FedEx Is Driving To A More Profitable Future (NYSE:FDX)

vandervliet93

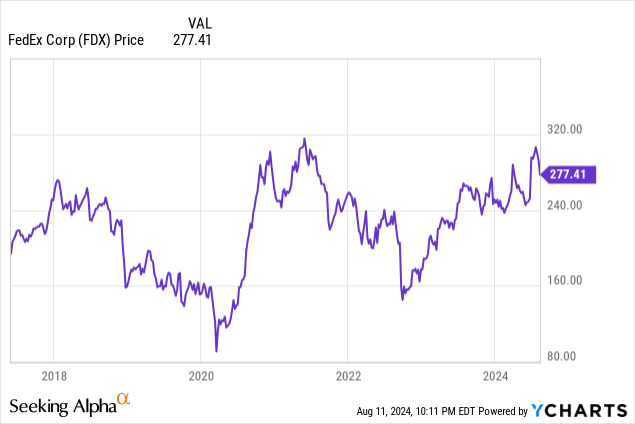

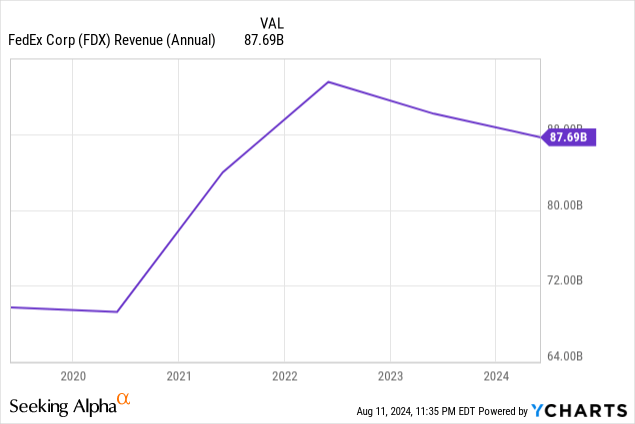

FedEx (NYSE:FDX) is easily one of the top brands that come to mind in the transportation space. Apart from that, the stock has not been able to provide capital appreciation since November 2020. In my opinion, the main factor why the company has not been able to is because its revenue growth might have peaked in the short-to-mid-term. Since the stock is cheap from a forward PE perspective, FDX is, if you are optimistic enough about the economy in the short term, a cautious buy at this point.

FDX, a giant improving profitability, slowly but surely

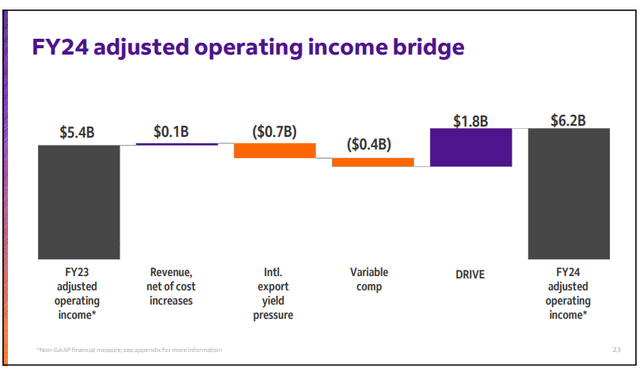

Besides that growth stagnation, the company has been able to improve a lot operationally with its DRIVE initiative, which has also the potential to increase operating margins significantly.

The DRIVE initiative, before and after

The DRIVE initiative is quite simple and is based on the construction of Network 2.0. The idea is to use the already impressive FDX asset list and use it in a holistic way instead of separating business lines. Traditionally, FedEx has worked, as seen in the 2022 10K, under 4 operating segments.

- FedEx Express: This provided express distribution of packages in more than 220 countries. Operations also included the TNT Express brand, which served mostly in Europe.

- FedEx Ground: The segment provided business and residential ground package delivery services.

- FedEx Freight: This is a provider for LTL or Less-Than-truckload shipments.

- FedEx Services: Basically a horizontal segment that provides support to the other 3 segments in marketing, customer services, technical support, billing, and collection services.

Now, as explained in the current 2023 10K, the Ground and Services segments are going to be merged into the FedEx Express or Federal Express segment. This is not only a change in the reporting of the financial situation of the company, but is mainly a transformation of the entire way shipments are processed and delivered.

This consolidation will cause, for example, the company to stop doing redundant routes that were covered by multiple transportation options, like plane, truck, or rail. Eventually, it is expected that this measure would eliminate over 10% of those routes, and over 100 stations would be closed by 2027.

Additionally, the company will opt for the best price-to-cost initiatives for covering those same services, reducing flight dependence by 30% while also increasing total miles moved by railway from 8% to 15%. This is important to cost-cutting because rail is way cheaper than truck and plane-made shipments. All those measures are expected to bring around $6 billion in total savings from 2023 up to 2027.

The current state of FedEx

Moving away from the excellent DRIVE initiative that significantly impacts the bottom line, FDX’s top-line results have not been good enough, in my opinion, mainly because of a cooling macroeconomic environment instead of microeconomic factors. Let’s take a dive into the current Q4 FY 2024 earnings presentation.

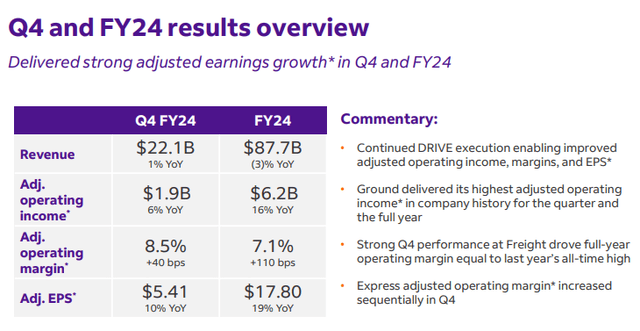

Revenue grew by just 1%, but adjusted EPS grew by 10%, mainly because of operational improvements from the DRIVE program. Although this might seem like a bad revenue result, the truth is that the company has not been able to see revenue growth consistently after the pandemic boom era.

Additionally, revenues were positive in the three segments: Express, Ground, and Freight, but unfortunately, international operations continue to work with a negative yield environment. The management explains in the earnings call that this occurs because of an increase in international cargo flight capacity.

This is, in my opinion, a very bad tailwind because it will bring $700 million in operating income losses while also not bringing any sort of real growth to the company.

On the other hand, the management also reported a very welcomed increase in market share, which is significant due to the difficulties of moving the needle against very serious competitors like Carol Tomé’s UPS (UPS) due to belonging to a very well-consolidated industry.

What now for FedEx?

From a balance sheet standpoint, FDX is well-capitalized, with current assets exceeding current liabilities and long-term liabilities, while high compared to earnings, well covered by a large amount of fixed assets. The company has also reported a $5 billion plan for doing buybacks, which might provide interesting buying support for the shares.

Additionally, there is still the FedEx Freight spin-off discussion over the table. Allegedly, such an operation would potentially give FedEx a close to $50 billion deal. The management has expressed in the earnings call that as soon as they have a decision made on that idea, it will be communicated. I think the operation at those valuations would be beneficial for FedEx shareholders, but it might be a moral hit for the company.

Another discussion for speculation might come from the competitive advantages that the DRIVE operation might bring to FedEx. For example, because of improved margins, FDX might be able to lower prices and begin to take market share from UPS. This, of course, would lower the FedEx margins but might increase revenues and eventually bring new growth for the company after 2027. I am not entirely sure of what should happen with this topic in the international segment due to the margins being already negative.

Valuation

At this price and without having executed the DRIVE program completely, I think FedEx might be fairly valued. However, while the company is able to deliver good operating results through the years, I believe the stock might be able to bring some decent capital appreciation.

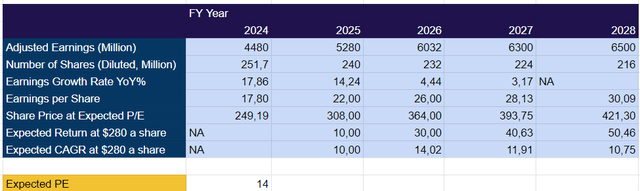

In the following valuation framework, I have considered the management projections for the EPS provided in the earnings release. It is worth remembering that these numbers have been already adjusted by the expected amount of share buybacks done by year. Additionally. I expect a future PE ratio of 14, which might be rich but would reflect a company that met growth again after some years of post-pandemic stagnation.

Image created by the author based on 10K projections (Author)

As a fairly valued company, FDX is, in my opinion, a shy buy at the frontier of becoming a hold. In any case, if macroeconomic conditions hold, any lower prices should be a decent possibility for a stock to buy.

FDX risks

Although FedEx is quite a strong company, with good financial and logistical protections for the business, it is somewhat far from being a riskless investment.

Some of the risks that the investment thesis I present are straight down evident, for example, the immense difficulty in achieving the DRIVE initiative in the established times. Any delay in the DRIVE and Network 2.0 plans could impact the share performance through the years. This, added to the stock not being super cheap, might increase the risks of underperformance.

The other big risk to FDX is also evident and is a macroeconomic slowdown. Recently, we have had some volatility in the financial markets due to the end of the Federal Reserve hiking interest rates cycle. This brings macroeconomic uncertainty that could severely hit a transportation low-margin stock like FedEx.

Another risk, in this case, less potent, is about the international operations, which might hurt profitability in an incremental way if some sort of softness in international trade occurs. Additionally, a low expected revenue growth rate could not generate a high 14 times PE ratio required for this thesis to work.

Conclusion

FDX is a solid company that is in a transformation process from being a good and decent company to a higher margin one thanks to the DRIVE program. If everything holds, the stock might have a place in a well-rounded portfolio; otherwise, as the stock is fairly valued, maybe a better price could be obtained for this to be a better bargain. For now, I think the stock is a cautious buy.