Argosy Investors Q1 2024 Letter

IsiMS/E+ via Getty Images

Dear Investors,

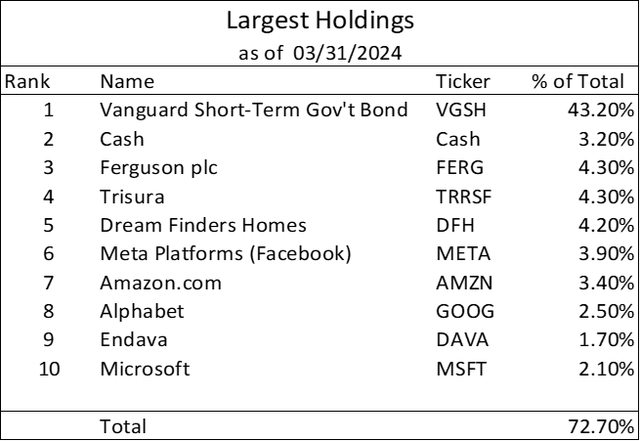

Year-to-date, the S&P 500 (SP500, SPX) returned 10.6%. We ended the quarter with 46.4% of the portfolio in cash and short-term government bonds. We continue to take a conservative stance towards the current market environment, which clearly has not benefited us in a market as prolific as the current one, driven by aggressive growth stocks like Nvidia. We remain focused on the long term, choosing not to invest as aggressively when opportunities are scarce, with a plan to invest more aggressively when the market is serving up more easily identifiable opportunities. What has frustrated this approach in the last 15 years is that the market downturns have been so brief that it has been frankly challenging to put capital to work quickly but prudently. Whether it is the market becoming more efficient or investors “buying the dip” with confidence in the Fed’s backstop of the stock market, we do not know. We are working on developing a list of companies we admire and would acquire with limited confirmatory research should prices dislocate in the future and present us better valuations.

Existing Portfolio Activity

Added: DAVA

Going back to at least 2017 with research on Syntel that ultimately led to Syntel’s acquisition by Atos, I have spent a lot of time understanding and investing in IT services. IT services generally earn extremely high returns on capital, and historically have augmented organic growth with acquisitions that build capabilities in other technical or geographical areas. Over time, IT services have evolved from relatively low-skilled IT infrastructure monitoring and troubleshooting, and now some companies are more focused on customer-facing activities. This new generation of IT services businesses is involved in custom application development, generating next generation experiences for customers. Admittedly, the buzzwords in this industry are annoying and it can be sometimes difficult to understand the scope of services companies offer, and how much overlap there is with the older generation of IT services businesses. The main differentiator is that most of their work is on a time-and-materials basis, whereas legacy providers were replacing a previously insourced cost and needed to offer fixed price contracts to win business by guaranteeing customers superior cost to insourcing. Finally, one of the main characteristics of Endava’s business model is that its engagements are project-based and have single deliverables for completion. This makes the business more sensitive to the economic cycle relative to legacy IT providers who are, again, generally replacing an ongoing function previously performed by a company’s internal team, i.e. is recurring in nature.

Right now is an interesting time to add to our investment in DAVA because the company has experienced a hangover from the COVID pandemic surge in spending. The pandemic caused significant IT investments to accommodate work-from-home policies and an expectation of permanent changes to how business was conducted, from remote sales calls to social distancing in manufacturing operations and more. From fiscal 2019 through fiscal 2023, sales grew at a 28.9% compound growth rate (‘CAGR’). This is a small decline from the 31.0% CAGR from 2017 to 2019, when the business was much smaller. To frame this more succinctly, in the last six years, the business has increased revenue by 5x.

Unsurprisingly, at least to me, the business is going through a post-COVID hangover, and needs to lap some strong comparables before resuming double-digit growth.

On top of the need to lap strong comps, the business over-invested in people, believing that the boom times would persist. The slowdown caught management by surprise and their worker utilization has fallen significantly. Fortunately, this can be fixed relatively quickly and margins should rebound towards 2019 levels.

In addition to all of this, the advent of artificial intelligence (‘AI’) has caused some people to question the value that Endava can provide if companies adopt AI. Who is going to help these companies adopt AI? Sure, Google (GOOG,GOOGL) and Amazon (AMZN) will have their own internal resources, but there are so many more companies who don’t have a need for full-time software engineering talent who will need a company like Endava to help them adopt AI. AI seems like more of an opportunity than a threat for Endava.

The business currently trades for 15x next year’s still-depressed earnings, a multiple we believe is far too low for a business that should grow at double digits for at least the next five years. There is certainly a realistic scenario where DAVA can trade for a price approaching $80 in 2-3 years.

New Portfolio Activity

Bought: TBBB, DEO

While a small position, it is worth explaining what I find attractive about Tiendas BBB (TBBB). Started by a McKinsey consultant (not always a sign of an attractive investment), Tiendas BBB is a hard discounter a la Aldi or Lidl, retailers well-known in the United States. TBBB operates over 2,200 stores in Mexico, with visibility to 12,000 stores over the long-term, and I believe the potential for even more beyond that. As with Aldi, TBBB offers a limited number of primarily private label products, approx. 2,000-3,000, at less than 15% gross margins, in relatively small stores supplied by an efficient supply chain network. These metrics compare to competitors who stock tens of thousands of items, mostly third-party brands, and at gross margins >20%.

What allows the hard discounter model to thrive is the low number of stock-keeping units (SKUs), which results in higher sales per SKU, which allows the hard discounter to negotiate competitively at even a small scale vs other retailers. As their scale grows, hard discounters can negotiate increasingly better prices with suppliers, placing greater pressure on competitors who already operate on thin margins. Also as a result of the low number of SKUs, hard discounters are able to negotiate attractive payment terms, and because their inventories remain low as a result of high inventory turnover, they have negative working capital and generate positive cash flow as basically a perpetual loan from their suppliers. This cash flow allows hard discounters to pay for their growth without incurring significant debt.

As a result, we estimate TBBB’s 2020-2023 growth was 33% per year, while long-term debt only grew at a 5% rate. Because of the characteristics discussed here, TBBB is capable of growing stores by 15% per year in addition to growing same-store sales at 5-10% per year going forward. It seems likely they can continue at this pace for the next 10-15 years and returns could approach or exceed 20% per year.

Diageo (DEO) was likewise added to the portfolio this quarter. We don’t believe we have any special insight into this well-known spirits maker, but believe DEO is capable of providing long-term attractive returns and became priced at a level where we felt we were taking less risk in the short term as well. Owner and marketer of the Johnnie Walker Scotch, Tanqueray gin, Smirnoff vodka, Guinness beer, and Baileys liqueur brands, plus a stable of emerging brands, Diageo is a fixture any time alcohol is being served. We believe we’re paying a high-teens multiple of quite stable and growing earnings, and benefit from a healthy 3% dividend in the interim. We won’t wow anyone with our analysis on this one, but when everyone else is rushing to buy Nvidia, our exposure to alcohol should help with any hangovers in the rest of the market.

Conclusion

The investment universe is difficult to unpack currently, given the level of uncertainty. From the latent (and lagged impact of higher rates to geopolitical unrest and an upcoming U.S. election with divergent policy implications, there are a lot of unknowns right now. There are always a lot of unknowns, but what is unusual this time around is the valuation of the S&P 500 is well above other times in history when rates were similar. 4Q 2006 and 4Q 1966 were the last times we saw rates approximately equal to today, and coincidentally on both occasions the S&P 500 P/E ratio was 17-18x. Current P/E ratio is almost 28x, which indicates we’re at historically high valuations on an absolute basis and particularly in comparison to other times when monetary policy was similar.

Until July,

Argosy Investors

Appendix

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.