Airbnb: Shorter Bookings Trend Implies A Weak Consumer Spending (Rating Downgrade) (NASDAQ:ABNB)

Klaus Vedfelt

Investment Thesis

Airbnb (NASDAQ:NASDAQ:ABNB) saw its stock plummet by over 13% following mixed 2Q FY2024 earnings results and a disappointing 3Q revenue outlook. The company reported a slowdown in bookings growth due to a weakening consumer spending environment, coinciding with higher unemployment rates and lower PMI data, which triggered a significant broad-based market selloff. In my last coverage (buy rating) I highlighted that ABNB operates a cyclical business. The growth slowdown can be a leading indicator of economic weakness or a potential recession. Despite the post-earnings selloff, the stock remains 9% above my prior publication price but has underperformed the S&P 500 index by 19%.

However, I believe a “growth scare” driven selloff justifies a lower valuation, as we have also seen growth slowdowns in advertising revenue for Google (GOOGL) and Meta (META). Additionally, Amazon (AMZN)’s retail business experienced some softness as well in the recent quarter. While the guided single digit 3Q growth outlook may indicate a cyclical headwind rather than a structural shift, it’s uncertain whether the macro risk will start materializing from here and further impact bookings. I believe the Fed’s “higher for longer” rates policy will create a substantial risk of slowing the economy. Given the current economic data, I have downgraded the stock from buy to hold, as its valuation is still not cheap.

Bookings Slowdown Reflects Weak Economic Data

The company model

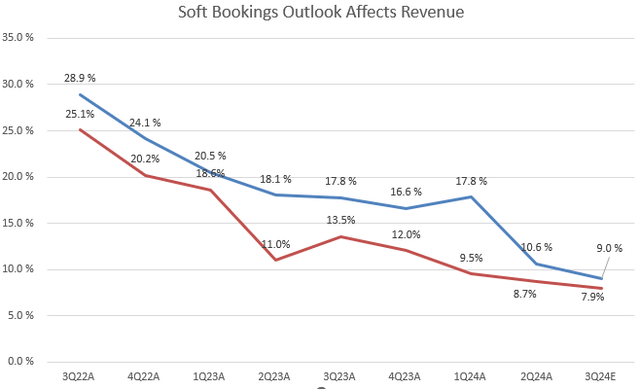

ABNB has experienced a sharp deceleration in revenue growth, dropping to 10.6% YoY in 2Q FY2024, compared to 17.8% YoY in 2Q FY2023. This slowdown was primarily due to a decline in bookings growth, as shown in the chart. In the 2Q Shareholder Letter, the company provided YoY growth numbers only for the Latin America and Asia-Pacific regions. It indicated that bookings growth in the EMEA region (which accounts for 39% of total nights and experiences) was relatively “stable,” while the North American region (33% of total nights and experiences) showed a slight acceleration in YoY growth. I believe the language suggests that the EMEA region may have experienced flat or slightly negative YoY growth in 2Q FY2024, despite the company mentioned that nights booked for the Olympics through 2Q were more than double compared to the same period last year.

For 3Q FY2024, the company provided disappointing revenue guidance, indicating a midpoint of 9% YoY growth. This outlook is largely attributed to shorter booking trends. Additionally, the company expects a continued sequential slowdown in the YoY growth of total nights and experiences. Assuming 3Q FY2024 follows the same percent change of YoY growth as in 2Q (8.7%/9.5%-1), we can estimate that bookings for the current quarter would grow by 7.9% YoY. The management also warned that the bookings outlook shows signs of slowing demand from U.S. guests, which aligns with the deteriorating economic data released in this early August that triggered a significant market selloff. If consumer spending trend gets worsen, it will most likely reflect into ABNB’s bookings result in 2H FY2024.

Lastly, it is unlikely that ABNB’s “above-trend” growth observed from FY2020 to FY2022 will continue. During the 2Q earnings call, the management noted that the company’s growth is beginning to normalize following the post-pandemic travel surge when people were eager to travel and booked well in advance.

Margin Slightly Declines

The company model

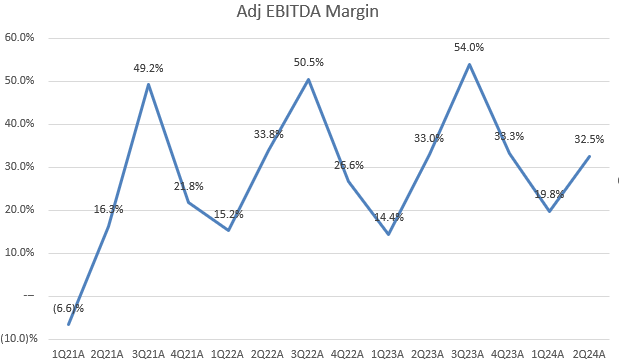

In addition, ABNB’s adjusted EBITDA margin shows a slightly YoY contraction of 50 bps in 2Q FY2024. The company expects 3Q FY2024 adjusted EBITDA to be the same level as 3Q FY2023 of $1.83 billion. Considering the midpoint of revenue guidance of $3.7 billion, this implies a 49.5% of adjusted EBITDA margin in the current quarter, which may indicate a significant contraction compared to 54% in 3Q FY2023. The management explained a faster growth of marketing expense due to investments in new growth markets such as Peru, Colombia, Chile, and Argentina. Furthermore, ABNB forecasts a at least 35% of adjusted EBITDA margin in FY2024, which indicates a continued YoY margin contraction in 4Q FY2024. I think these marketing investments will take time to translate into bookings growth.

The company also mentioned that its FY2024 FCF margin would be a few bps above its 35% EBITDA margin guidance. I believe the management’s ambiguous tone may imply its FCF margin would be lower than 38.7% seen in FY2023.

Stock Based Compensation Has Been Growing

The company model

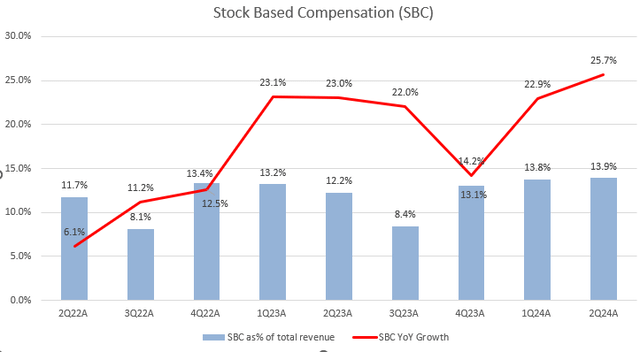

It’s important to note that ABNB experienced a YoY decline in operating income and EPS on a GAAP basis in Q2 FY2024. The company’s 9.2% YoY growth in adjusted EBITDA was driven by a significant YoY increase in stock-based compensation (SBC), as shown in the chart. SBC growth accelerated to 25.7% YoY in Q2 FY2024. Additionally, SBC as a percentage of total revenue expanded to 13.9% in the last quarter, while the adjusted EBITDA margin contracted. This suggests an even more severe contraction in the GAAP margin.

Valuation

Seeking Alpha

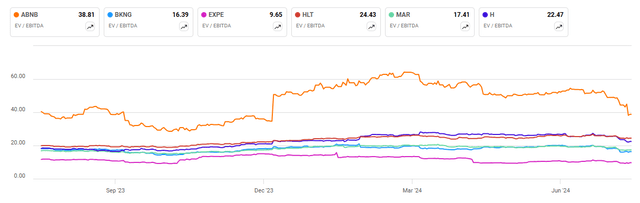

Despite the recent selloff, ABNB is trading at a premium valuation on a TTM basis to its peers. Considering the company’s FY2024 revenue consensus of $11.03 billion and assuming a flat YoY adjusted EBITDA margin of 36.8% in FY2024 (guided at least 35%), this implies the stock is trading at an EV/adjusted EBITDA FY2024 of 15.6x, which is still higher than 14.3x of Booking Holdings (BKNG) but slightly below 16.9x of Hilton Worldwide Holdings Inc (HLT). This indicates that ABNB’s valuation is not appealing yet amid the potential economic slowdown.

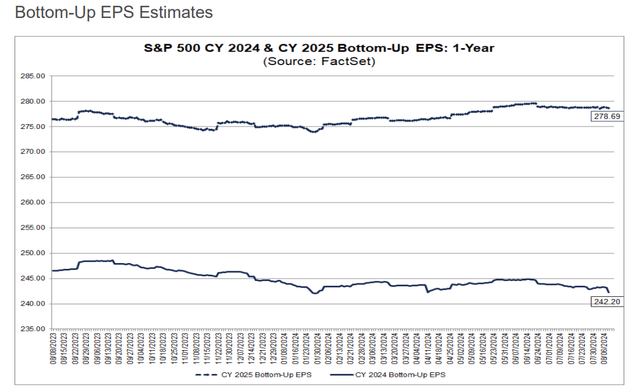

FactSet

We know that the company’s SBC has been growing and inflates its non-GAAP metrics. If we consider the FY2024 non-GAAP EPS consensus of $5.3, ABNB’s adjusted P/E FY2024 would be 21.7x, mostly in line with the S&P 500 index’s 22x in FY2024 (5344/$242). Therefore, ABNB’s valuation does not signal a buying opportunity either. However, the upside risk is that bookings could rebound faster than the market currently expects if we achieve a soft landing in the economy, which could justify a higher multiple. Given the recent economic data, the risk of a recession is increasing.

Conclusion

In conclusion, ABNB’s slowdown in bookings growth, combined with a weakening economic environment, raises concerns about a further deterioration in its revenue outlook. The significant drop in its stock price actually reflected a mixed 2Q earnings and a disappointing 3Q outlook, as the company’s valuation remains elevated. The growth acceleration in SBC and non-GAAP margin contraction confirmed that its adjusted earnings growth may be misleading. The current macro risks and the Fed’s “higher for longer” suggest a higher downside risk. From a risk-reward perspective, ABNB, as a cyclical stock, may present a more attractive buying opportunity during an early economic expansion. Therefore, the stock has been downgraded from a buy to a hold, as its valuation does not yet offer a compelling buying signal.