Stereotaxis Makes A Strategic Acquisition Bolstering Its Future (NYSE:STXS)

gehringj/E+ via Getty Images

Stereotaxis Reports Solid Results

We must contextualize Stereotaxis’ (NYSE:STXS) reported results until their new products get approved. The company will have limited sales growth and a modest cash burn in the meantime. This doesn’t mean we shouldn’t analyze the current business. It just shouldn’t be where the majority of our focus lies. I have fairly low expectations for the existing business, but very high expectations for the medium term (next ~2 years). With that in mind, let’s briefly look at the Q1 results.

Stereotaxis reported $6.9 million in sales, which slightly missed estimates for $7.05 million. I was confident its guidance would be met because I (correctly) thought the Genesis installations for Q1 were already done by the time the March Q4 call occurred. Stereotaxis recognized one installation in the quarter and the partial sale of another one.

Even though Q1 isn’t the focus for investors, you’d want management to guide for a beatable result. I think the $4.3 million in recurring sales came in below expectations. This decline from $4.7 million last year was due to J&J catheter shortages motivated by competition. Once Stereotaxis gets its MAGiC catheter approved, these shortages won’t exist because MAGiC will replace the J&J catheter. Stereotaxis will control its own destiny. Furthermore, the firm will be financially able to have 1 sales representative per hospital to increase robot utilization (currently have about 1 rep for every 3 hospitals).

The firm got 2 new Genesis orders since the last call. These were replacement orders in Europe. Hospitals in Europe see the MAGiC human trial underway right in their backyard, making them more bullish about the future of robotics in EP (electrophysiology) than America. This will change once MAGiC is approved in America. 2 orders are better than I expected. I was expecting 0-1 new order because it was only 2 months since the prior call and China is pausing new orders until Genesis is approved. It doesn’t make sense to order a Niobe a few months before Genesis is approved. New Genesis orders have also been pressured by the J&J catheter shortages, since hospitals don’t want to order a device that might not have a healthy supply of catheters to do procedures. If a new Genesis order is made now, MAGiC will likely be approved by the time it is installed, but hospitals don’t want to take that risk.

The firm burned $2.3 million in Q1. The burn rate was below last year’s $3.2 million because most of the R&D expense on its innovation plan has occurred already. The firm is in the late stages of its regulatory submissions and approvals for its main new products, which I will update you on later in this article. Management believes Q1 will be the cash burn peak for 2024. I am modeling a $1.5 million burn rate per quarter until MAGiC gets the CE Mark. Even if it doesn’t get approved until the end of the year, the current $18.2 million in cash and no debt will be plenty to get us through this pre-launch period. Stereotaxis will use its existing salesforce to sell the semi-mobile robot initially. It will scale hiring only after sales momentum and profitability occur. The integration of Access Point Technologies (which I will detail later in this article) won’t have much of an impact on the burn rate.

Stereotaxis now has a $16 million system backlog. Typically, investors like to see a rising backlog because it means greater future sales are impending. While that’s also true for Stereotaxis, I’d rather see the backlog more quickly turn into installations to demonstrate the success of these EP practices to potential new customers. Management has stuck with expecting a 6-12 month gap between orders and installations, but we’ve seen delays in excess of a year and in a couple cases over 2 years.

Shifting construction timelines make adopting Genesis difficult even after the order is received. This is why investors are so excited about the semi-mobile robot, which requires no multi-month shutdown of the EP lab due to heavy construction. This $16 million backlog is expected to be the primary driver of Stereotaxis’ low-double digit sales growth in 2024. It’s nice to see potential MAGiC sales in 2024 not in the numbers, since it can provide a modest near-term consensus estimate increase upon approval in Europe.

Stereotaxis recently announced a Genesis installation in Nola, Italy in Santa Maria della Pietà Hospital. I found this noteworthy because it was installed with a new X-ray machine made by Neusoft Medical called NeuAngio 30F. Management mentioned it would focus on showing off the semi-mobile robot, revving up manufacturing, and integrating it with an X-ray machine between its approval this year and launch next year. This is the angiography system that will be integrated with the semi-mobile robot. It has a low radiation dose, clearer images, and offers a more efficient workflow. Lower radiation won’t impact Stereotaxis EPs since the procedure is controlled in a separate room.

Neusoft Medical

If this Nola installation is included in the Q2 sales report, I expect the firm to get close to $7 million in sales again. I’m not sure why analysts are expecting $4.5 million in Q2 sales. However, revenue recognition timing of Genesis installations has no impact on my valuation of the firm anyway.

Stereotaxis Makes A Surprise Tuck-In Acquisition

Stereotaxis announced my favorite type of acquisition: a strategic tuck-in acquisition at a low price. The firm purchased a small catheter company called Access Point Technologies located in Minnesota. According to LinkedIn, the firm has 11-50 employees. 15 of its employees are on LinkedIn. The firm boasts its team has over 150 years of combined medical device experience. Therefore, I’d say the employee count is probably towards the low end of that range, making it easy to integrate (Stereotaxis had 122 employees as of year-end 2023). Even though this is a Minnesota company, America is its smallest market. Asia is its largest market, with Europe coming in 2nd.

Access Point Tech is expected to do $5 million in sales in the first 12 months after the acquisition closes in Q3. I estimate this means $4 million in gross profit. It’s hard to see how a small business with $4 million in gross profit and about 20 employees could be burning much money. I estimate they were operating between breakeven and a less than $1 million annual loss. Stereotaxis’ existing salesforce will modestly increase Access Point’s sales, potentially pushing Access Point to profitability if it’s not already there. I don’t think this modest increase is baked into the $5 million guidance because Access Point has been hovering around $5 million in sales in recent years.

The upfront cost of the deal is about 1.5 million shares (about 1% dilution) which is about $3 million. The total cost of the deal could be 6.1 million shares (about 4.5% dilution) if all the milestones are hit in the next 5 years. These milestones aren’t detailed specifically, but they revolve around US & EU sales targets being hit along with US & EU regulatory approvals of robotic catheters. This is a great situation for investors because the firm paid less than 1 times gross profit if none of the targets are hit. If Access Point gets a robotic catheter approved, it will be well worth the additional ~4.6 million shares issued over the next 5 years.

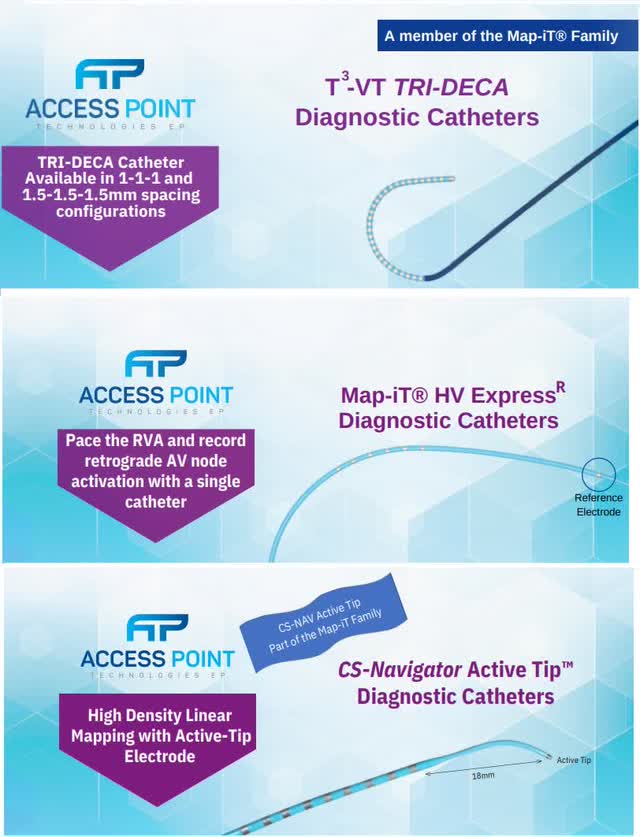

Access Point currently only makes manual catheters. The 3 categories of catheters currently in Access Point’s lineup are fixed cured diagnostic catheters, steerable diagnostic catheters, and ablation catheters. To be clear, diagnostic catheters are often referred to as mapping catheters. All mapping catheters are currently manual. Even the mapping catheters used in Stereotaxis robotic procedures are manual. Basically, all ablations for arrhythmias require a mapping catheter prior to the procedure.

The 3 catheters below are the most differentiated devices in the firm’s lineup. The HV Express mapping catheter is used for pediatric patients; these are the patients star EP Dr. Sabine Ernst treats with robotics. The CS Navigator and T3 High Density mapping catheters are used to treat ventricular tachycardia. You can use the Access Point Technologies website to read the brochures which detail the technical specifics of these catheters.

As I mentioned, this is a strategic acquisition, which means the current products aren’t the most important aspect of this deal. Stereotaxis has been working with Access Point to develop its magnetic robotic guide catheter. Stereotaxis is creating a family of guidance devices which include various versions of the guidewire & guide catheter to expand into other endovascular indications outside of EP. As a reminder, these 5 indications are ischemic & hemorrhagic stroke, tumor embolization, peripheral artery disease, coronary angioplasty, and abdominal aortic aneurysm. Stereotaxis has had delays in manufacturing MAGiC (in the past) and the guidewire (currently) for regulatory submissions, which makes this vertical integration with a catheter design firm crucial to streamlining future interventional device development and production.

Furthermore, this acquisition will cause the Access Point team to focus most of its efforts on finishing up the robotic guide catheter instead of making more manual catheters. This increases my confidence in Stereotaxis getting this product out on time. In announcing this deal, management stated it expects the guide catheter to be commercially available in early 2025. I’m a little cautious on that timeline, since Stereotaxis has a penchant for modest delays. However, it would be nice to see the Access Point team show off their specialty: developing catheters and getting them approved.

In its late-2021 Innovation Day investor presentation, Stereotaxis said it would be working on a guide catheter, so this new launch was expected. In addition, we got a positive surprise as a part of this acquisition. Stereotaxis is working on a robotic mapping catheter with Access Point. This will bring all the advantages of magnetic robotics to diagnostic catheters. This magnetic robotic mapping catheter will have high precision, reach, safety, flexibility, and speed just like MAGiC. This will increase high-margin, recurring, disposable sales in each procedure. Mapping catheters can be nearly $2,000. This means with both MAGiC and the magnetic mapping catheter alone, Stereotaxis can earn $5,000 per procedure with +80% gross margins.

Both the guidecather and the mapping catheter will have an easier approval process than MAGiC. That’s because, like the guidewire, they aren’t the source of care being delivered. The guidewire will require a 510(k) in America. This takes about 6 months to get approval; it doesn’t need clinical trials, unlike MAGiC.

The main energy sources for catheter ablations are radio frequency (RF) and cryo (freeze). MAGiC uses RF energy. About 75% of catheter ablations for arrhythmias use RF energy; the other 25% are cryoablations. The newest energy source is pulsed field. Pulsed Field Ablation (PFA) is a new technology which needs to be studied further but has some early promise. It can be used to treat certain arrhythmias, but it won’t be used in some of the areas of the heart Stereotaxis specializes in. There is a lot of excitement about this new technology. One of the panels discussing PFA at the Heart Rhythm Society (HRS) conference in Boston earlier this month had a line out the door to get in.

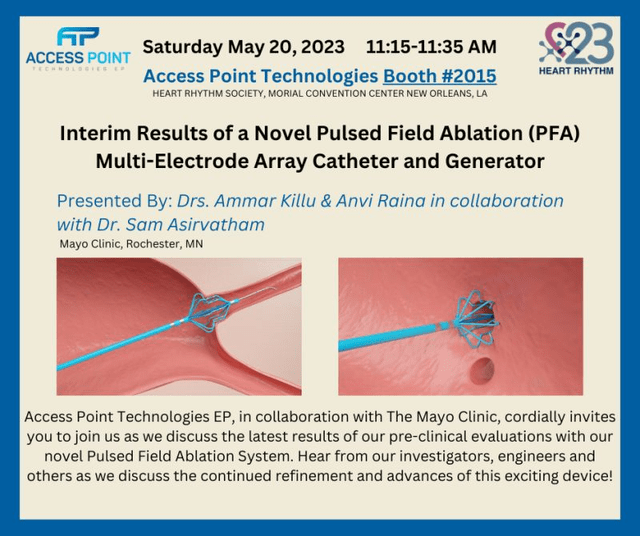

Stereotaxis CEO David Fischel believes PFA will first take market share from cryoablations over the next few years. Robotic magnetic precision, reach, and flexibility have the potential to make PFA catheters much safer and more effective. Two private companies are working on magnetic robotic PFA catheters. They have animal studies planned this summer. As you can see in the image below, Access Point collaborated with Mayo Clinic to show the pre-clinical results of their manual PFA catheter last year.

Access Point has much more experience developing PFA catheters than Stereotaxis does. It’s tough to say where Access Point is in its development of a PFA catheter. This won’t be the company’s initial focus. Therefore, I expect the private companies to come out with their robotic PFA catheters first (Stereotaxis will get a royalty). However, it’s nice to avoid relying only on 3rd party companies to produce PFA catheters since they might cease EP operations like Acutus Medical.

In summary, these future interventional devices improve Stereotaxis’ outlook in the intermediate and long term. I think most investors are only focused on getting MAGiC approved. Once MAGiC is approved, the market will have more confidence in future products. I think it makes sense for readers to focus on these new products now to prepare themselves for what the market will see shortly.

Updated New Product Regulatory Submission & Approval Timelines

As the slide below shows, Stereotaxis has 5 parts to its innovation plan. They are the following: a more accessible robot, its own ablation catheter, a family of guidewires and guide catheters which expand the indications the robotic platform can be used for, a collaboration with MicroPort in China, and hardware & software products to conduct digital surgery. I wanted to share this slide because it shows an image of one of the semi-mobile robot’s arms in the in the top right along with the guide catheter and guidewire in the middle. The semi-mobile robot folds into itself when not in use to eliminate the need for magnetic shielding in the walls of the EP lab.

I made a color-coded list of all the potential catalysts for Stereotaxis in the next couple years. I like to put in specific months in my timeline to show how confident I am in a specific event. Instead of saying I’m very confident an event will happen in Q1, I’ll put January. Plus, it’s easier to organize which event will occur first if you go by months. Green is for regulatory submissions in the EU and US. Red is for regulatory approvals. Blue is for innovation days. Black is for China. Yellow is for software launches. Bolded purple is for the combined launch of the majority of its products.

As you can see, the near-term catalysts this summer are the submissions of the semi-mobile robot, the approval of the semi-mobile robot in Europe, the approval of Genesis in China, and the MAGiC catheter CE Mark in Europe. After MAGiC gets the CE Mark, Stereotaxis will need to submit tenders in certain countries in Europe (France & Scandinavian countries) before it can be fully utilized in those countries. That process will take 6-12 months, but it’s just paperwork.

I will now review the product news on the call, which shifted some timelines and kept others the same. Let’s start with the MAGiC catheter. Stereotaxis got a completeness check for its submission to the Notified Bodies in Europe. It took about 1 month this time, opposed to about 4 months last time. The team answered the clinical questions and got one small follow up. I expect them to get the technical questions in the next couple weeks. If there isn’t a tough string of follow-ups, they could get the final round of biocompatibility questions in June. After those follow-ups, we could see an approval in August.

I’m modeling my timeline based on the process last time. In early March 2023, the firm had just gotten the 2nd round of questions (technical). It took about 3 months from there to get the decision in June of last year. Therefore, I am adding 3 months to mid-May to get to an August approval. However, Stereotaxis already made progress on the technical and biocompatible questions last year. Plus, the process seems to be going quicker this time, which means a mid-summer approval is possible.

The FDA quickly changed MAGiC’s PMA Supplement to a regular PMA. This allows the FDA to perform a manufacturing audit and other checks. However, this change doesn’t mean Stereotaxis will be required to do an additional clinical trial. Stereotaxis is still early in its discussions with the FDA, which means a full additional trial is possible.

The firm has begun enrolling patients in its 300-patient expanded trial in Europe. According to ClinicalTrials.gov, about 150 patients have been enrolled in Denmark and Lithuania. The last update was in late March, with enrollment still ongoing. The primary completion date was estimated to be in June. The 2 primary outcomes measured were acute procedural success and freedom from major adverse events (both up to 7 days post procedure). Stereotaxis needed this data in 20 patients to get its CE Mark, since feasibility data was required.

Since Stereotaxis plans to use this trial in its PMA submission as well, the secondary outcomes measured could be valuable. They are chronic freedoms from the treated arrhythmia, device-related adverse events, and freedom from a new arrhythmia (all 3, 6, and 12 months out).

I penciled in an FDA approval in November which allows for modest pauses due to questions. The statutory timeline is 6 months, which likely began in March when the submission was switched to a regular PMA. The clinical data from the 300-patient study will be in by the time the FDA gets to the clinical review step of the PMA approval process, sometime in the summer. So far, MAGiC has a perfect safety record. The product works; it’s just a matter of jumping through the regulatory hoops over the next few months.

Stereotaxis is finishing up the final testing required for submission of the semi-mobile robot to regulators in America and Europe. The LED lights and covers have come in from suppliers, which indicates the firm is taking the last steps before the submission. We’ve seen pictures with the cover off on social media in the background. I expect a submission announcement in June.

Stereotaxis is working with MicroPort to get Genesis approved along with MicroPort’s catheter (Stereotaxis gets a royalty). Obviously, the regulatory burden in China is unknown, but a Chinese company wouldn’t have worked with Stereotaxis to come out with a compatible catheter along with integrating its mapping software (Columbus) with the robot if it didn’t think an approval was likely. I expect NMPA approval for Genesis in June. It’s telling that management didn’t walk back its prior guidance on an approval. Once MicroPort’s catheter is approved late in the year, the MicroPort sales team will heavily push Genesis since the firm will have a financial incentive to do so.

The MicroPort EP/EverPace clinical sales team has 100 members. One-on-one training of this sales team to sell Genesis has already begun. I expect a few Genesis orders to come out of China after it’s approved. I think momentum will accelerate in early 2025 once MicroPort starts heavily pushing it. Stereotaxis will try to get MAGiC approved in China after it gets CE Mark; the MicroPort catheter and MAGiC are very similar.

Stereotaxis pushed the timeline for the guidewire regulatory submission back to late Q3 from mid-year. That’s a modest delay, which it blamed on its contract manufacturer not producing enough guidewires with the specs necessary for regulatory submission (about 1,000 are needed).

Stereotaxis has said in previous calls, it plans to do a guidewire Innovation Day presentation to show off the new indications it will be used for once it is submitted to regulators. On this call, David said Stereotaxis plans to also do a Synchrony & SynX Innovation Day after Synchrony is submitted to regulators late in Q3 (SynX doesn’t need approval). Synchrony will begin formal testing in a couple months.

Synchrony is the connected display for the robotic procedures, which will replace Odyssey Vision. SynX is the connected app doctors will communicate on (replaces Odyssey Cinema). The image below is from the Google Play Store. SynX first launched on the Play Store in October 2023 and has been receiving updates since. It is currently in limited release. It will have a soft launch with Synchrony later this year. Its full promotion will occur when the semi-mobile robot is launched early next year. Stereotaxis had a small SynX setup at the HRS event earlier this month, but it wasn’t pushed. However, EPs were excited about the acquisition of Access Point.

Stock Price Expectations For 2024

Stereotaxis has about 133 million shares outstanding if you include the 49.4 million convertible preferred shares. Analysts expect the firm to do about $82.5 million in sales in 2026. That means it trades at about 3.5 times 2026 sales. That multiple should increase if Stereotaxis meets its submission, approval, and launch goals because the firm would transition into a high margin growing business with a razor-blade model in an economically insensitive industry. In 2024, the goal is to de-risk the 2026 sales estimates. These estimates will be de-risked if the firm gets MAGiC, the guidewire, Synchrony, and the semi-mobile robot approved this year (plus Genesis in China). Therefore, the stock will increase after these catalysts occur, even though the financial benefits mostly won’t be seen until 2025.

Investors are rightly focused on MAGiC because its extra magnets allow the semi-mobile robot to be smaller than Genesis. Without MAGiC the semi-mobile robot can only do endovascular procedures with the guidewire and guide catheter which hasn’t been submitted to regulators yet. Once MAGiC is approved, Stereotaxis won’t be burning money and will have significant sales growth. Upon approval, investors will look for the next big product launch and see a slew of positive news coming in the near term. Their increased confidence in the future can send the stock higher.

Timeline Risks

The 3 biggest risks are the same ones I laid out in my last article. First, China might not approve Genesis and the MicroPort catheter in a timely manner. After this conference call, I’m less worried about that risk because management reiterated their prior timelines.

Second, MAGiC might take longer than I expect to get FDA approval. The change from a PMA Supplement to a PMA only slightly pushed back my expected approval timeline because no new trials are needed. I’m pretty confident that the FDA won’t require another trial, since the expanded EU trial with 300 patients is larger than the trial Stereotaxis did to get its initial catheter approved (182 & 75 patients in 2 trials) over 15 years ago (it was never marketed nor sold). However, it’s still possible something else comes up that shifts the approval until late 2025.

Third, Stereotaxis could take longer than expected to submit the guidewire to regulators. If neither MAGiC nor the guidewire are approved in America by early next year, Stereotaxis will delay the semi-mobile launch in America. On the May call, Stereotaxis shifted the target for the guidewire submission from mid-year to late in Q3. That’s only a 2-month shift, but there were only 2 months in between the last 2 calls, so it’s arguable the firm made little progress.

The goal is to manufacture enough guidewires consistently for regulatory submission. Management said on the November 2023 call, the main design updates necessary for scaled production were complete. The proof will be when the submission is made. This timeline could easily shift until late 2024. By then, Access Point will be integrated. The Access Point team could help with any final design/manufacturing issues Stereotaxis and its contract manufacturer are having. Management guided for a late-2024 approval of the guidewire, but that’s a little too optimistic if it’s submitted in September, since I think an approval will take about 6 months. That’s why I have an approval occurring in March on my timeline.