Amazon: $2 Trillion Reached – More To Come (NASDAQ:AMZN)

leolintang/iStock via Getty Images

My Coverage History

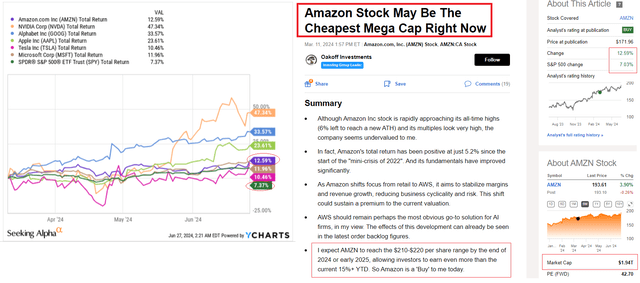

I published my first and so far only article on Amazon.com, Inc. (NASDAQ:AMZN) stock here on Seeking Alpha in March 2024. At the time, I argued that AMZN was the cheapest stock of all megacaps, despite its seemingly inflated valuation multiples. I also argued at the time that while Amazon’s stock price was only slightly above its pre-“mini-crisis 2022” highs, the company’s business was growing disproportionately better. I expected then that AMZN stock would continue to rise thanks to the company’s shift in focus (from retail to AWS) and its undervaluation. A little over 3 months have passed since then, and although AMZN did not become the fastest-growing stock of the mega caps, it managed to outperform the broader market with a total return of 12.59%:

YCharts, Seeking Alpha, Oakoff’s compilation

My Thesis Today

Just yesterday, on 26 June 2024, Amazon reached an important milestone of $2 trillion in market cap. I think there is more to come: Amazon’s financials and recent developments show that the company’s market position should help it reach new heights. My valuation model suggests that Amazon’s market capitalization should keep expanding – the stock price could reach $247 by the end of FY2025.

My Reasoning

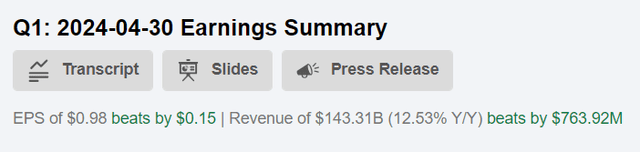

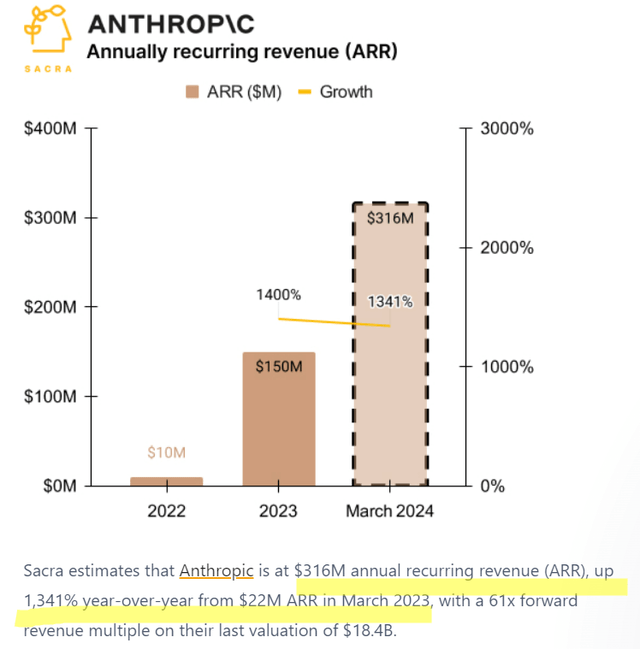

Despite a challenging global economic environment and a weaker consumer online retail sector, Amazon reported Q1 revenue of $143.3 billion (+12.5% YoY), which exceeded the consensus estimate by nearly ~$764 million, according to Seeking Alpha data. The EPS figure of $0.98 also beat the Street’s expectations by $0.15 (that’s ~18%), driven by “strong contributions from both retail operations and AWS.”

Seeking Alpha, AMZN

What I like, looking at the consolidated results, was the COGS-as-of-sales reduction from 53.2% last year to ~50.68% in Q1, which is an improvement of nearly 255 basis points in just 1 year. Fulfillment and shipping costs per unit decreased, and merchandise margins improved. SG&A costs decreased on an absolute basis by 6.13% YoY, and it looks like the disciplined approach to budgeting and slower headcount growth also contributed to better-than-expected financial outcomes.

Now, let’s examine the separate segments. Amazon’s retail business enjoyed double-digit growth in both North American and International operations as far as I can discern. NA sales reached ~$86.3 billion which was 12% higher than the same period last year and EBIT was at $4.98 billion, bringing it to a six times increase over Q1 2023 levels. The international part also improved greatly as sales were worth $31.9 billion (+10% YoY) and an EBIT of $903 million compared to the operating loss of -$1.25bn before; it was also its first profitable quarter in 2023 alone apart from little gain recorded during Q3 2023.

AMZN’s 10-Q, Oakoff’s notes

As demonstrated in the figures above, AWS has had an exceptional performance, significantly boosting Amazon’s overall success. Revenue saw an impressive growth of 17%, reaching $25 billion. Notably, the EBIT margin hit a record high of 37.6%; the segment’s operating profit surged to $9.4 billion, marking an 84% increase from the previous year and making up 61.4% of the total consolidated EBIT. The global shift towards generative AI seems to have propelled AWS forward, establishing it as a key player in the AI-as-a-Service market today. And I think AWS still has more growth opportunities ahead of it.

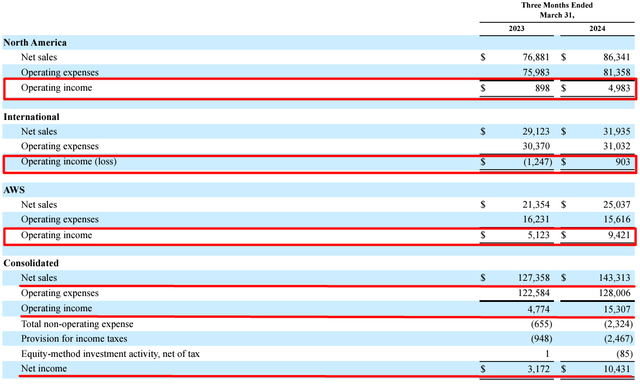

First, as I wrote in my previous AMZN article, its investment of up to $4 billion in Anthropic – a provider of AI foundation models – should further strengthen AWS’s capabilities in this space, only accelerating its top-line growth rates. Anthropic itself has seen outstanding growth rates in recent quarters, which I think shows how much the demand for creating large language models has changed – and we are probably only at the beginning of this new trend.

Sacra, Oakoff’s notes

Second, I believe that AWS’s Bedrock – “first launched in April 2023 as part of a set of new tools for building generative AI on AWS” – will provide an additional boost to revenue and keep the EBIT margin at a relatively high level (perhaps even increasing the current levels). In such a short time on the market, Bedrock has already acquired many major customers, and their number is apparently set to grow, as the company offers solutions that, according to the management, no other competitor has yet.

Bedrock already has tens of thousands of customers, including Adidas, New York Stock Exchange, Pfizer, Ryanair, and Toyota. In the last few months, Bedrock’s added Anthropic’s Claude 3 models, the best-performing models in the planet right now; Meta’s Llama 3 models; Mistral’s Various models, Cohere’s newest models, and new first-party Amazon Titan models.

A week ago, Bedrock launched a series of other features, but perhaps most importantly, Custom Model Import. Custom Model Import is a sneaky big launch as it satisfies a customer request we’ve heard frequently and that nobody has yet met.

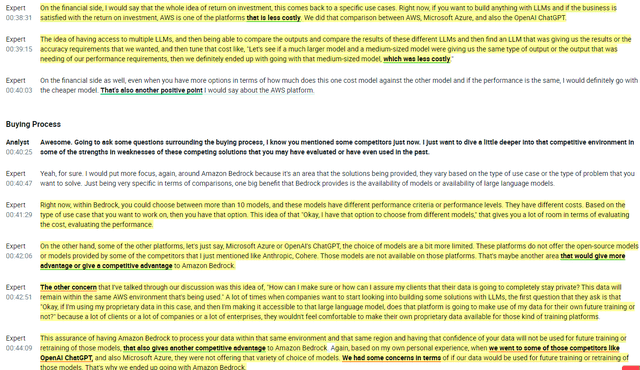

My assumption about the sustainability of demand for AWS’s Bedrock is indirectly confirmed by interviews with those who have been able to use it in practice. AlphaSense recently published excerpts from an interview with an AWS Bedrock and SageMaker customer who generously shared their experiences and insights. Despite having concerns about data privacy with OpenAI and ChatGPT, they “praised Bedrock as a fully managed LLM service platform” and appreciated the ability to choose between different model providers. It’s also important to note on their part – cost-wise, they found AWS to be less expensive compared to Microsoft (MSFT) Azure and OpenAI, while also noting that Azure doesn’t offer the same variety of models as Bedrock. So from a competitiveness standpoint, Bedrock should help keep AWS at the forefront of the current cycle of increasing demand for AI solutions – indicating a high likelihood that financial growth will not only be maintained but accelerated as the TAM expands.

@AlphaSenseInc on X

Even without touching on the topic of AI and looking only at the retail business, Amazon still has some opportunities to improve efficiency on this front. As BofA analysts recently wrote, the company is going to focus on establishing Inbound Cross Docks and new Consolidation Centers, enhancing inventory network distribution with new fees to incentivize third-party sellers to distribute their inventory, and increasing the unit share of new Same-Day sites, which are more cost effective than traditional fulfillment centers. In addition, the increasing integration of robots in fulfillment centers, the slowdown in space growth compared to unit growth, and the increasing use of third-party shipping services and Amazon’s supply chain will contribute to improved efficiency going forward.

We think Amazon can drive upside, given another year of limited fulfillment expansion in 2024 (similar to 2023). Maintaining 1Q margins through the end of the year would drive 3% upside to Street profit estimates, but an upside case with 50 bps margin improvement from here could drive 5% upside.

With all this in mind, let’s talk about the valuation of the company.

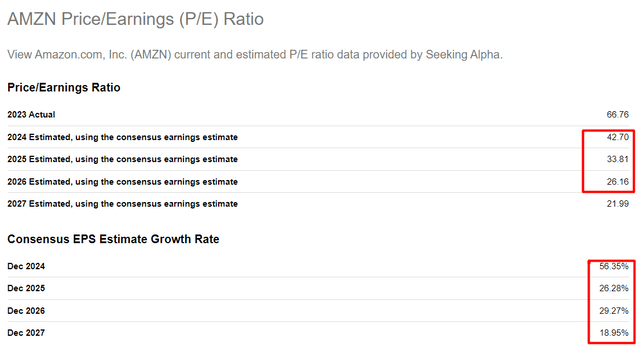

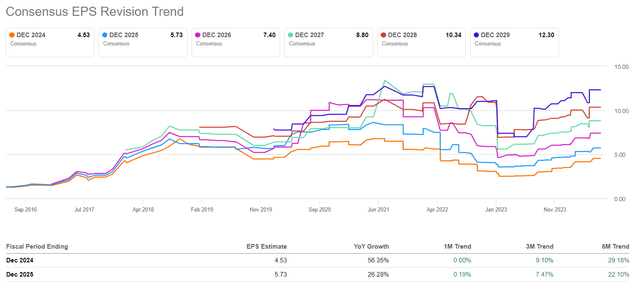

The current price-to-earnings ratio of almost 43x for 2024 seems quite high, but if we assume that the company actually grows its earnings per share by more than 56% YoY in 2024 and records further growth of almost 27% YoY in 2025, as the consensus expects, then I don’t believe that AMZN can be called an overvalued company today. If we assume that BofA analysts are right and the company can indeed command a premium of at least 3% to current EPS consensus forecasts, then I think the Street should have less reason to expect the multiple to shrink to 33.8x by the end of 2025 as it’s implied today:

Seeking Alpha, AMZN, Oakoff’s notes

I expect AMZN’s EPS to grow at a premium of at least 3% to existing forecasts in 2024 and 2025 – then EPS for those years would be $4.77 and $6.17 respectively. If the currently implied multiple contraction doesn’t happen, and AMZN trades at 40 times earnings at the end of 2025, the implied stock price should be around $247 in 1.5 years – this gives me an upside potential of 26.6% to the current stock price.

Risks To My Thesis

As one of the main concerns, I think investors should always keep in mind that Amazon may encounter intense competition in the coming years as more companies ramp up their online sales efforts and match Amazon’s prices in physical stores. So despite its currently still-leading position in different business areas, thanks to innovations like Prime and the growth of third-party sales, Amazon could face significant challenges.

I would also like to draw your attention to the fact that, no matter how hard I try to justify its valuation, AMZN stock still can’t be described as cheap. Holding a stock that is trading above 40x of forward earnings, investors are taking a big risk if Amazon fails to meet expectations, which have risen sharply in recent quarters. It looks like it’s going to be increasingly difficult to beat EPS and sales figures in the future.

Seeking Alpha, AMZN

One of the risks can also be found through technical analysis. Despite its super-strong momentum, AMZN stock is now at great risk of falling back into its usual medium-term price range if it fails to successfully consolidate above $190 in the next few trading sessions.

TrendSpider Software, AMZN, Oakoff’s notes added

Your Takeaway

Despite all the potential risks the company could face in the near term, I still believe Amazon’s impressive financial results point to further growth potential that should be capitalized on through its investments in AI. Speaking of Bedrock in particular, it has already attracted large customers and offers unique capabilities that set it apart from the competition, as far as I can tell. Also, Further, Amazon’s concentration on improving its logistics system and efficiency via initiatives like inbound cross docks and robotics integration should increase profitability overall.

With expectations of continued EPS growth and a potential stock price increase to $247 by the end of 2025, Amazon’s prospects look bright at this point and make the company an attractive investment opportunity. In my opinion, the recently reached $2 trillion market cap milestone could be just the beginning.

I maintain my buy recommendation for AMZN.

Good luck with your investments!