HP Inc. Stock: Where Tech Growth Meets Consistent Dividends And Buybacks (NYSE:HPQ)

BalkansCat

HPQ Stock: Investment Thesis

In summary, HP Inc. (NYSE:HPQ) is a solid company with stable margins in an industry with few players and limited growth, which doesn’t attract new entrants. Over the years, HP’s invested capital has been decreasing, coupled with a rise in product prices, which consequently boosted its ROIC.

My thesis is focused on the generous shareholder yield that HPQ stock will pay investors over the years due to the 100% cash flow distribution policy that the company has in place. Those will come partially through dividends, but mostly in the form of stock buybacks, boosting investors’ income even in the unfortunate event that the share itself does not appreciate in the next years.

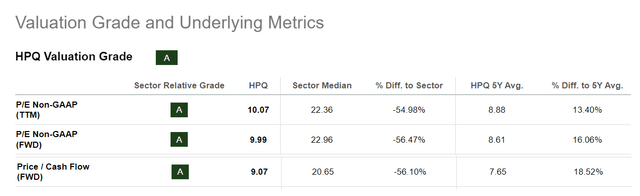

Additionally, after comparing valuation multiples against peers, we come to the conclusion that the entire PC sector is undervalued and that the HP stock has P/E and P/Cash Flow ratios about 50% lower than the sector median. This highlights that the share price also has room for appreciation on top of the promising shareholder yield.

Also, specifically for the industrial 3D printing segment — which is something that HP does very well — I believe there is significant profitability to be heaped, as multiple industries will start to adopt this type of machinery to assist their operating tasks, thus increasing the market demand gradually. Moreover, HPQ also has a personal systems segment that offers growth opportunities and potential for margin improvement.

In addition to returning a large part of its cash flow to shareholders, HPQ is cutting costs and focusing on higher-margin products, which could further enhance the company’s results in the future.

For now, the company is focused on reducing its debt, which has led to a pause on the stock buybacks — though it continues to pay dividends higher than the sector’s average. I also feel it’s important to point out that, over the past five years, HP stock has repurchased just over 60% of its current market value. Hence, in my view, the company is a perfect fit for investors seeking passive income, as it has a well-established and consistent dividend policy.

All in all, I believe HPQ stock is a good investment option for the long run at the moment, especially for those who appreciate tech stocks with growth potential that don’t neglect satisfactory dividend distribution.

A Little Bit About HP Stock

HP Inc. is a global company in the personal computer, peripherals, and printers industry, with a market segmented across end consumers, small and medium-sized enterprises (SMEs), and large corporations.

The company outsources most of its production, getting involved only in the most valuable links of the production chain, such as design, branding, and marketing. This strategy results in a very low capital expenditure, enabling high profitability on invested capital.

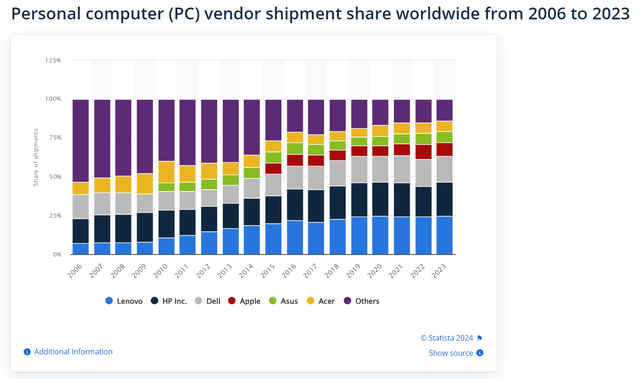

Currently, HP is the world’s second-largest computer manufacturer by volume, holding approximately 22% market share, as of 2023. Additionally, it is the leading hardcopy peripherals manufacturer, commanding about 35% of the market share as of Q1 2024.

In 2023, the company reported net revenues of approximately $53 billion and a net income of $2.84 billion. The previous year, revenues reached $63 billion with a net income of $3.7 billion.

Understanding HP’s Personal Systems and Printing Segments

Personal Systems

The Personal Systems business unit offers desktops, laptops, workstations, point-of-sale systems for retailers, monitors, peripherals, as well as support and maintenance services.

The company categorizes the production of this business line into commercial PCs, optimized for use by large enterprises, the public sector, and SMEs; and consumer PCs, focused on gaming, learning, and remote work. Additionally, the division’s results are segmented into Laptops, Desktops, Workstations, and Others.

Laptops: includes commercial or consumer laptops, along with peripherals designed for this product class.

Desktops: consists of non-portable commercial or consumer PCs, monitors, peripherals, and point-of-sale systems for retailers.

Workstations: encompasses non-portable computers for technical and specialized use, as well as monitors and peripherals geared towards this product class.

Others: includes revenues from services.

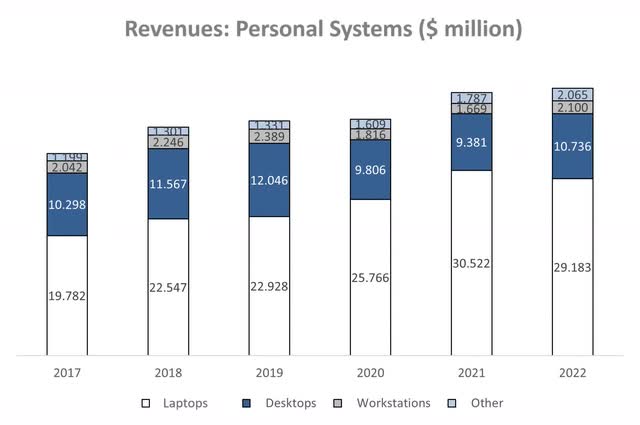

The graph below displays the revenue evolution for Personal Systems by product type over the last five years up to 2022.

We can see that, during this period, the revenue from Personal Systems grew at an annualized average rate of 7%. This expansion, however, was primarily driven by the growth in notebook revenue, which averaged an 8% annual increase. Revenues from desktops and workstations, on the other hand, grew by an average of 1% per year during the same period.

In my view, this is because the computer industry is transforming, as portable computers have become more accessible and progressively more powerful in recent years. The result has been a gradual replacement of desktops with laptops and a consistent decrease in demand for non-portable PCs over the last decade.

Currently, HP is, without a doubt, a strong player in the manufacturing of premium laptops, competing with Dell Technologies Inc. (NYSE:DELL), Lenovo Group Limited (OTCPK:LNVGY), Apple (NASDAQ:AAPL), and others in this segment. In the PC industry as a whole (including non-portables), it is the world’s second-largest manufacturer, with a market share of 21.9% measured by total unit shipments. Lenovo still has the top place with 24.7%.

The following graph shows the evolution of the company’s market share regarding this metric.

In particular, during the pandemic, the Personal Systems segment experienced a non-recurring boost from the remote work policies adopted by companies. Consequently, I’m assuming a more modest growth in the coming years.

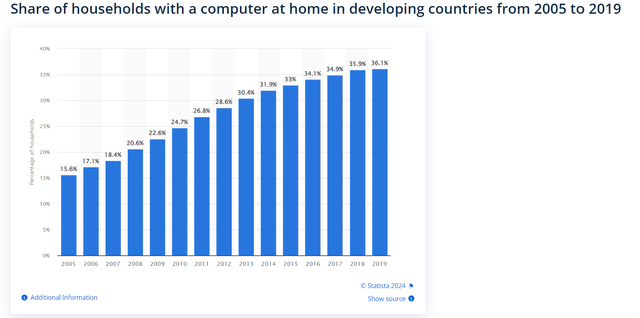

Nevertheless, I would also like to point out the significantly lower penetration of personal computers in developing countries compared to developed ones. For instance, in 2019, about 79% of households in developed countries had computers, compared to only 36% in developing countries (graph below). Hence, this gap translates into a substantial opportunity for industry expansion in these regions, and if HPQ manages to take a head start in this expansion, HPQ stock will surely heap the benefits.

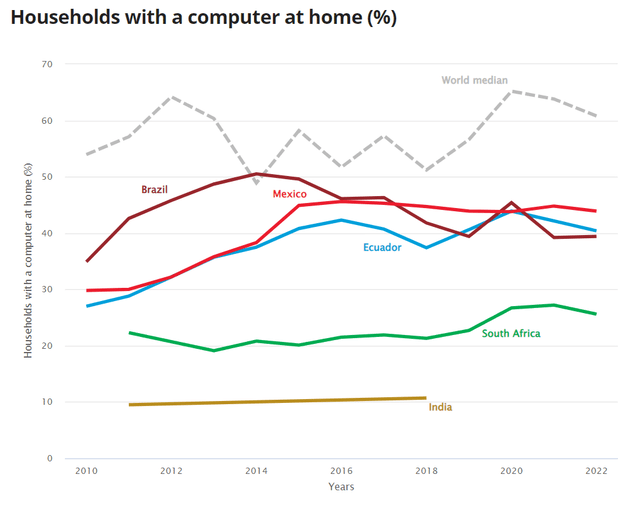

And for a more up-to-date data, we see on the next chart how the computer penetration rate in emerging countries’ households still lags behind the world median (which includes economies such as India, with a 10.7% rate). Surprisingly, economies such as Brazil, Mexico, and South Africa, which are technologically developed nations, have not even hit the 50% mark yet, highlighting promising room for HP’s market expansion.

Moreover, HP announced last year its intention to focus its Personal Systems expansion efforts on service-oriented areas, such as Device-as-a-Service (DaaS). In summary, this new contractual solution allows businesses to pay monthly subscriptions to use company computers.

It’s safe to say that this arrangement is beneficial both for HPQ and its commercial clients. For HPQ, it provides predictable and recurring revenue, as well as supporting more consistent demand compared to the traditional market. For clients, it reduces the need for hardware management from IT teams and helps avoiding substantial one-time investments to purchase new devices. In short, this is a promising area with significant potential to generate additional revenue for the company over the coming decades.

Finally, HP also plans to expand its business within the peripherals market with a focus on hybrid work, which will possibly unlock a new revenue stream. At the end of 2021, for example, the company announced the acquisition of Poly for $3.3 billion, a manufacturer of audio and video solutions for computers. The company had a revenue of $1.7 billion and a gross margin of 47% in the 12 months prior to the acquisition, with more than 30 million devices connected.

In summary, I expect the Personal Systems segment to continue driving the bulk of the company’s growth over the next few years. This growth will likely stem from both the ongoing global trend toward hybrid work policies and the expansion of computer penetration in developing countries.

Printing

The Printing Business unit sells commercial and consumer printers and copiers, as well as supplies and services. Additionally, HPQ has recently been investing in increasing its market share in 3D printing, focusing on the industrial segment.

The company divides this business line into:

Office Printing Solutions: targets SMEs and large corporations, as well as intermediate goods for other manufacturers.

Home Printing Solutions: focus on consumers, and small and micro businesses.

Graphic Printing Solutions: focus on large-format printers used in commercial, industrial, and logistics (including textile and packaging applications).

3D Printing and Digital Manufacturing: aimed at the 3D manufacturing industry.

Regarding the results of this segment, HP categorizes its revenue into three groups:

Commercial: includes office printing solutions, graphic printing solutions, and 3D manufacturing.

Consumer: encompasses home printing solutions.

Supplies: includes a range of consumable items for recurring use, such as ink and laser cartridges, 3D printing supplies, among others.

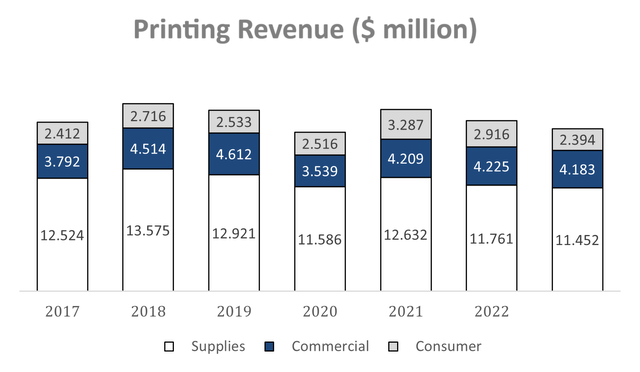

The graph below shows the revenue split among these three segments.

As we can see, the majority of the Printing revenue comes from the Supplies segment. Indeed, the sale of supplies plays a crucial role for HPQ stock, as it allows the company to continuously monetize its customer base for several years after the purchase of a printer.

Since the use of third-party supplies is often restricted in HP printers, customers are inclined to buy supplies from them. Furthermore, the company’s management focuses on offering contractual solutions with advance payments for the supply of printing materials. This arrangement gives the company pricing power, cash flow exceeding profits, and a high recurrence of revenue from Supplies.

As for the commercial segment, I foresee modest growth over the next decade, particularly driven by the expansion of the 3D printing sector and the logistics and packaging industries.

Currently, the HPQ boasts a promising portfolio of 3D printers, including devices designed for mass production with metal manufacturing. Apart from that, the company continuously invests in launching patents in the 3D printing industry, so much so that the company has been consistently one of the top patent holders in this market over the last few years.

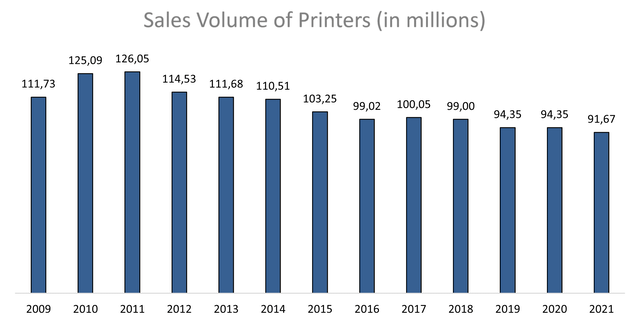

Now, regarding the consumer-focused segment, I do not anticipate significant growth in the coming years. For me, this is an industry facing secular downward trends, as individuals increasingly replace paper documents and books with digital versions. Between 2009 and 2021, the annual demand for consumer printers declined at an average rate of 1.6% per year, as shown in the following graph:

To conclude, I anticipate a relatively stable outcome for the Printing segment over the next few years, which will be translated into moderate revenue growth in the commercial sector. This segment is currently crucial for HP stock’s cash generation, but over the long term, I foresee it gradually losing its relevance compared to the Personal Systems segment.

What HPQ’s Latest Results Showed Us

In general, and in my view, HP’s Q3 2024 results were solid, especially regarding revenue growth. Also, I still anticipate improvements by the end of this fiscal year, with rising demand and sustained or expanded margins as the cost reduction program yields results.

We must not forget that HP stock operates in both a dynamic and highly competitive market, and even with the slower printing sector recovery, HPQ still managed to deliver more than satisfactory results. The proof is that the company has finally got back to revenue growth for the first time in nine quarters, with a 2% year-over-year increase, mainly driven by strong performance in Personal Systems. For that, HP’s President and CEO Enrique Lores even dedicated a short moment during the earnings call to highlight this milestone:

“We are pleased with our return to revenue growth and proud of the innovations delivered in the quarter, including the launch of our next-generation AI PC lineup”

The recovery in commercial PCs was also robust, signaling a continued market stabilization and probably the continuation of the secular trend I discussed previously.

Alongside revenue growth, HPQ continues to reduce structural costs and is boosting its cost-saving goals, expecting to achieve 80% of its three-year target by the end of 2024. This means that the company will sit in a more comfortable position to convert most of its cash flow into hefty distributions.

Additionally, in the third quarter, HP returned approximately $868 million to shareholders, including $600 million in stock buybacks and $268 million in dividends. A couple of sections later in this analysis, we’ll see that this figure is already one-third of the sustainable annual distribution that HPQ is expected to deliver to shareholders. This means that the estimated shareholder yield we are gonna calculate afterward is indeed a safe bet and also a generous passive income return.

Lastly, regarding HPQ’s debt, the company ended the quarter within the target leverage ratio and remains committed to its capital allocation strategy, expecting to return approximately 100% of free cash flow to shareholders.

Fundamental Perspectives For HP’s Business Model

Currently, through a strategic value creation plan, HP is focused on investing in key areas such as gaming, hybrid systems, subscriptions, corporate services, industrial graphics, and 3D printing.

Besides reducing costs by simplifying organizational structures and removing unnecessary expenses, these key areas will offer better margins and good returns on invested capital, consequently increasing shareholders’ returns.

Despite investments across a wide range of sectors, I believe HP’s true competitive advantage stems from the corporate printing supplies segment, where the demand and switching costs are higher. Once a customer purchases an HP printer, they are “stuck” to the subscription system, allowing HPQ’s pricing power to do its job gradually.

Therefore, even in a declining sector, HPQ stock is able to boost revenues and benefit from the absence of new entrants due to the low attractiveness of entering a stagnant market with few significant players.

Furthermore, hardware subscription plans, which are relatively new, will contribute to recurring revenues — starting with printers, and then computers.

All in all, I truly believe the outlook for HP stock is favorable. The company holds a significant market share in an area with little appeal for new entrants, competitive advantages, recurring revenues, and a policy of distributing 100% of free cash flow to shareholders, which will provide substantial returns through buybacks and dividends.

A Quick Forecast On Shareholder Yield

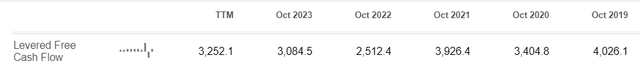

Since HP is a company that delivers free cash flow exceeding profits, we are gonna use that for our quick forecast. Now, let’s take a look at the HPQ stock’s Levered Free Cash Flow (Levered FCF) over the past 5 years and estimate an average for it. According to the company’s financials here in SA (image below), the 5-year average Levered FCF is sitting around $3.4 billion annually.

Now, as I usually play on the safer side, let’s assume that HPQ stock will deliver a solid and sustainable $3 billion per year in Levered FCF, lower than the average we calculated.

Since the company has already announced it will distribute 100% of its free cash flow to shareholders in the coming years, we can estimate that it will distribute the sustainable value of $3 billion we calculated, either in the form of dividends or stock buybacks.

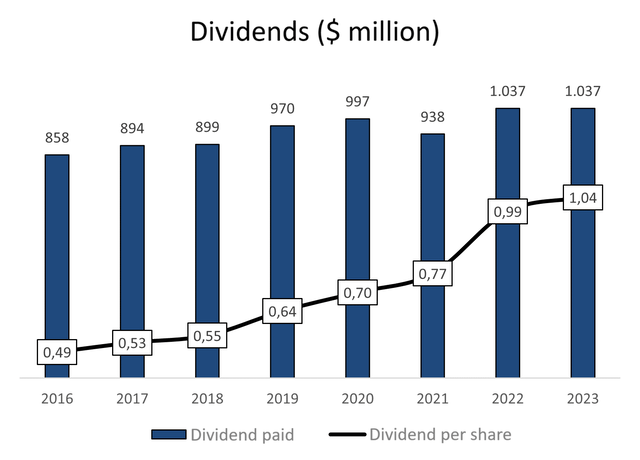

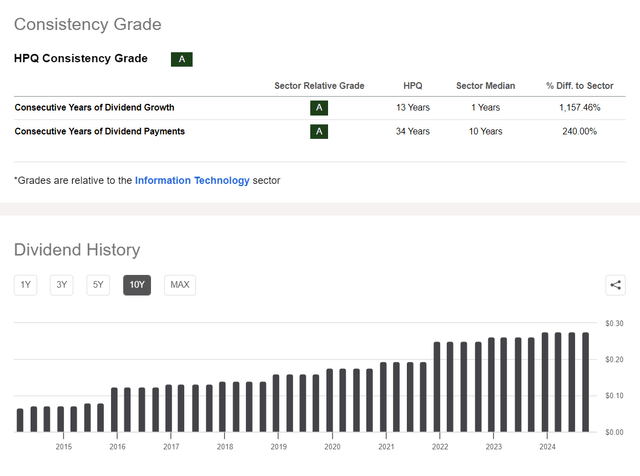

Over the past few years, HPQ stock has paid out about a 3% dividend yield annually, so most part of the shareholder yield came from stock buybacks.

And that’s indeed true because HPQ’s aggressive repurchase program has led the company to spend an average of $3 billion per year on stock buybacks since 2016. As is well known, this policy gradually reduces the number of shares in circulation, which causes dividends per share to grow more than net income over the long term.

In the chart below, we can spot this effect: while the total distribution of dividends has grown at a rate of only 3% per year since 2016, dividends per share have increased at an annual rate of 12% during the same period.

While I write this analysis, HPQ share price trades at $33.82 and the company market cap sits around $32.6 billion. Hence, considering the sustainable $3 billion it will distribute, we can expect an annual shareholder yield of approximately 9%. Therefore, I believe that HP stock fits the profile of investors seeking passive income, as the company has a well-established and consistent dividend distribution policy.

Finally, in my view, it is likely that hybrid work models have become a secular trend, meaning that from now on, the demand for computers will be structurally higher than in the past. However, I preferred to be conservative and estimate a more modest growth for the coming years.

Concerning Dividends and Relative Valuation

Before addressing the dividend distribution and consistent growth that HP stock has delivered over the past 10 years, let’s take a look at the company’s relative valuation against its peers.

If we compare HPQ’s main valuation multiples such as P/E (FWD) and Price/Cash Flow (FWD) — as well as all the others — to the sector median (as shown in Seeking Alpha), we see that they are quite below the average, which might indicate an undervalued status.

Anyhow, the figures from the sector median include data from stocks such as FUJIFILM Holdings Corporation (OTCPK:FUJIY), NetApp, Inc. (NTAP), and Western Digital Corporation (WDC), which are indeed in the Information Technology sector but do not compete directly with HPQ stock.

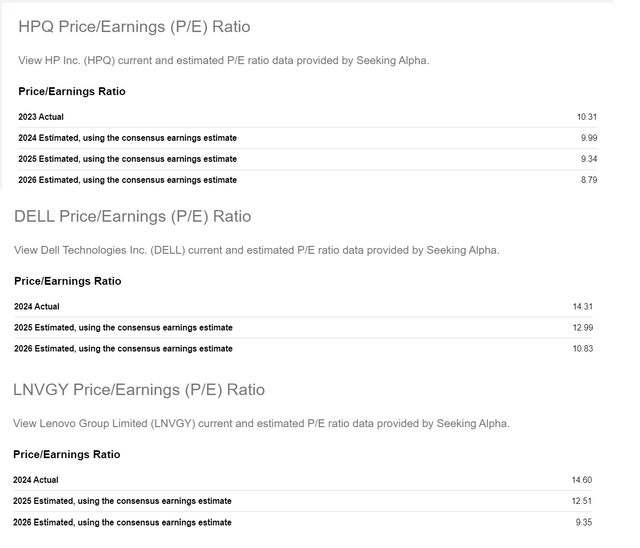

So, when we compare HP’s multiples with the company’s true competitors, such as Dell, Lenovo, and Apple, we see that they are more in line with the sector. For example, HPQ’s P/E (FWD) ratio of 9.99 is not that far from Dell’s 12.99 and Lenovo’s 12.51. As for Apple’s, we are gonna leave it out of this comparison since we all know that the APPL stock usually trades at a premium price, thus skyrocketing all its multiples.

Also, if we take a look at the consensus earnings estimates (picture below) for the end of 2024 until 2026 for all 3 stocks, we spot that all of them have relatively low future P/E ratios, which are quite below the sector median. And on top of that, HPQ wins the comparison by having the lowest figures from all 3 companies.

In my view, this just shows that the entire sector seems to be undervalued at the moment because all 3 leaders have great business models and prospects. And we mustn’t forget that they are still tech stocks, which are poised for growth and technology disruption at all times.

Anyhow, let’s not forget that this competition I just described is within the PC market. We have to remember that HPQ also operates, and it’s the true market leader in the printing industry, which, in my opinion, gives another edge to the stock prospects, especially regarding 3D printing.

It’s true that you could consider all 3 companies for your portfolio, but this time I decided to cover HPQ stock, and the main reason does not come from its slightly lower valuation multiple, but from my main thesis — the solid passive income it has and will distribute.

Apart from the 12% dividend growth in the past 5 years, which is already a great result, we have a true picture of how great of a distributor HP stocks is by realizing it has paid dividends for 34 years in a row and grown its value for 13 consecutive years. And, if this growth streak wasn’t broken even during the company’s high-leverage period, I can only assume that it will carry on as strong as ever, especially after the debt restructuring.

Hence, I truly believe that the annual 9% shareholder yield we calculated previously — which is already a great figure — is indeed a safe bet, with more room to grow as HP invests in higher-margin products and reduces its debt level.

Finally, concerning dividends and relative valuation, I can conclude that the HP stock is potentially undervalued (share appreciation) and that its cash flow prospects are quite promising (high shareholder yield), delivering great returns on both venues and being a great choice at the moment.

Potential Risks That Threaten The Company’s Fundamentals

As a company that sells products and services globally, HPQ is naturally vulnerable to macroeconomic risks, especially if we include the escalating trade tensions between the United States and China, which started in 2018. For example, according to the latest HPQ earnings release, about 63% of its net revenue came from customers outside the US. So, what I spot here is that any types of protectionist measures implemented by foreign countries — such as increased import fees — could negatively impact the company’s results. Additionally, since most of HPQ stock revenue comes from overseas, the company also has to take the exchange rate risk into consideration. This means that its dollar earnings could be negatively affected by the relative appreciation of the US currency against others, especially those from third-world economies that generally have a harder time controlling their inflation.

Furthermore, as part of two highly concentrated oligopolies (printing and PC/Laptop industries), HP has a higher chance of being accused of anti-competitive practices by regulating authorities in different countries, something that has already happened in the past. However, we have to understand that this risk is evenly distributed among the six leaders in the PC sector. In the printer industry, however, the risk tilts more towards HPQ, which alone holds more than 35% of the market share. For example, in the past, the company announced that its new printers would be compatible with third-party ink cartridges, as it was being accused of anti-competitive practices and of creating a “Printer Ink Monopoly”. However, consumers know very well that using third-party cartridges in HP printers does not come without drawbacks, so HPQ seemed to have found a way around this situation.

Moving on, it’s also impossible to ignore the fact that we see fewer household printers as time goes by. For over a decade, the demand for personal use printers has gradually declined as individuals replace paper documents and books with digital versions on smartphones and computers. In my opinion, this trend will continue in the future, leading to declining long-term revenue from “Home Printing Solutions.” However, the trend is positive for the commercial sector, which still needs printing solutions in the textile, logistics, packaging, and 3D printing industries.

Recently, the computing industry has experienced several moments of electronic component shortages due to the pandemic, such as lockdowns in Asia. With that in mind, we can add another fundamental risk to HPQ’s business model. Since HPQ assembles both personal computers and printers, it relies on suppliers for a wide range of computer hardware simultaneously: processors, memory, screens, motherboards, among others. Now, since all components are essential to build the end product, whether it’s a printer or a computer, a shortage in just one of them could significantly affect HPQ stock results. For instance, in Q3 2022, the company had to lay off up to 6,000 staff because it was unable to meet the demand for printers due to components that were missing. As a result, HPQ delayed the delivery of new devices, something that surely threatened the brand image.

Final Words

All in all, even accounting for the risks discussed above, I truly believe that HPQ stock has competitive advantages that will allow it to generate increasing cash flows in the coming years, which will eventually be translated into solid dividends, stock buybacks, and an estimated shareholder yield of 9% annually.

As mentioned previously, the company outsources most of its production, focusing on the highest value-generating links in the supply chain, such as design, branding, and marketing. This approach results in a very low capital expenditure to run its business, which in turn leads to high returns on invested capital, thus providing room for growth and stock appreciation.

Apart from that, in the personal computer industry, HPQ is the dominant player in both the premium and commercial segments, and both of them, in my view, have positive long-term trends. Firstly, because businesses continue to rely on computers for most of their tasks, even with smartphones becoming more versatile each year. Moreover, unlike lower economic classes, consumers of premium laptops are less affected by inflation, so I’ll assume they will carry on buying HP’s devices regardless of their prices.

As for the printing industry, I expect HP to maintain its high market share, the same way it did over the past decade, especially in the industrial 3D printing market, where the true profits lie. Also, the trends are positive for the commercial sector, particularly in the textile, logistics, and packaging industries, which will benefit from the growth of the e-commerce market. However, for printers aimed at end consumers and personal use, I don’t see it as promising as it once was, as individuals are increasingly replacing paper documents and books with digital versions on smartphones and computers.

So, for investors looking at a great and renowned tech company with a consistent distribution policy and most probably undervalued, I believe HPQ stock is a great pick for the long run. Moreover, the combination of HP’s well-known branding with its large market share makes it a solid company overall, bringing some sort of safety and peace of mind for investors who are not used to the usual volatility of tech stocks.

And, even if you don’t get much stock appreciation over the years (which I doubt), rest assured that HPQ’s aggressive stock buybacks will make your dividends grow at a more than satisfactory rate.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.