ClearBridge Canadian Small Cap Strategy Q3 2025 Commentary

Durant Photography/iStock via Getty Images

By Michael Richmond, CFA, & Michael Shaw, CFA

Enduring through a Historic Gold Rally – Market Overview

Gold’s historic surge in the third quarter made parsing through performance of the ClearBridge Canadian Small Cap Strategy and the performance of the broader Canadian small cap market difficult. Gold has been on an astonishing run. The yellow metal ended the third quarter at a record high of US$3,873 an ounce — up 17.1% for the quarter and 46.6% year to date. The expectation of lower interest rates, sticky inflation and persistent central bank purchasing have clearly sparked the animal spirits around gold.

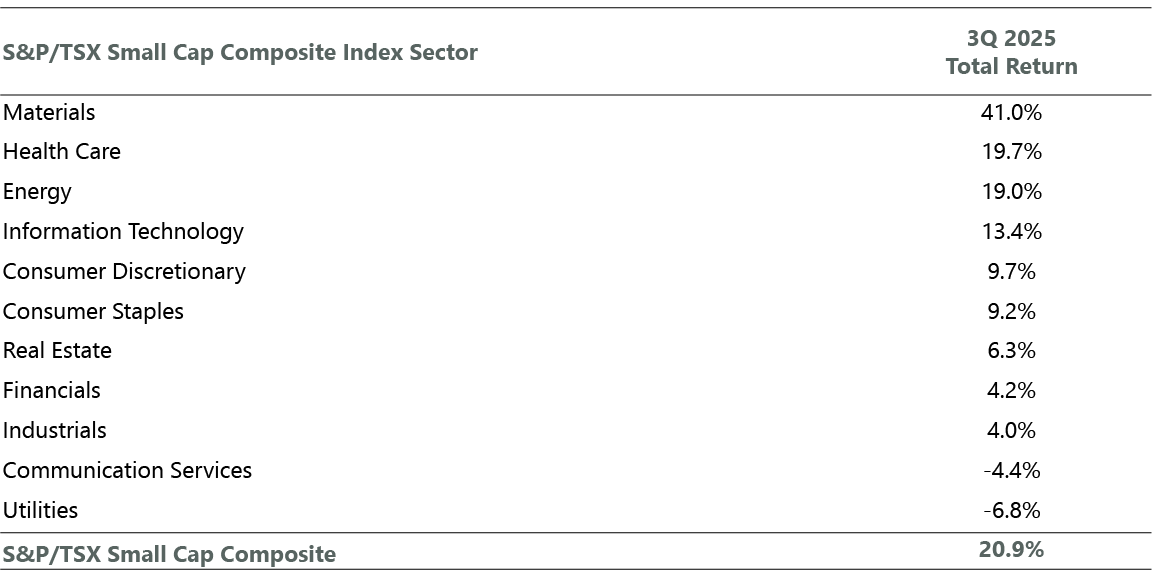

The run in gold has had a profound impact on the performance of the S&P/TSX Canadian Small Cap Index. At the start of the third quarter, over a quarter of the index were gold or silver miners (25.6%). Prior to the rebalancing of the index in mid-September, that figure had grown to 28.2%. The materials sector — primarily comprising precious metals miners — was up 41% during the quarter, far outpacing any other sector and representing nearly two-thirds (65%) of the 20.9% return posted by the index. Suffice it to say, positioning around gold was one of the key determinants of relative performance in the quarter and broadly the reason why the Strategy underperformed (Exhibit 1).

Exhibit 1: Sector Performance Broadly Positive

As of September 30, 2025. Source: ClearBridge Investments, FactSet.

Absolute Strategy performance during the quarter was strong. We saw positive contributions from seven out of the 10 sectors we were invested in during the quarter. The Strategy had particularly strong absolute contributions from materials (including our gold exposure), energy and real estate. We had several holdings that continued to bounce back from the April lows, and we are happy with our decision to lean into risk during the tariff-induced selloff.

The Strategy’s sizable underweight position in gold resulted in an inability to keep up with the outsize move in the overall index, resulting in an underperformance of over 1,200 bps. The headwind was compounded by the rally in cannabis equities — which we view as fundamentally challenged businesses — following posts on Truth Social from President Trump suggesting adding cannabidiol to Medicare coverage, as well as idiosyncratic moves in select crypto-related information technology (IT) and financials names.

We are comfortable with the moves we took in late 2024 and early 2025 to increase our exposure to metals and mining stocks, including increasing our gold exposure. Looking ahead, we will remain selective with our approach to precious metals equities. Our exposure to gold is concentrated in royalty streaming companies, which provide diversified participation across multiple projects and jurisdictions while mitigating operational, geopolitical and geological risk. That said, we believe sector-wide capital allocation discipline remains uneven, and history suggests the most value-destructive decisions in Canadian small cap resources tend to occur when “higher for longer” becomes consensus. We will continue to reassess our assumptions and look for companies — across all sectors — that combine prudent capital allocation, durable competitive advantages and sustainable growth under appropriate capital structures.

Portfolio Positioning

M&A activity in the portfolio and idiosyncratic volatility in financials, IT and industrials allowed the Strategy to remain active during the quarter. We eliminated four names — two following M&A transactions — and added one new name to the portfolio.

We added Triple Flag Precious Metals (TFPM), a precious metals royalty streaming company that offsets our reduced position in Sandstorm Gold following its announced combination with U.S.-domiciled streaming company Royal Gold (RGLD). Triple Flag maintains our preference for asset-light, diversified participation in gold with a high-quality asset base.

We eliminated InterRent Real Estate Investment Trust (OTC:IIPZF) and Parkland (OTCPK:PKIUF) following their respective M&A transactions. InterRent is in the process of completing a take-private transaction and Parkland is in the process of being acquired by a U.S.-based competitor. In both cases, we believed that the market was properly valuing the transactions, and we sold to reallocate the capital to better risk-reward opportunities.

We also eliminated Trican Well Service (OTCPK:TOLWF). Trican has been a long-term oilfield services holding in the Strategy. The company announced and completed the acquisition of an Alberta-based private competitor in the third quarter at an attractive valuation. The equity subsequently outperformed and surpassed our estimate of fair value. We view Trican as a very well-run company with an industry-leading capital allocation track record and would be happy to own it again at an appropriate discount to intrinsic value.

We also eliminated Boralex (OTCPK:BRLXF), a small cap renewable power producer based in Quebec. While we see a long-term runway for renewable power investments globally and regard Boralex as a best-in-class capital allocator and operator in the Canadian small cap universe, we believe there are better risk-reward opportunities elsewhere. Unfortunately, the market for renewable power development has shifted to favor more well-capitalized organizations and we believe that Boralex may struggle given its size.

We added to our positions in cyclical names such as North American Construction (NOA), ATS (ATS), Boyd, GDI Integrated (OTCPK:GDIFF), EQB (OTCPK:EQGPF) and Descartes (DSGX). All have underperformed on various operational headwinds and sector rotations. We see the relative underperformance as an opportunity to increase our exposure to high-quality businesses at attractive discounts to intrinsic value.

Outlook

Our investment approach remains bottom-up and research driven, supported by a patient culture and a long-term horizon that lets us act when expectations diverge from fundamentals.

North American macro signals are mixed. A softer labor backdrop and tariff related uncertainty argue for caution, while AI-related investment is creating pockets of resilience and incremental growth across software, semiconductors, data center infrastructure and productivity-enhancing tools. In this environment, we are emphasizing companies with competitive advantages, strong balance sheets and self-funded growth that can navigate a cooler jobs market yet participate in AI-enabled capex cycles. Consistent with our philosophy, we believe high-quality growth companies are best positioned to weather uncertainty and improve competitive positions when markets dislocate.

In Canada, we see a developing, longer-term opportunity as the new federal government advances a more supportive policy mix. Steps aimed at easing internal trade frictions, accelerating approvals for major projects and reinvesting in national capabilities can improve private-sector visibility and catalyze activity over a multiyear horizon. We expect beneficiaries to include select industrials (engineering and construction, building products), energy and power infrastructure, as well as service providers tied to permitting and project execution. Canadian small cap investors will need to balance the long-term opportunity from a revitalized major-projects industry in Canada against the short-term fluctuations in the North American labor market.

Portfolio Highlights

Performance was strong for Canadian small caps in the quarter; however, leadership was narrow with the materials sector the only sector to best the benchmark return. Given an underweight position to materials, the ClearBridge Canadian Small Cap Strategy underperformed its S&P TSX Small Cap Index benchmark in the third quarter. On an absolute basis, performance was strong, with the Strategy posting gains in seven of the 10 sectors in which it was invested. The primary contributors were the materials, energy and real estate sectors while the financials sector was the main detractor.

Relative to the benchmark, the Strategy experienced negative stock selection and sector allocation effects in the quarter. In particular, stock selection in IT, materials, financials, energy and consumer staples, an underweight to materials and overweights to utilities, industrials financials and consumer staples detracted from performance. On the positive side, stock selection in utilities and real estate, an underweight to the consumer discretionary sector and a lack of exposure to the communication services sector contributed to results.

Among individual securities, the leading relative contributors to performance were OR Royalties, Hudbay Minerals, Capstone Copper, Enerflex and Lundin Mining. The largest detractors from relative performance were Propel Holdings, EQB, Empire, Kinaxis and not holding Energy Fuels.

Michael Richmond, CFA, Portfolio Manager

Michael Shaw, CFA, Portfolio Manager