Buy These Mega Yields In June To Enjoy All Summer Long

RelaxFoto.de/E+ via Getty Images

Co-authored by Treading Softly.

It’s estimated that the average person makes between 33,000 and 35,000 conscious choices daily. Everything from:

- what you’re going to eat

- when you’re going to eat

- What clothes will you wear?

- How fast are you going to drive?

The list goes on. It’s no wonder that by the end of the day, many of us are tired of making decisions. You take steps to try and streamline your day and develop habits so that the decisions you make are less conscious and more automatic to reduce decision fatigue. For many of us, after all the decisions we make every day, it can be difficult to sit down to look at our portfolio and decide the best way forward with our investments. So many forces are at play within our country, our economy, the global economy, and the global political sphere. Knowing how to balance all of these factors can be difficult.

Do you want to support the adoption of EVs, or would you prefer vehicles that run on ICE? Is oil the bane of your existence and renewables the future, or are renewables highly wasteful and oil better over time?

It can be difficult to sort through all of this, but today, I want to take a moment to look at two outstanding income opportunities that you can buy this June and have the answer as yes. You can benefit regardless of which one of those turns out to be the most accurate eventually. You can benefit from renewable adoption, and oil and gas majors. This can mean you have less decision fatigue and more time to enjoy the summer.

Let’s take a look at how!

Pick #1: BGR – Yield 6.0%

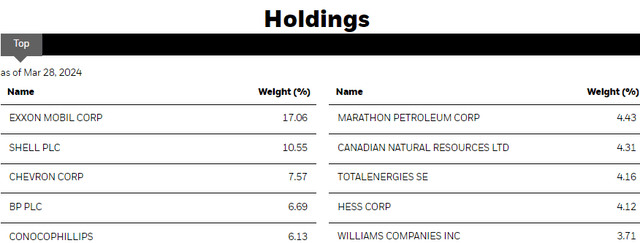

BlackRock Energy and Resources Trust (BGR) is a CEF (Closed-End Fund) that focuses on the oil majors. BGR invests primarily in large caps, with over 96% of its portfolio invested in companies with a market capitalization exceeding $10 billion.

BGR‘s top holdings are a “who’s who” of the oil world. Source.

Simply put, BGR provides investors with immediate exposure to big oil, which is a good place to be with oil prices in the $70s and higher.

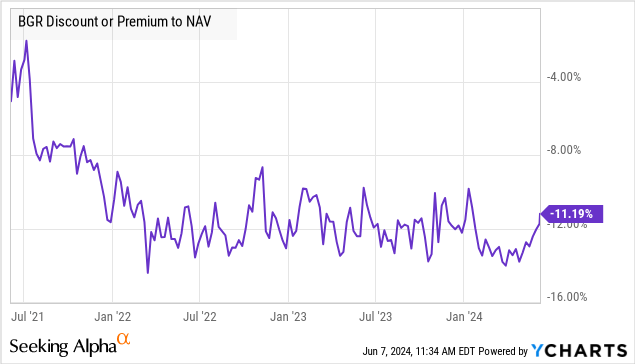

One aspect that makes BGR an attractive fund is that it has been trading at a steep discount to NAV.

This means that we can gain exposure to the portfolio at a significantly lower price than if we bought the stocks ourselves.

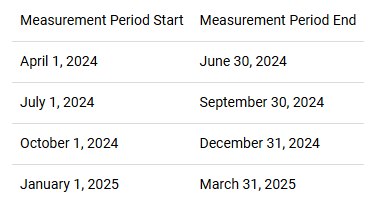

BlackRock has many funds trading discounted and has started taking meaningful steps to close this gap. It has introduced a “discount management program.” With this program, if the average daily discount exceeds 7.5% over a 3-month period, BlackRock will make a tender offer for 2.5% of shares outstanding priced at 98% of NAV.

Here are the measurement periods:

Blackrock Website

The chart above shows that BGR has been at a double-digit discount throughout April and May. This means that unless BGR shoots up in price, the tender offer will be triggered, and BlackRock will be buying back 2.5% of shares. At current prices, 98% of NAV would be around $14.50.

This will be repeated for the following three quarters, until either BGR is trading discounted that is less than 7.5% (above $13.72 at current NAV), or BlackRock has bought back 10% of all shares outstanding.

BlackRock has recently been targeted by Saba, an activist investor in the CEF space. While Saba hasn’t targeted BGR in particular, BlackRock’s efforts to close the discount gap across its funds appear to be a response to Saba’s pressure. Last week, BlackRock significantly increased its distributions at several funds. It remains unclear whether we can expect a distribution raise for BGR as well. However, BGR’s NAV certainly indicates there is ample room for a distribution raise.

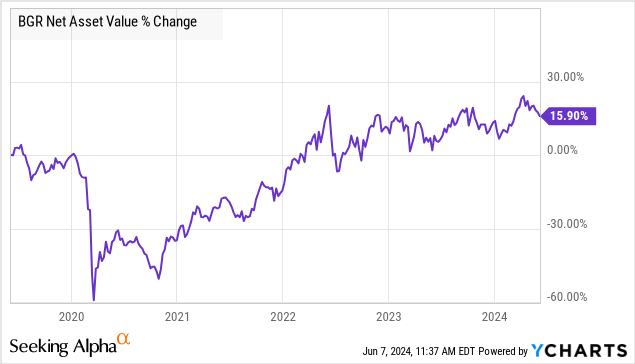

For CEFs, the total return will be a combination of distributions +- the change in NAV. If NAV is climbing, that indicates that the fund is retaining more capital than it is distributing. If NAV is shrinking, that indicates the fund is distributing more capital than it is earning. Since stock market prices are volatile, we can’t read too much into a single year. Any CEF is going to have years when NAV is down, and years when it is up. However, if we start seeing a sustained trend, it can tell us whether the fund has room to increase the distribution or whether the distribution might be too large.

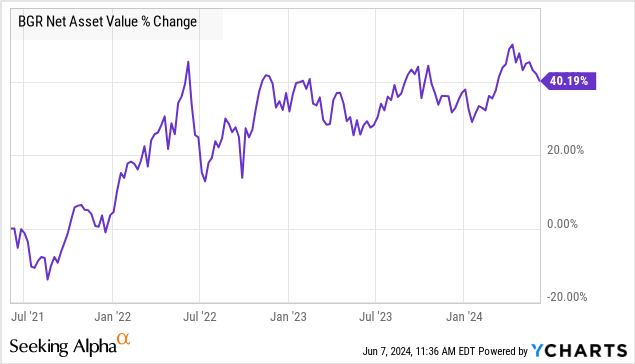

For BGR, NAV has grown significantly over the past three years.

If we look at the big picture, it has fully recovered from the COVID collapse, and NAV is 20% higher than it was in 2019.

This indicates to us that there is clearly room for BGR to increase its distribution – which, given BlackRock’s newfound devotion to reducing the discount to NAV, a healthy distribution hike would be one way to get there.

The manager of a CEF has a lot of discretion in setting the distribution, so we can’t say for sure if BlackRock will decide to raise it. What we can say for sure is:

- BGR has been materially out-earning its distribution, causing NAV to rise.

- BlackRock’s discount management program will help decrease the discount through share buybacks at a substantial premium to current prices.

- A distribution hike might help decrease the discount and reduce the need for BlackRock to buy back shares.

The bottom line is that all these things are good for shareholders. We get NAV growth, distribution growth, price growth, or a combination of the three. BlackRock has allowed its funds to trade at steep discounts to NAV, which has provided us with an extended buying opportunity. It is now taking tangible steps to reduce that discount, which is great for those of us who buy it before the discount shrinks.

Pick #2: NEP – Yield 11%

NextEra Energy Partners, LP (NEP) is a “yieldco,” a company that is designed to pay investors a high yield in exchange for buying and holding long-term income-producing assets.

For energy companies, the infrastructure is costly to build. It is a process that is full of political and sometimes legal hurdles; the construction itself is specialized, and it requires significant real estate. If you run a power company like Florida Power & Light (“FPL”), you need a lot of electricity to be generated. A handful of power plants isn’t going to cut it. As the population you service grows, you need more electricity. You can either buy it from somewhere else – a risky proposition as the seller can decide not to sell and that can lead to rolling brownouts. Or you can build your own power plants – a time-consuming process, but when you are in the business of selling electricity, it is a good idea to generate your own electricity. The problem is that after construction, your capital is tied up in that power plant for decades. So, where do you get capital to build more?

This is the problem that NextEra Energy (NEE) had, and NEP was the solution. NEE had a collection of electricity-generating assets, which ensures it has the electricity it needs to sell to its customers at FPL. Yet, it needed capital to build more to keep up with demand, preferably without putting its A- credit rating at risk.

There are plenty of investors who are truly interested in owning assets that will produce long-term cash flow. So NEE created an investment vehicle, NEP, that would raise capital by issuing shares and use that capital to acquire electricity-producing assets from NextEra Energy Resources, a subsidiary of NEE responsible for building new power plants. The price NEP pays to acquire the assets goes to NEER, which then uses that capital to fund new construction projects. The electricity that is produced by NEP’s assets is sold to FPL, which then sells it to the end consumers. NEP shareholders are rewarded with dividends, encouraging them to buy more shares when NEP needs more capital to buy more plants from NEER.

It is a nice virtuous circle, allowing capital to be recycled and everyone gets what they want. FPL gets electricity, NEER frees up capital to reinvest, and NEP investors get dividends. NEE coordinates it all as the parent of all three companies.

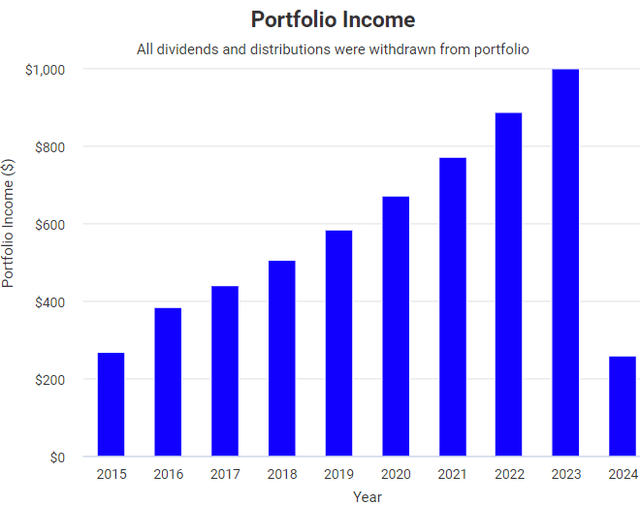

Someone who invested $10,000 in NEP in 2015 has seen the distributions they receive increase to about $1,000/year. Source.

The share price also ran up, trading in the mid-$80s in 2021. It has since trended down and then crashed last year. It bottomed out in the low $20s before recovering to where it is today, in the low $30s.

What is the distribution? It is higher than it has ever been. Today, we can invest in NEP and immediately receive an ~11% yield. The chart above shows an investor who invested $10,000 in 2015 didn’t receive over $1,000/year (10% yield) until 2023. That investor waited eight years to see their dividend grow. Today, we can invest $10,000 and receive over $1,100/year in dividends. The amount that NEP pays is higher, but the price of NEP’s shares is lower.

The cause of this is a significant change in growth outlook. NEP was promising investors 12-15% annual growth in its dividend. For years, it delivered on that promise. To grow, NEP is dependent upon raising capital to buy assets from NEER. This means issuing equity and debt. With share prices low, issuing equity is not an attractive option. With interest rates high, issuing debt isn’t much fun either. Due to this combination, management had to give in and admit that a 12%+ growth rate wasn’t practical.

Management reset expectations for a 5-8% growth rate and set about managing its CEPFs (Convertible Equity Portfolio Financings), which are financings that were designed to be repaid with equity issuance, but at current prices that isn’t practical so they are being repaid with cash – as well as refinancing/paying off its debt.

The market freaked out, and the price collapsed.

Yet despite the slower growth, the investment opportunity is more attractive than ever. Someone who bought in 2015 waited for eight years to get a yield on capital lower than the yield we can get right off the bat today. We can’t expect 12% growth, but when you are starting at an 11% yield, 6% growth is not bad at all. Dollar for dollar, if NEP can maintain the distribution over the next eight years, investors today will make a lot more money than investors who bought in 2015 and held through 2023. If NEP can grow the distribution at 5-8%, as management is targeting, forward returns are much higher.

The remaining question is whether NEP can maintain that level of growth. In the near term, management expects to produce this growth organically within its portfolio. It is taking advantage of “repowering”, which involves upgrading older wind turbines with newer technology. This increases the electricity output with a small investment compared to building a whole new wind farm.

This will be sufficient for a couple of years, but eventually, NEP will need to go back to its role as a capital raiser to fulfill its role in the ecosystem set up by NEE. The cost of capital needs to come down either through declining interest rates or a rising share price, preferably through a combination of both.

Nobody can predict what interest rates will be in three years, yet it is a safe bet that they will either be lower or the current high rates will be the “new normal,” and the markets will adjust to them, which includes the prices of real estate and other cash-producing assets.

NEP’s share price took a tough fall, but since October, it has been steadily trending upward. For the share price, we believe it is a matter of rebuilding trust in management. Management needs to execute its plan and demonstrate that it can provide growth that achieves the new target. As NEP keeps raising its distribution, shareholders will come back. They will find that we are already here, buying shares while they are at bottom prices.

Conclusion

With BGR and NEP, we can benefit from both oil and gas majors and the adoption of renewable energy. We can benefit from both, all while collecting outstanding income from the yields that are provided on our investments. I see both of these investments as being heavily undervalued at this time. NEP saw a large share price decline because investors became disillusioned with the change in management’s guidance. BGR continues to trade at a hefty discount to NAV, meaning that you can get more value per dollar by buying the fund than by directly buying the assets it owns. Looking forward, we see both as avenues to success and a great summer, collecting income regularly while enjoying the summer with fewer worries and fewer decisions.

When it comes to retirement, the last thing you want to do is to have to worry about every decision you need to make constantly. It’s better to have a clear mind and an easy life than one that is constantly plagued by decision-making all day long. The decisions I want you to have to worry about are what you’re going to do with your leisure time, whether you are going to take up a new hobby, who you will visit, or when you will visit. Enjoy your retirement. Don’t be a slave to decision-making about the market.

That’s the beauty of my Income Method. That’s the beauty of income investing.