with minimal risk. I rate CSHI a Buy for those looking for a place to park their opportunistic cash positions.

CSHI’s Strategy and Goals

The NEOS Enhanced Income 1-3 Month T-Bill ETF (the “Fund”) (formerly the NEOS Enhanced Income Cash Alternative ETF) seeks to generate monthly income in a tax efficient manner.

To add onto this, Troy Cates, a managing partner at NEOS, has discussed in-depth in an interview that CSHI seeks to generate approximately 1-1.5% yield on top of what the U.S. 1-3 month treasury bills currently yield. The fund accomplishes this goal by holding the entirety of its portfolio in U.S. 1-3 month treasury bills and using them as collateral to sell out-of-the-money SPX put spreads. These put spreads are typically sold 8-10% out-of-the-money and are shorter-term options that are rolled every week, according to Cates.

What makes CSHI a solid place to park your cash is that its put spreads and distribution targets are extremely conservative based on its current options holdings.

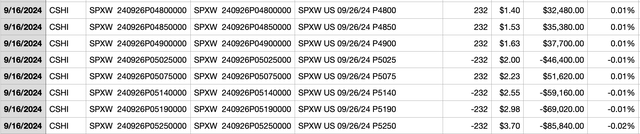

CSHI Holdings (neosfunds.com/cshi)

In the worst-case scenario where the S&P 500 drops below 5000, CSHI’s max loss is 0.67%. This number can be calculated by first finding how much CSHI has to cover if all their sold put options were exercised. The worst-case scenario for CSHI is when all their sold put options are exercised, while their bought put options expire worthless. In this hypothetical case, CSHI’s puts at 4800, 4850, and 4900 will expire worthless while the rest are exercised. Thus, the cash settlement would equate to the collateral needed to cover the exercised sold put options minus the amount from its bought put option at 5075. We then finish by adding in the net credit from selling the put spreads to find our maximum loss and divide that by CSHI’s NAV to get our maximum percentage loss.

If you read my article on the Simplify Enhanced Income ETF (HIGH), “HIGH: Unnecessary Risk From Unpredictable Option Spreads,” you’ll know that I’m not a big fan of the ETF due to its unpredictability. However, that’s not the case with CSHI. It’s been clearly laid out that the fund buys treasuries and sells SPX put spreads with guidance on the moneyness and their distribution targets. This makes the fund much more predictable and stable as a cash-parking vehicle. Yes, there is options risk with CSHI, but your max loss is less than a 1% when the market drops without warning. And in the case that the market continues to drop, the fund managers will continue rolling the options further out-of-the-money to protect its assets. We can move out of hypothetical scenarios and look at how CSHI handled the unwinding of the Japanese Yen carry trade in August.

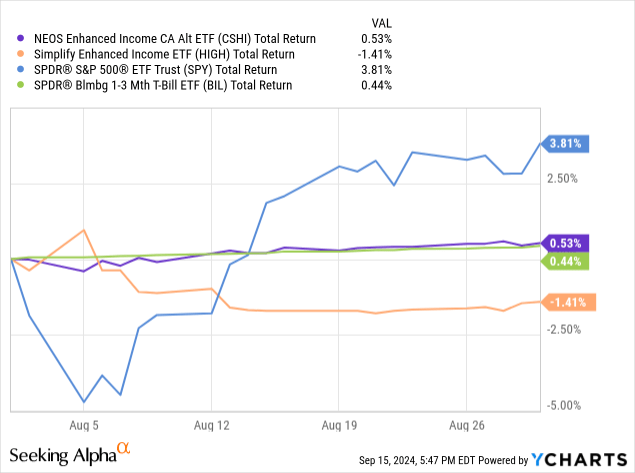

What you’ll notice is that CSHI was hardly affected by changes in the overall market and closely followed the returns of U.S. 1-3 month treasury bills with slightly higher volatility. Compare this against something like HIGH, which lost approximately 1.41% in August 2024 and performed erratically against the S&P 500.

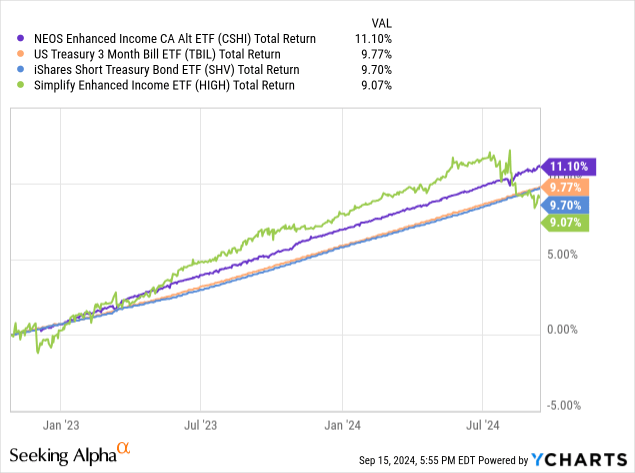

Now, the reason to buy CSHI over U.S. treasuries directly is that the extra yield from selling put spreads does push CSHI significantly ahead, depending on how long you hold it.

For cash positions you hold indefinitely, taking advantage of the extra yield would make sense if the extra volatility is not life-changing. For context, CSHI’s standard deviation since its inception has been 0.3%. The oversimplified idea is that this fund is great if you are okay with taking a 0.3% loss in the worst-case scenario. Most of the time, CSHI will outperform, holding only treasuries or HYSAs with minimal added risk. It’s an excellent fit for cash positions that could be held longer.

CSHI Is Not Always The Right Fit

Of course, there are situations where CSHI is not the right fit. The first example that comes to mind is when buying real estate. You may put your money into CSHI when shopping for real estate, but once you get an accepted offer, it would be wise to transfer your money into an even more liquid and stable position to guarantee your ability to close. Essentially, in short-term conditions where you have a strict balance you must meet, CSHI still has enough risk that it may not be worth investing in the fund.

Additionally, please pay particular attention to CSHI’s goal of generating a 1-1.5% yield on top of U.S. treasury rates. With the likelihood of an incoming rate cut, CSHI will not stay at its current 5.91%. Instead, CSHI’s yield will lower to whatever the U.S. 1-3 month treasury bill rate becomes, plus approximately 1%. If you believe that the Federal Reserve will cut interest rates, then other cash-like assets where you can lock in a higher interest rate could make a lot more sense.

CSHI isn’t meant to replace income funds, either. If the total value of your portfolio at any given moment is not super important as long as it goes up over time, you will fare better with funds with more aggressive options strategies if income is your goal.

Great For Longer-Term Cash Positions

Overall, however, CSHI is a great place to park cash that will be held indefinitely in anticipation of other investment opportunities or situations. The options risk generated by CSHI’s conservative SPX put spread strategy is minimal compared to the amplified returns generated over the long run. There are cases where the fund doesn’t make sense that need to be reviewed individually. In general, I rate CSHI a Buy for investors seeking cash positions designed to take advantage of future investment opportunities.