Cloudflare Stock: Keep On Riding The Recovery (NYSE:NET)

Sundry Photography

Cloudflare: Gaining Ground As Gen AI Takes Centerstage

Cloudflare, Inc. (NYSE:NET) stock has outperformed the S&P 500 (SPX) (SPY) since my previous update in June 2024. I upgraded NET’s thesis, assessing that its valuation has improved markedly while it’s still expected to deliver a sector-leading growth profile. Cloudflare’s Q2 earnings release corroborated my optimism, as the leading networking company delivered a solid scorecard. In addition, Cloudflare raised its guidance, supporting my thesis that the company’s growth trajectory is still in the early innings.

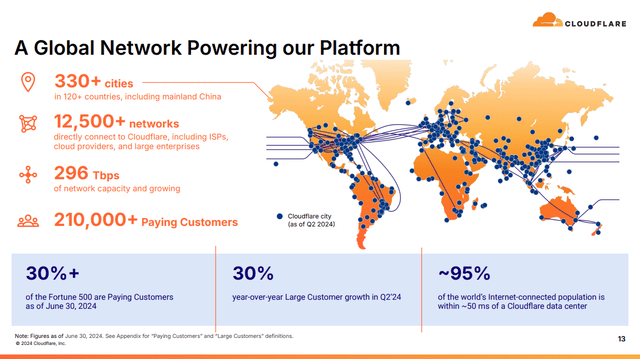

Cloudflare Global Network (Cloudflare Filings)

Cloudflare’s global connectivity portfolio is a critical underpinning of its network dominance. As a result, it has allowed the company to develop a comprehensive platform that helps enterprise customers consolidate their spending across NET’s multi-stack offerings.

In addition, Cloudflare has adjusted its go-to-market strategy with a “pool of funds” approach. Accordingly, the concept promotes faster adoption of Cloudflare’s offerings across its stack, helping its customers consolidate their computing, networking, and security needs into its cloud-agnostic platform.

However, there could be execution risks embedded in its pool of funds GTM strategy. While it helps customers consume several of Cloudflare’s offerings within a typically multi-year contract period, it might also reduce the clarity and predictability of its revenue model. As a result, investors must anticipate possible variability affecting its deferred revenue metrics. Furthermore, the reliability of its net retention rate metric could also be affected, potentially lowering the visibility of Cloudflare’s revenue recognition. Hence, investors should spend more time assessing NET’s ability to monetize its novel GTM approach over the next four quarters.

Notwithstanding my caution, I have assessed its global network as a critical competitive advantage for scaling its edge computing offering. Accordingly, the company reported a 20% increase in developers linked to Cloudflare Workers over the past four months. Management attributed the remarkable performance to its “complete solution for [developers] to build and ship full-stack applications.”

Within its AI strategy, Cloudflare underscored a 67% QoQ increase in Workers AI sales as developers leverage its “inference-tuned GPUs live in 167 cities worldwide.” Hence, I assess that Cloudflare’s scale and CapEx investments over the years have helped it build up a global competitive edge as edge computing becomes increasingly crucial for AI inferencing.

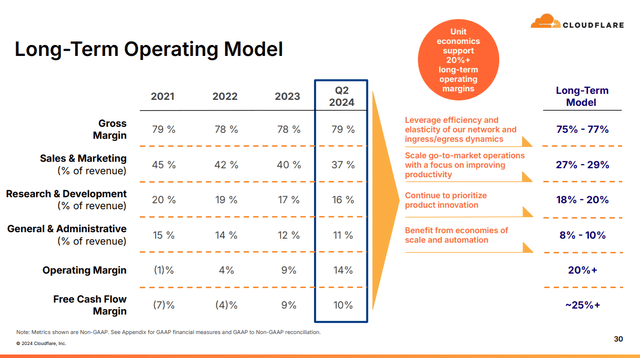

Cloudflare’s Long-Term Model Suggests Significant Growth Prospects

Cloudflare’s Long-Term Model (Cloudflare Filings)

Therefore, it’s increasingly likely that Cloudflare’s growth prospects are still nascent as it scales toward its long-term model. The company has made significant adjusted profitability progress over the past three years, lifting its adjusted operating margin to 14% in Q2. In addition, its free cash flow conversion has also been robust (10% in Q2), validating the sustainability of its CapEx investments. Based on the company’s long-term guidance of hitting 25% FCF margins, Cloudflare’s ability to expand its TAM across the stack is critical to meeting its long-term model.

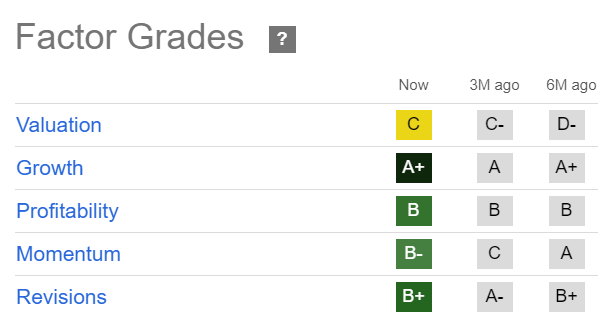

NET Quant Grades (Seeking Alpha)

Wall Street estimates have also been upgraded, validating NET’s bullish thesis. Moreover, its “C” valuation grade doesn’t seem overvalued when adjusted for the stock’s best-in-class growth prospects.

NET’s forward adjusted PEG ratio of 2.04 is about 5% over its tech sector median, corroborating my assessment. Despite that, it’s also clear that the stock is priced for growth. As a result, investors must be careful with the AI infrastructure investment thesis that has taken the world by storm. Cloudflare expects to dedicate 11% (at the midpoint) of its estimated FY2024 revenue to CapEx investments. It’s markedly higher than the 6% metric recorded in Q2.

Therefore, the company is likely betting that it has the confidence to capitalize on the secular AI investment theme. However, execution risks with its revised GTM strategy and potential AI overhype risks could impact investor sentiments on its growth-adjusted valuation. While I assess NET’s PEG ratio as reasonably valued (but not undervalued), lower-than-anticipated growth prospects would likely lead to a substantial valuation de-rating.

Is NET Stock A Buy, Sell, Or Hold?

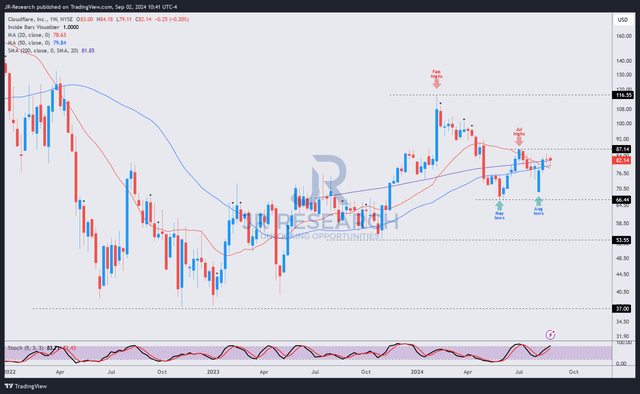

NET Price Chart (Weekly, Medium-Term) (TradingView)

NET’s price action suggests a constructive consolidation phase, supported by its May and August 2024 lows. However, its momentum has weakened since it topped out in February 2024. The stock’s momentum grade has declined from “A” to “B-” over the past six months, corroborating my observation.

Despite that, NET remains in an uptrend continuation thesis as long as its May 2024 lows hold robustly. I assess that buyers need to regain sufficient momentum to break decisively above the stock’s July 2024 highs as critical to underpinning its upward bias.

As a result, while I assess that the buying opportunity in the stock is still valid, investors should spread out their allocations progressively to allow more time to evaluate the stock’s ability to break out of its July highs first.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!