American Airlines Stock: Don’t Fret Delta’s Warning (NASDAQ:AAL)

DaveAlan

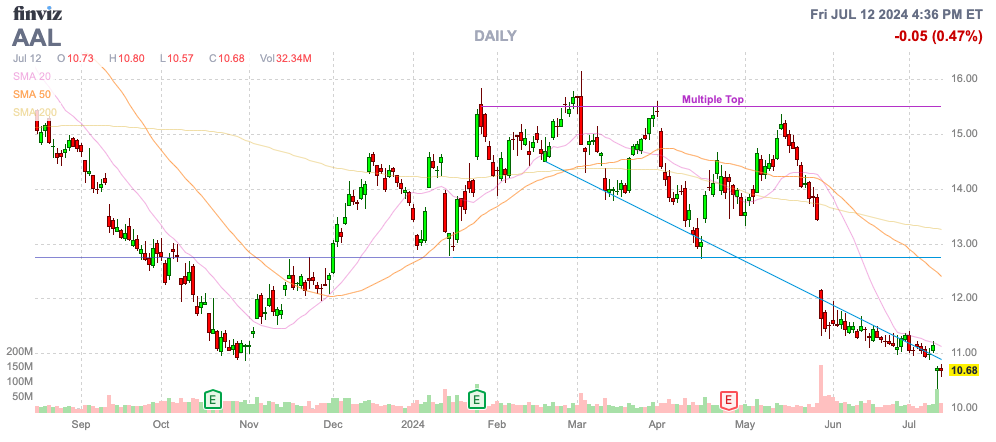

The airline sector continues to produce massive profits, while the stocks are constantly sold off on any slightly negative news. American Airlines Group Inc. (NASDAQ:AAL) has somehow fallen back to $10 following Delta Air Lines, Inc. (DAL) reporting a quarter where profits were at near record levels, but the market didn’t like the outlook. My investment thesis remains ultra-Bullish on American Airlines stock, though the stock and sector continue to struggle to obtain fair valuations by Wall St.

Source: Finviz

Not Much Of A Warning

Delta Air Lines missed Q2 ’24 earnings and revenues before the stock market opened on Thursday, causing the stock to slip. The airline reported a massive EPS of $2.36, only below the record Q2 levels from last year.

While the market never likes a company missing estimates, Delta Air Lines already outlined a scenario where the capacity issues causing the problems to end Q2 and start Q3 will be under control very soon. On the Q2 ’24 earnings call, CFO Glen Hauenstein made the following statement:

With scheduled seat growth decelerating into the fall, June and July will be the low point with unit revenue trends expected to significantly improve in August and beyond.

The domestic airlines flew a record 3.01 million passengers on July 7 following the July 4th holiday. The only issue is matching capacity with demand.

Delta Air Lines guided to Q3 EPS of $1.70 to $2.00, just below the analyst target at $2.06. Even more important, the large legacy airline kept the following guidance for the year:

- 2024 EPS estimates at $6 to $7

- 2024 FCF targeted at $3 to $4 billion.

The airline had recently hiked the quarterly dividend by 50% to $0.15 per share. Furthermore, Delta Air Lines forecasts the unencumbered asset base reaching $30 billion by year-end in a sign of the growing strength of the balance sheet via paying for new aircraft with cash.

The airline stock now trades at only 6x EPS targets, while the company is producing massive cash flows. Once Delta Air Lines returns debt ratings to investment grade, the company will no doubt start repurchasing cheap shares.

American Airlines Read

Naturally, the markets read the Delta report as negative for American Airlines. Delta Air Lines is the top run and most profitable legacy airline, with a higher focus on international routes where demand is the strongest and capacity isn’t as competitive.

At least that was the headline view, but Delta Air Lines only reported 4% international revenue growth. Domestic revenues were up a strong 5% with Other revenue up 19% due to the loyalty program.

American Airlines has already warned on Q2 numbers when replacing the CCO back at the end of May. The big question is whether the airline had fully reflected the weak results in the prior warning, or if Delta Air Lines is indicating even further weakness for American Airlines in the period from June through August.

The airline is targeting a Q2 EPS of $1.00 to $1.15, down from the prior guidance of $1.15 to $1.45. American Airlines had set a 2024 EPS target of $2.25 to $3.25 after reporting Q1 results, and the consensus analyst estimates are now at just below $2.

A big issue for the airlines is that fuel costs are still excessive. Delta Air Lines spent an additional $300 million on fuel during Q2 compared to last Q2 and 25% more than Q2 ’19 while still delivering a similar EPS.

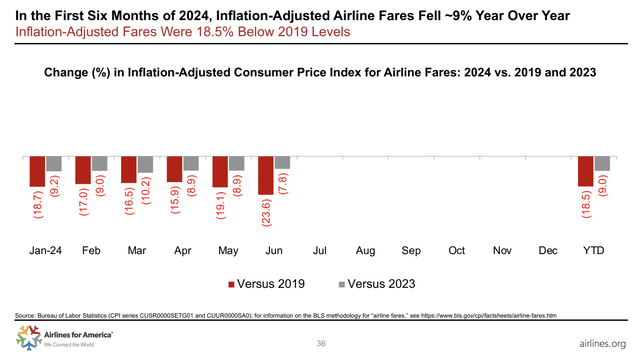

Airfares now usually adjust overtime for the higher and/or lower fuel costs, but the current capacity out of balance likely made this more difficult for the Q2/Q3 period. Airlines.org reported average airfares down 9% YoY and down 18% over the 2019 levels, while fuel costs are actually higher.

While these dynamics are less than ideal, a big part of the issue is the normalization of the revenge travel in 2023. Airline traffic remains phenomenal, but domestic carriers got a little carried away with capacity growth, yet these legacy airlines are still highly profitable.

Delta Air Lines has already confirmed the industry is heading back into balance, leading to higher yields going into August. Though, the stocks trade as if the airlines might end up bankrupt again.

American Airlines won’t report Q2 ’24 earnings until before the open on July 25. The airline forecast an EPS of $1+, so all eyes will be on whether these numbers adjust, though the end of May update likely already accounted for a substantial amount of the fares already sold for June.

The stock hardly trades above $10 only requiring a $1 EPS for the year to justify the current stock price. The current consensus estimates are for American Airlines producing a $2 EPS, making the stock exceptionally cheap.

Takeaway

The key investor takeaway is that investors should continue using the weakness in the airline stocks to load up. American Airlines is exceptionally cheap while the market continues to trade the stock as if bankruptcy were a threat, while the real reality is the improving balance sheets soon allowing for stock buybacks again.